Uncovering the Best Cities for Remote Workers

Introduction

One-in-three jobs in the U.S. can be done remotely, and among those who were working remotely in April, three-in-four expect that they’ll have continued long-term remote flexibility beyond the pandemic. For a significant share of the American workforce, remote work will allow housing choices to be made with greater geographic flexibility than ever before. And there’s already evidence that this newfound flexibility is translating to heightened mobility -- 42 percent of remote workers say that they’re planning to move over the next 12 months, compared to 26 percent on-site workers. The potential for remote workers to shake up housing markets is evidenced by rent trends in Boise, ID, where prices are now up 31 percent year-over-year. The housing choices of remote workers will have important implications for the long-term evolution of America’s urban geography.

To better understand which markets are likely to heat up due to remote work, we’ve constructed a new index that ranks 230 cities across the country. We’ve ranked these cities on a range of factors that our previous research has shown will be important in attracting remote workers in the coming years. In a recent survey, we found that the top three considerations of remote workers when considering where to live are (1) housing affordability, (2) access to natural amenities, and (3) access to urban amenities.1 In addition to these three factors, our index also includes a “remote friendliness” component which captures a blend of resident satisfaction and the city's historical ability to attract and retain remote workers. For each of these four factors, we construct a sub-index which pulls from a variety of data sources (see methodology appendix below). Our final index is constructed from these sub-indexes using the following weights:

- Remote-Friendliness: 40%

- Housing Affordability: 20%

- Natural Amenities: 20%

- Urban Amenities: 20%

In this report, we present the results of our “Best Cities for Remote Workers” index, and explore some of the key takeaways and potential implications unearthed by the analysis. For a more detailed look at all the things that make life great in each of the cities that comprise our top 10, check out this writeup.

