Coronavirus Is Inspiring Some to Move, and Many to Stay Put

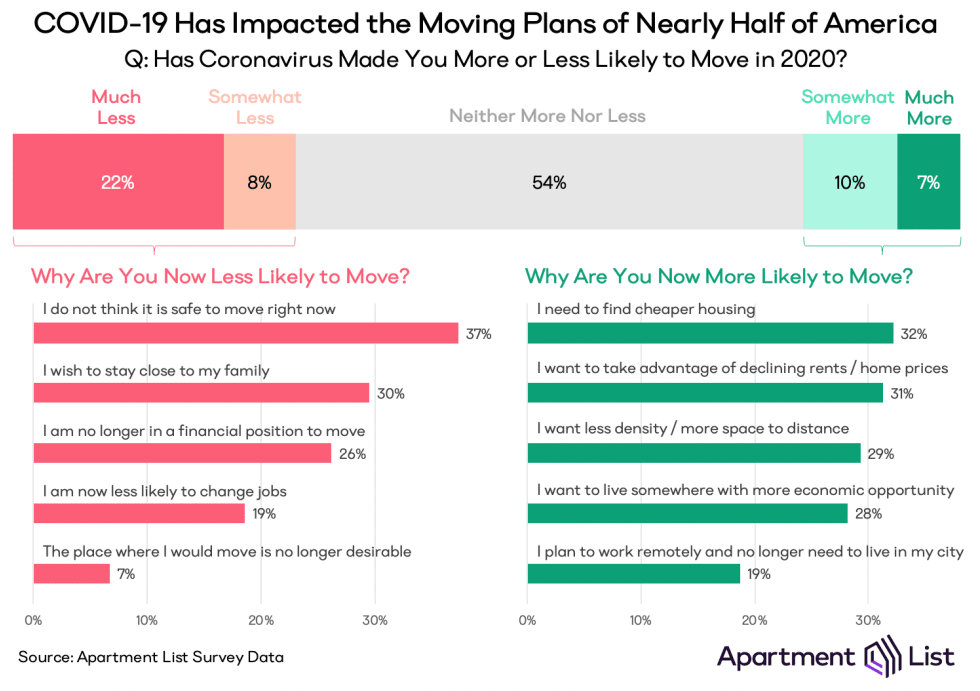

- Americans are moving less today than ever before, but some suspect the coronavirus will reignite mobility. Our survey finds that because of the pandemic, 17 percent are now more likely to move by year’s end. But another 30 percent say they are more likely to stay where they are.

- Economic fallout from the pandemic is having the broadest impact on moves. It is encouraging some (who need to find cheaper housing) while discouraging others (who cannot afford to move).

