Apartment List Renter Migration Report: 2020 Q1

Welcome to the Apartment List’s first quarterly Renter Migration Report of the new decade! In this report, we analyze data on millions of searches to see where our users are preparing to move, shedding new light on the migration patterns of America’s renters. These patterns are of particular importance, as long-distance moves are often motivated by employment opportunities, with research showing that residential mobility can drive economic advancement.

We look at which parts of the country are retaining their renter populations and which parts renters are ready to move on from, as well as which metros are doing the best and worst jobs of attracting renters from other parts of the country. In some cases, the patterns we observe in this data are intuitive, while in others we unearth surprising insights.

Read on for our analysis of some of the key insights we observe and please explore the interactive map at the top of the report to draw insights of your own.

Denver draws the largest share of renters moving from afar

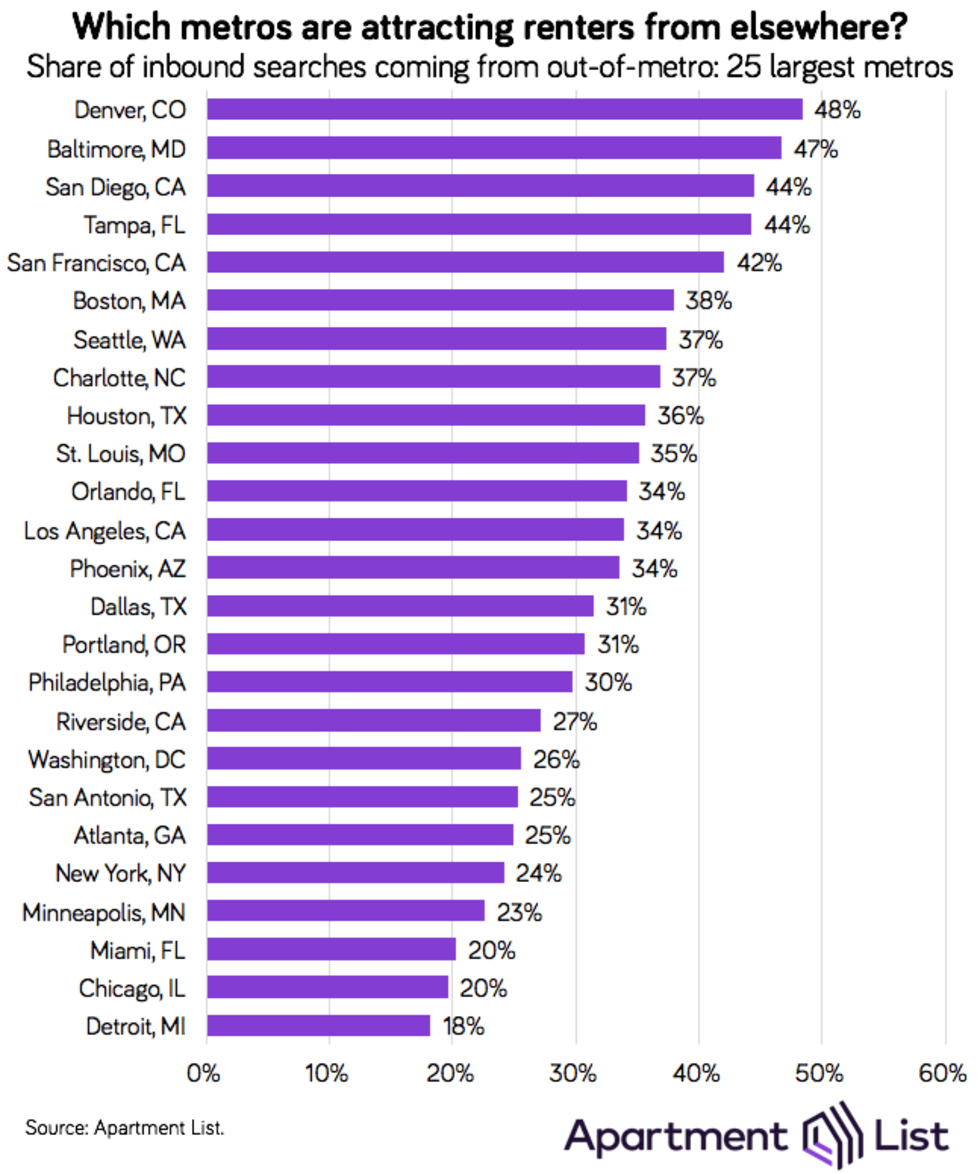

In order to better understand which metros are attracting the most renters from elsewhere, we calculate the share of inbound searches coming from outside the metro. The following chart shows the nation’s 25 largest metros ranked on this metric:

Denver ranks first, with nearly half of searches coming from users who currently live outside the metro. With a thriving job market fueled by a years-long tech boom, Denver continues to attract renters from around the country, even as the area’s housing costs continue to increase. Notably, Washington, D.C. is the most common source of out-of-metro searches for apartments in Denver. D.C. residents account for 10.5 percent of inbound searches to Denver coming from outside the metro, compared to just 2.4 percent coming from San Francisco and 1.1 percent coming from Seattle. It may be that as the tech industry bears increased scrutiny, Denver area startups are finding it increasingly important to attract workers with policy backgrounds and connections.

Baltimore has the second highest share of searches coming from outside the metro. But compared to Denver, which draws interest from around the country, Baltimore’s high ranking on this list is attributable to its status as an affordable alternative to one of the nation’s most expensive rental markets. A full two-thirds of users searching in Baltimore from outside the metro are currently based in D.C.