Click Here for Complete Ranking and Underlying Data

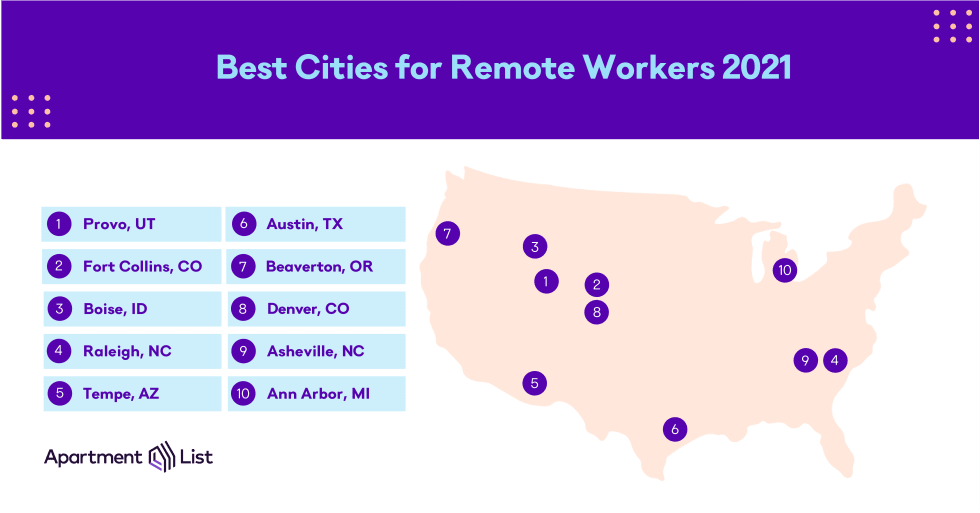

Provo, UT tops our ranking of best cities for remote workers

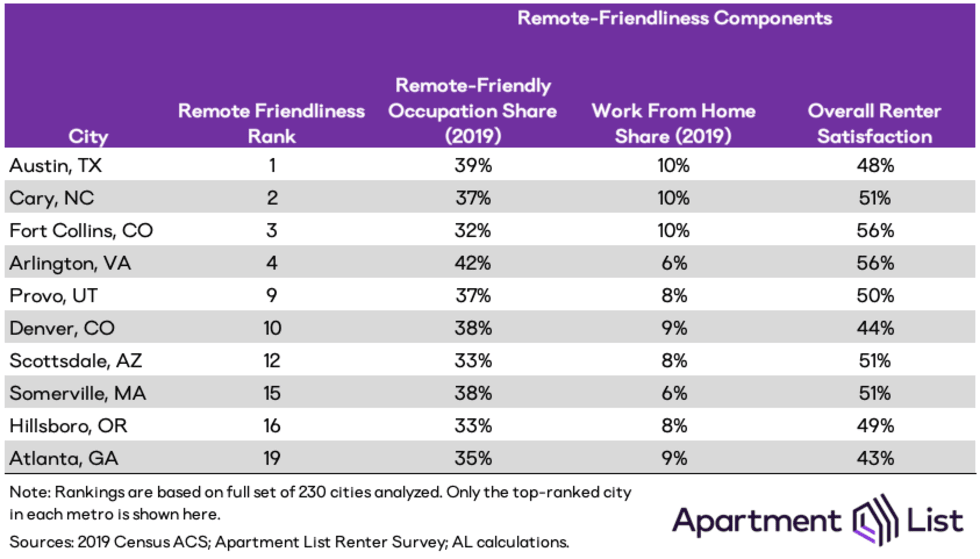

After aggregating data for the nine individual metrics that feed into our final index, the top spot in our ranking of Best Cities for Remote Workers goes to Provo, UT,2 a college town that offers a great mix of the traits valued by remote workers. Provo ranks #3 on our natural amenities sub-index -- 46 percent of the land area within a 100 mile radius of the city consists of publicly accessible lands that are designated for biodiversity protection. Provo also ranks #9 on our remote-friendliness sub-index, with high satisfaction among existing residents and an above average prevalence of both remote workers and remote-friendly jobs.3

With a median monthly housing cost of $964 in Provo, an individual worker earning the national median wage for remote-friendly occupations ($59,000) would need to spend just 20 percent of their monthly gross income on housing, making Provo among the most affordable 25 percent of the cities in our ranking. Nearby Salt Lake City has earned the nickname “Silicon Slopes” in recent years due to an influx of tech capital and workers, and Provo’s larger neighbor also lands near the top of our rankings at #15 out of 230. But although it may be less widely known, Provo actually scores higher than Salt Lake City on nearly every factor we consider, with the sole exception of restaurants and entertainment per-capita.4

Will college towns emerge as hubs of remote work?

One trend that immediately jumps out from these rankings is the prevalence of college towns in our top ten. Provo is home to Brigham Young University and Fort Collins -- our #2 ranked city -- is home to Colorado State University. Tempe (Arizona State) and Ann Arbor (University of Michigan) are two other cities in our top ten that are best known as college towns. And while some of the larger cities on the list may not be thought of primarily as “college towns,” every city in the top 10, with the exception of Beaverton, OR, is home to at least one major university.

This is not simply a coincidence; there is good reason to believe that college towns may be poised to grow as hubs of remote work. Going forward, if more new grads start their careers with companies that allow them to work remotely, sticking around in one’s college town post-graduation could become increasingly common. Discussions of remote work’s impact on housing choice often focus on the degree to which newly remote workers will be willing to uproot themselves to take advantage of their newfound flexibility, but over the long-term, the bigger shift may occur as the next generation of the workforce begin careers that are remote-friendly from the outset.

College towns also tend to rank highly for urban amenities -- even though many college towns are small- to mid-size cities, they are often rich in restaurants, nightlife and entertainment. Ann Arbor, for example, ranks #11 on our urban amenities sub-index and Asheville comes in at #23. College towns that are in geographically desirable locations -- Boise ranks #1 for natural amenities and Provo ranks #3 -- and that maintain some degree of affordability are poised to be particularly attractive for remote workers.

