- 44 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

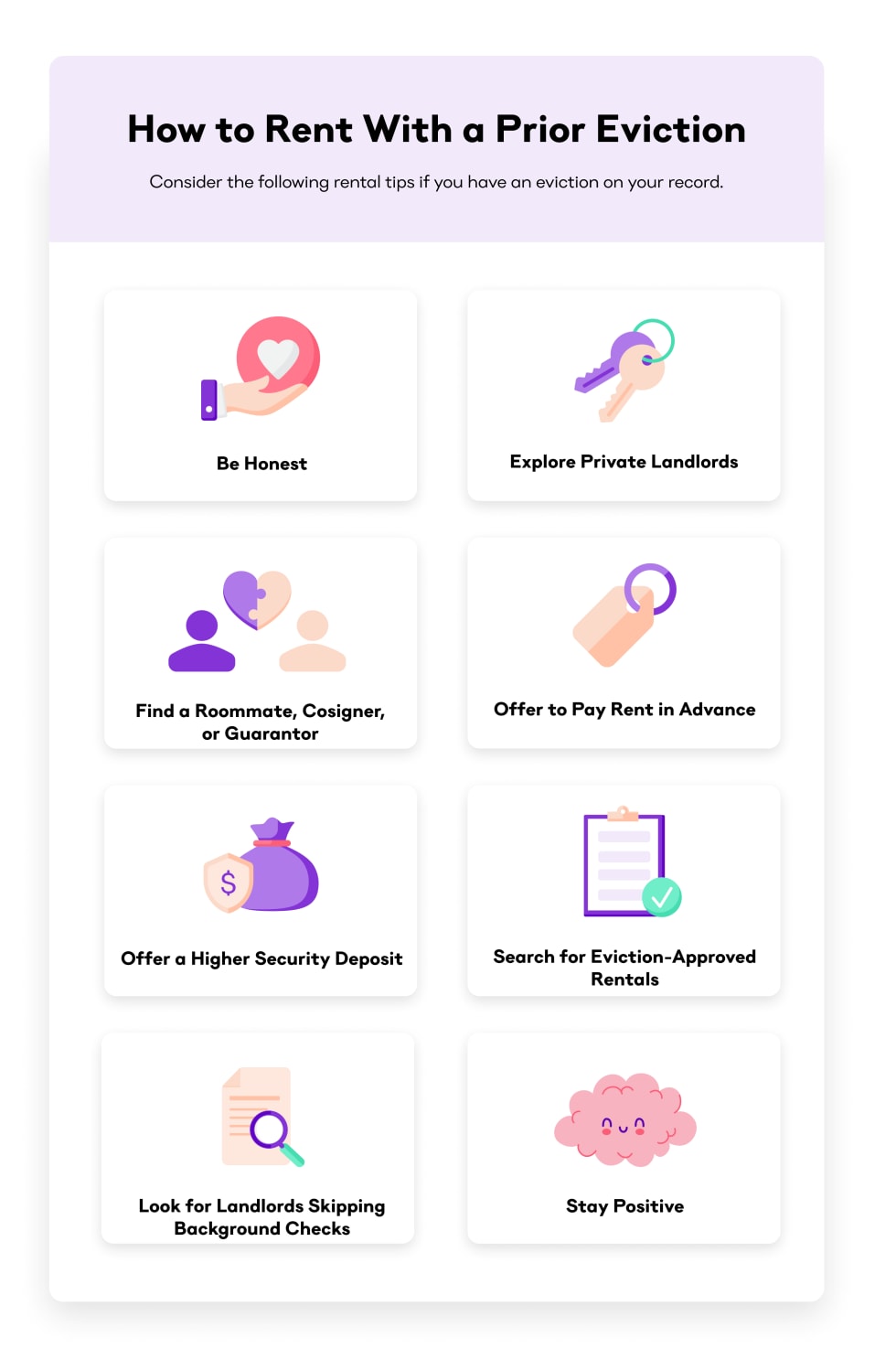

You can still rent an apartment even if you have an eviction on your record. While it may take more effort, strategies like focusing on private landlords, strengthening your credit, offering an extra security deposit, and being upfront about your situation can help you secure an eviction-friendly rental.

After all, evictions are so common that nearly 1.5 million rulings annually happen nationwide.