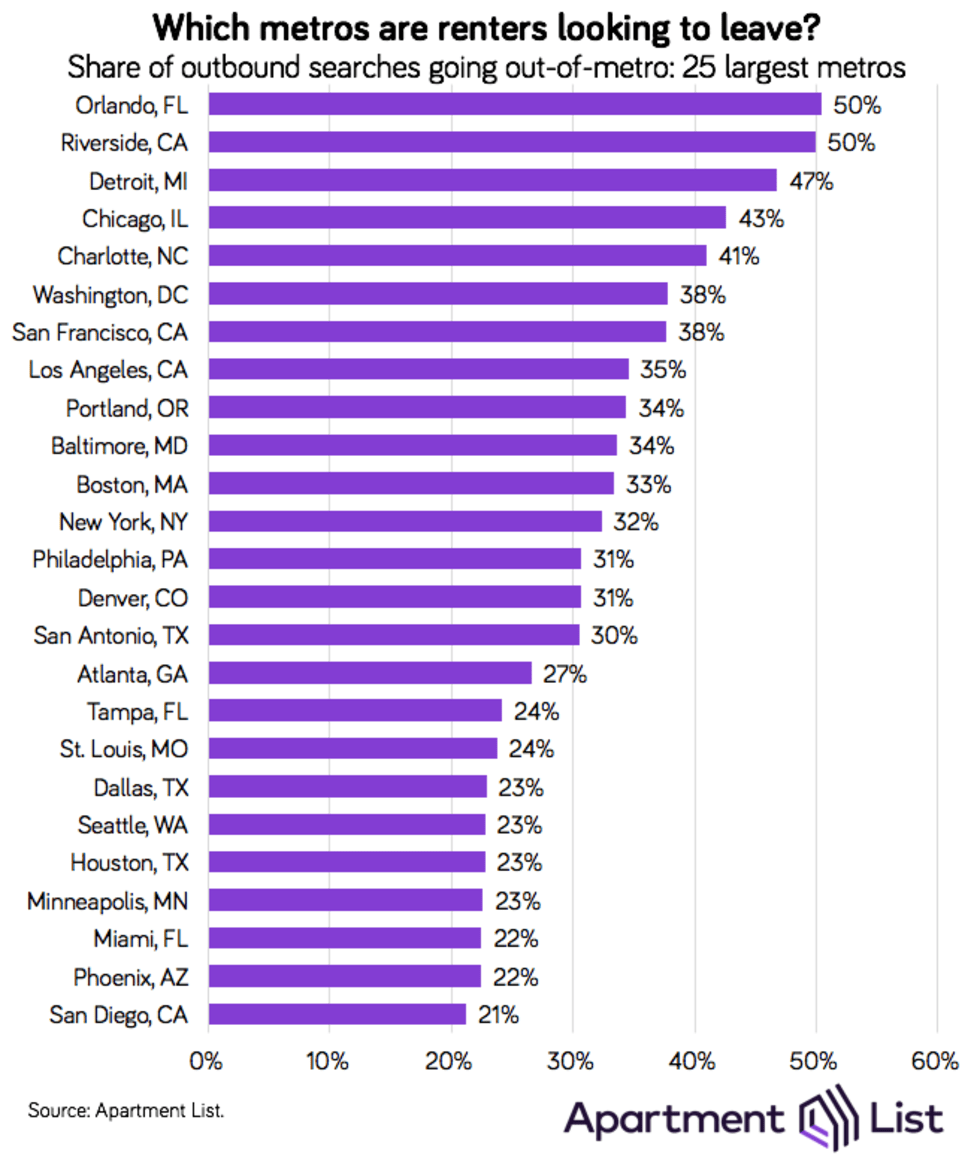

At the other end of the spectrum, just 18.2 percent of searches in the Detroit metro came from outside the metro, the lowest share that we observe among the 25 largest metros. Detroit has suffered from a decades-long population loss, and although this loss has slowed in recent years, the area has yet to cement a full revival. In addition to failing to attract renters from elsewhere, our data also show that many renters currently living in Detroit are looking to get out. Detroit has the third highest share of outbound searches going out-of-metro; 46.8 percent of apartment hunters who are currently living in Detroit are searching for apartments outside the metro.

Orlando ranks first in the share of users looking to leave the metro. However, unlike Detroit, Orlando has a thriving local economy and has been experiencing robust population growth. Despite having a high share of users who are searching outside the metro, Orlando also has a relatively high share of inbound searches coming from outside the metro, indicating that the area is experiencing a changing population rather than a declining population. The three most popular outbound search locations from Orlando are all other Florida metros, however, New York is the second most common location for inbound searches to Orlando coming from outside the metro.

Is L.A. turning into a Nashville Party?

We recently ranked Nashville as the decade’s “most-changed” metro. Over the course of the 2010s, Nashville grew into an economic force and was considered a prime contender in Amazon’s search for an “HQ2” location (although Nashville did not win that contest, Amazon has made the city the home of its East Coast operations hub).

