Built-for-Rent Construction Continues Booming

Single-family homes account for roughly two-thirds of the nation’s housing stock, and the majority are occupied by the families that own them. But a sizable share – 16.6 percent – are rented instead, and recent trends in construction data suggest that these single-family rentals will become an increasingly popular housing option in the years to come.

The Latest Housing Trend: A Surge in Built-for-Rent Single-Family Homes

Growth in single-family rentals is driven by a strong demand for single-family homes but a lack of affordable homeownership opportunities. Home prices have nearly doubled over the past decade, and two-thirds of that growth has occurred since the pandemic. Compounding this are high interest rates that further amplify the long-term costs of owning a home. So for many households that want to live the single-family lifestyle, renting is the only financially viable option.

Single-family rentals are typically operated by a mom-and-pop landlord or a small institutional investor. But the new model that is becoming increasingly common is the “built-for-rent” (BFR) community: a large-scale development of single-family homes that are designed for renter occupancy from the start. BFRs borrow some features of multifamily housing, like professional leasing offices, on-site property management, and community amenities, and are marketed as a middle-ground between renting and homeownership.

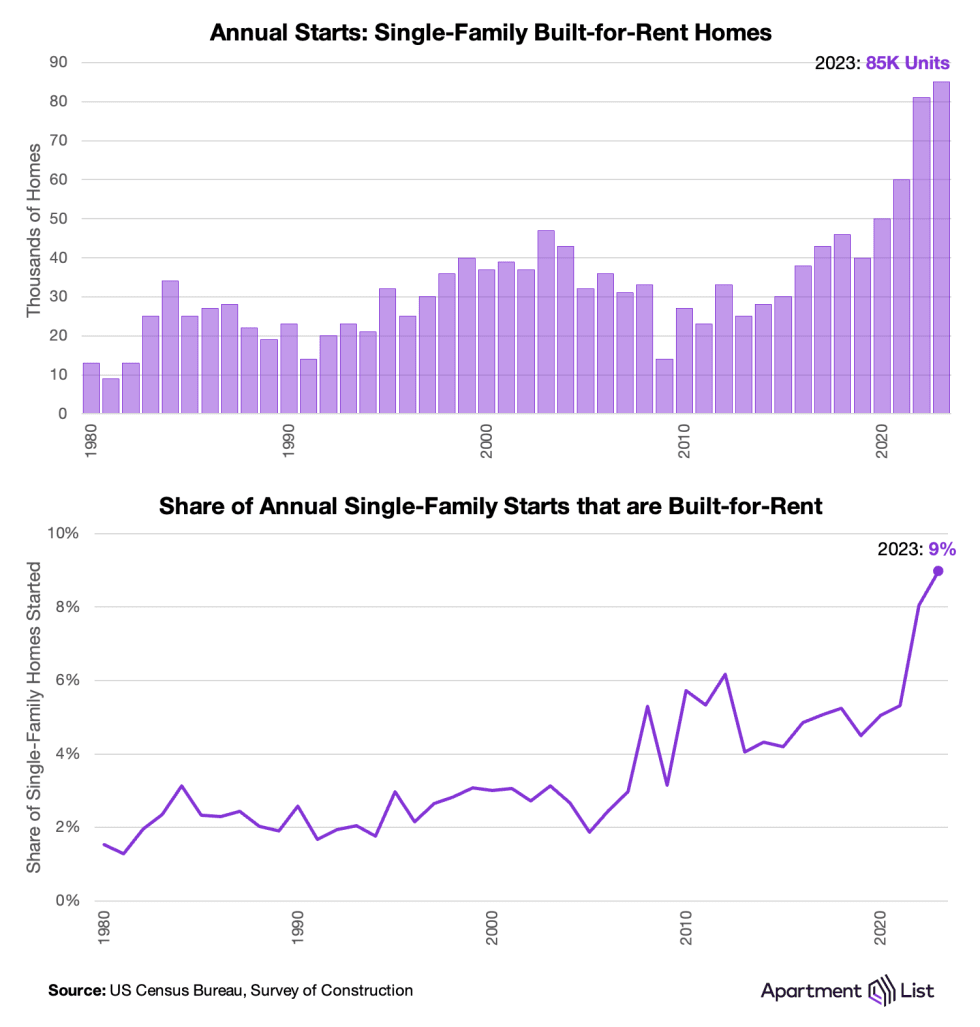

And according to the Census Bureau’s Survey of Construction, BFR development is booming. In 2023 alone, construction started on 85,000 BFR single-family homes, a three-fold increase over the past decade. This accounted for 9 percent of all single-family starts that year, again an all-time high. Even as top-line home construction has cooled since 2021, built-for-rent construction has continued accelerating.

