Million Dollar Scam: Rental Fraud Costs 5.2 Million U.S. Renters

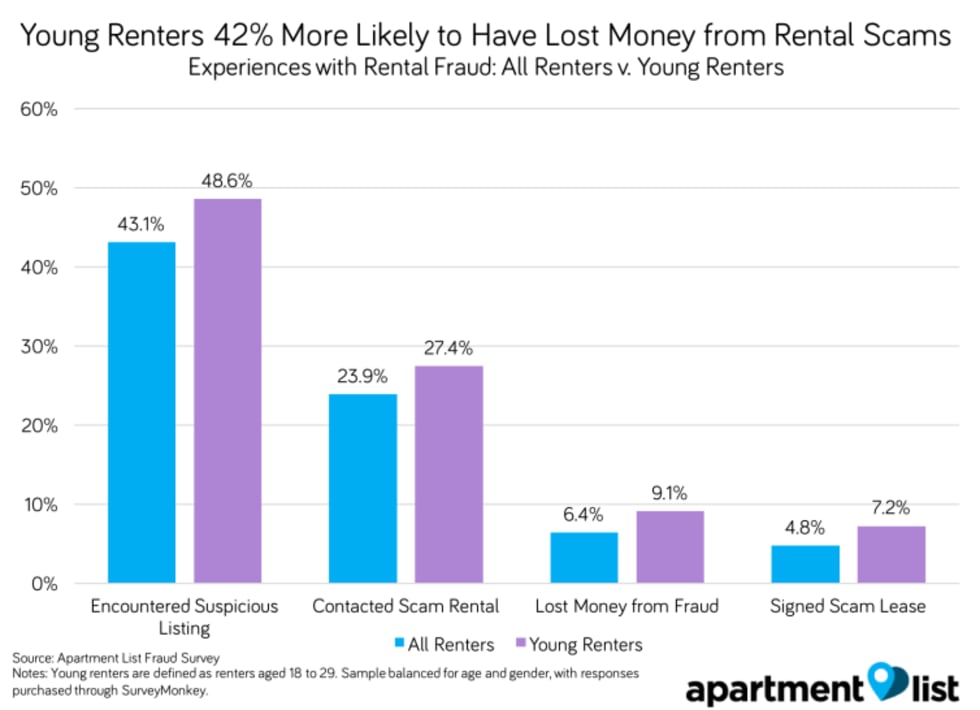

Rental fraud is an unfortunate yet common experience for many renters. An estimated 43.1 percent of renters have encountered a listing they suspected was fraudulent, and 5.2 million U.S. renters have lost money from rental fraud.

Younger renters are more likely to experience rental fraud, with 9.1 percent of 18 to 29-year-old renters having lost money on a rental scam, compared to 6.4 percent of all renters.