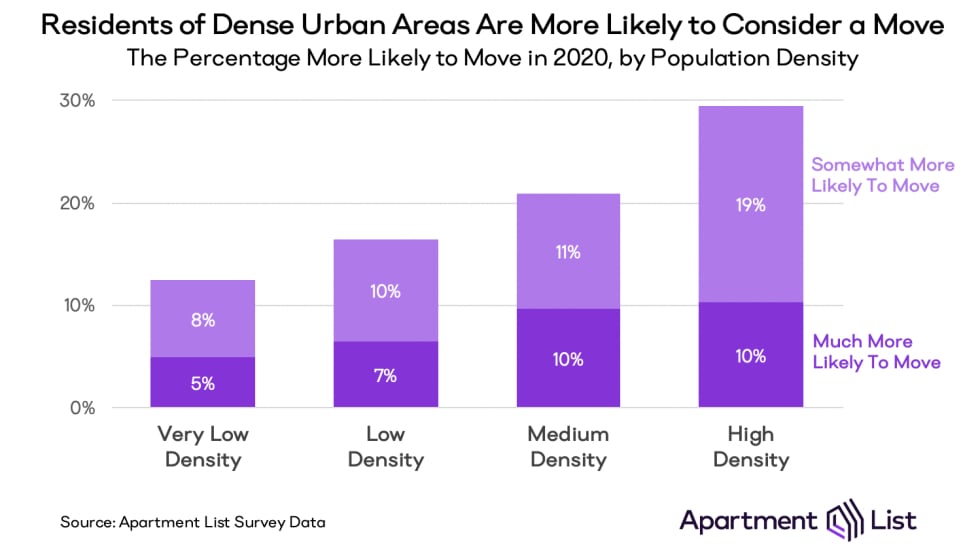

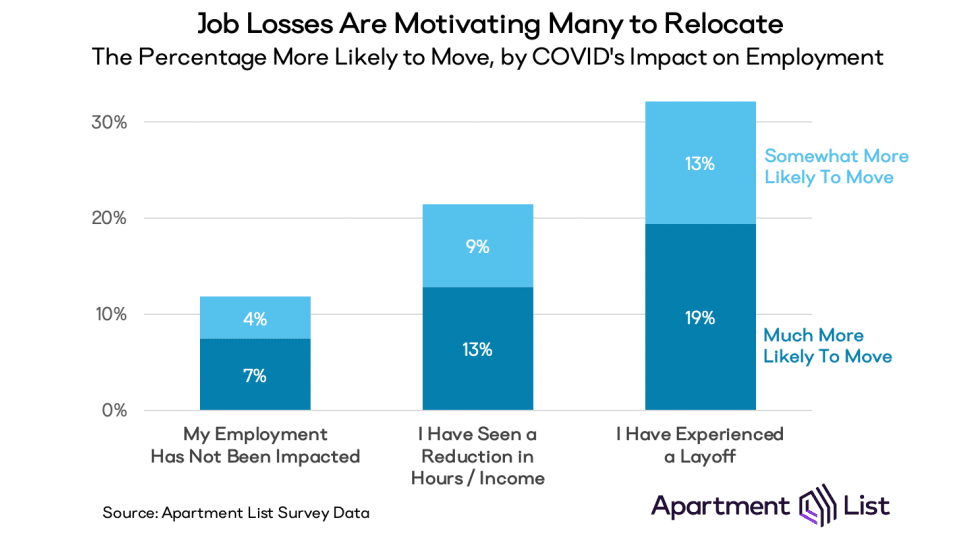

- Renters (25 percent), residents of dense urban areas (29 percent), and those who have been laid off (32 percent) are the groups most likely to be considering a move.

- But it is not just opportunistic remote workers looking to move. Many low-income Americans will be moving out of necessity, and for them, affordable housing options will be difficult to find.

Introduction

Moving, whether for opportunity or adventure, has long been cemented in the American psyche. It may be motivated by a pursuit of education, career advancement, a desire to own a home or start a family, or simply a change of pace. But while Americans have historically moved more frequently than those in many other countries, the U.S. mobility rate has actually been declining for the past 35 years. According to the Census Bureau, over 20 percent of Americans changed homes in 1985; by 2019, that rate had been cut in half.

Now, as the coronavirus pandemic continues to uproot daily life, there are many reasons to think American mobility will rebound. For one, a number of large companies are embracing remote work beyond the pandemic, meaning their workers are no longer tied to a particular location. Plus, months of sheltering in place has many urban dwellers thinking about greener (and more spacious) pastures. And at the same time, millions of Americans have recently lost their jobs, leaving them with no choice but to move in with family or find some other more affordable living situation. Lately there has been much anecdotal speculation on these trends. In this report we analyze recently collected survey data to get a more concrete idea of how the current pandemic will shape American mobility.

Financial Pressure Is Both Encouraging and Discouraging Moves

Over the past three months, Apartment List has surveyed more than 10,000 Americans about the pandemic and its impact on their housing and employment. In this month’s survey, we asked respondents whether the coronavirus has altered their plans for moving in 2020.1 Nearly half say that it has, with 30 percent saying that they are now less likely to move, and 17 percent saying that they are now more likely to do so. While the pandemic may be spurring some Americans toward increased mobility, many more are finding it in their best interest to stay put.

The decision to move or not to move is a complicated choice that depends on a range of personal circumstances. That said, our data highlight some of the primary factors at play. For instance, the biggest factor discouraging moves is safety. 37 percent of those who are now less likely to move are concerned that moving during a pandemic will be dangerous to their health. At the other end of the spectrum, the most common factor encouraging mobility is a need to downgrade to cheaper housing, accounting for 32 percent of those who are more likely to move. Meanwhile, the narrative that remote work will fuel an exodus from cities may be a bit overhyped. Although 19 percent of those who are more likely to move cite this reason, it is actually the least prevalent factor we asked about.

Unsurprisingly, economic fallout from the pandemic is having the broadest impact on near-term migration, in both directions. Since April, tens of millions have lost jobs, as many as 31 percent have failed to make on-time housing payments, and many fear an eviction or foreclosure is on the horizon. For some, this means they have no choice but to move into cheaper housing; for others, this means they are no longer in a financial position to move, even if they had wanted to.

This financial pressure is bearing down particularly hard on the nation’s renters. Mobility is generally seen as one of the main benefits of renting; without being tied down to a mortgage, renters are more free to explore new places and opportunities. To some extent, our survey results show this flexibility: 25 percent of renters say that because of coronavirus they are more likely to move, compared to just 11 percent of homeowners. However for renters especially, mobility is a reflection of economic stress rather than lifestyle flexibility. Renters are nearly twice as likely as homeowners to say they are moving to find cheaper housing (40 percent versus 23 percent, respectively). And among renters looking to move, 58 percent say that if they don’t, they are concerned they will be evicted from their home before the end of the year.

