October 2017 Rent Report

Methodology Updates

Apartment List is committed to making our rent estimates the best and most accurate available, and as part of our efforts toward that goal, we've recently made some changes to our methodology. Data from private listing sites, including our own, tends to skew towards luxury apartments, introducing sample bias.

In order to address these limitations, our estimates now start with reliable median rent statistics from the Census Bureau, which we then extrapolate forward to the current month using a growth rate calculated from our listing data. In calculating that growth rate, we use a same-unit analysis similar to Case-Shiller’s approach, comparing only units that are available across both time periods to provide an accurate picture of rent growth in cities across the country.

We are continuously working to improve our methodology and data, with the goal of providing renters with the information that they need to make the best decisions. You can read more about our new methodology here.

Welcome to the October 2017 National Apartment List Rent Report! Our national rent index is down 0.1 percent month-over-month, marking the first time since January that we've seen rents fall.

Read on for an analysis of the trends we're seeing this month:

National index down 0.1 percent month-over-month

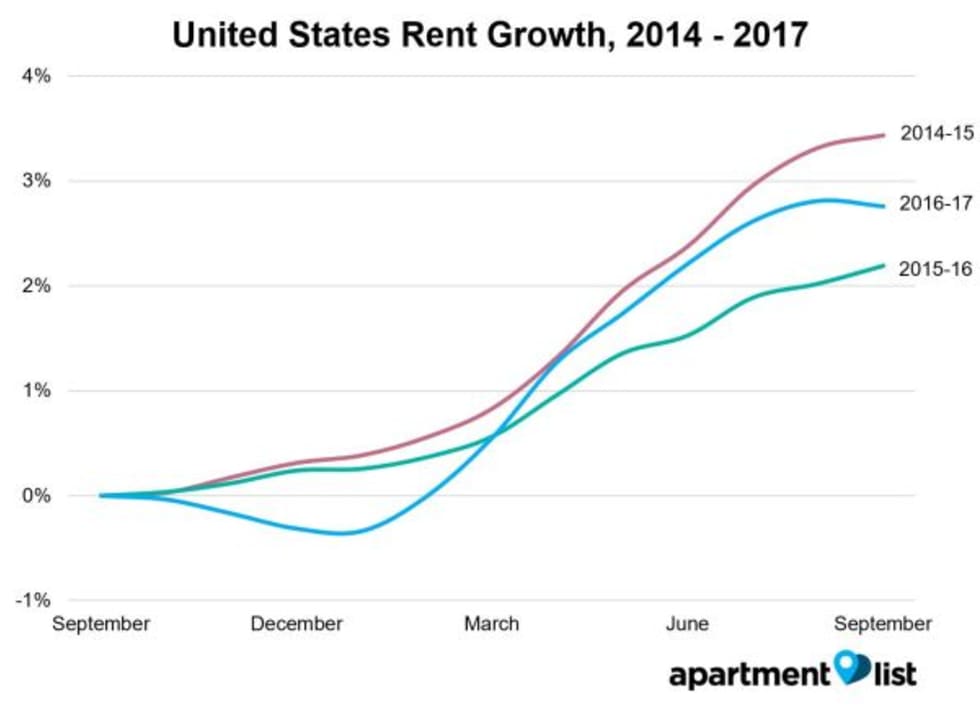

After increasing by 3.1 percent through the first eight months of the year, our national rent index fell by 0.1 percent between August and September - this is the first time that we've seen a rent decrease since January. Year-over-year growth is currently falling in between the levels from the two prior years.

Rents began to flatten last month, with our national index posting the smallest monthly gain since January, and now growth has actually turned negative. The fall and winter months are generally the off-season for renting when we tend to see lowered growth, but it's rare to see rents fall, even by a small amount. Going back to January 2014, this is only the fifth time that our national index has decreased month-over-month, with the other four months of negative rent growth occurring during the slump at the end of last year.