Rising tech hubs are likely to maintain momentum

Our top ten list includes only three large cities with populations of over 250,00 -- Raleigh, NC; Austin, TX; and Denver, CO. These three cities were some of the fastest growing markets in the decade preceding the pandemic,5 as they emerged as a new crop of tech economies offering a significant cost-of-living advantage over established hubs such as San Francisco, Seattle, New York City, and Boston.

The rising popularity of these cities has caused that affordability advantage to begin eroding to varying degrees, but they still haven’t risen to the ranks of the nation’s most expensive markets. In fact, Denver is the only city in the top 10 where the median-earning remote worker would need to spend more than the recommended 30 percent of their gross income to afford median housing costs (and even there, the threshold is only barely crossed at 31 percent). These cities have already established themselves as popular destinations for workers in remote-friendly occupations, and are likely to maintain that momentum as remote work becomes increasingly common

Many of these markets have already been showing signs of heightened demand

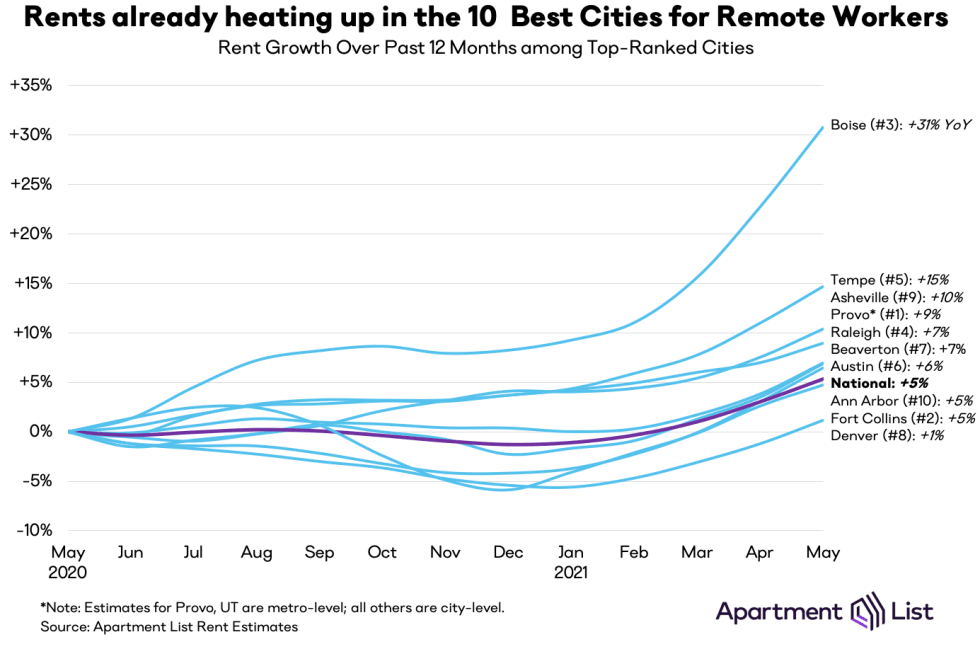

One sign that our index is effectively capturing the traits that remote workers find desirable is the fact that many of the highest ranking cities have already emerged as hot markets in the time since COVID forced the economy into a large-scale remote work experiment. Seven of our top ten cities all currently have year-over-year rent growth exceeding the national average.

Of particular note, Boise has the nation’s fastest rising rents, with explosive growth of 31 percent over the past year. The boom in Boise has shown no real signs of slowing down since the start of the pandemic, and if rent growth continues at this level, affordability and displacement could quickly become major concerns. In this way, Boise could come to represent a cautionary tale demonstrating the potential for disruption when remote workers abruptly flock to small and mid-size cities. This raises important questions about the equity implications of remote work.

Boise is the most extreme example, but rents in Tempe are up 15 percent year-over-year and Asheville has seen a 10 percent increase. Even Denver, where rents had been falling for most of 2020, is now seeing a rapid rebound, with prices up 7.1 percent since January of this year. Our index was constructed with eye toward forward-looking implications, but surging demand in many of our top-ranked cities shows that these trends have already begun to play out.

Will coastal cities lose their appeal?

