Apartment List's 2025 Millennial Homeownership Report

Today millennials represent the largest generation in the United States, and spanning the ages of 29-44 they are primary actors in the housing market. They are the age their parents were when they settled down, started families, and bought homes; however, today’s affordability climate is vastly different and for many Millennials the “American Dream” is no longer synonymous with homeownership.

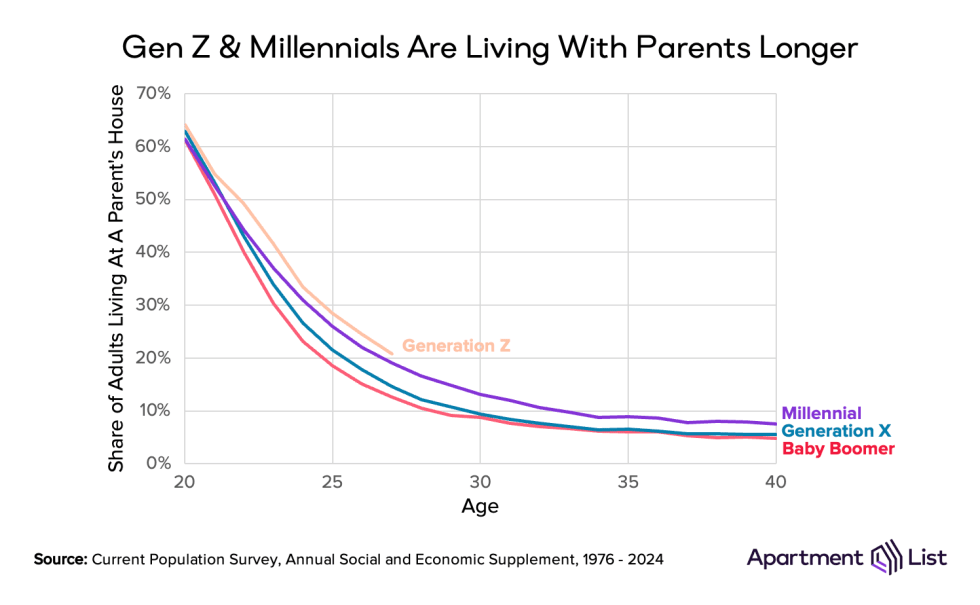

Data from the Census Bureau shows that by sheer volume, Millennials are responsible for a substantial share of home purchases during the past year. But on a per-capita basis, the Millennial homeownership rate has been growing slower than that of previous generations. And an early look at Generation Z shows the trend is worsening, not improving.