Rents began to flatten last month, with our national index posting the smallest monthly gain since January, and now growth has actually turned negative. The fall and winter months are generally the off-season for renting when we tend to see lowered growth, but it's rare to see rents fall, even by a small amount. Going back to January 2014, this is only the fifth time that our national index has decreased month-over-month, with the other four months of negative rent growth occurring during the slump at the end of last year.

Despite the decrease over the past month, rents are still up 2.8 percent year-over-year at the national level. Year-over-year growth is currently falling directly in the middle of the 2.2 percent rate from this time last year and the 3.4 percent growth rate from October 2015. Year-over-year rent growth continues to pace ahead of the overall rate of inflation, which stands at 1.9 percent as of the latest data release. Rent are also growing slightly faster than average hourly earnings, which have increased by 2.5 percent over the past twelve months.

Rents down month-over-month in 49 of 100 largest cities

The slight drop in rents at the national level is being mirrored in many of the nations biggest markets -- the map below show's month-over-month rent growth for the nation's 100 largest cities (markers are sized by population):

Note that rents declined month-over-month in 49 of the nation's 100 largest cities, whereas last month only 23 cities saw rents fall. Similarly, only 8 cities saw rents increase by more than 0.5 percent over the past month, compared to 19 cities that crossed that threshold last month and 47 cities in August. Despite the seasonal slowdown, rents are still up year-over-year in 90 of the 100 largest cities. The chart below shows how rents have changed over the past year for the five cities that experienced the fastest growth:

Reno overtook Sacramento this month for the nation's fastest rent growth, with an increase of 9.7 percent over the past year. Each of the cities in the above chart have experienced sharp rent hikes of around 7 percent or higher in the past 12 months.

At the state level, Nevada experienced the fastest year-over-year growth in the nation at 5.1 percent; in addition to Reno's huge gains, rents are also up by 5.1 percent in Las Vegas.

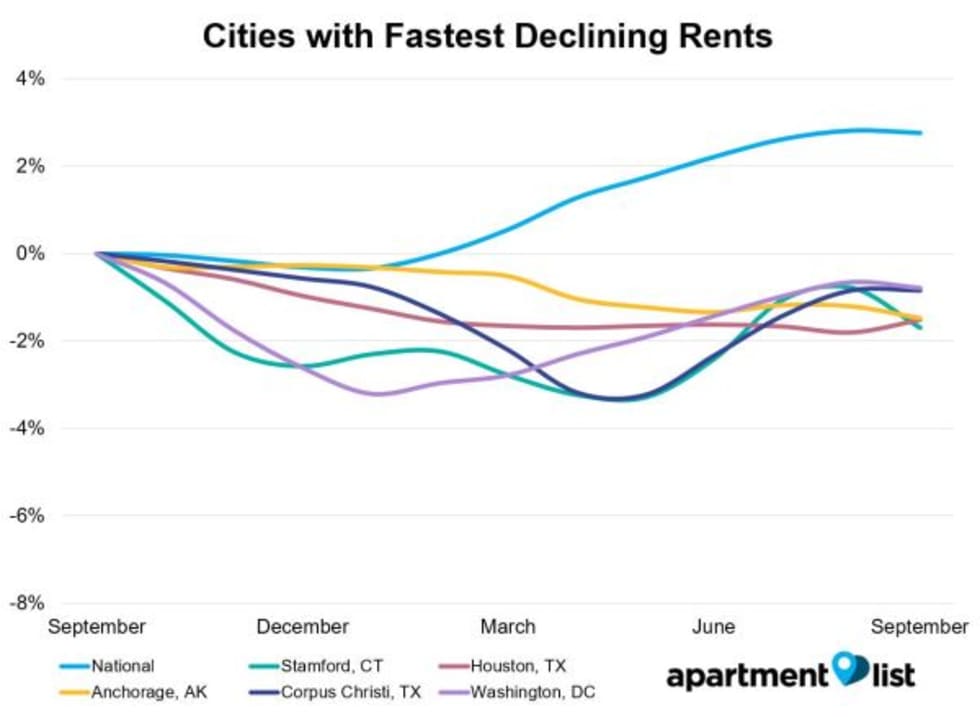

Few cities experiencing Y/Y rent declines

Only 10 of the 100 largest cities have seen rents fall over the past year, but an additional 27 saw modest gains of less than 2 percent. The chart below shows trends for the five cities where rents declined most:

