Apartment List Renter Migration Report: 2020 Q3

Welcome to Apartment List’s quarterly Renter Migration Report. In this report, we analyze data on millions of searches to see where our users are preparing to move, shedding new light on the migration patterns of America’s renters. We look at which parts of the country are retaining their renter populations, which places renters are ready to move on from, and which metros are attracting renters from other parts of the country.

COVID-19 and Migration: What We Know Already

The ongoing coronavirus pandemic has forced many renters to rethink their current living situation. Some are choosing to stay where they are because it’s either safer or cheaper to do so. But others are looking at the pandemic as an opportunity to find housing that better suits their personal preferences and economic needs. Earlier this year, our team conducted a survey on migration preferences in which we found that 25 percent of the nation’s renters are more likely to move in 2020 because of the pandemic. The rate was even higher for those living in dense cities and those who had experienced a layoff or some other reduction in income.

While many renters are considering a move, they are not giving up on cities. A separate analysis of Apartment List search data indicated that in the three months following the onset of the pandemic, renters were, on average, searching for homes in places that are more dense than their current city. Furthermore, a larger share of search traffic was flowing from suburbs to cities, not the other way around. However, this analysis highlighted some significant regional variation, hinting that renters in one city may behave quite differently than those in another.

Today, our newest renter migration report provides a look at how renters will be rearranging themselves across the country in a post-COVID world. This analysis incorporates data from millions of user searches from April 1, 2020 through August 10, 2020, and is conducted at the metro level according to Census defined metropolitan areas.

Identifying Migration Patterns In the Wake of A Global Pandemic

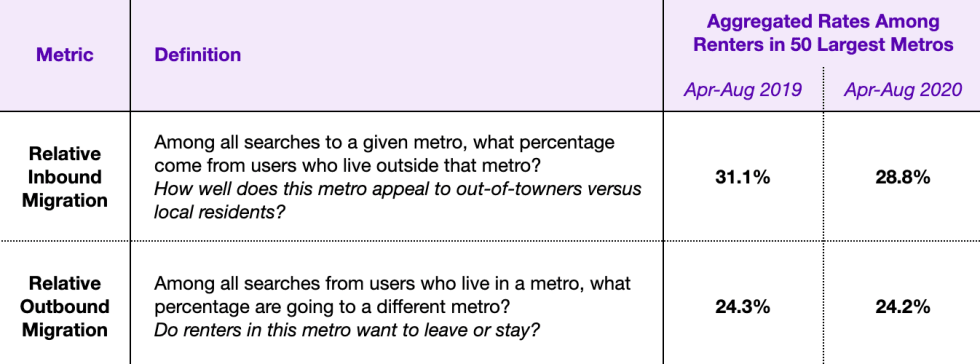

To start, we focus on two important concepts: relative inbound and relative outbound migration. These tell us to what extent typical (pre-COVID) migration patterns have been upended by the pandemic. They also help us understand which parts of the country are attracting out-of-towners, and which places are exporting residents to other regions. We start with a broad national picture, by aggregating changes in relative inbound/outbound migration across the 50 largest metropolitan areas.

Across the nation’s 50 largest metros, relative inbound migration dropped from 31.1 percent to 28.8 percent year-over-year. Meanwhile, relative outbound migration stayed essentially flat, barely ticking down from 24.3 percent to 24.2 percent. Together, this tells us that in the wake of the COVID-19 pandemic, big rentals markets are not seeing the outside influx of demand that they did last year. More and more, renters are choosing to either search locally or search in smaller markets outside the 50 largest that typically dominate search volume.

As a result of COVID-19, hot markets are cooling off as some cool markets heat up

We can plot these migration metrics for individual metros to visualize the local year-over-year change in inbound/outbound migration. In the chart below, the higher a metro sits on the y-axis, the more interest it is attracting from renters in other parts of the country. The further to the right it sits along the x-axis, the greater share of its residents are looking to leave for a different area.

Of the 50 largest metros, 37 saw a year-over-year decline in relative inbound migration, presented as downward movement in the chart above. At the same time, 26 of the 50 largest metros saw a year-over-year decline in relative outbound migration, shown by leftward movement in the animation.

For both inbound and outbound shifts, the largest declines occurred in the places where the level of the given metric was highest in 2019. For example, from April through August of last year, the San Francisco metro had the second highest relative inbound migration rate, but has since experienced the largest decrease in that share. Similarly on the outbound side, New Orleans had the highest relative outbound rate in 2019, and has had the sharpest decline since.