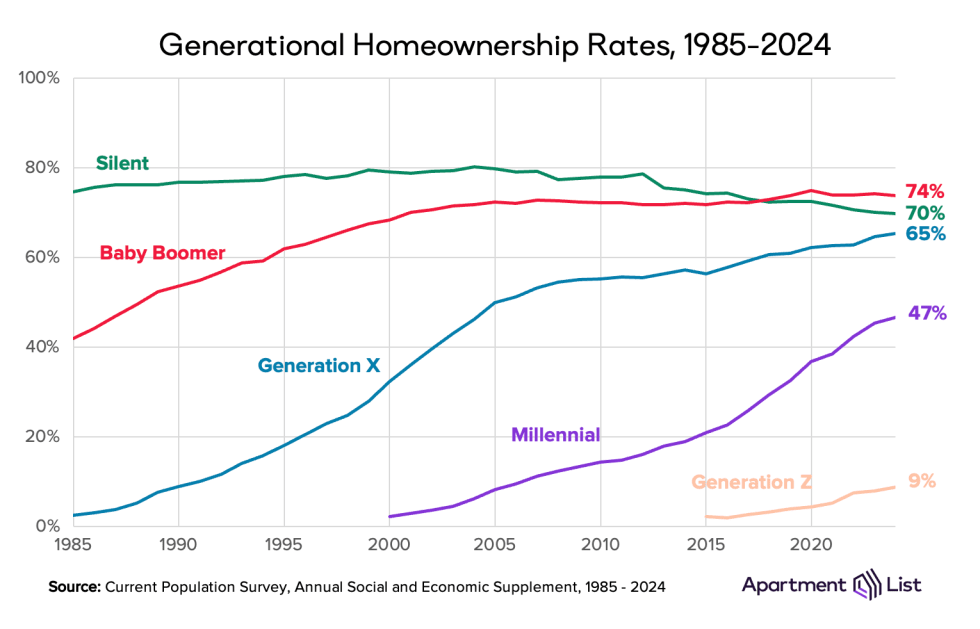

In 2024 the Millennial homeownership rate stood at 47 percent, according to the latest data from the Census Bureau’s Current Population Survey. As expected, rates are higher for older generations; at the top are Baby Boomers, of whom 74 percent own homes. Boomers recently passed the Silent generation (70 percent) who, now in their 80s and 90s, may be selling homes to live with younger relatives or in assisted living facilities. Generation X homeownership has been trending up since 2015, reaching a high of 65 percent today. Next come Millennials (47 percent), followed by Generation Z (9 percent), the oldest of whom were just 27 in the most recent year of data.

How we measure homeownership

In this report, we calculate homeownership rates at the individual-level: the share of adults who are the householder, or the spouse of a householder, in an owner-occupied home. This differs from a commonly-cited household-level rate: the share of occupied housing units that are owner-occupied. The individual measurement will be lower and is more responsive to emerging trends in household composition that affect the homeownership rate, for example adults living with their parents later in life. Last year we published an article exploring in greater detail the nuances between these two definitions and discussing why we believe the individual-level rate is a more appropriate approach for tracking trends in homeownership.