Another interesting observation about our top ten is the fact that it includes no coastal cities, despite the fact that the coasts are home to the currently dominant hubs of tech and the knowledge economy broadly. The lack of cities such as San Francisco, New York City, Seattle, and Boston is largely a reflection of how unaffordable housing has become in these markets. Seattle, for example, ranks #7 for both our urban amenities and natural amenities subindexes, but gets dragged out of the top 10 by it’s poor affordability ranking.

Climate risk is another factor that drags down many coastal markets in our final rankings. We incorporate FEMA’s Natural Hazards Risk Index as one of the components of our natural amenities subindex. With the East Coast prone to hurricanes and the West Coast plagued by wildfires and earthquakes, the areas that FEMA rates as having the highest risk are concentrated on the coasts. Los Angeles, Miami, and New York City, in particular, are the major markets that score worst based on FEMA’s assessment.

Virtually all of the nation’s major coastal cities suffer from serious housing affordability issues, and there is little indication that these problems are improving. At the same time, many of these same cities are likely to be disrupted by a changing climate in the years to come. For remote workers considering where to settle down, sky high housing prices and heightened natural disaster risk could make coastal markets seem increasingly less attractive in the coming years.

Conclusion

The remote work revolution will not end when the pandemic does. As companies begin to transition from COVID-era protocolos to long-term remote work plans, it is clear that many workers will now have unprecedented flexibility in choosing where to live. Our Best Cities for Remote Workers index sheds new light on the types of destinations that remote workers are likely to find attractive if they do choose to take advantage of their newfound flexibility.

Our analysis shows that college towns, particularly those that offer good urban and/or natural amenities at affordable price points, could prove fertile ground for a remote work boom. We also find that emerging tech hubs such as Austin and Raleigh are unlikely to cool down in the coming years. Meanwhile, the coastal superstar cities that have been attracting droves of highly educated workers for decades may finally be poised for a slowdown.

A broad embrace of remote work has the potential to disperse the opportunity that has long been concentrated in a handful of the nation’s strongest regional economies. At the same time, there is valid cause for concern that remote workers could bring with them the affordability concerns that also plague the nation’s superstar cities.

Click Here for Complete Ranking and Underlying Data

Methodology Appendix

Our best cities for remote workers ranking is based on a composite index consisting of the following four sub-indexes weighted as follows:

- Remote-Friendliness: 40%

- Housing Affordability: 20%

- Natural Amenities: 20%

- Urban Amenities: 20%

Details on the components that feed into each of these four sub-indexes are as follows.

Remote-Friendliness Index

Our remote-friendliness sub-index captures a blend of resident satisfaction and the city's historical ability to attract and retain remote workers. It is calculated as an average of the normalized values for the following metrics:

- The share of the workforce that was working from home in 2019, taken from the Census American Community Survey.

- The share of workforce in remote-friendly occupations, based on Apartment List calculations using data from the Census ACS and ONET.

- Overall satisfaction of existing residents, excluding local job market and commute factors, based on data from the Apartment List Renter Satisfaction Survey

We believe that this remote-friendliness sub-index captures the degree to which a city’s existing local economy serves as fertile ground for a culture of remote workers. Even as remote work grows ever more commonplace, the agglomeration effects that occur in cities will still be important, and we expect that many remote workers will still value being in a city where they can establish professional networks with peers in similar fields. Similarly, the places where remote workers were most heavily concentrated in 2019 sheds light on the places that remote workers were already being drawn to pre-pandemic.