The key is knowing where to look for an apartment that may be open to renters who have had past evictions, how to present yourself, and what landlords value most in a tenant.

| Record Type | How Long It Lasts |

|---|---|

| Eviction filing (court record) | Up to 7 years (varies by state) |

| Credit report entry | 7 years under the Fair Credit Reporting Act |

| Rental history databases | Indefinitely, unless removed |

Here are a few practical steps to boost your chances of scoring a rental after you’ve previously been evicted.

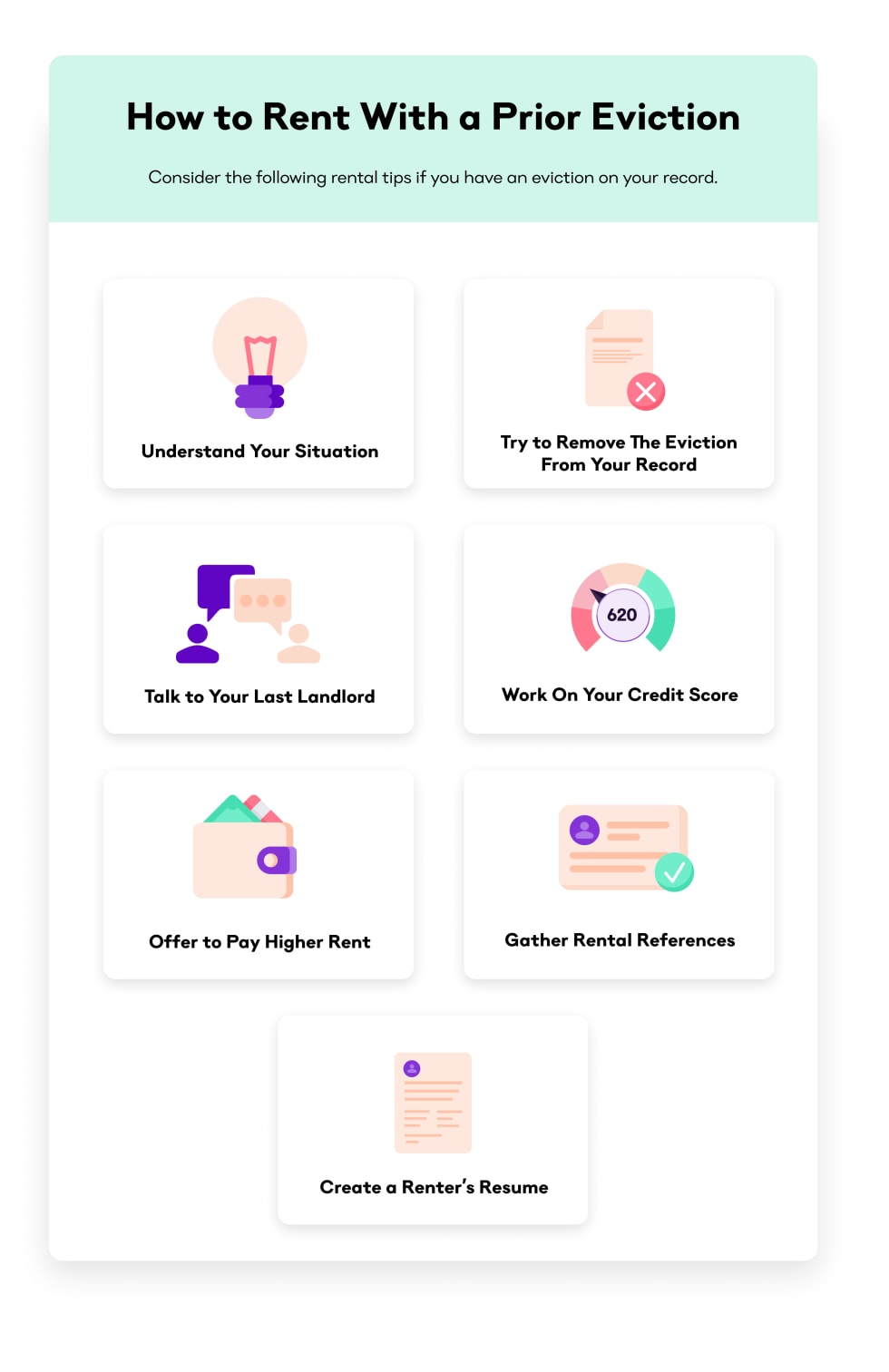

An eviction may limit your options at first, which means being flexible is key. You may not land your dream apartment right away, but you can find a safe, affordable space that meets your needs.