A Large Share of Renters Already Live in Single-Family Homes

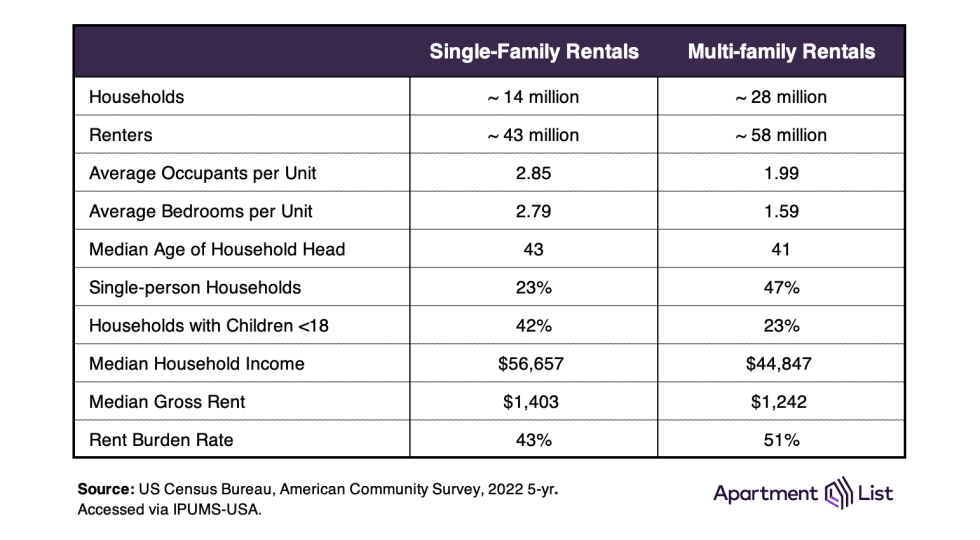

While the built-for-rent model is itself small (but growing), the broader single-family rental market is quite established. Already there are 43 million Americans living in rented single-family homes, representing over 40 percent of all renters across the country. An additional 58 million renters live in multi-family rentals (i.e, apartments, and unsurprisingly, the two groups have different geographic and demographic profiles. This is highlighted in the table below, which summarizes data from the Census Bureau’s American Community Survey in 2022.

Single-family homes are associated with suburban living, while apartments tend to be concentrated in denser metropolitan regions. So as one might expect, the average single-family rental offers more living space (2.8 bedrooms compared to 1.6) and has larger households (2.9 people compared to 2.0). Single-family households are older and include more school-age children, while apartments are more likely to be rented by an individual living alone.

Owing to their larger size, the median rent for a single-family home is 13 percent higher than an apartment. But this is more than offset by household incomes, which are 26 percent higher for single-family renters. Rent burden rates – the share of households spending more than the recommended 30 percent of income on rent – are therefore much lower for single-family households. In this way, single-family rentals are attractive for families as they move up the income ladder, have children, and want more physical space. But the financial gap between renting and owning is still wide; the median household income for single-family renters still trails those of homeowners by a wide margin ($56,657 compared to $93,531).

