Apartment List Renter Migration Report: 2021 Q3

Welcome to Apartment List’s quarterly Renter Migration Report. In this report, we analyze data on millions of searches to see where our users are preparing to move, shedding new light on the migration patterns of America’s renters. This quarter’s report incorporates the search preferences of users who registered with Apartment List between July 1 and September 30, 2021.

Dramatic rent increases have hit virtually all corners of the nation in 2021. Nationally, the median rent price is up over 16 percent since January, and in some cities rent growth is more than double that. Today, renters who are looking to move are not only dealing with this affordability crunch, but also navigating a tight market with historically low vacancy rates. At the same time, migration patterns are also being impacted by one of the most significant societal shifts brought about by the COVID pandemic -- remote work. This collision of market trends and changing preferences may result in more longer-distance moves -- in the third quarter of 2021, 40 percent of Apartment List users were searching to move to a new metropolitan area, and 26 percent were searching in a different state altogether. Below we highlight some emergent migration trends that are taking place in our marketplace which could signal a shift in where the nation’s renters live in the near future.

San Jose, Raleigh, and Austin emerge as “revolving door” metros

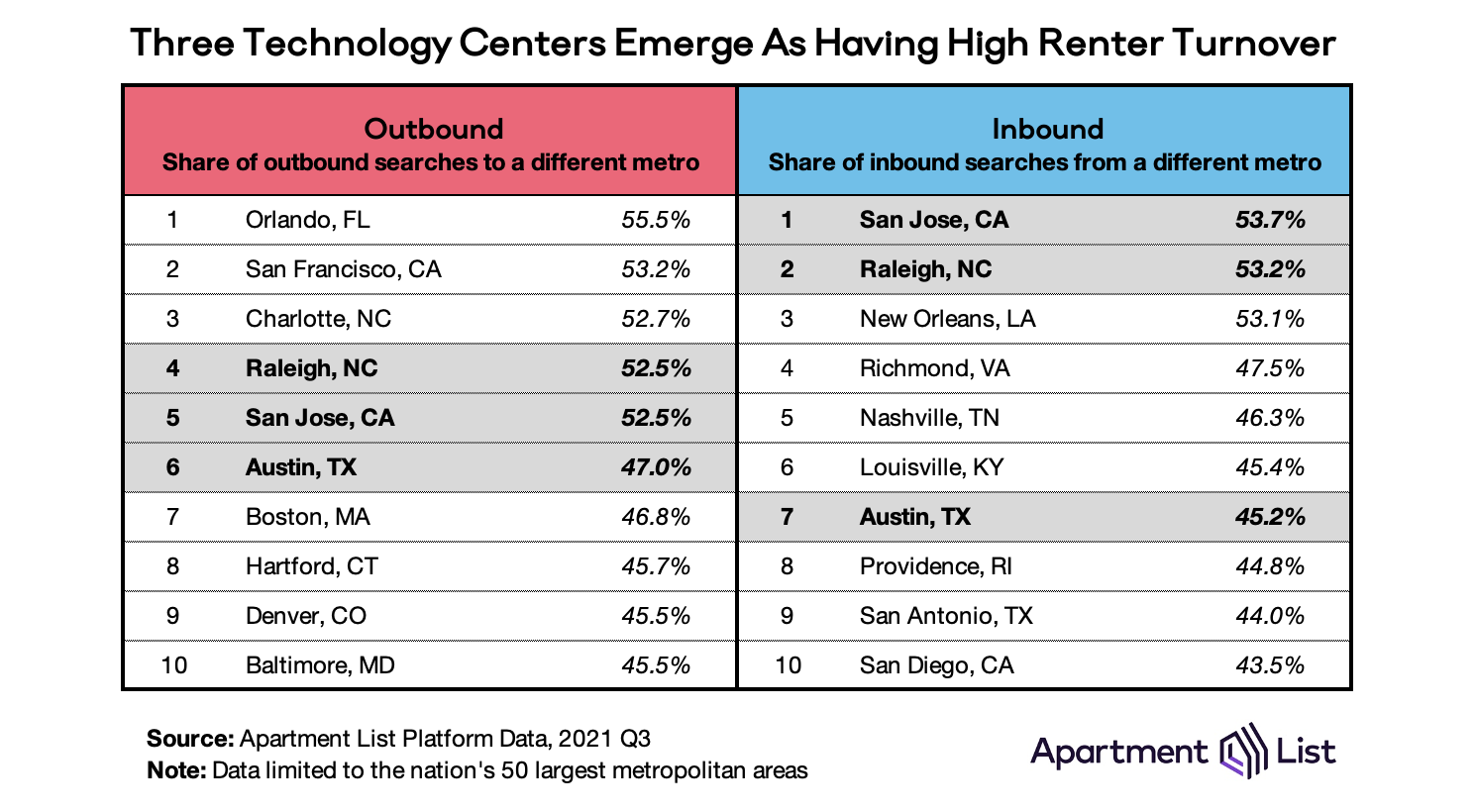