Start by focusing on basics, such as budget, location, and move-in timeline, and worry less about extras like amenities or square footage. Once you rebuild your rental history, you’ll have more negotiating power for the next time you find an apartment.

In some cases, you can have an eviction removed or “expunged” from your record, especially if it was filed in error or you’ve since resolved the issue. This process usually involves going back to court and proving that the eviction was inaccurate or unfairly reported. If you succeed, landlords and credit bureaus must update their records. Even if removal isn’t possible, showing proof that you attempted to resolve it can help demonstrate accountability to future landlords.

Large property management companies often have strict screening rules, and a past eviction may automatically disqualify you. Private landlords, on the other hand, may be more open to hearing your story and considering your current stability. When reaching out, be upfront about your history but emphasize what’s different now—steady income, stronger credit, or references. Building a personal relationship can go a long way in convincing a private landlord to take a chance on you.

Competition is fierce in big cities, and large complexes often have zero flexibility in their screening. Smaller towns, secondary neighborhoods, and locally owned buildings tend to be more open to negotiation.

These landlords are often more interested in filling vacancies quickly than rejecting applicants over past mistakes. Expanding your search radius can improve your odds of finding someone willing to work with you, while still landing you in a livable and affordable space.

Look for short-term or month-to-month apartments, as some of them may waive credit checks if you can prove you have the funds upfront.

Some landlords don’t run credit checks, especially if they own just one or two units and prefer to manage applications directly. These rentals can be great opportunities if your credit still shows eviction-related debt. But be cautious—“no credit check” listings are also where scams are most common.

If your eviction was tied to unpaid rent, clearing that balance can be a game-changer. Reach out to your former landlord, explain your situation, and ask if they’ll confirm repayment in writing. If you left on better terms than the court filing suggests, you may even be able to get a reference letter. A landlord vouching for your growth since the eviction can carry real weight with new property owners.

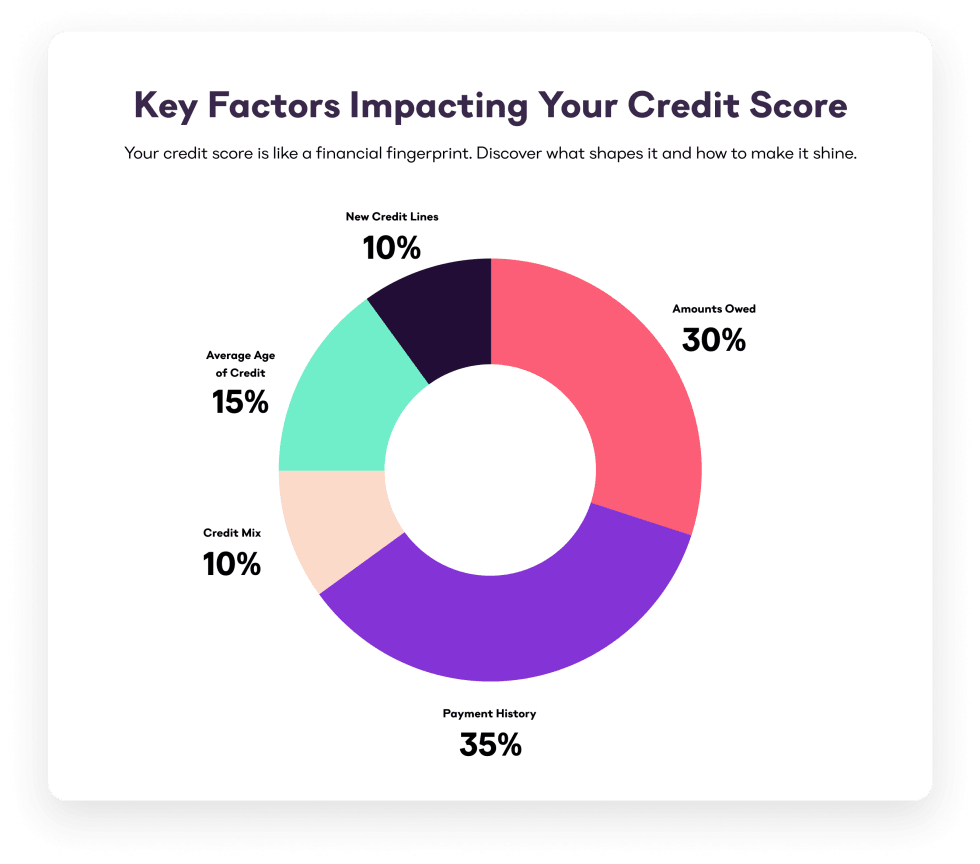

Your credit history plays a big role in the rental process, even more so if you’ve faced eviction. Start by pulling your free credit report to check for errors. If eviction-related debt is still listed, pay it down or negotiate a payment plan.