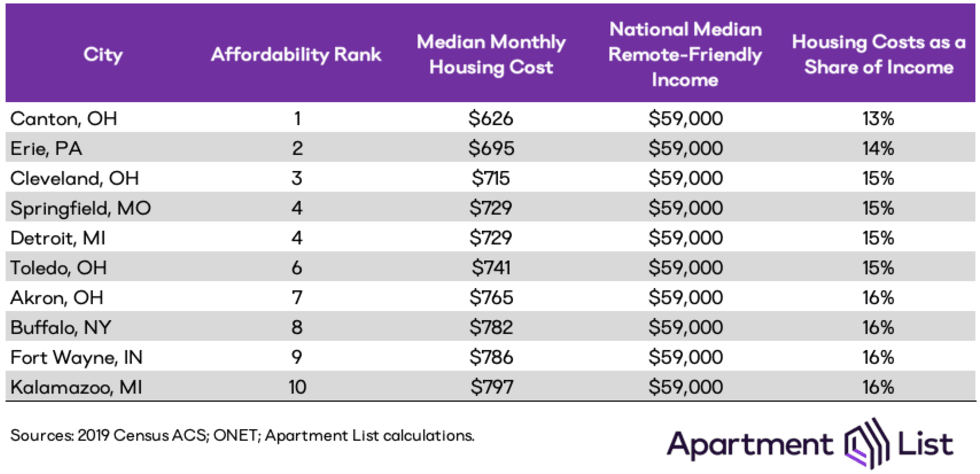

Housing affordability Index

To calculate our housing affordability index, we look at the median monthly housing costs in each city, across both renters and homeowners, taken from the 2019 ACS. We then compare that monthly cost to the $59,000 national median income for workers in remote-friendly occupations. Cities are ranked based on the share of the national remote-friendly median income needed to afford local monthly housing costs.

Among the 230 cities included in our ranking, Canton, OH is the most affordable, with a median monthly housing cost of $626, which would take up just 13 percent of the monthly income of an individual median-earning remote worker. Irvine, CA is most expensive -- the median monthly cost of $2,479 requires 50 percent of the median remote-worker income. In 174 out of 230 cities, the median-earning remote worker can afford the median housing cost without spending more than the recommended limit of 30 percent of gross income.

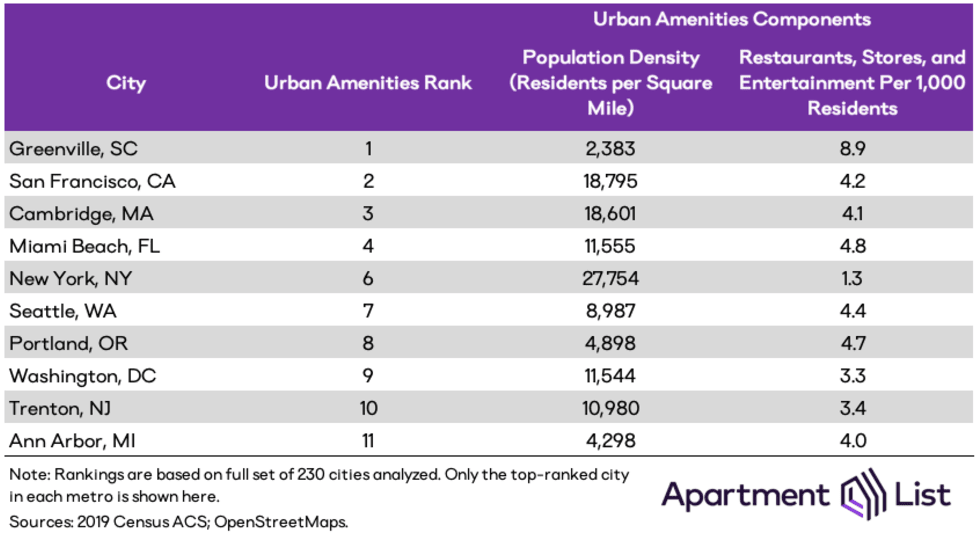

Urban Amenities Index

Our urban amenities index is an average of the normalized value of the following two metrics:

- Population density, calculated as the number of residents per square mile, taken from the 2019 ACS. Among the cities in our analysis, population densities range from 169 residents per square mile in Anchorage, AK, to over 28,000 residents per square mile in New York City.

- Restaurants, stores, and entertainment per capita, based on points-of-interest data from OpenStreetMaps. Greenville, SC ranks first here, followed by Miami Beach, Portland, Seattle, and San Francisco.