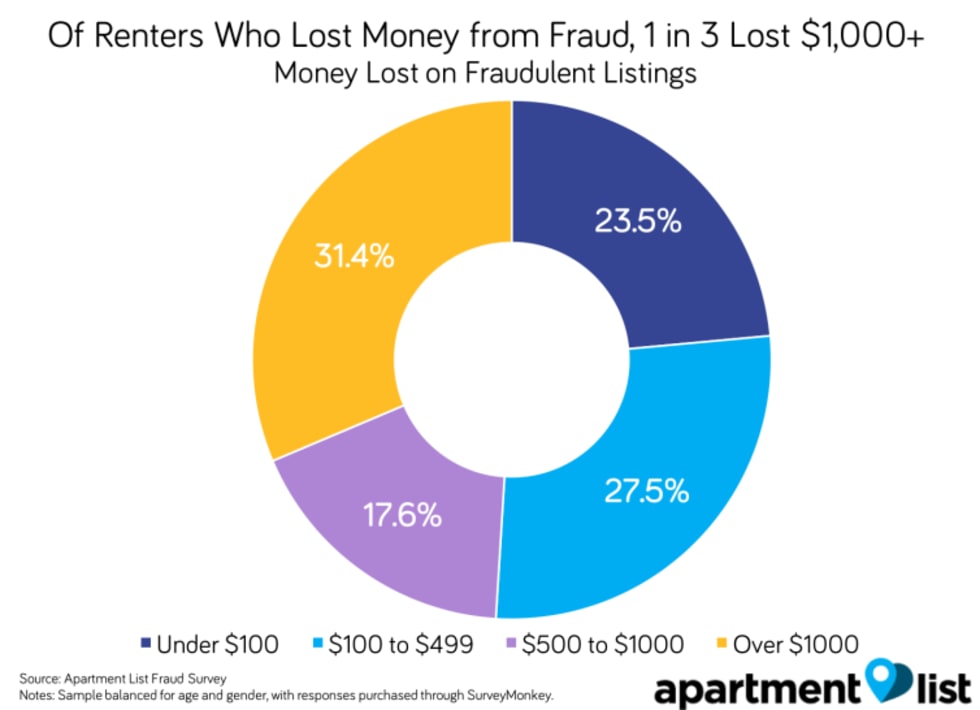

Of renters who have lost money in rental scams, one in three have lost over $1,000, likely after paying a security deposit or rent on a fraudulent property.

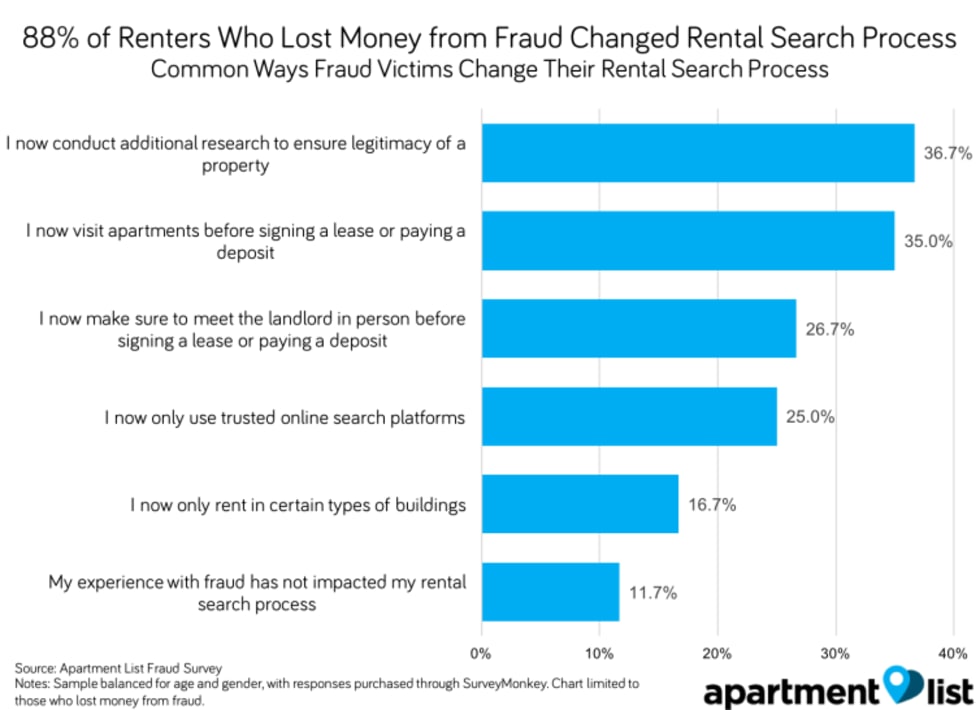

An estimated 88.3 percent of renters who have lost money from rental fraud changed how they search for rentals. For example, some conduct additional research and others make sure to visit properties before paying.

Our full guide of how to detect and avoid rental fraud can be found here.