Millennials are attaining homeownership more slowly than previous generations

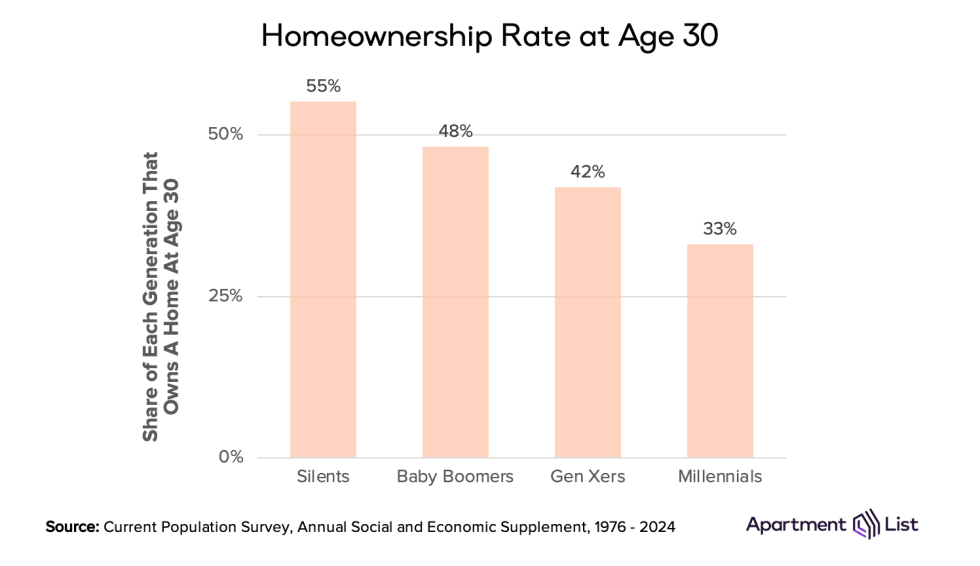

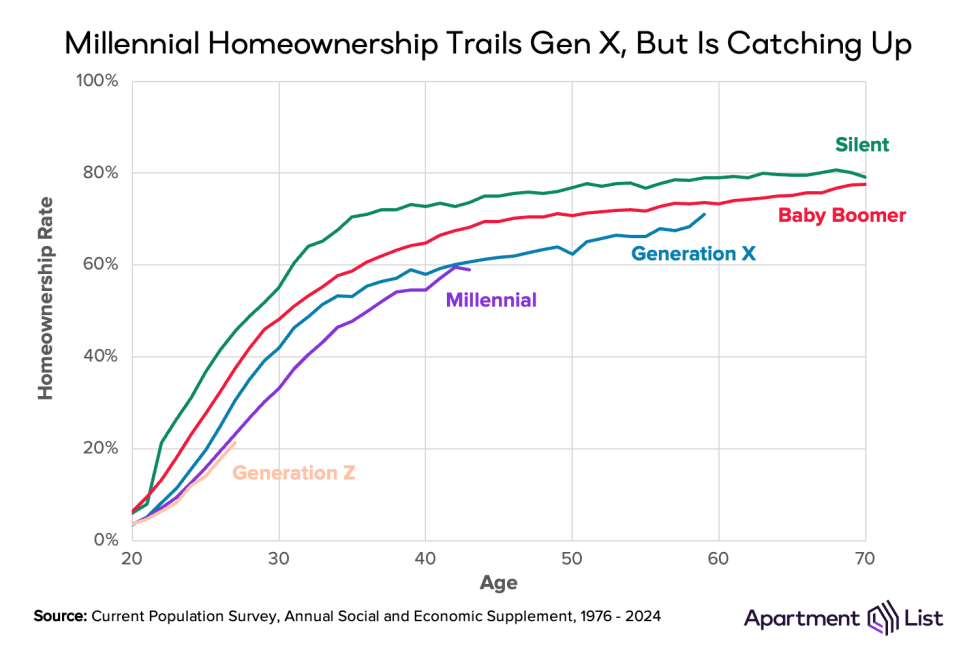

Turning back to the Census data, we can make a stronger comparison across generations by controlling for age and calculating homeownership within equal stages of life. While Millennials have developed a unique reputation for struggling in the housing market, their situation is not new. In fact, they are the third consecutive generation to purchase homes slower than the preceding generation. By age 30, 55 percent of Silents owned homes, compared to 48 percent of Baby Boomers, 42 of Gen Xers, and just 33 percent of Millennials.

Throughout their 20s, Millennials were held back from homeownership in part because of the Great Recession, when the housing market collapsed just as many were graduating college and getting professional careers off the ground. The post-recession period was also defined by a shift in new home construction: less investment in suburban, single-family homes and greater investment in urban, multifamily apartments. So as the economy recovered and Millennials were drawn to jobs in centrally-located cities, many found that renting apartments made more financial sense than buying starter homes, which were becoming increasingly scarce and expensive.

The Great Recession had a similar effect on Generation X, who at the time were in their 30s and 40s and had purchased many of the homes that would be foreclosed when the bubble burst. This caused a flattening of their homeownership rate, and has narrowed the gap between Millennials and Gen X into their early 40s. However the Millennial rate is sure to evolve in the coming decade as more Milleans reach their 40s.

Into their late-30s, Millennial homeownership trails Gen X in 48 states

Indiana, Iowa, and Washington DC are the only states where Millennials have caught up to Gen X in the housing market. In Indiana, 67 percent of Millennials between the ages of 35 and 39 own homes, compared to 65 percent of Gen Xers when they were the same age. In Iowa and DC the gaps are even narrower, with less than one percentage point separating the two generations. But in every other state Gen X homeownership continues to eclipse Millennials, in some cases by a margin exceeding 10 percentage points, like New Hampshire and Connecticut. Explore the state-level data using the interactive chart below.

