- 45 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

Not all apartments require a credit check. To qualify without one, renters can provide proof of income, pay a larger deposit, offer to prepay rent, or secure a cosigner. Private landlords, month-to-month rentals, and smaller properties are the most likely to approve tenants without a credit check. Expect landlords to ask for alternative documentation, such as references, bank statements, or a renter’s resume, in place of your credit score.

With data indicating that around 28% of Americans have ‘Fair’ to ‘Poor’ credit scores, it's clear that the credit check requirement can pose a significant barrier for many. The good news is that you're not without options. A simple "no credit check apartments near me" search online will make that apparent.

This article is designed to show you how to get an apartment with bad credit, offering 11 tips to help you secure a great apartment without a credit check. Our goal is to provide you with a sense of hope, as well as practical solutions if you're intimidated by the traditional credit check process.

Landlords use credit checks to reduce financial risk. A credit report shows:

Bottom line: Landlords want reassurance you’ll pay rent reliably. But credit isn’t the only factor—they may accept alternative proof of financial stability.

No. While most property management companies do, private landlords and smaller complexes often waive credit checks. Instead, they may request:

Pro tip: Ask directly about application requirements before paying a fee. Many landlords only do soft credit checks (which don’t hurt your score).

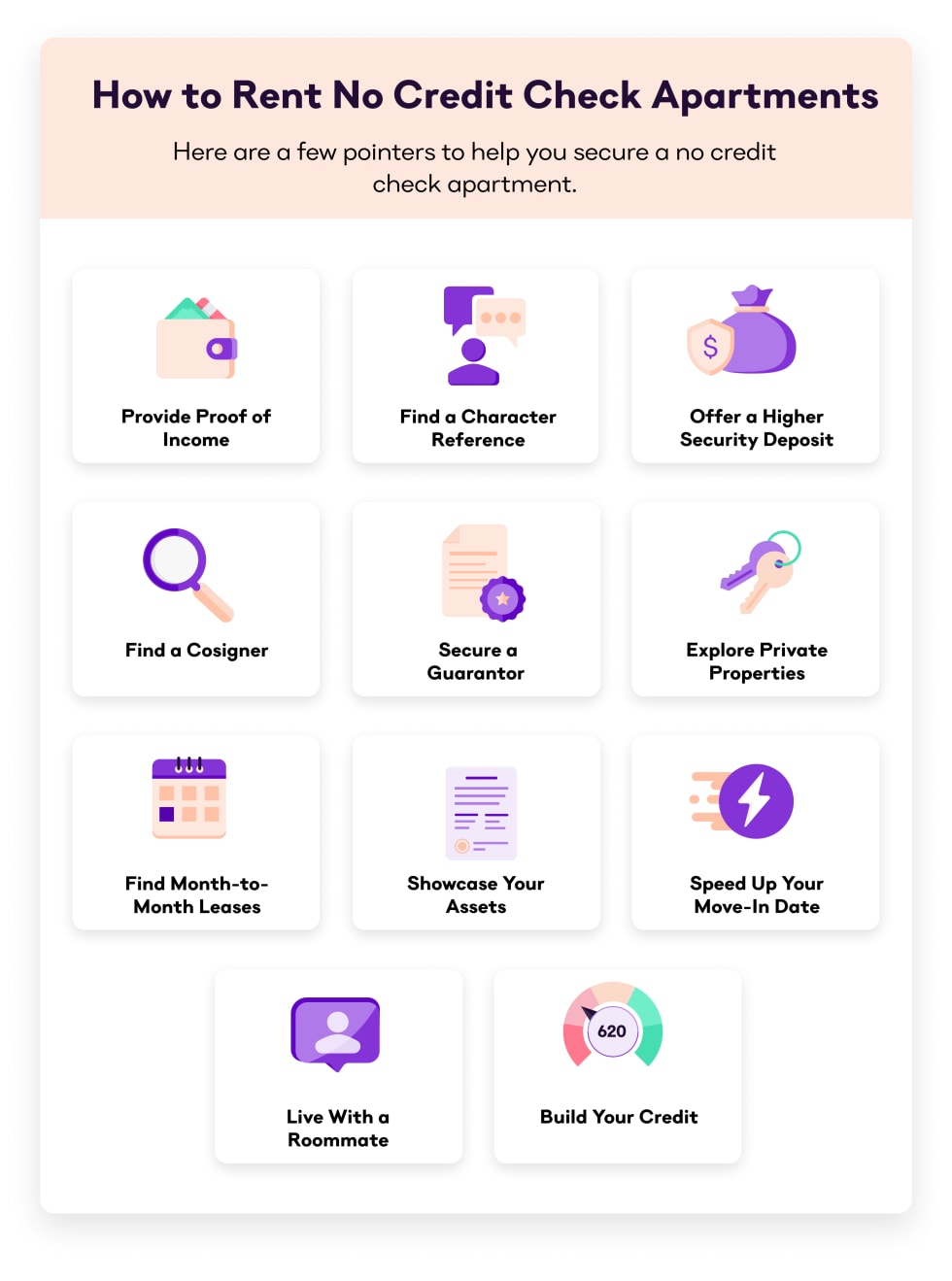

Here are 12 strategies to improve your odds:

Large property management companies usually run strict credit checks. Private landlords, on the other hand, who offer For Rent by Owner properties, have more flexibility in choosing tenants.