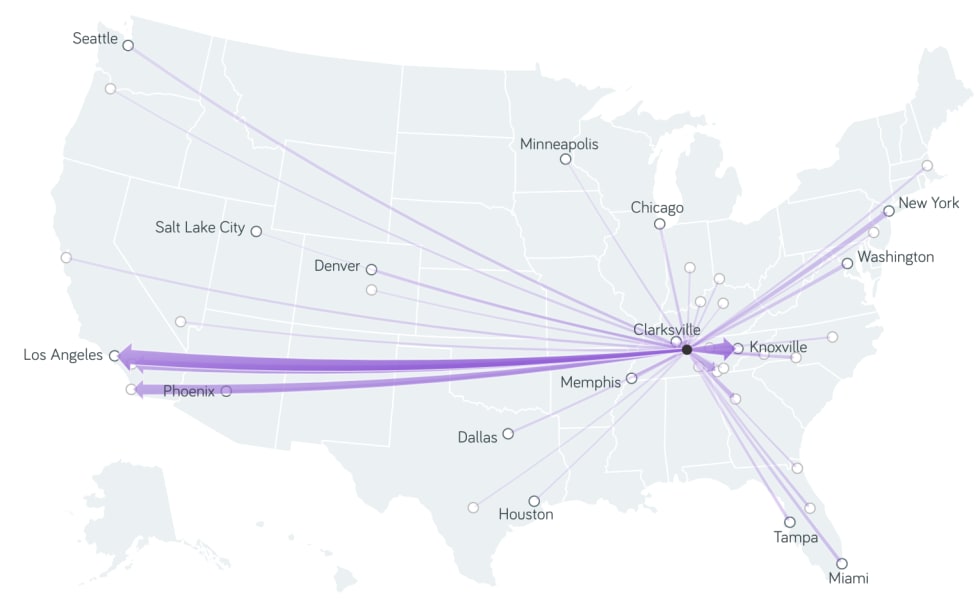

Over the last decade, the Nashville metro had the seventh fastest rate of population growth among the nation’s 50 largest metros, and our data show no signs of that growth slowing. 51.3 percent of inbound searches to Nashville come from outside the metro. Nearby Memphis and Knoxville are the top two inbound search locations for Nashville, but they are followed by Chicago and New York, two of the nation’s largest cities.

While the inbound search data confirm Nashville’s popularity, the outbound search data reveal an interesting new trend among those looking to leave the area. Although 71.6 percent of renters currently living in Nashville want to stay in the metro, the most popular destination for those looking to leave is not one of the neighboring metros, but rather Los Angeles. Nashville has long been home to one of the nation’s most robust music scenes, but as other industries begin to transform Nashville, some Music City artists may be deciding to try their luck on the West Coast entertainment hub.