This trend has resulted in a sort of convergence, such that in 2020, America’s large metros bunch much more closely together on the scatterplot. Many of the hot markets that had been attracting significant interest from out-of-towners have cooled, while some less-popular destinations are now attracting more inbound interest. In metros where renters used to leave at a high rate, more are now deciding to stay. Below, we further unpack these trends by diving deeper into the data of a few specific metros.

San Francisco renters are sticking around, but fewer new residents are looking to move in

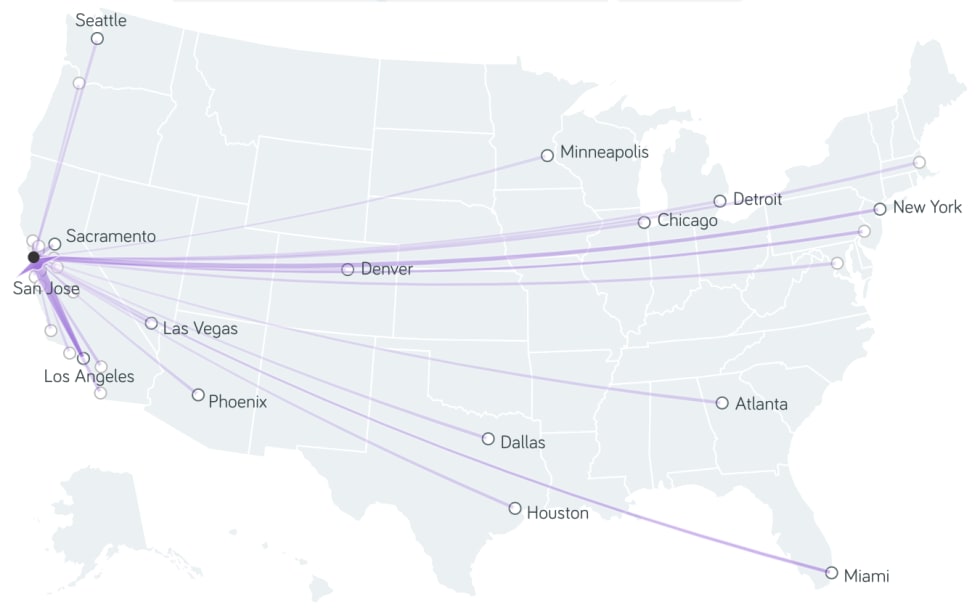

Among the nation’s 50 largest metros, San Francisco saw the biggest year-over-year drop in relative inbound migration: the share of renters looking to move from other parts of the country. From April through early-August, 35.6 percent of inbound searches to San Francisco came from outside the metro. Inbound interest is still strong by national standards, but down significantly from 47.2 percent in the same time period last year. Furthermore, the nearby San Jose metro is now making up a greater share of inbound searches compared to last year; when accounting for this shift, the San Francisco metro has experienced a 15 percentage point decline in the share of inbound searches coming from outside the Bay Area.

Among renters who say that they are now more likely to move because of the pandemic, the need to find more affordable housing is the most commonly cited reason. Amid this climate of heightened financial concern, it appears that the nation’s most expensive housing market has grown less attractive to renters searching from other, less expensive parts of the country. At the same time, we are witnessing early signs that a shift toward remote work will outlast the pandemic, and Bay Area tech companies are leading this trend. Even the workers who are still drawn to the area's desirable tech jobs may no longer feel that they need to actually live in San Francisco. Others may be delaying their moves while their employers are fully remote.

This decline in relative inbound migration is likely contributing to recent softness in Bay Area rents. San Francisco has seen the nation’s fastest decline in rents since the start of the pandemic, with prices down by 3.3 percent from March through July. Although San Francisco remains the nation’s most expensive rental market, local renters are likely finding better deals now than they have in some time, which may encourage them to stick around. Despite speculation of a Bay Area exodus, we actually see that the share of renters who are currently living in the San Francisco metro and looking to move elsewhere has been largely stable, increasing only very slightly from 31.6 percent at this time last year to the current rate of 32.1 percent. To the extent that demand for Bay Area apartments has fallen off, it appears that the region is simply attracting fewer new residents from elsewhere, as opposed to seeing existing renters leaving the area.

Relative inbound migration dropping off for tech hubs across the country

San Francisco is not alone experiencing a dropoff in interest from other parts of the country. In fact, a similar trend is playing out in many of the nation’s foremost tech hubs. For example, the share of inbound searches to Denver coming from outside the metro fell from 42.6 percent last year to 37.3 percent in the most recent data. Similarly, Raleigh, Austin, Nashville, Seattle, and San Jose all saw relative inbound migration fall by at least four percentage points.