Single-Family Rents Are Concentrated in the South and West

Single-family rentals are not evenly distributed across the country. The map below shows the percentage of single-family homes in each metropolitan area that were renter-occupied in 2022. White represents the national average of 16.6 percent. Large swaths of the Upper Midwest and New England are shaded orange, where single-family rentals are less common, while purple is prevalent across the southern and western United States.

California stands out as the national epicenter for single-family rentals. Of the 15 metros with the highest rates, 10 are located in the state. And the rate frequently jumps above 30 percent in California’s Central Valley, a farming region where homeownership is particularly expensive relative to agricultural incomes.

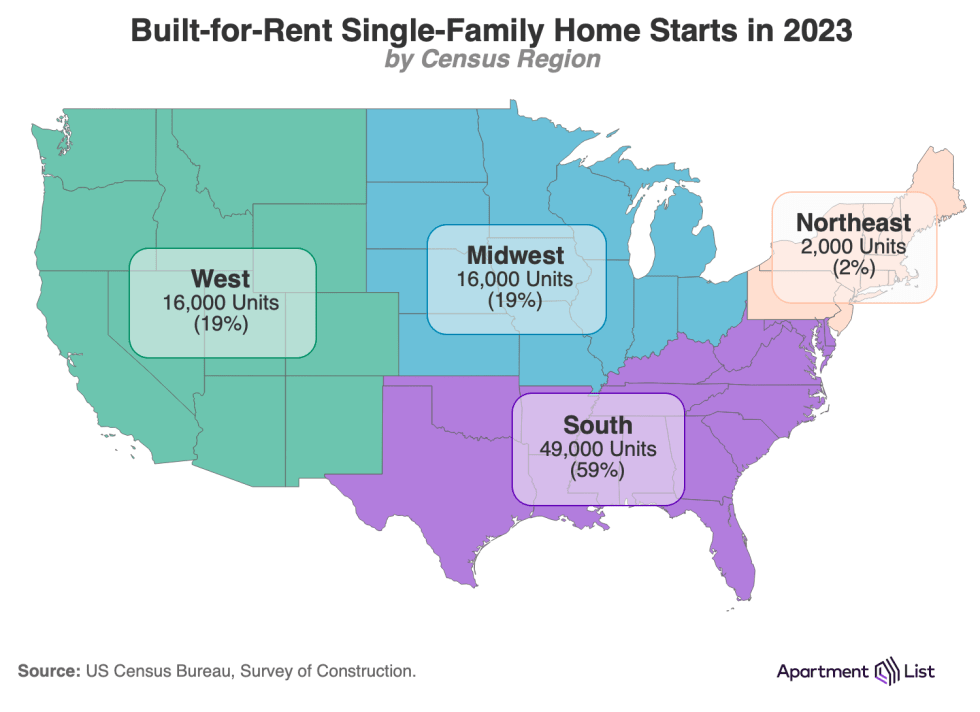

The purple hues are expected to get stronger in coming years, for two reasons. First, as described by Harvard’s Joint Center for Housing Studies, investor ownership of single-family homes increased dramatically during the pandemic, particularly in lower-cost markets across the southern and western United States. Second, these are the regions where BFR development is actively concentrated. Nearly 80 percent of the all new BFR single-family construction last year took place in the South and West.

What Does This All Mean For the Future of Housing Access & Affordability?

Housing experts are split on the long-term effects of this trend. Proponents point out that single-family rentals allow greater financial flexibility and access to single-family neighborhoods, and that the surge in built-for-rent communities is a natural response to demographic shifts, particularly a large generation of millennials who are increasingly starting families, working from home, and valuing the extra space that comes with suburban living. Detractors, on the other hand, argue that institutional investors tend to buy homes at lower price points, further locking out families from buying starter homes that are already in short supply and concentrating the equity gains of homeownership in corporations instead of people. In any case, large-scale investor involvement in the single-family sector remains nascent and will surely draw the attention of policymakers in coming years as housing affordability remains a top-of-mind issue for many American households.

Share this Article