- 74 units available

- Studio • 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more

If your renter applications aren’t getting accepted because you don’t financially qualify, you may need a cosigner for an apartment. Landlords want to make sure you’ll pay for your rent, and an apartment cosigner can be helpful in specific rental situations, such as having a low credit score.

The good news is that you can overcome most rental objections with this savvy rental strategy. This article covers everything you need to know, including how to find a cosigner.

A cosigner for an apartment is a third party who signs the lease with you. They're usually a family member or friend with a better salary and/or credit score. If you fail to pay your rent, the cosigner is legally required to pay on your behalf.

Although the cosigner may not live in the apartment, their name is still on the lease. Cosigners have legal access to live in your apartment and have the legal power to take over your lease entirely.

There are several reasons you may need someone to cosign a lease, starting with a lack of rental history.

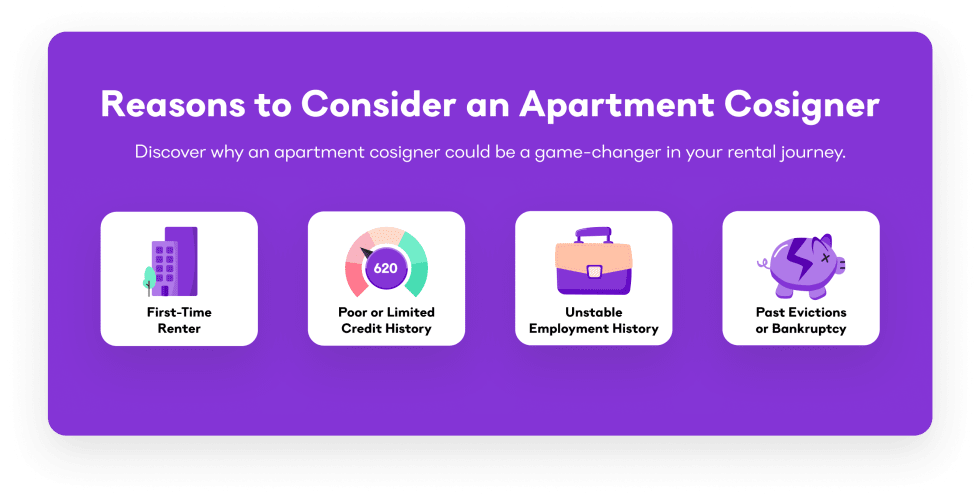

First-time renters who are excited to move into their first place often face challenges when they realize they need a rental history. Landlords want to know you can pay your rent on time and are a good tenant. Lacking a rental history could pose an obstacle unless you have a co-signer.

Landlords use your credit score and credit history to determine your financial stability and trustworthiness. No matter what caused it, a poor credit score can be a red flag. You can tell your landlord about the issue and explain that it's resolved, but you may need a lease cosigner with sparkling credit to provide them more peace of mind.

What’s going on with your employment history? If you’ve been in and out of jobs, work freelance, or have dealt with a long unemployment stretch, landlords may decide you’re too much of a risk. Submitting your bank statements showing your income and spending habits can help, but you’ll probably still need a rental cosigner to sign the lease with you.

A previous eviction will impair your ability to get an apartment, even if it wasn’t your fault. For example, if a previous landlord failed to pay the mortgage, the rental could be foreclosed on and trigger an eviction. It’s also challenging to secure a lease if you’ve had a bankruptcy in the past.

If you need help cosigning an apartment, it can’t just be anyone. There are a handful of criteria and steps to determine cosigner income requirements.

If you're on the fence about using a cosigner, here are some of the benefits and drawbacks to consider.

There are some benefits of someone cosigning for an apartment, including making it easier to get approved for your next place.

Landlords want to know that someone can step in and pay your rent when you can’t. Having a cosigner on your lease gives them peace of mind, provided they have a reliable stream of income and a good credit history.

You may qualify for an inexpensive rental in the suburbs or deep into the outer neighborhoods of your favorite city. But you may not have the finances and credit score to secure a nicer apartment. A cosigner can help you step up into a better rental situation in the neighborhood you want.

Renting an apartment can help build your credit, provided the landlord reports your payments to the major credit bureaus. But you may need a cosigner to convince the landlord you’re a reliable tenant who will get rent paid on time.

You may be financially responsible with a reliable income, but having an emergency backup to pay your rent offers peace of mind. Of course, it depends on your cosigner. Your parents may be fine chipping in if you get sick or are in between jobs, but a friend may not be as eager.

Some landlords charge more rent or a higher security deposit to renters with no rental history or poor credit scores. You can eliminate these issues with the help of a co-signer on your lease. It may be possible to negotiate your rent if you have a cosigner on the lease with you.

Despite all the benefits of having a cosigner on a lease, there are some downsides to consider.

