February 2019 Rent Report

Methodology Note:

Apartment List is committed to making our rent estimates the best and most accurate available. To do this, we start with fully representative median rent statistics for recent movers taken from the Census Bureau American Community Survey. We then extrapolate this data forward to the current month using a growth rate calculated from our listing data. Growth rates are calculated using a same-unit analysis similar to Case-Shiller’s approach, comparing only units that are available across both time periods in order to provide an accurate picture of rent growth in cities across the country.

Our approach corrects for the sample bias inherent in private sources, producing results that are representative of the entire market. Our methodology also allows us to construct a picture of rent growth over an extended period of time, with estimates that are updated each month.

Read more about our methodology here. For further methodology questions or custom data requests, contact us at rentonomics@apartmentlist.com.

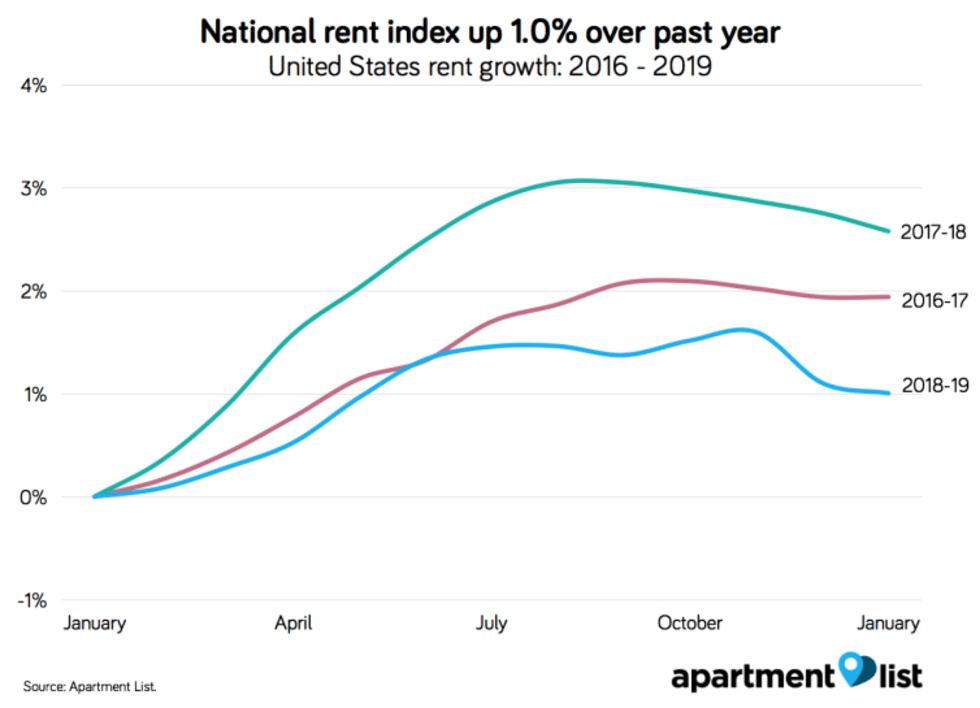

Welcome to the February 2019 National Apartment List Rent Report! Our national rent index fell by 0.1 percent month-over-month, the second straight monthly decrease. Year-over-year growth now stands at 1.0 percent, lagging the rates from the two prior years.

Read on for an analysis of the trends we're seeing this month.

National index down 0.1% M/M

Our national rent index decreased by 0.1 percent over the past month, marking the second straight monthly decrease, a trend that is characteristic of the seasonal trend of falling rents during the winter months. Year-over-year growth currently stands at 1.0 percent, trailing the levels from the two prior years.

Despite the fact that rents normally experience a slight decrease in the fall and winter months due to seasonality, our national rent index was bucking that trend with monthly increases in October and November. However, over the past two months, the national index has fallen by a total of 0.6 percent, marking a return to the usual seasonal trend. Rent growth was generally sluggish throughout the course of 2018, and year-over-year growth is still lagging the pace from the previous two years.

Year-over-year growth currently stands at 1.0 percent at the national level, which is well below the 2.6 percent rate we saw this time last year as well as the 1.9 percent rate from January 2017. Rent growth is also pacing well behind the overall rate of inflation, which stands at 1.9 percent as of the latest data release, and is similarly lagging growth in average hourly earnings, which have increased by 3.2 percent over the past twelve months. The recent moderation in rent growth is a welcome bit of relief as millions of our nation's renters continue to struggle with housing affordability.