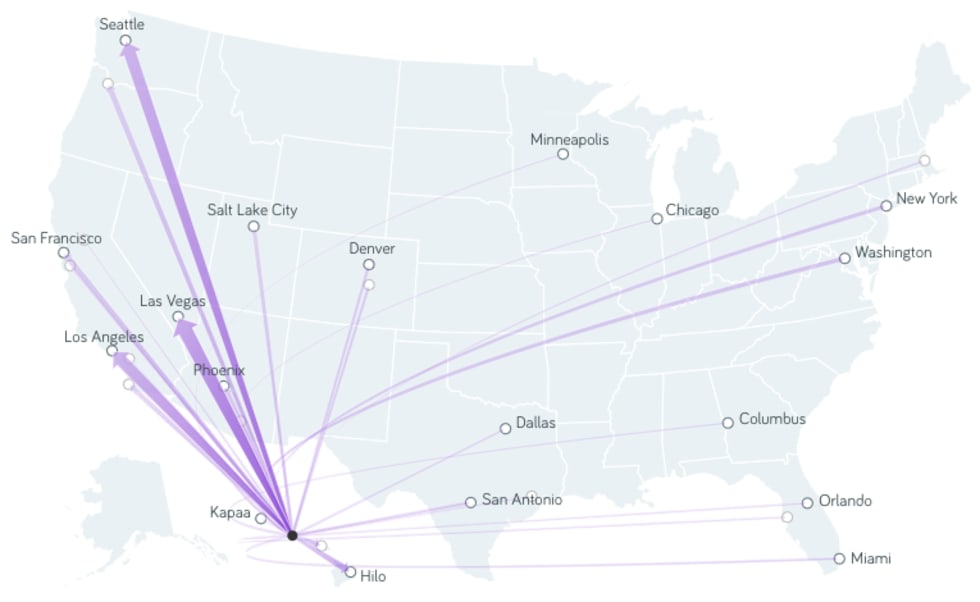

Angeleno’s flock to Phoenix

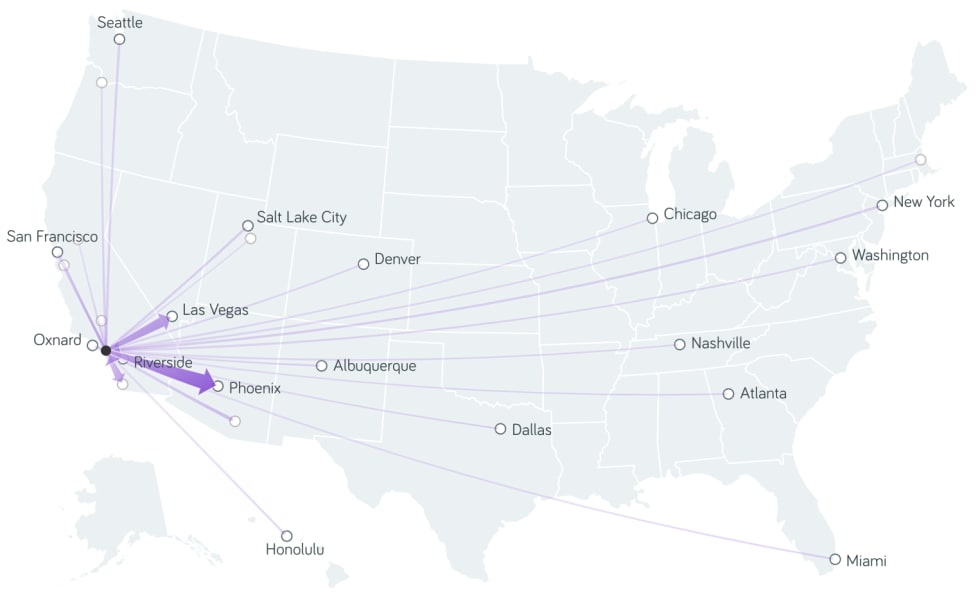

As Nashville residents make their way to L.A., over one-third of renters already living in the area are also looking to move on to greener pastures. More specifically, it seems that Angeleno’s are searching for less expensive pastures, and are looking beyond California to do so. 18.9 percent of renters looking to leave the L.A. metro are searching in Phoenix, making it the most popular outbound search destination from L.A.

L.A. is also the most popular source of inbound searches to Phoenix, accounting for a staggering 33.2 percent of users searching in Phoenix from outside the metro. Although Phoenix has grown rapidly in recent years and offers strong employment opportunities, it has thus far maintained its affordability. Similar to L.A., Phoenix is also a car-centric city, but lacks L.A.'s traffic issues. For these reasons, Phoenix presents an attractive alternative for those looking to leave L.A.

After Phoenix, Las Vegas is the second most popular outbound search location from L.A., accounting for 12.5 percent of users who currently live in L.A. but are searching for apartments outside the metro. Riverside ranks third, despite the fact that it borders L.A. For renters who are being priced out of L.A. it seems that moving out-of-state is a more enticing option than venturing to the further reaches of the Greater L.A. region.

