- 47 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

You’ll typically need a credit score of at least 600 to 650 to rent an apartment, although the requirements can vary by location and building type. If you're trying to figure out what credit score for an apartment you need, you're not alone. Many renters worry about being approved with a low score, but there’s a wide range of options depending on the market. Here's what you need to know about getting approved and how credit affects your rental application.

Are you trying to make sense of the average credit score to rent an apartment? A 2024 report by The Zebra found that the average credit score for U.S. renters was 650. Their survey also showed that 7.7% of respondents had a fair (580-669) credit score.

Anecdotally, many renters report that a score of 650 or above is often requested for approval of a rental application. In general, landlords are unlikely to approve you with a poor credit history but might consider you if you can demonstrate current financial stability.

The bottom line is that the score you need varies by location, but you're likely to get approved in most places if your score is at least 650. If you fall below that, however, that doesn't mean you won't be able to rent, as is clear from the national average and examples of regional averages.

| City | State | Avg. Credit Score |

|---|---|---|

| San Francisco | CA | 719 |

| Boston | MA | 716 |

| New York | NY | 715 |

| Seattle | WA | 706 |

| Oakland | CA | 702 |

| San Jose | CA | 699 |

| Washington | D.C. | 689 |

| Minneapolis | MN | 688 |

| Los Angeles | CA | 682 |

| San Diego | CA | 680 |

While a desirable credit score needed to rent an apartment is usually in the eye of the beholder, there is a widely used scale to measure the ranges:

Each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) varies in how they determine credit scores. As a result, there could be some differences, but these ranges give you an idea of what to expect.

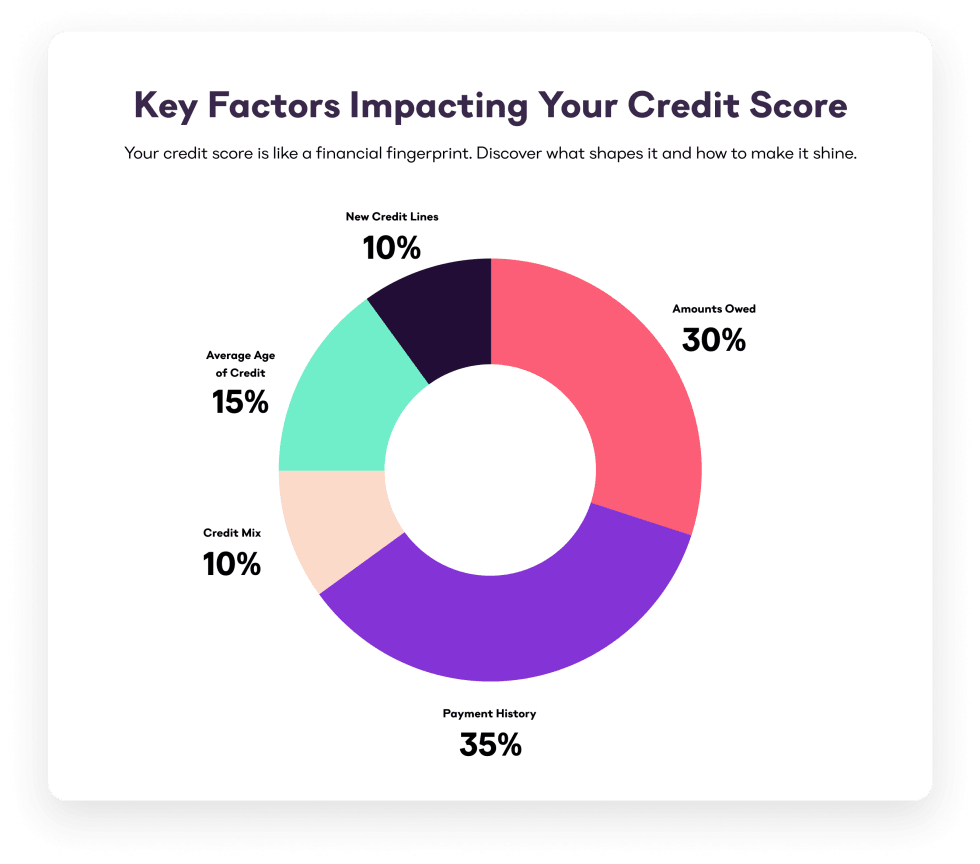

Each credit reporting agency looks at the weight of these components differently. For instance, Experian uses FICO, which offers a slightly different distribution than the system used by TransUnion.

Several factors that determine your credit score needed to rent also make you more desirable as a tenant and therefore more likely to be approved. For example, a solid payment history shows that you are willing and ready to meet your financial obligations, as does a long credit history. Also, the amount that you owe helps your landlord understand whether you'll be able to afford rent alongside your other bills. All of this information helps assure your landlord that you will make rental payments on time.