They may be more open to alternatives like references, income verification, or a higher deposit instead of a credit report. You’ll find these landlords renting out single-family homes, townhomes, condos, or smaller buildings. The key advantage is being able to speak directly with the owner and explain your situation, which can help build trust quickly.

Short-term or month-to-month rentals are often easier to secure without credit checks. Since these leases don’t lock landlords into a long commitment, they sometimes relax screening requirements in exchange for higher rent or upfront payment.

Furnished units, sublets, or temporary housing options are especially worth exploring. Just keep in mind that while month-to-month agreements give you flexibility, they also give landlords the ability to end the lease with shorter notice periods—so weigh the pros and cons.

Vacancies cost landlords money. If you find a unit that’s sitting empty, offering to move in right away can make you an attractive applicant, even without a credit check. This shows you’re ready to solve the landlord’s problem (lost rent from an empty unit).

If you can also prepay the first month’s rent or offer multiple months upfront, it strengthens your case even further. Flexibility with move-in timing is often a bigger win for landlords than perfect credit.

Online listing sites like Apartment List often reveal whether landlords require a credit check, but not always. The best strategy is to use these tools to identify properties, then message landlords directly to ask about their policies.

Many don’t openly advertise “no credit check,” but they may still accept renters with alternative qualifications. When reaching out, be upfront about your situation and emphasize your strengths, such as stable proof of income, strong references, or the ability to pay extra deposit.

Even if your credit is low, landlords care most about whether you can afford rent every month. Show recent pay stubs, tax returns, or an employment verification letter. A good benchmark is income equal to 3x the cost of monthly rent.

If you also have savings, include bank statements to demonstrate you have a financial cushion. This reassurance can often outweigh a low credit score. Offering documentation upfront can make your application stand out from others who simply fill out the form.

Use our rent calculator to help you determine how much you can comfortably afford in rent.

Landlord references are sometimes just as important as credit. A positive letter or call from a past landlord can show you’ve always paid rent on time and cared for the property. If you don’t have prior landlords, consider asking an employer or community leader who can vouch for your reliability.

Security deposits are designed to protect landlords against financial loss. If you can offer a larger deposit (where state law allows), it shows confidence in your ability to pay and reduces the landlord’s risk.

For example, if the standard deposit is one month’s rent, consider offering two months. Some landlords may also accept advance rent payments (e.g., three months prepaid). Be sure to get the terms in writing to ensure your deposit is refundable if you meet lease obligations.

A cosigner is someone who signs your lease with you and agrees to cover rent if you fail to pay. Many students and first-time renters use this option with parents or relatives. For landlords, a cosigner with good credit essentially guarantees they won’t be left unpaid. If you’re using a cosigner, make sure they understand their legal obligation—it’s a big commitment. Some landlords may even accept a cosigner instead of running your credit, especially in competitive rental markets.

If you don’t have a personal cosigner, guarantor companies are an alternative. Services like Rhino, Insurent, or TheGuarantors act as a financial backstop by promising to cover unpaid rent on your behalf. In exchange, you pay a fee (often a percentage of annual rent).

This isn’t free, but it can make you eligible for apartments you’d otherwise be denied. Guarantors are especially common in expensive rental markets like New York City, where landlords want extra assurance.

Even if your credit is poor, you may have other financial strengths. Show proof of consistent on-time bill payments (like utilities or car insurance), savings accounts, investments, or even a steady track record of paying rent through a roommate agreement. The goal is to reassure landlords that you are financially reliable. If parts of your credit report look better than others (like recent improvements), highlight those areas. A thoughtful presentation can help offset a weak score.

If you apply for an apartment with a roommate who has strong credit and a steady income, their financial profile can balance out yours. Landlords often review all applicants together, and strong credit on one application can be enough to secure approval.

Plus, splitting rent lowers your individual financial burden, which makes you a safer bet. Make sure the roommate understands the shared responsibility, because if either of you misses a payment, both names on the lease are affected.

In competitive cities, landlords have plenty of applicants and little incentive to waive credit checks. But in smaller towns, suburbs, or less competitive neighborhoods, landlords may be more flexible and willing to negotiate. Expanding your search radius can reveal private landlords or smaller properties where credit requirements are relaxed.