The table below shows the metros with the most inbound and outbound cross-metro searches this quarter. On the left are the ten metros with the highest share of residents searching to move away to a different metro; on the right are the ten metros with the highest share of inbound searches coming from users who currently live in a different metro. Together, these stats show which places are growing in popularity and attracting interest from renters across the country, and which areas renters are ready to move on from. And in the case of San Jose, Raleigh, and Austin specifically, the places that are experiencing high turnover with many renters considering moving both in and out.

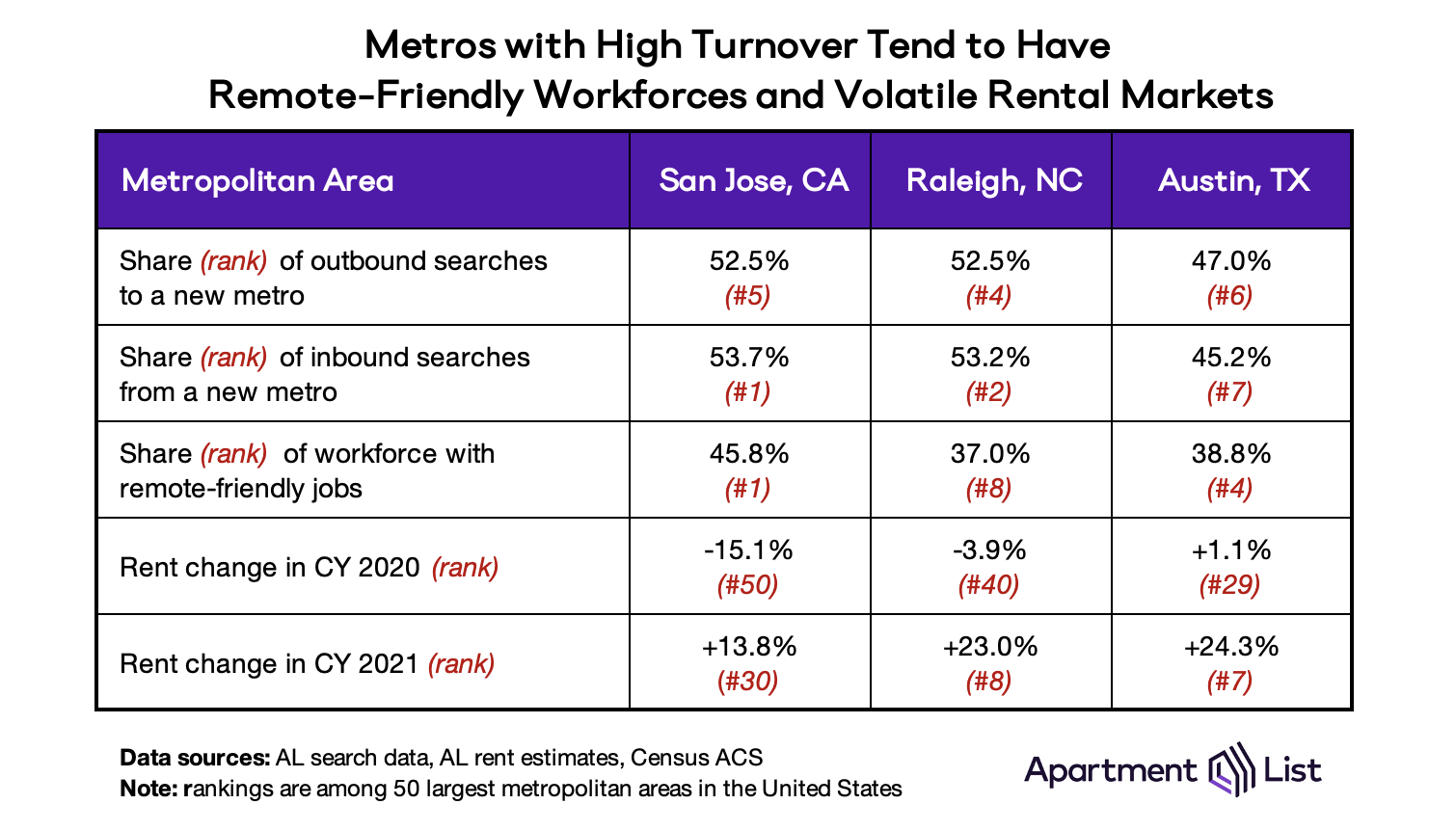

These three “revolving door” metros are the only places that appear in the top 10 for both metrics. In San Jose and Raleigh specifically, the cross-metro rate exceeds 50 percent for both outbound and inbound searches. These regions stand out as technology hubs heavily disrupted by the remote work revolution. In fact they rank first (San Jose), fourth (Austin), and eighth (Raleigh) in terms of the share of their workforce that have remote-friendly occupations. Newfound flexibility has likely given many residents of these metros the opportunity to move somewhere new, which in turn creates vacancies that attract new renters from afar. We have seen this dynamic play out in local rent prices, where over the last 18 months these cities experienced dramatic rent declines followed by similarly-dramatic rent rebounds as residents cycle in and out of the rental market.