Stamford, CT tops this list, with rents declining by 1.7 percent over the past year; the median 2-bedroom there now goes for $1,900. Houston is also still seeing negative year-over-year growth, with prices there down 1.5 percent; that said, rents in Houston increased by 0.3 percent over the past month. While the long-term effects of Hurricane Harvey on the area's rental market remain to be seen, additional price increases seem likely.

The other major market on this list is Washington, DC , where rents have decreased by 0.8 percent over the past year. Flat rent growth is affecting the entire DC metro -- of the ten largest cities in that metro, three have experienced falling rents over the past year, and only one has seen growth above 2 percent.

Please see additional data below for the nation's 100 largest cities, or check out the full data for your city or county at our rental data page. And as always, feel free to contact us with any questions!

| City Name | Median 1 BR price | Median 2 BR price | M/M price change | Y/Y price change |

|---|---|---|---|---|

| New York, NY | $2,090 | $2,490 | -0.1% | -0.1% |

| Los Angeles, CA | $1,350 | $1,740 | 0.1% | 4.5% |

| Chicago, IL | $1,090 | $1,280 | -0.9% | 1.8% |

| Houston, TX | $810 | $990 | 0.3% | -1.5% |

| Philadelphia, PA | $970 | $1,170 | 0.0% | 1.4% |

| Phoenix, AZ | $820 | $1,030 | 0.1% | 4.5% |

| San Antonio, TX | $840 | $1,050 | -0.3% | 2.3% |

| San Diego, CA | $1,560 | $2,020 | -0.1% | 4.4% |

| Dallas, TX | $890 | $1,110 | -0.1% | 2.6% |

| San Jose, CA | $2,050 | $2,570 | -0.3% | 2.5% |

Check out our rent reports for the following cities:

- Atlanta, GA

- Austin, TX

- Baltimore, MD

- Boston, MA

- Boulder, CO

- Charlotte, NC

- Chicago, IL

- Cleveland, OH

- Colorado Springs, CO

- Dallas, TX

- Denver, CO

- Detroit, MI

- Fort Collins, CO

- Fort Lauderdale, FL

- Houston, TX

- Indianapolis, IN

- Jacksonville, FL

- Los Angeles, CA

- Miami, FL

- Minneapolis, MN

- New York, NY

- Orlando, FL

- Phoenix, AZ

- Raleigh, NC

- San Antonio, TX

- San Diego, CA

- San Francisco, CA

- San Jose, CA

- Seattle, WA

- Tallahassee, FL

- Tampa, FL

- Tucson, AZ

- Washington, DC

If you would like to get future updates from Apartment List Rentonomics, please subscribe to our email list.

Methodology:

Apartment List Rent Report data is drawn monthly from the millions of listings on our site. 1-bedroom and 2-bedroom rents are calculated as the median for units available in the specified size and time period. Price changes are calculated using a “same unit” methodology similar to the Case-Shiller “repeat sales” home prices methodology, taking the average price change for units available across both time periods. For top city rankings, we calculated median 1-bedroom and 2-bedroom rents in 100 top cities and then ranked them by 2-bedroom rents.

About Apartment List Rent Reports:

Apartment List’s Rent Reports cover rental pricing data in major cities, their suburbs, and their neighborhoods. We provide valuable leading indicators of rental price trends, highlight data on top cities, and identify the key facts renters should know. As always, our goal is to provide price transparency to America’s 105 million renters to help them make the best possible decisions in choosing a place to call home. Apartment List publishes Rent Reports during the first calendar week of each month.

Share this Article