Millennials are finding the most success in smaller, Midwestern housing markets

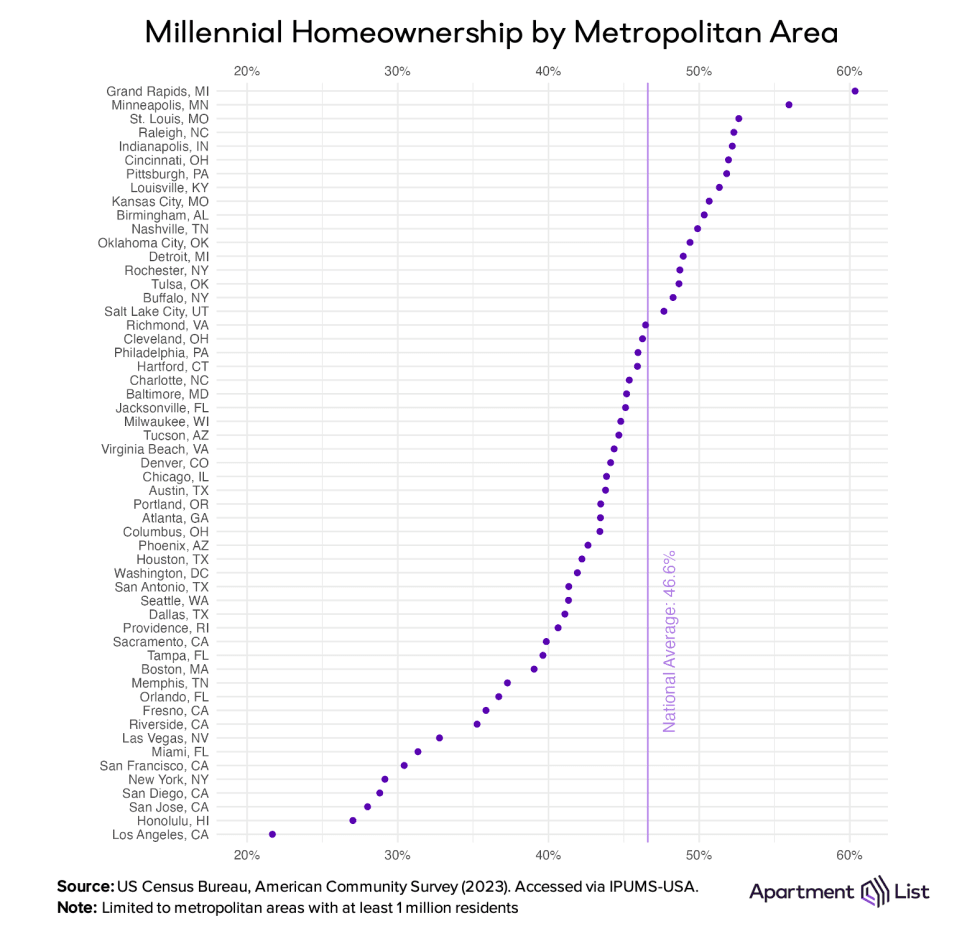

Within states, young homeowners have been shifting away from dense, expensive cities and towards smaller, more-affordable ones. Illustrating this point, the Millennial homeownership rate is 52 percent in the non-metropolitan parts of the country but just 35 percent in the nation’s largest urban markets.

In fact, only a handful of large metropolitan areas have a Millennial homeownership rate exceeding the national average of 47%. The chart below displays the nation’s 55 metros that have a population of one million or greater. Grand Rapids MI sits atop the list with a Millennial homeownership rate of 60 percent, and is followed by a number of markets concentrated largely in the Midwestern and Southern United States. Minneapolis MN, St. Louis MO, Raleigh NC, Indianapolis IN, Cincinnati OH, Pittsburgh PA, Louisville KY, Kansas City MO, and Birmingham AL are the only other major metros where more than half of Millennials are homeowners today.

It should come as no surprise that expensive coastal markets dominate the lower end of the list. Among the ten metros with the lowest Millennial homeownership rates, six are in California: Los Angeles (22 percent), San Jose (28 percent), San Diego (29 percent), San Francisco (30 percent), Riverside (35 percent), and Fresno (36 percent). The other four that round out the bottom 10 are Honolulu HI (27 percent), New York NY (29 percent), Miami FL (31 percent), and Las Vegas NV (33 percent). Despite many of these markets offering high income employment opportunities, years of labor market growth without sufficient new home construction has left a shortage of affordable homebuying options.

The interactive map allows you to observe geographic patterns in Millennial homeownership at both the state and metro levels.

Other states that have historically been looked at as affordable options – Florida, Arizona, Texas, etc. – also find themselves with below-average Millennial homeownership rates thanks to skyrocketing home prices following the COVID-19 pandemic.

Gen Z homeownership is off to a slow start as well

As Millennials grapple with the housing market into their 40s, the next generation is finally old enough to start buying homes of their own. As of 2024, 9 percent of Gen Z adults own a home, and unsurprisingly their homeownership rate is trending slightly slower than Millennials through their mid-20s. Gen Z is coming of age during an affordability crisis unlike anything faced by earlier generations. Home prices have surged 53 percent since 2020 and elevated interest rates are further compounding the costs of owning a home. Rents have grown comparatively much slower than home prices, but are also up 20 percent. As a result, we see young adults not just renting longer but even waiting longer to move out on their own; by age 25 nearly 30 percent of Gen Z is still living with their parents. If today’s affordability challenges persist, it is likely that Gen Z homeownership will fall even further behind Millennials in the coming years.

How is the housing market responding?

We’re already seeing the housing market adapt to these homeownership trends. Anticipating that Millennials and Gen Zers will still want to live in single-family neighborhoods even if they can’t afford to buy in one, the “built-for-rent” sector is booming, with over 100,000 built-for-rent single-family homes delivered in 2024 alone. In this way, rapid home price growth and low Millennial and Gen Z homeownership is proving to be a tailwind for the rental industry, which has enjoyed steady demand from many young adults who are priced out of homeownership and instead living in rentals for longer.

Share this Article