Scams exist in many forms, from identity theft to credit card fraud. Rental fraud is another type of scam many Americans encounter, but it often escapes renters’ attention because there is little existing data on its pervasiveness. A new survey from Apartment List reveals that rental fraud impacts millions of renters, costing many victims thousands of dollars. In total, an estimated 5.2 million U.S. renters have lost money on a rental scam, and far more have encountered scam listings or contacted fraudulent properties during an apartment hunt.

Rental fraud occurs when someone claiming to be a property manager or landlord, in certain cases the actual landlord, tries to rent a property that doesn’t exist, isn’t their rental or is substantially different than advertised. Scammers try to collect an application fee, security deposit or rent before the prospective tenant recognizes the scam. When searching for their next home, renters are putting sensitive information on the line, and must pay a hefty security deposit up front. Access to such critical information and funds can easily tempt scammers, so renters should get smart and look out for potential schemes while making a move.

In June, we ran a nationally representative survey of over 1,000 U.S. renters to get understand how renters are impacted by fraud and the most common rental scams. Of the renters surveyed, 43.1 percent of renters report encountering a listing they suspected was fraudulent, and 6.4 percent said they had lost money on fraud. An estimated 88 percent of renters who previously lost money from a rental scam changed how they search for rentals to avoid another negative experience. In addition to the findings from our survey detailed below, we’ve used these survey responses to compile a comprehensive guide to help renters avoid getting caught in ugly schemes during the next apartment search.

Over 5 Million Renters Have Lost Money from Rental Fraud

We surveyed renters about their experiences with fraud to learn how many renters have encountered fraudulent listings, reached out to these properties, lost money or signed a lease.

Encountering fraudulent listings is, unfortunately, a common part of the rental search, with 43.1 percent of renters encountering listings they believed were scams. While many renters ignore these listings, over half of the renters who encountered fraudulent listings contacted a property before realizing it was fraudulent. Luckily, most renters are able to identify suspicious listings before losing money. Of renters who encountered a listing they suspected was a scam, 85.2 percent ignored these listings or realized the scam before losing money.

Still, too many renters believed a fraudulent rental was legitimate until it was too late: 6.4 percent of U.S. renters lost money on a rental scam. Generally, perpetrators of fraud try to collect money upfront or early on, which is one reason so many renters fall prey to these scams. In total, an estimated 5.2 million renters have lost money due to rental fraud.

Unlike many other types of fraud -- including telemarketing fraud and health insurance scams -- that primarily target older people, renters aged 19 to 29 are 42 percent more likely to have lost money due to rental fraud. An estimated 9.1 percent of young renters lost money from a rental scam, compared to 6.4 percent of all renters. Millennial renters are generally more tech-savvy than older generations, but despite being familiar with online rental searches, many lack the ability to recognize fraud. Young renters often move to new cities, for example, for a summer internship or post-grad job and, thus, may be forced to sign a lease sign unseen. Additionally, fraudulent listings tend to advertise rentals at a below-market rate, so renters with a tighter budget or less familiarity with the local market are more likely to believe scam listings are real.

How Much Money Do Fraud Victims Lose?

Scam artists behind rental fraud try to get renters to pay application fees or a security deposit for a property that is not available, they don’t own or is different than the actual property. Of the 6.4 percent of renters who lost money due to a rental scam, the median loss is $400, but many renters lost a lot more.

An estimated 31.3 percent of rental fraud victims lost over $1,000 from rental scams, and 17.6 percent lost over $2,000. Renters who lost under $100 likely paid an application fee for a background or credit check on a fraudulent property, while those who lost larger amounts most likely paid a deposit or first month’s rent.

What Fraud Schemes are the Most Common?

The best way to avoid scams is to knowing common types of rental fraud.. We asked the renters surveyed to categorize their fraud experiences and ranked these common types of rental fraud schemes from most common to least common:

- Bait-and-Switch: A different property is advertised than the available rental, and the scammer tries to collect a deposit or get a lease signed for this property.