Rents down M/M in 63 of 100 largest cities

The decline in rents at the national level is mirrored in many of the nation's biggest markets -- the map below show's month-over-month rent growth for the nation's 100 largest cities (markers are sized by population):

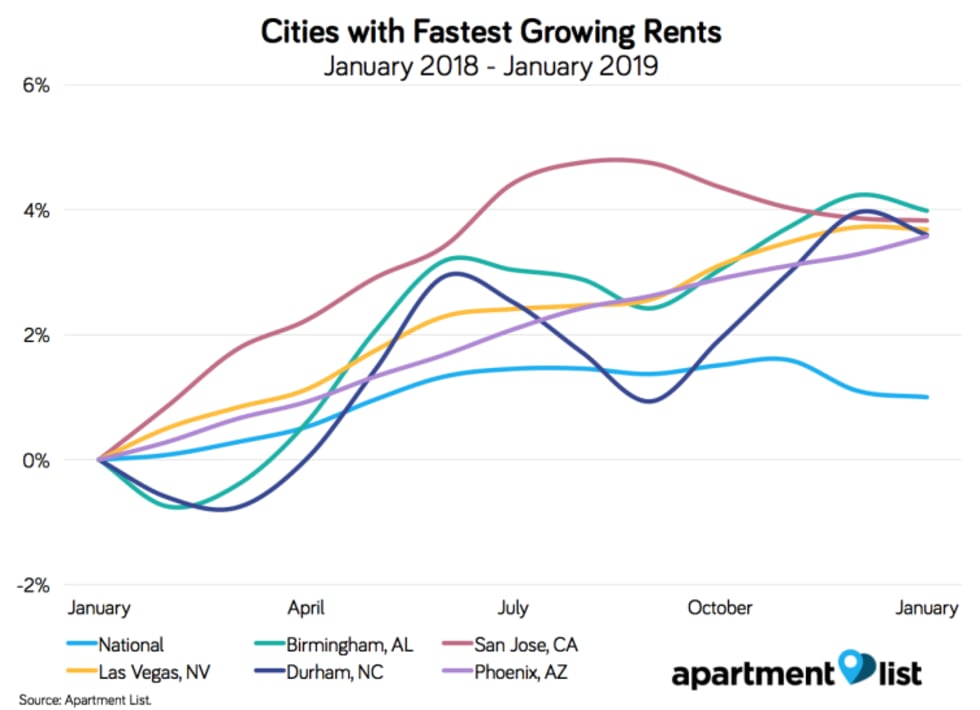

Rents fell month-over-month in 63 of the nation's 100 largest cities, up reversal from last month, when 63 of these cities saw rents increase. Rents are up year-over-year in an even greater share of the nations largest markets -- 90 of the 100 largest cities have seen rents increase over the past twelve months. The chart below shows how rents have changed over the past year for the five cities that experienced the fastest growth:

Birmingham, AL has experienced the nation's fastest rent growth with an increase of 4.0 percent over the last year. San Jose ranks second with 3.8 percent year-over-year growth, followed by Las Vegas, where rents climbed by 3.7 percent over the past year.

At the state level, Nevada experienced the fastest year-over-year growth at 3.3 percent, followed by Delaware at 3.0 percent.