Although no other metro has seen a shift of the same magnitude as San Francisco, similar factors seem to be at play in these other tech hubs. While the Bay Area and Seattle have been dominated by the tech industry for decades, Denver, Austin, Raleigh, and Nashville have seen more recent tech booms, which have quickly driven up rents in these once affordable markets. Given that tech companies have generally been the fastest to embrace remote work, renters in other parts of the country may now feel that they do not need to move to a tech hub to take advantage of the thriving job markets that they offer. That said, despite the downward trajectory, these metros all still rank fairly high for relative inbound migration.

More affordable alternatives to the priciest markets are gaining in popularity

As inbound interest to San Francisco cools, another Northern California metro has seen inbound interest increase -- Sacramento. In 2020, relative inbound migration to Sacramento increased by 3.8 percentage points compared to last year; this is the second largest increase among the nation’s 50 largest metros. San Francisco is the most popular source of inbound searches to Sacramento, and this migration flow has strengthened from 2019 to 2020. As more flexible working arrangements gain popularity, affordable metros on the peripheries of major job centers may become increasingly attractive, and Sacramento appears to be showing early signs of this trend.

A similar dynamic appears to be at play in a few of other metros that renters consider more-affordable alternatives to some of the nation’s most expensive markets. Richmond, VA, which sits about 100 miles south of Washington, D.C. saw relative inbound migration increase from 31.4 percent last year to 34.6 percent this year. This distance would be taxing as a daily commute, but may feel reasonable for workers who are showing up at the office on a more limited basis. Other examples include Riverside, CA, which borders Los Angeles, and Philadelphia, a major city in its own right, but also one which sits within super-commuting distance of both New York City and Washington DC.

Boston experiencing greater turnover in its renter population

In contrast to the tech hubs described above, which are all experiencing lower levels of inbound interest, Boston saw the share of searches coming from outside metro increase from 34.2 percent to 39.1 percent from 2019 to 2020, the largest increase among the 50 largest metros. Additionally, Boston saw the biggest increase in the share of renters looking to leave the metro, with relative outbound migration increasing from 21.1 percent to 28.7 percent. The combination of these changes could mean that Boston is poised for more churn in its renter population in the near future.

The increase in Boston area renters looking to move elsewhere may be driven by the area’s large student population. As colleges plan for remote learning in the fall, many students who were based in Boston at the onset of the pandemic may have since looked to move back to their hometowns. On the inbound side, the New York City metro is still the top source of searches for Boston apartments from renters currently living elsewhere. That said, the share of inbound searches from NYC has actually declined year-over-year. Most of the other places that account for a large share of inbound searches to Boston are small nearby metros, such as Providence, RI; Worcester, MA; Barnstable, MA; and Manchester, NH. As rents have recently fallen in Boston and the surrounding areas, renters in the bordering metros may be looking to see if they can find a deal closer to the city.

New Orleans renters staying put during the pandemic

From April through August of last year, 42.4 percent of users living in New Orleans were looking to move elsewhere, by far the highest rate among the 50 largest metros. However, that share fell to 35.6 percent this year, accounting for the nation’s steepest decline in relative outbound migration. At the same time, relative inbound migration to New Orleans also fell from 35.5 percent last year to the current level of 32.0 percent. The data characterized New Orleans as a market exhibiting high turnover before the pandemic -- lots of renters who already lived there were looking to leave, but lots of new residents were looking to move from elsewhere. In contrast, New Orleans is now retaining more of its population, but also attracting less interest from elsewhere.

While this growing stability in the area's population could seem like a positive signal, it may not be indicative of a thriving market in this instance. The local economy is heavily dependent on tourism and an outsize share of its workforce is employed in the service occupations that have been most heavily impacted by the pandemic. New Orleans residents facing new economic challenges may no longer be able to shoulder the financial burden of long distance moves. Among New Orleans renters who are looking to move elsewhere, nearby locations in Louisiana such as Baton Rouge, Hammond, and Lafayette have grown more popular.

Conclusion

In recent months, there has been significant speculation about how the COVID-19 pandemic will change where Americans want to live. While our previous research has shown that predictions of a widespread urban exodus may be premature, this new data shows that at the broader metro level, we are beginning to see signs of the COVID effect. Most notably, the nation’s pricey tech hubs have begun to lose some of their luster, although they still remain fairly popular destinations. Meanwhile, some more affordable markets are gaining in popularity. As remote work and widespread layoffs reshape the labor market, the rental market is beginning to respond.

Share this Article