- 47 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In high-cost rental markets like New York, San Francisco, or Los Angeles, landlords often require extra financial security before approving tenants. Studies suggest that there has been a 50% increase in guarantor demand over the past five years, which is especially true for students, first-time renters, or those without strong credit.

If you’re not sure what a guarantor is or whether you need one, this guide covers everything: what guarantors do, how they compare to co-signers, requirements, risks, and alternatives if you can’t find one.

A guarantor is someone who signs a lease agreement alongside the tenant, agreeing to take on financial responsibility if the tenant cannot pay rent or fees. Unlike a tenant, they do not live in the apartment.

Common guarantors include:

Guarantors are most often required in expensive cities where landlords want assurance that rent will be paid on time.

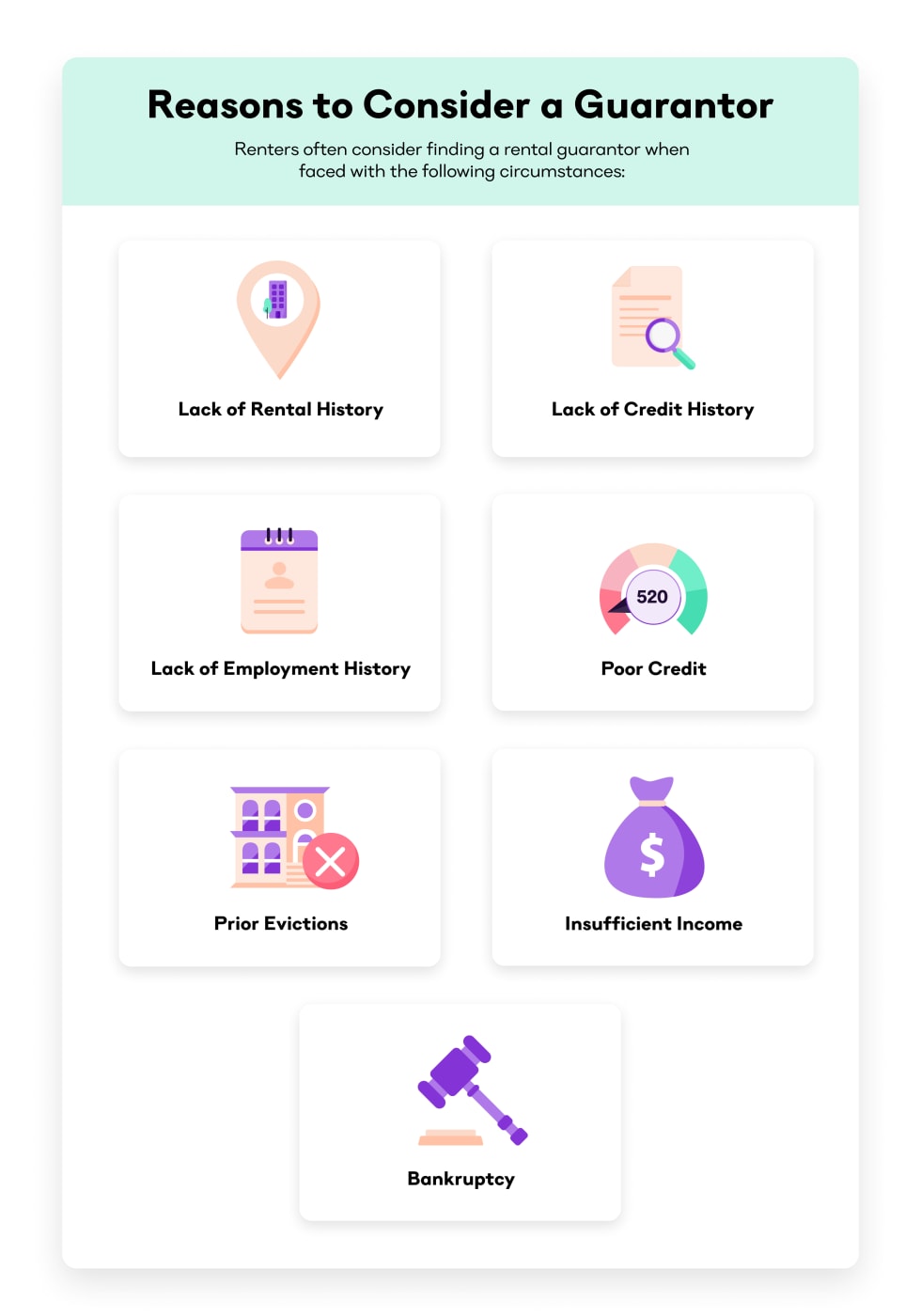

Landlords typically ask for a guarantor if they see financial risk in a tenant’s application. You might need one if:

In short: a guarantor gives landlords peace of mind that rent will still be covered.

Looking for more? Check out this great breakdown from Maverick Law Firm:

Landlords sometimes use the terms interchangeably, but there are important differences:

| Feature | Guarantor | Co-signer |

|---|---|---|

| Signs the lease | Yes, but not as an occupant | Yes, as a tenant |

| Right to live in apartment | No | Yes |

| When responsible | Only if tenant defaults | Responsible at all times |

| Common in | NYC, LA, high-cost markets | Student rentals, private landlords |

Because co-signers are considered additional tenants, they are legally responsible for rent throughout the length of the agreement. A guarantor is only responsible once the tenant has failed to pay rent on time.