Few cities experiencing Y/Y rent declines

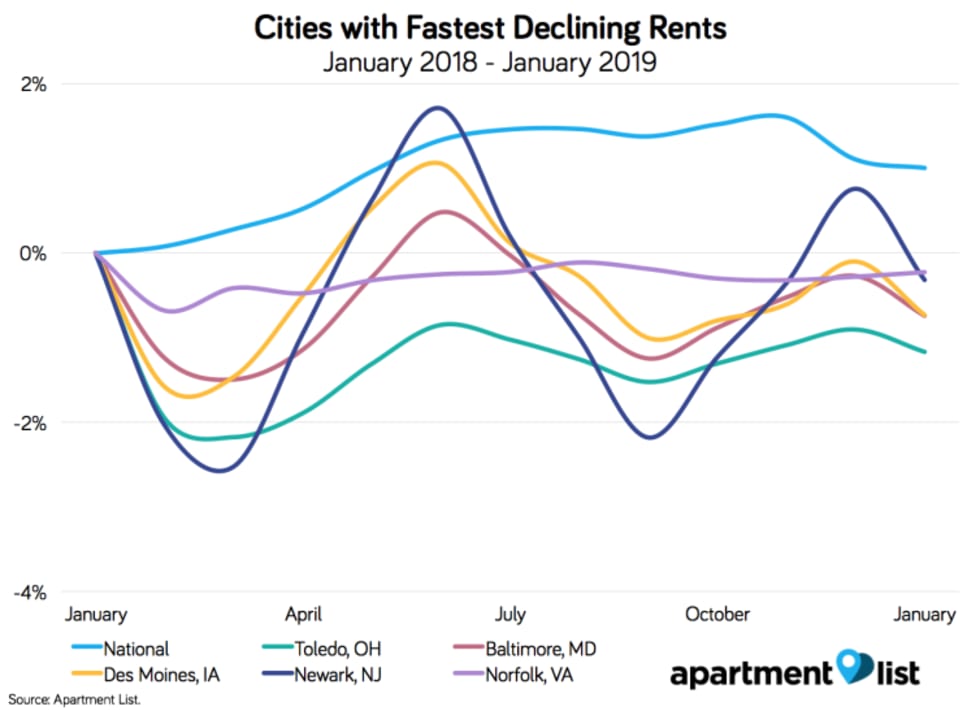

Just 10 of the 100 largest cities in the nation have seen rents fall over the past year. That said, an additional 28 cities have experienced modest gains of less than 1.0 percent over the past year. The chart below shows trends for the five cities where rents declined most:

Toledo, OH has experienced the largest dip in rents over the past year with -1.2 percent growth, followed by Baltimore, MD which saw rents fall by 0.7 percent over the past year.

At the state level, Louisiana saw the biggest year-over-year decline with -0.7 percent growth, followed by Alaska, which has seen rents fall by 0.3% over the past year.

Please see additional data below for the nation's 100 largest cities, or check out the full data for your city at our rental data page. And as always, feel free to contact us with any questions!

| City Name | Median 1 BR rent | Median 2 BR rent | M/M rent change | Y/Y rent change |

|---|---|---|---|---|

| New York, NY | $2,118 | $2,523 | -0.6% | 2.4% |

| Los Angeles, CA | $1,363 | $1,752 | 0.0% | 1.4% |

| Chicago, IL | $1,076 | $1,266 | -0.2% | 0.9% |

| Houston, TX | $837 | $1,024 | -0.3% | 0.0% |

| Philadelphia, PA | $972 | $1,173 | -0.2% | 0.7% |

| Phoenix, AZ | $852 | $1,061 | 0.3% | 3.6% |

| San Antonio, TX | $846 | $1,063 | 0.0% | 2.1% |

| San Diego, CA | $1,559 | $2,023 | 0.0% | 1.6% |

| Dallas, TX | $893 | $1,110 | -0.1% | 1.4% |

| San Jose, CA | $2,091 | $2,621 | 0.0% | 3.8% |

Check out our rent reports for the following cities:

- Atlanta, GA

- Austin, TX

- Baltimore, MD

- Boston, MA

- Boulder, CO

- Charlotte, NC

- Chicago, IL

- Cleveland, OH

- Colorado Springs, CO

- Dallas, TX

- Denver, CO

- Detroit, MI

- Fort Collins, CO

- Fort Lauderdale, FL

- Houston, TX

- Indianapolis, IN

- Jacksonville, FL

- Los Angeles, CA

- Miami, FL

- Minneapolis, MN

- New York, NY

- Orlando, FL

- Phoenix, AZ

- Raleigh, NC

- San Antonio, TX

- San Diego, CA

- San Francisco, CA

- San Jose, CA

- Seattle, WA

- Tallahassee, FL

- Tampa, FL

- Tucson, AZ

- Washington, DC

If you would like to get future updates from Apartment List Rentonomics, please subscribe to our email list.

Methodology:

Apartment List Rent Report data is drawn monthly from the millions of listings on our site. 1-bedroom and 2-bedroom rents are calculated as the median for units available in the specified size and time period. Price changes are calculated using a “same unit” methodology similar to the Case-Shiller “repeat sales” home prices methodology, taking the average price change for units available across both time periods. For top city rankings, we calculated median 1-bedroom and 2-bedroom rents in 100 top cities and then ranked them by 2-bedroom rents.

About Apartment List Rent Reports:

Apartment List’s Rent Reports cover rental pricing data in major cities, their suburbs, and their neighborhoods. We provide valuable leading indicators of rental price trends, highlight data on top cities, and identify the key facts renters should know. As always, our goal is to provide price transparency to America’s 105 million renters to help them make the best possible decisions in choosing a place to call home. Apartment List publishes Rent Reports during the first calendar week of each month.

Share this Article