- Phantom Rentals: A scam artist makes up listings for places that don’t exist or aren’t rentals and tries to lure renters with low prices.

- Hijacked Ads: A fake landlord posts advertisements for a real property with altered contact information. Homes for sale are often re-listed as rentals in this type of fraud.

- Missing Amenities: A real rental is listed as having features and amenities it lacks in order to collect a higher rent, the rental market equivalent of catfishing in online dating, when someone fakes their identity. The leasing agent tries to get renters to sign the lease before they notice the missing amenities.

- Already Leased: A real or fake landlord attempts to collect application fees or security deposits for a rental that is already leased.

Note that in many of these fraud schemes, the scam artists use slightly altered real listings, making fraudulent listings harder to detect. Visiting a property can help identify scams, but renters moving from other cities often sign leases sign unseen.

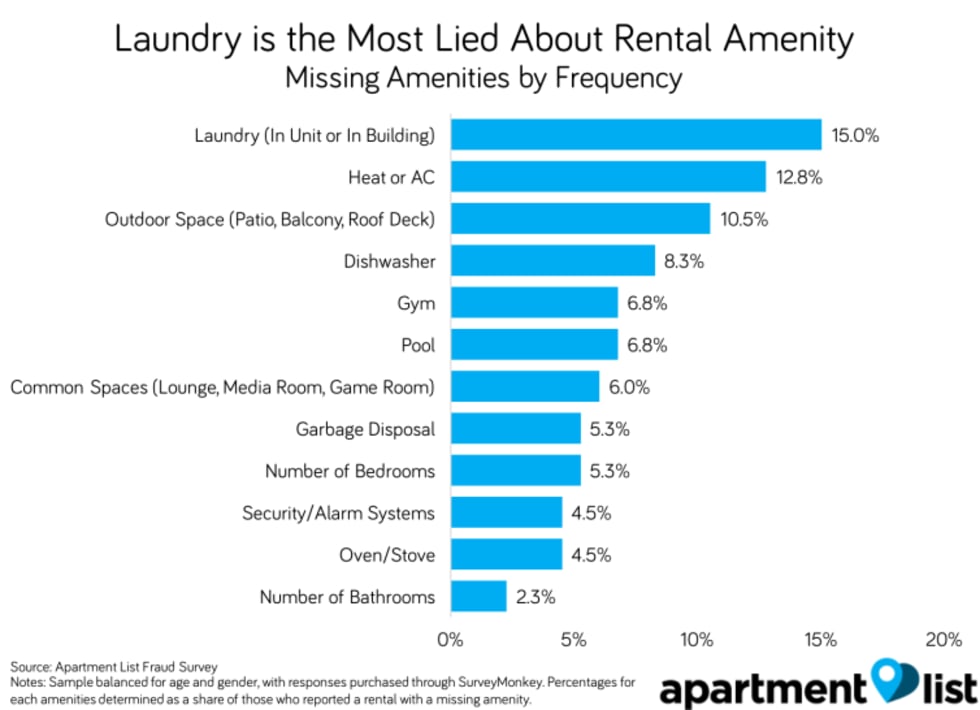

Laundry and Heat/AC are the Most Frequently Lied About Amenities

Even when an apartment exits, fraud can occur when an apartment is substantially different than advertised, the rental market equivalent of catfishing in online dating. In this instance, an apartment may rent at an above-market value because tenants believe the apartment has additional amenities, for example, an extra bedroom or in-unit laundry. Renters who visit a property will generally be able to identify these missing amenities and may even still be interested in the property, but those who rent sight unseen may not notice the missing amenities until it’s too late. According to the renters surveyed, these are the most commonly missing or lied about amenities:

A recent Apartment List study found that laundry is the hardest amenity to find, with 53 percent of renters requesting in-unit laundry and only 13 percent of properties providing it. Given the high demand for laundry, it’s no surprise it’s the most likely amenity to be missing from a rental. Heat/AC is the second most commonly lied about amenity, likely because unless a renter visits a property on a very hot or very cold day, they are unlikely to test if the heat/AC works prior to moving in. Unfortunately, renters who move into a home with missing amenities generally end up living in the apartment through the duration of the lease, despite the rental missing features they expected.