Moreover, a co-signer has the same rights to use the property as a tenant. Therefore, which one you choose will depend on your situation, and whether the person signing with you wishes to have the rights (and responsibilities) of a lessee.

Almost anyone can be a guarantor if they meet financial criteria, but most landlords prefer:

Most landlords will ask for:

Some landlords also run a credit check directly on the guarantor.

Guarantors take on significant financial responsibility. If the tenant fails to pay, the guarantor may face:

Because of the risk, guarantors should only sign if they fully trust the tenant and can afford to cover the rent.

Typically, a guarantor is bound for the entire lease term, usually 12 months. If the lease renews automatically, the guarantor may remain responsible until a new agreement is signed.

Most people ask:

If personal options don’t work, you can use a professional guarantor company like:

These companies usually charge 70–90% of one month’s rent as a fee.

Hi [Name],

I hope you’re doing well. I wanted to reach out because I’m applying for an apartment at [Apartment/Building Name] in [City], and the landlord requires a guarantor. This means they need someone who can sign the lease alongside me and agree to cover the rent only if I cannot.

Here are the key details:

I want to be upfront that this is a serious responsibility, and I would never ask if I didn’t believe I could cover my rent. I have [steady income/savings/plan to budget carefully] in place, and I see this as a safeguard the landlord requires, not something I anticipate you needing to step in for.

If you’re open to discussing this, I’d be happy to walk you through the details, provide all the paperwork, and answer any questions. I completely understand if it isn’t the right fit for you.

Thank you for considering this — your support means a lot to me.

Best, [Your Name]

Pro tip: Be prepared to share your budget and financial plan when you ask someone to be your guarantor. It shows responsibility and makes them more comfortable saying yes.