Beyond these three, other technology-friendly markets that are experiencing high outbound migration this quarter (e.g., San Francisco, Boston, Denver, Baltimore) also rank high in terms of remote-friendly workforces and dramatic price swings.

Snowbird migration remains popular, especially from New York City to Miami

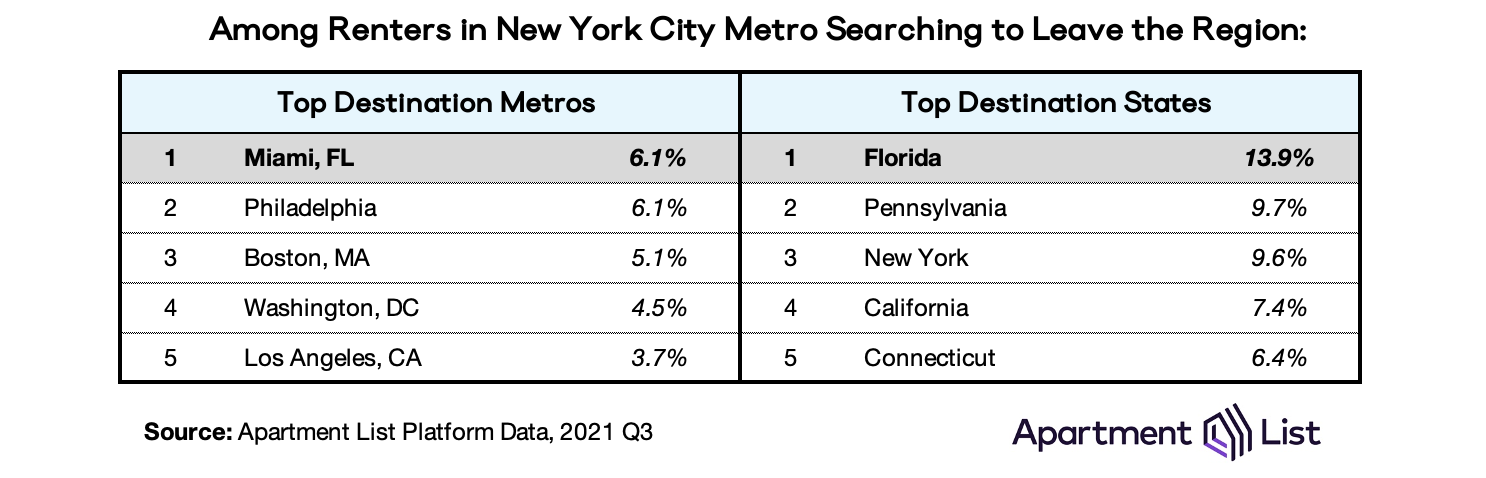

Despite being separated by more than 1,000 miles, Miami is the number one destination for New York City renters, narrowly edging out nearby Philadelphia. 6.1 percent of searches leaving the New York City metro are destined for Miami, and another 7.8 percent are destined for other parts of Florida, namely Tampa, Orlando, and Jacksonville metros.

Overall, Florida is the most popular state for NYC residents looking to move out of the metro. 14 percent of these renters are searching in Florida, compared to 10 percent in Pennsylvania, 10 percent to other parts of New York state, and 7 percent to California. So while some outlets report that the New York-to-Florida migration pattern is reversing, our data indicate that as temperatures drop, the Sunshine State retains its appeal.