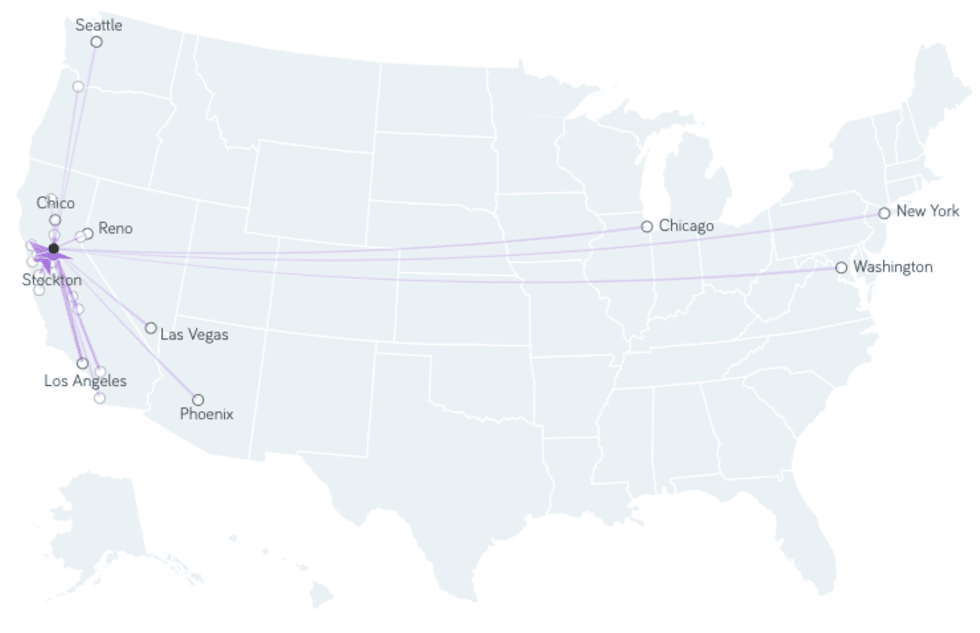

Will Sacramento become the new Bay Area hot spot?

In contrast to L.A., renters in the Bay Area are more inclined to stay local, and are willing to consider all of the options the region has to offer, rather than move out-of-state. Among renters looking to leave San Francisco, the nearby San Jose metro is the most popular search location, followed by Sacramento.

The San Jose metro ecompasses Silicon Valley, and the housing and job markets of San Jose and San Francisco have long been intertwined. Sacramento, however, lies ninety miles northeast of San Francisco and has not traditionally attracted tech jobs and talent in the same way. However, Sacramento boasts some of the last remaining affordable real estate in the region. As super commuting and remote work become increasingly popular, Sacramento may be starting to draw tech workers even as they maintain jobs in San Francisco or San Jose. And if tech talent shows a willingness to move there, Sacramento may emerge as an alternative for early-stage startups that can’t afford San Francisco rents.

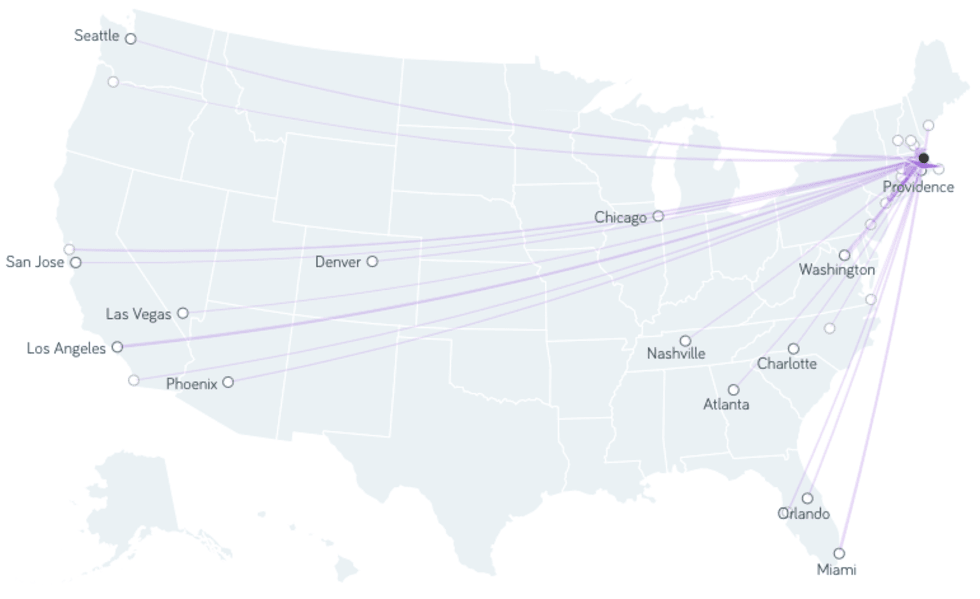

Boston renters are slow to leave New Egland

On the East Coast, Boston presents an analogue to the trend described in the Bay Area above. Boston is also home to a highly educated workforce, as well as some of the nation’s most expensive housing costs. In spite of those high prices, Boston is doing a relatively good job of retaining it’s renters -- two-thirds of apartment hunters currently living in the Boston metro want to stay there.