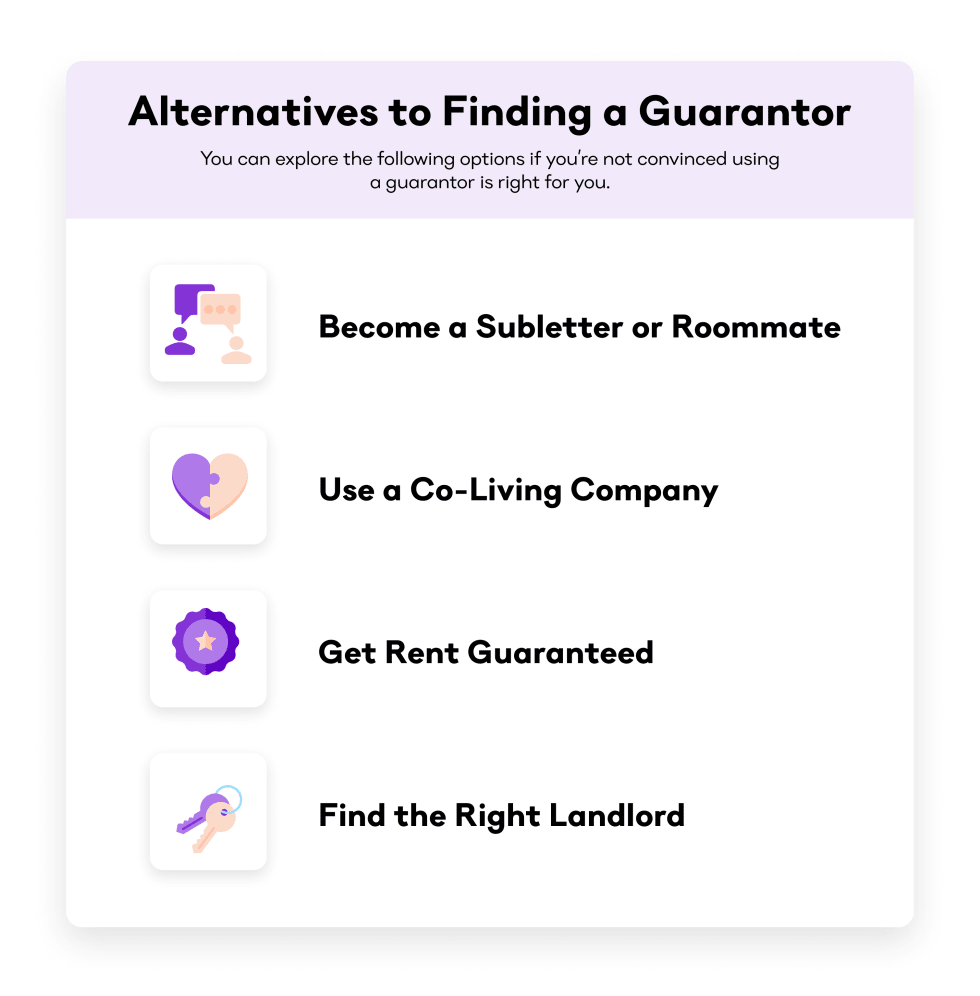

If you can’t secure a guarantor, you may still have options:

Guarantors make renting possible for people with limited income or credit, especially in expensive cities. While they can help secure an apartment, they carry financial risks for the person who signs. If you can’t find one, alternatives like guarantor companies or upfront payments may help.

Ready to move to the city of your dreams but need an apartment lease guarantor? Do your legwork early and use Apartment List to find properties accepting guarantors. Then, make sure to build good faith with your friends and family. Try to build a special emergency fund into your budget to cover your rent in a pinch.

Most landlords expect guarantors to have good to excellent credit, typically 700–750+. Some may accept lower if the guarantor has very high income.

If you need a guarantor and decide to find one through a company, they usually charge a fee of 70–90% of one month’s rent.

Being a guarantor does not affect your credit score. However, if you fail to cover any missed rental payments, that will have a negative impact on your credit.

In some rare instances, landlords may allow you to be your own guarantor if you put your assets up. Typically, however, if your landlord wants you to get a guarantor, it’ll be a third party.

An apartment lease guarantor will sign the lease as a legally binding document. After providing their guarantor information, the landlord will request their signature on the lease agreement.

It's not the end of the world if you can't find a guarantor or co-signer for your lease. There are some companies like willing to act as your lease guarantor or co-signer.

A common rule is that a guarantor’s annual income must equal 80x the monthly rent. For example, for a $2,000/month apartment, that’s $160,000 per year.

Yes. Landlords usually require pay stubs, tax returns, bank statements, and a credit check to verify a guarantor’s ability to pay.

If a tenant defaults and the guarantor refuses, landlords can pursue legal action, collections, or wage garnishment against the guarantor.

Yes. Professional guarantor services (e.g., Insurent, The Guarantors) will act as your guarantor for a fee — typically 70–90% of one month’s rent.

Yes, but you may need to pay more upfront, provide proof of savings, or look for landlords who don’t require one.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more