A recent Apartment List study found that laundry is the hardest amenity to find, with 53 percent of renters requesting in-unit laundry and only 13 percent of properties providing it. Given the high demand for laundry, it’s no surprise it’s the most likely amenity to be missing from a rental. Heat/AC is the second most commonly lied about amenity, likely because unless a renter visits a property on a very hot or very cold day, they are unlikely to test if the heat/AC works prior to moving in. Unfortunately, renters who move into a home with missing amenities generally end up living in the apartment through the duration of the lease, despite the rental missing features they expected.

Fraud Victims Change How they Search for Apartments

Of renters who lost money from fraud, 88.3 percent altered their rental search process. These are the most common ways fraud victims have changed how they look for apartments:

In order to avoid a second experience with fraud, 36.7 percent of the renters surveyed conduct additional research to ensure legitimacy of a property. An estimated 35 percent are no longer willing to rent sight unseen, and 26.7 percent won’t sign a lease or pay a deposit before meeting the landlord in person. After losing money from rental fraud, some renters even change where they search for rentals or the types of buildings they are seeking.

Unfortunately, many renters encountered fraudulent listings, and some have even lost money from fraud. Given that 43.1 percent of renters encountered fraudulent listings but only 6.4 percent lost money from fraud, it’s clear many renters have developed strategies to identify scams. In order to help more renters avoid common scams, we’ve compiled this comprehensive guide to avoiding rental fraud. Make sure to take a look before beginning your next apartment hunt!

In addition to running a national survey, we surveyed renters in the 30 largest U.S. metros. Estimates of the share of renters who encountered a fraud listing and the share who lost money from fraud are provided below. Please note that these estimates are based on a smaller sample size than the national estimates and, thus, tend to be more volatile.

Interestingly, the metros where the most renters encountered fraudulent listings are not necessarily the same locations where the most renters lost money from fraud. This indicates that in some metros where scam listings are more common, renters are more vigilant in their rental search, allowing them to better avoid common scams.

Experiences with Rental Fraud by Metro

| Metro | Encountered Fraud Listing | Lost Money |

|---|---|---|

| Atlanta | 28.6% | 9.5% |

| Baltimore | 33.3% | 7.1% |

| Boston | 34.1% | 7.0% |

| Charlotte | 23.9% | 4.3% |

| Chicago | 36.2% | 2.1% |

| Cincinnati | 42.9% | 2.4% |

| Dallas | 10.9% | 10.9% |

| DC | 34.1% | 9.3% |

| Denver | 37.8% | 8.9% |

| Detroit | 29.7% | 2.8% |

Methodology

Apartment List ran a national survey of 1,126 renters, in addition to local surveys of 50 to 54 renters in the 30 largest U.S. metros. Surveys ran from June 1, 2018 through June 22, 2018.

All graphs are based solely on the national survey. Local responses are only used to calculate the fraud rates by metro.

All responses were purchased through Survey Monkey. The survey sample matches the age and gender distribution of population at large, unless noted otherwise.

Data for the following metros are age balanced, but not gender balanced, to allow for sufficient responses: Charlotte, Orlando, San Antonio, Portland, Pittsburgh, Sacramento, Las Vegas, Cincinnati, Kansas City, Detroit, Minneapolis, Denver, Baltimore and St. Louis.

The estimate of the number of renters who lost money from rental fraud is calculated using the share of renters who lost money within each age bracket.

For any methodology questions, don’t hesitate to contact us at rentonomics@apartmentlist.com.

Share this Article