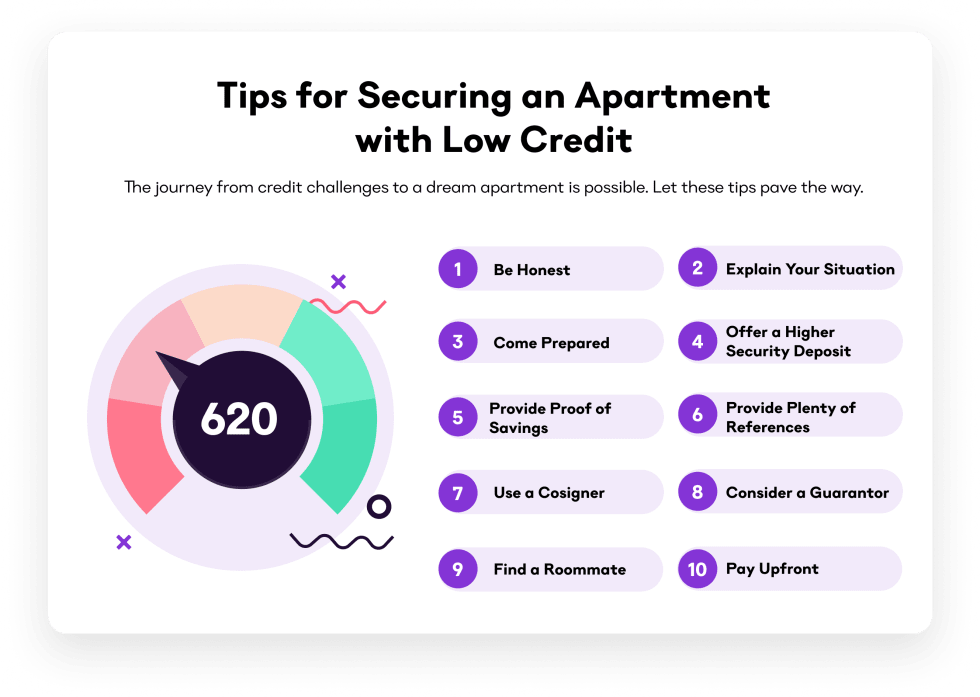

If you can’t meet the minimum credit score to rent apartment, there are still ways to secure a lease. We wrote a whole guide on renting with no or bad credit, but here is the overview:

It’s not easy to score an apartment with a bad credit score, but it can be done. You’ll need a combination of the above strategies and determination to reach your goals.

Bad credit isn’t the end of your rental journey. There are still ways you can improve and build your credit score and position yourself as a more desirable tenant.

Credit scores fluctuate and can rapidly climb over time. Keep trying to improve your score, even if you don’t feel like it’s making much difference. You’ll see positive changes as your efforts pay off.

The question isn't always, "What credit score do you need to rent an apartment?" but what can you do to improve your credit? Your credit fluctuates regularly and can improve with some simple steps, like paying down debt and increasing your available credit.

Staying proactive and talking to prospective landlords about your situation can also help secure your next lease. They may also agree to a more expensive short-term lease that reduces their risk of renting to someone with bad credit.

Ready to find a new place? Use Apartment List's quiz to find a place matched with your ideal location, price point, and amenities.

Most landlords require a score between 600 and 650, but this varies depending on location and property type.

Ask for the reason, offer additional proof of stability, or try a different landlord or property with more flexible credit requirements for apartments.

Most landlords use your FICO Score, typically FICO Score 8, which ranges from 300 to 850. Some may rely on VantageScore, which often differs slightly. It’s best to ask which scoring model a landlord uses when applying.

Yes. A 670 credit score is considered “good” and usually qualifies renters for most apartments. However, some luxury buildings or competitive markets may prefer scores of 700 or higher.

Yes, but you’ll likely need additional support. A cosigner, a larger deposit, or strong income documentation can help. Look for landlords who consider alternative factors, such as rental history or savings.

The time to get a 650 credit score will depend on where you’re starting from, your credit habits, and how much debt you currently carry. It could take a few months to several years. Building or rebuilding credit requires consistent on-time payments, lowering debt, and avoiding new credit issues.

Getting approved for an apartment can be challenging if you have a low credit score, lowincome, or little to no rental history. Showing steady income, good references, and being honest with your landlord about your current situation can help renters get approved for an apartment.

To meet the 3x rent rule, you could try combining incomes with a roommate, using a guarantor or co-signer, or showing proof of substantial savings. Some renters also apply for apartments with more flexible income requirements, like through private landlords or a month-to-month agreement.

Ask for the reason, offer additional proof of stability, or try a different landlord or property with more flexible credit requirements for apartments.

Most landlords use your FICO Score, typically FICO Score 8, which ranges from 300 to 850. Some may rely on VantageScore, which often differs slightly. It’s best to ask which scoring model a landlord uses when applying.

Yes. A 670 credit score is considered “good” and usually qualifies renters for most apartments. However, some luxury buildings or competitive markets may prefer scores of 700 or higher.

Yes, but you’ll likely need additional support. A cosigner, a larger deposit, or strong income documentation can help. Look for landlords who consider alternative factors, such as rental history or savings.

The time to get a 650 credit score will depend on where you’re starting from, your credit habits, and how much debt you currently carry. It could take a few months to several years. Building or rebuilding credit requires consistent on-time payments, lowering debt, and avoiding new credit issues.

Getting approved for an apartment can be challenging if you have a low credit score, lowincome, or little to no rental history. Showing steady income, good references, and being honest with your landlord about your current situation can help renters get approved for an apartment.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more