A preference for “urban amenities” could signal high value placed on having access to the wide variety of restaurants, bars, and shops that make city-life vibrant. It could also signal a preference for the physical environment of cities themselves, and the excitement and convenience that can come from living in a densely populated, walkable urban neighborhood. Our urban amenities index considers both factors.

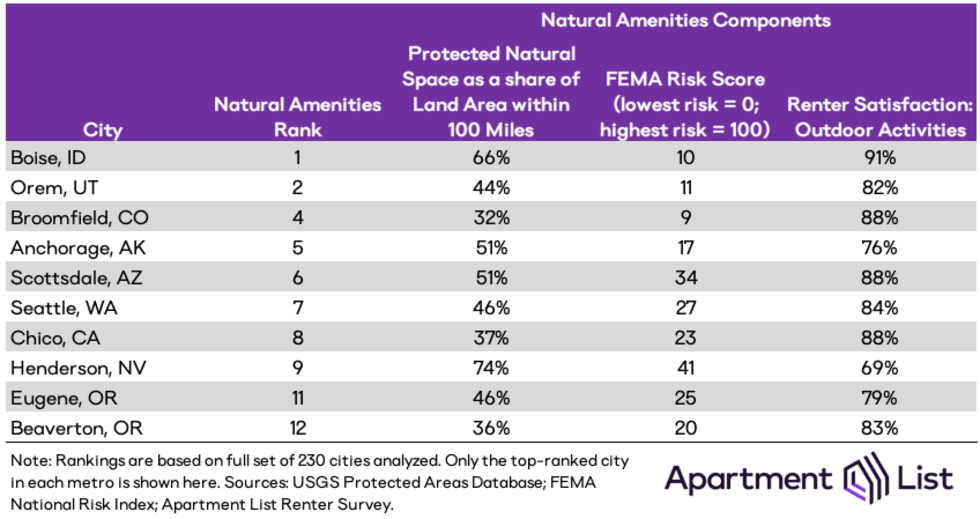

Natural amenities Index

Our natural amenities sub-index is an average of the normalized values of the following three metrics:

- The percentage of land area within a 100 mile radius of each city that is designated for biodiversity protection and open to the public (e.g. state and national parks), estimated using the USGS Protected Areas Database.

- The city’s vulnerability to natural disasters, using FEMA’s National Risk Index for Natural Hazards.

- Satisfaction of existing residents with “access to outdoor activities,” based on data from the Apartment List Renter Satisfaction Survey.

Plentiful natural amenities is one of the factors that we know a significant share of remote workers are looking for. We quantify this based on the availability of protected natural spaces and the satisfaction of existing residents. But with climate change posing ever-greater risks, we also consider the degree to which nature has the potential to disrupt life in each city.

Click Here for Complete Ranking and Underlying Data

- When asked, “Which of the following is the most important factor for your choice of where to live in the next several years?” 21 percent of remote workers who are planning an upcoming move chose “Access to a housing market where I can afford homeownership,” while 19 percent chose “Access to natural amenities” and 18 percent chose “Access to urban amenities.” 18 percent also selected “Access to family nearby,” but although family ties and social networks will undoubtedly play a role in the housing choices of remote workers, these dynamics are not captured in our index calculation.↩

- Note that in the top 10 list presented here, we’ve restricted the data to include no more than a single city from a given metro. Among the complete set of 230 cities that we analyzed, Orem, UT (Provo metro) ranks #4 and Cary, NC (Raleigh metro) ranks #6; these cities have been excluded from the rankings presented here in order to avoid repetitiveness.↩

- 37 percent of the workforce in the Provo metro is remote-friendly, well above the national average of 29 percent. 8 percent of Provo residents worked from home pre-pandemic, compared to 6 percent nationally.↩

- Provo ranks #110 for urban amenities out of the full set of 230 cities analyzed.↩

- From 2010, the total U.S. population grew by 6.6 percent; over the same period, the populations of the Austin, Raleigh, and Denver metro areas grew by 34 percent, 26 percent, and 18 percent, respectively. ↩

Share this Article