Then build positive credit history with on-time payments for utilities, credit cards, or loans. Over time, stronger credit can help offset your past eviction and give landlords confidence in your ability to pay rent reliably.

Few things reassure landlords more than guaranteed payment. If you have the savings, offering two or three months’ rent upfront can reduce their risk and improve your chances of approval.

Even if they don’t require it, making this gesture shows you’re serious and financially stable. Just make sure you can comfortably afford it. Don’t drain your safety net entirely, since you’ll need cash on hand for moving expenses and emergencies.

Security deposits are a landlord’s safety cushion, so offering more than the minimum can work in your favor. This approach shows you’re committed to protecting the property and making payments.

For example, if a landlord typically asks for one month’s rent, consider offering two. Since deposits are refundable if you leave the apartment in good shape, this strategy is often lower risk for you than paying higher monthly rent.

In competitive markets, offering slightly more than the listed rent can set your application apart. It demonstrates seriousness and helps landlords feel compensated for taking on perceived risk.

Just be cautious: this option can add financial strain over time. If you go this route, set a realistic budget and make sure you can sustain it. Pairing this strategy with proof of stable income helps reassure landlords that your offer is viable.

Strong references can help balance out a shaky rental history. Ask previous landlords, supervisors, or colleagues who know your reliability to write short recommendation letters.

Focus on your character, financial responsibility, and stability since the eviction. If you had an eviction during the pandemic, explain the context. Many landlords are sympathetic to COVID-era challenges.

Think of a renter’s resume as your “apartment pitch.” Include your employment history, proof of steady income, rental references, and any supporting documents like bank statements or pay stubs.

Organize this resume neatly in a single PDF so landlords can review it quickly. A polished renter’s resume helps shift focus away from your eviction and toward your qualifications, showing that you’re proactive, transparent, and serious about being a great tenant.

Living with a roommate can show a landlord greater financial stability. Cosigners and lease guarantors aren’t completely similar, but both can help make a potential landlord feel more confident renting to you.

While both cosigners and guarantors are held responsible for renters who fail to make rent payments, a cosigner has the right to reside on the property during the lease while a guarantor does not.

Honesty can go a long way when trying to rent an apartment while having an eviction on your record. Let the new landlord know what led to the eviction and how your financial stability has improved. More than that, a lack of honesty can cause issues that could even result in another eviction later. So it's important to be up front about your situation.

If you’re worried about eviction, acting early can make all the difference. Here are some steps that may help you stay in your home:

The sooner you take action, the more options you’ll have to avoid an eviction altogether.

An eviction is never easy to deal with, but it isn't the end of the world. You can still rent an apartment after being evicted and rebuild your rental history. So, don’t worry about how to rent with an eviction on your record. Instead, figure out where to get started in your apartment search by checking out Apartment List’s online quiz today!

Want more help insight into removing evictions from your record? Check out this fantastic, detailed guide on exactly how to phrase your eviction appeal from Attorney Robert Flessas:

It can take up to seven years for an eviction to disappear from your credit report.

You’ll need to petition the court to have the eviction removed. However, the court will only remove it if you're disputing an inaccurately reported eviction.

Eviction can impact your credit if there are fees associated with the eviction that go to collections. Does eviction stay on your record? Well, it can, again, depending on what is reported.

If you're landlord is open to negotiating, start by explaining your prior eviction and the steps you've taken to prevent one in the future. Consider offering a higher security deposit, paying more in rent, staying on a month-to-month lease or short term lease, offering rental references, or finding a cosigner to help your prospective landlord feel at ease renting to you.

Yes. It may take more time and effort, but many landlords are open to renting to tenants with past evictions, especially if you show financial stability.

Most evictions stay on your credit for 7 years, but their impact lessens over time, especially if you rebuild good payment history.

These are rentals where landlords are willing to consider applicants with past evictions, often in smaller complexes or managed by private owners.

Yes. If you repay past debts, landlords are far more likely to view you favorably—and you may even be able to remove the eviction record in some cases.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more