Cosigning is a risk for the cosigner. If they ever step in to pay your rent, they’ll likely experience financial strain. Their financial situation could also change, and they may not want to be your cosigner anymore but are still legally on your lease.

You could end up putting a strain on your relationship with your cosigner. If a relative or trusted friend is your cosigner, and they know you're financially struggling, they may scrutinize every purchase or night out. Make sure you can handle the strain and keep consistent communication with your cosigner to give them peace of mind.

Getting a cosigner for an apartment means they have legal access to your apartment. If you’re late on your rent, or your landlord is unhappy with noise complaints or other problems, they may end up calling the cosigner to talk about the issue.

It’s not always easy to find a cosigner, especially if you don’t have trusted family members with solid finances. Some people are simply not comfortable being cosigners and don’t want to be on the hook legally. You could end up in a situation where there’s no one to ask.

Cosigners are obligated to cover more than your rent. If you break the lease or damage the apartment beyond the scope of your security deposit, they could seek compensation from you and the cosigner. It’s also possible for you to impact the co-signer's credit score if you both fail to pay the rent.

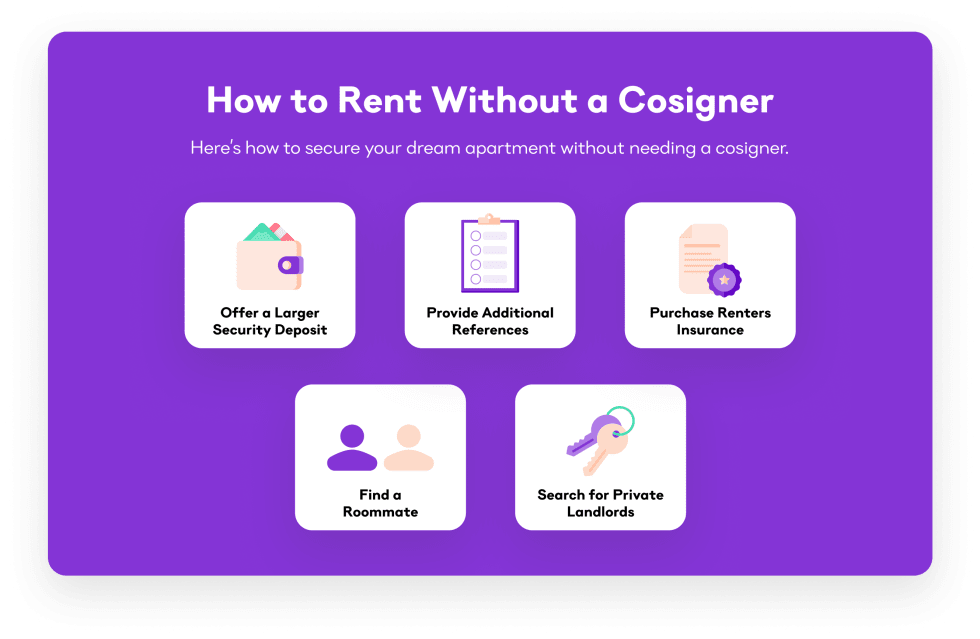

If you’re not comfortable finding a cosigner for an apartment, there are other alternatives that can help.

Landlords are more agreeable to renting to a tenant they may see as risky with a larger security deposit. In the event you can’t pay the rent, they can keep the deposit to recoup their costs and start listing the unit again. If you go this route, ask about going back to the standard deposit during your lease renewal after proving your reliability as a tenant.

Most landlords will require references as part of your apartment application. Previous landlords, an employer, or a supervisor for an organization you volunteer with all make good references. If possible, supply more references than were requested of you to strengthen your rental application.

Renters insurance offers financial protection against damage, theft, some natural disasters, and bodily injury. Although it protects you as the renter, it also means your landlord won’t have to deal with repairing specific damage covered by your rental insurance policy. Some landlords require renters insurance, but you can offer it up on your own to build your landlord’s confidence in you as a renter.

Some landlords are more comfortable renting to someone with poor credit or no rental history if they have a roommate. When you live with someone else, you share all the expenses and responsibilities. Here are some tips for finding the right roommate for you.

Private landlords who own the home, apartment, or condo for rent may be more open-minded to leasing it to you. Instead of being a large corporation with set policies in place, they’re more willing to listen to your situation and come up with a solution. For example, if they know your friends or family, they may rent to you based on that alone.

If you’re ready to go apartment hunting and have issues with credit, salary, or rental history, come prepared with a cosigner or guarantor in mind. Having a plan in place makes you a decisive and organized tenant who’s ready to move forward.

Are you ready to find your next apartment? Sign-up with Apartment List and take our quick quiz to find the best place for you. With us, you’ll spend 5 minutes and save 50 hours searching.

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more

In unit laundry, Patio / balcony, Hardwood floors, Dishwasher, 24hr maintenance, Garage + more