Among the one-third of Boston area renters who are looking to move elsewhere, the three most popular destinations are Providence, RI; Hartford, CT; and Manchester, NH. Although these destinations are all out-of-state. Providence and Manchester are both closer to Boston than Sacramento is to San Francisco, and Hartford is just slightly further. These three smaller New England cities represent affordable alternatives to Boston that are ripe for renewal and can offer local scenes that will remind Boston expats of home.

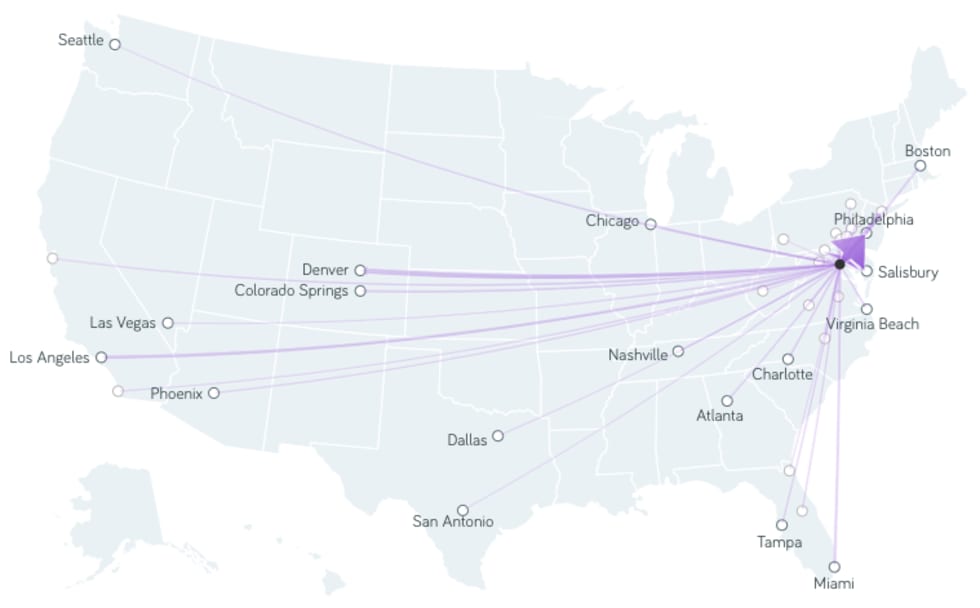

Philly more popular than Baltimore among those fleeing D.C.

Washington, D.C. is another example of a pricey East Coast market, and compared to Boston, it is less effective at retaining its renter population. 37.8 percent of Apartment List users searching from the D.C. metro are looking at apartments outside the metro, the sixth highest rate among the 25 largest metros.

Nearby Baltimore, which is within commuting distance of D.C., has long been a popular choice for those priced out of the nation’s capital and it accounts for 14.6 percent of outbound searches from D.C. However, this is slightly less than the 14.8 percent of searches going to Philadelphia, the most popular outbound destination from D.C. Philadelphia is roughly equidistant between D.C. and New York City, and it has become increasingly popular with former residents of both cities in recent years. Although that popularity has driven price increases, Philadelphia remains one of the most affordable big cities in the Northeast.