City Residents Are More Likely To Consider A Move

Today, American cities face an uncertain future. After years of growth, driven primarily by young professionals seeking high-paying jobs and urban amenities, cities have been hit hard by coronavirus. The density that many value in normal circumstances has become a temporary liability amid social distancing. And according to our survey, it is true that many city residents are considering a move. Nearly 30 percent living in high-density urban areas say that because of the pandemic, they are more likely to move by year’s end. This is more than double the rate of those living in rural parts of the country, where residents are much more likely to stay put rather than to relocate. 2

The data paint a picture of two distinct groups that may contribute to an out-migration from cities. The first are wealthier residents who have the financial means to move and who can take their work with them. Previously, our team reported how remote work shields predominantly higher-wage workers from housing insecurity; now, with jobs secure, we see this flexibility inspiring them to consider moving. 32 percent of city residents who can telecommute are now more likely to move, and their top motivations are to take advantage of declining rents elsewhere (39 percent), to work remotely in a different place (33 percent), and to live in a lower-density environment (31 percent).

But it is not just remote workers who are considering a move. The second group sits at the other end of the economic spectrum and represents a much more dire reality. These are lower-income city residents struggling to keep up with high housing costs in the wake of an economic crisis. Among those in households earning less than $50,000 annually, 29 percent say that they are now more likely to move, but for very different reasons than the group described above. 40 percent cite the need to downgrade to cheaper housing and 30 percent say they are pursuing better economic opportunity. For these individuals, moving is less a matter of personal preference, and is primarily motivated by a need to secure stable and affordable housing in the face of financial uncertainty.

Those Financially Impacted by COVID Are Looking To Relocate

The economic fallout from coronavirus has been unprecedented, and as previously reported, the impacts are disproportionately endured by lower-income, service-oriented sectors of the economy. In our survey, 23 percent of respondents say they experienced a layoff as a result of coronavirus, and another 28 percent have had their incomes reduced. The downstream consequences are clear: in June, only 50 percent of these individuals were able to make their full housing payment on time, and over 46 percent say they are at least somewhat concerned that they will face an eviction or a foreclosure in the coming six months.

As a result, many are planning a move in search of financial security. Among employed workers whose incomes have not been affected by the pandemic, just 11 percent are now more likely to move. That rate doubles to 22 percent for those whose incomes have been reduced, and jumps to 32 percent for those who have experienced a layoff.

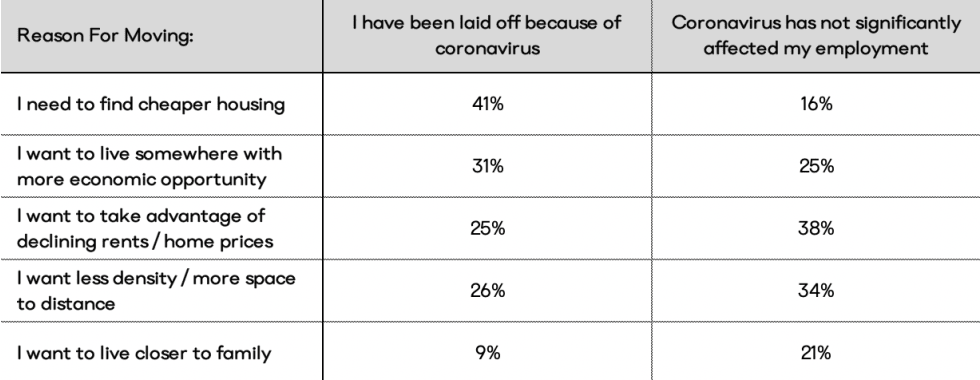

As expected, the factors motivating prospective moves are different for each of these groups. 41 percent of those who have been laid off say that they are moving out of necessity, compared to just 16 percent of those whose jobs are intact. Those unaffected are less concerned about finances and more focused on living closer to family (21 percent) or in lower-density areas (34 percent).

Conclusion

Where people choose to move has broad implications for local housing markets across the nation. In the wake of the COVID-19 pandemic, the conversation around mobility has primarily centered on the possibility that the widespread adoption of remote work could loosen the previously unbreakable ties between labor and housing markets. We do find that a subset of our survey respondents are now planning to move away from the city where their employer is located and work remotely, lending some credence to a trend that has so far been observed mostly anecdotally. However, this is not the dominant theme that emerges from our survey results.

Rather, we find that many of those who are now more likely to move are planning to do so in order to seek more affordable housing. At the same time, the respondents who are now more likely to move are actually outnumbered by an even greater share who say that they are less likely to move as a result of the pandemic. Financial instability and health concerns seem to be top of mind for those who have deferred their moving plans. If more and more Americans are looking to move into cheaper units that existing tenants are now less likely to vacate, the affordable housing market -- which was already undersupplied -- is likely to experience even more pressure. Meanwhile, a more permanent shift toward remote work will likely have some impact on mobility trends, but we expect that this effect will be less pronounced and will play out over a longer horizon.

- In this month's survey, we received 3,872 responses from renters and homeowners telling us about their moving plans. The survey was conducted using SurveyMonkey and our panel of respondents match the age and gender distribution of the United States as a whole.↩

- Density categories are defined using the number of people per square mile in each respondent's home zip code. Very low density = <1,000. Low density = 1,000-4,999. Medium density = 5,000-9,999. High density = 10,000+.↩

Share this Article