Often, you’ll also find lower rent prices outside the city center, making it easier to qualify based on income and affordability, even if your credit isn’t perfect.

Apartment List's tools make it easy for you to flex your location in order to find no credit check housing just outside of the area you start in.

If a landlord skips the credit check, they’ll likely require alternative documentation instead:

| Document/Requirement | What It Shows | Why Landlords Like It |

|---|---|---|

| Pay stubs / tax returns | Proof of income | Confirms rent affordability |

| Bank statements | Savings & financial cushion | Shows renter stability |

| Rental references | Past reliability | Proves history of paying rent |

| Larger security deposit | Extra financial guarantee | Reduces risk of default |

| Cosigner / guarantor | Backup payer | Ensures rent gets paid |

When you use tools like Apartment List, you can find a lot of information about a prospective landlord in the description. Very often, if there is an income or credit score requirement, it will appear in the property's description. This is especially true of properties that provide low-income housing, which will usually include detailed information about who is eligible to apply there.

Undoubtedly, one of the best ways to find out if your credit score will impact your chances of renting is simply to ask the landlord. You never know who might be interested in your application, particularly if you can explain your situation.

If you find a property through Apartment List, you can use our messaging system to reach out to prospective landlords and inquire about income and credit requirements. If you aren't sure what to say, try copying and pasting the template below. You do not need a salutation within our messaging system.

"My name is [Your Full Name], and I recently came across this listing for your apartment on Apartment List.

The property seems to align perfectly with what I'm looking for, and I'm highly interested in learning more about it. However, before I proceed further, I would like to inquire about the application process, specifically regarding credit checks.

Due to [brief explanation of situation, such as being a student, recent relocation, etc.], I'm seeking rental opportunities that offer flexibility around credit score requirements. I would be happy to schedule a time to view the apartment or discuss further details over the phone.

Thank you very much for your consideration, and I appreciate your time in addressing my inquiry."

Even if you find a no-credit-check apartment, building credit will make future moves easier.

Here are a few ways to boost your score for the future:

If you can take all or most of the steps above, you'll be well on your way to restoring your credit quickly.

Renting with bad or no credit requires some creativity, but it’s far from impossible. Many landlords are willing to work with responsible tenants who can show proof of financial stability or provide extra assurance with things like a roommate, larger deposit, or cosigner.

With Apartment List, you can search for apartments that fit your needs and message landlords directly to ask about their credit requirements. Take our quiz today and start exploring listings in your area and connect with properties that match your situation.

These are rentals where landlords don’t pull your credit report. Approval is based on other qualifications like income, references, or deposits.

While having no credit or bad credit might limit your options, apartments that take bad credit still exist. By providing proof of income or offering a cosigner, you can make yourself a more attractive resident.

While most landlords will check credit, apartments that don’t check credit are available, particularly with private landlords or in less competitive areas.

According to Business Insider, most landlords require a 670 or higher, though it differs depending on the landlord and location.

The primary goal of credit checks for landlords is to vet prospective tenants to ensure they will fulfill the duties of a good tenant by paying their rent on time and caring for the property.

Yes, but you’ll likely need additional proof of financial stability, such as a cosigner, guarantor, or larger deposit.

Most apartments perform soft credit checks rather than hard credit checks. If you’re trying to avoid hard inquiries, ask about the type of credit check the leasing agent will perform, or consider apartments for rent with no credit check.

Paying down high credit card balances or correcting errors on your credit report can lead to noticeable improvements within a few months. Building a strong payment history or recovering from significant issues like missed payments or high debt can take longer, often 6 to 12 months or more. Consistent effort and responsible financial habits are key to steadily improving your credit over time.

The fastest way to improve credit is to pay down high credit card balances to lower your credit utilization ratio. Disputing any errors on your credit report can also lead to fast improvements if inaccuracies are resolved. These two changes can impact your credit in as little as a month. Lenders usually report new information to agencies every 30 days to 45 days, and sometimes quicker.

In other cases, it could take as long as 18 months for your credit to recover after missed or defaulted payments or three months to improve your score if you maxed out your credit cards.

Apartments typically look for key financial indicators on credit checks to assess a potential tenant’s reliability. This includes your credit score, payment history, and outstanding debts. Landlords want to see that you consistently pay bills on time and don’t have significant delinquencies, such as late payments or accounts in collections. They also check your credit utilization ratio and the types of accounts you have, such as credit cards or loans. Some may also review public records for bankruptcies or evictions.

A cosigner with a good credit score, income, and the ability to cover your rent if you are unable to pay can help you get an apartment. Co-signers should be someone you know well, such as a parent, spouse, or friend. They do not necessarily have to be a roommate.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more