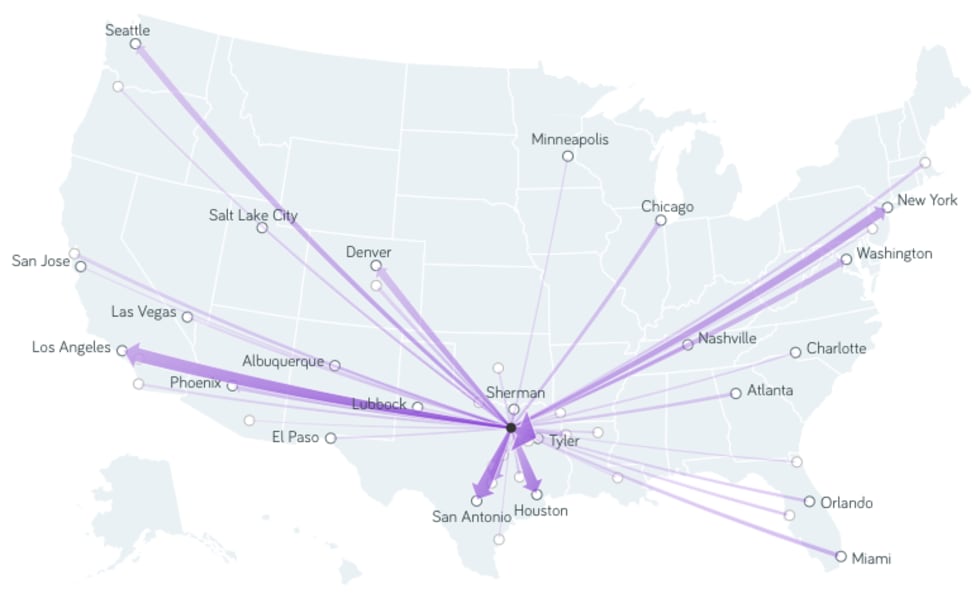

Dallas renters search far and wide

In contrast to the examples above, renters who are moving away from Dallas are not concentrating in nearby metros, but rather dispersing throughout the county. Tyler, TX is the most popular outbound search destination for those leaving Dallas, but it accounts for just 5.5 percent of those searches, a far smaller share then many of the outflows mentioned above.

Meanwhile, Los Angeles is the second most popular outbound destination, accounting for 5.2 percent of searches. Significant numbers of renters are also leaving Dallas for New York City, Denver, Seattle, Phoenix, and D.C. Dallas is also drawing in renters from around the country as well. New York City and Chicago are the second and third most popular sources of renters looking to move to Dallas from elsewhere. These significant crossflows show that Dallas is a magnet and incubator for top-tier workers in the nation’s knowledge industries.

Las Vegas: Hawaii’s “Ninth Island”

Making an out-of-state move from Hawaii is significantly more complicated than doing so from anywhere on the mainland. In spite of that difficulty, 30.1 percent of renters currently living in Honolulu are looking to leave the metro and the majority of those are searching outside of Hawaii entirely.

It turns out that Las Vegas is the most popular destination for those looking to leave Hawaii, accounting for 11.0 percent of outbound searches. In fact, Las Vegas is home to the largest population of Native Hawaiians outside of Hawaii, and has even been referred to as the “Ninth Island.” The tourism-based economy of Las Vegas is similar in many ways to that of Hawaii, and its much lower cost of living is enough to lure many Hawaiians from the beach to the desert.

Conclusion

Knowing where Americans are moving to and from is key to understanding the evolution of our nation’s cities. Publicly available migration data from Census tracks these trends, but that data source captures moves that have already occurred and is released with a fairly lengthy time lag. Search data from platforms such as Apartment List can help supplement our understanding of migration patterns by serving as a leading indicator that shows where renters are looking to move before those moves have actually occurred.

It is important to note that Apartment List users are not fully representative of the American population as a whole, and that rental listing searches do not always result in completed moves. That said, the trends we observe are nonetheless informative, and we hope that this data tool will serve as a valuable resource for those looking to understand the mobility patterns of America’s renters.

Methodology

Results are based on searches of Apartment List users occurring between June 1, 2019 and December 31, 2019. We include data from both registered and unregistered users. While registered users are uniquely identified, unregistered users who perform multiple searches may be counted multiple times. For users who search in multiple locations, we consider the initial search location to be the primary one. Each user’s current place of residence is defined by the IP address from which the user is searching. All results are aggregated at the metro level, using Census definitions of metropolitan statistical areas.

Share this Article