California remains a major exporter of renters

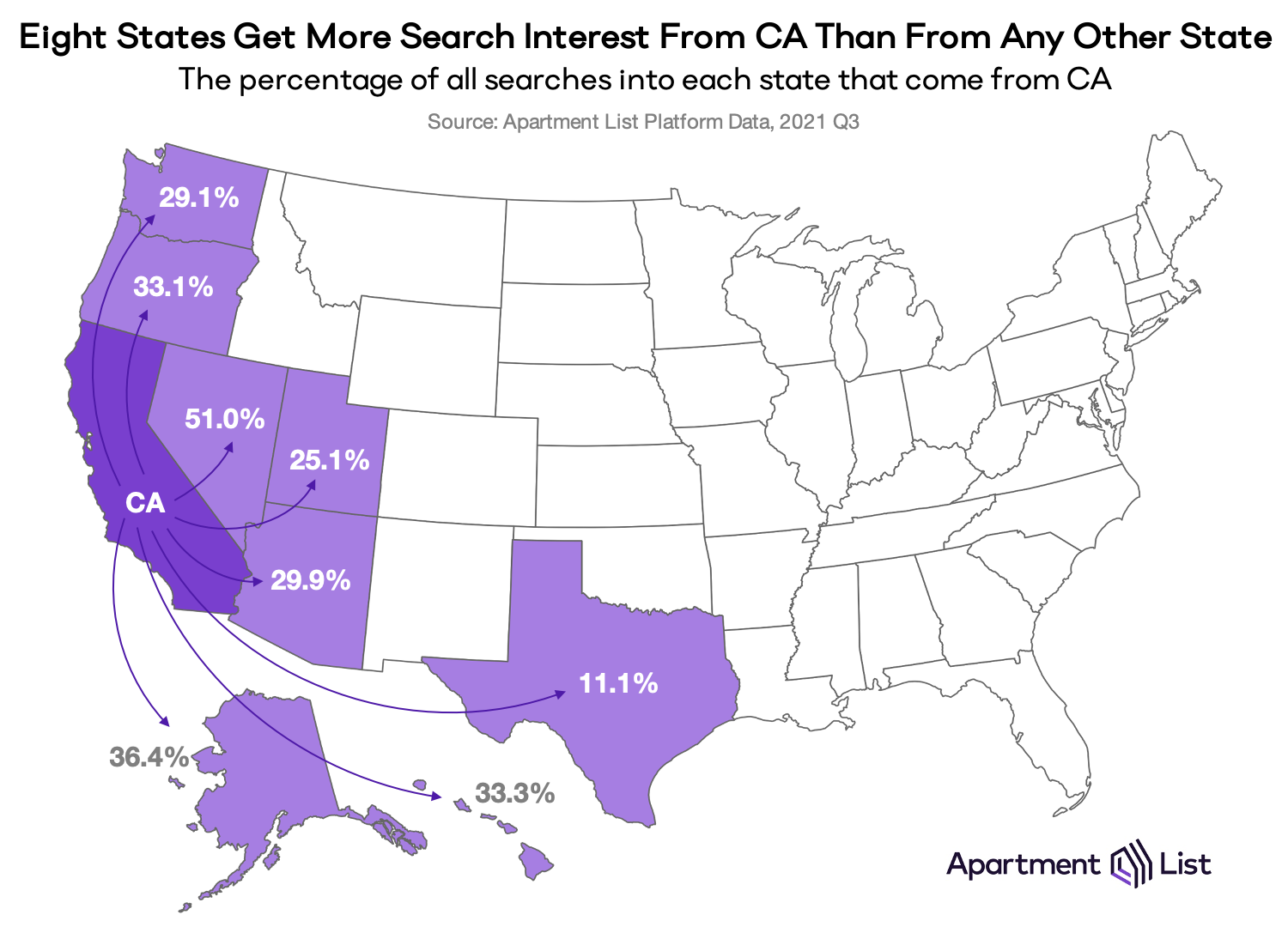

As a large, expensive, and politically liberal state, California has long held a reputation for exporting residents across the country and altering economic and political landscapes along the way. This notion hit a major milestone in 2020, when for the first time in its 170-year history California experienced net population loss, losing over 182,000 residents in the wake of the COVID-19 pandemic. Our search data indicate that this trend may be continuing, as California supplies more search interest across the country than any other state. In the most recent quarter, eight states -- Alaska, Hawaii, Washington, Oregon, Nevada, Arizona, Utah, and Texas -- received more searches from California than any other state. In Nevada specifically, over half of all apartment searches came from California residents.

There are other states that also serve as regional exporters: Georgia provides much of the search interest to other states across the South, Illinois to the upper Midwest, New York to the Northeast, and Texas to California, Colorado, and other nearby Southern states. But no state disperses renters across the nation quite like California. California is home to some of the nation’s most-expensive rental markets, and even in the regions that were once-affordable, rising rents are quickly pricing out lower-income households.

Conclusion

2021 is poised to be a historic year for the rental market, as rapid price appreciation threatens affordability across the country. Housing is already taking center-stage in local politics, as cities debate rent control, upzoning, eviction moratoria, and other legislation to improve short- and long-term housing security for renters. All of these shifts have the potential to accelerate migration as renters reconsider how their current living arrangements align with their housing preferences, their work arrangements, and their financial standing. Our team at Apartment List will continue to monitor the data, bringing fresh insights on a quarterly basis to understand how the rental market is evolving.

Share this Article