- 46 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

Would-be renters have to submit a completed application, pay applicable fees (administrative, security deposit, and pet), and sign the lease to rent an apartment in 2025.

Despite being up against an average of 2,654 new renters daily, getting an apartment doesn’t have to be difficult when you understand the approval process and application timeline. But before you can sign a lease agreement and move in, you’ll need to follow the steps below for an apartment rental application.

Here’s a look at everything you need to apply for an apartment, the documents required for the application process, and tips to help ensure you'll get approved.

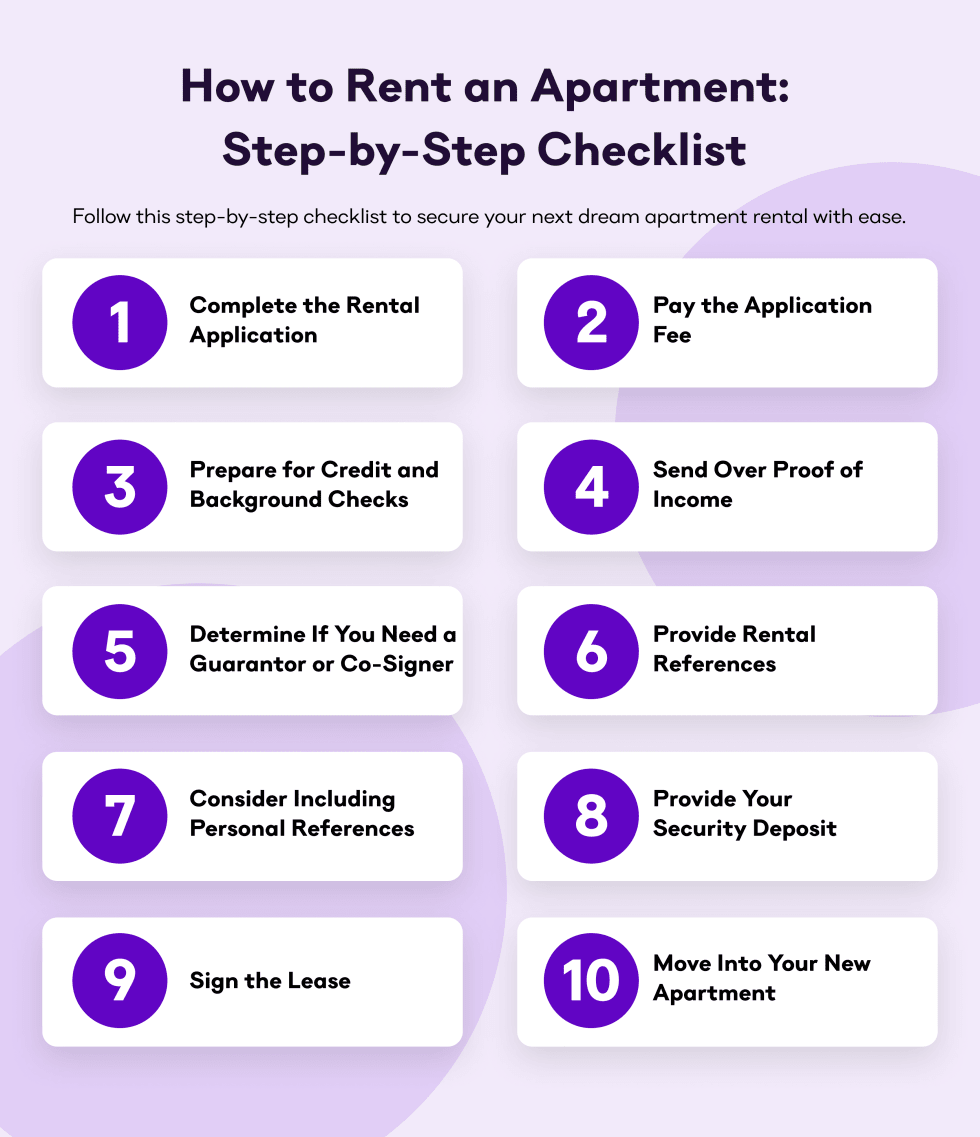

Below are the ten steps renters must follow to secure an apartment.

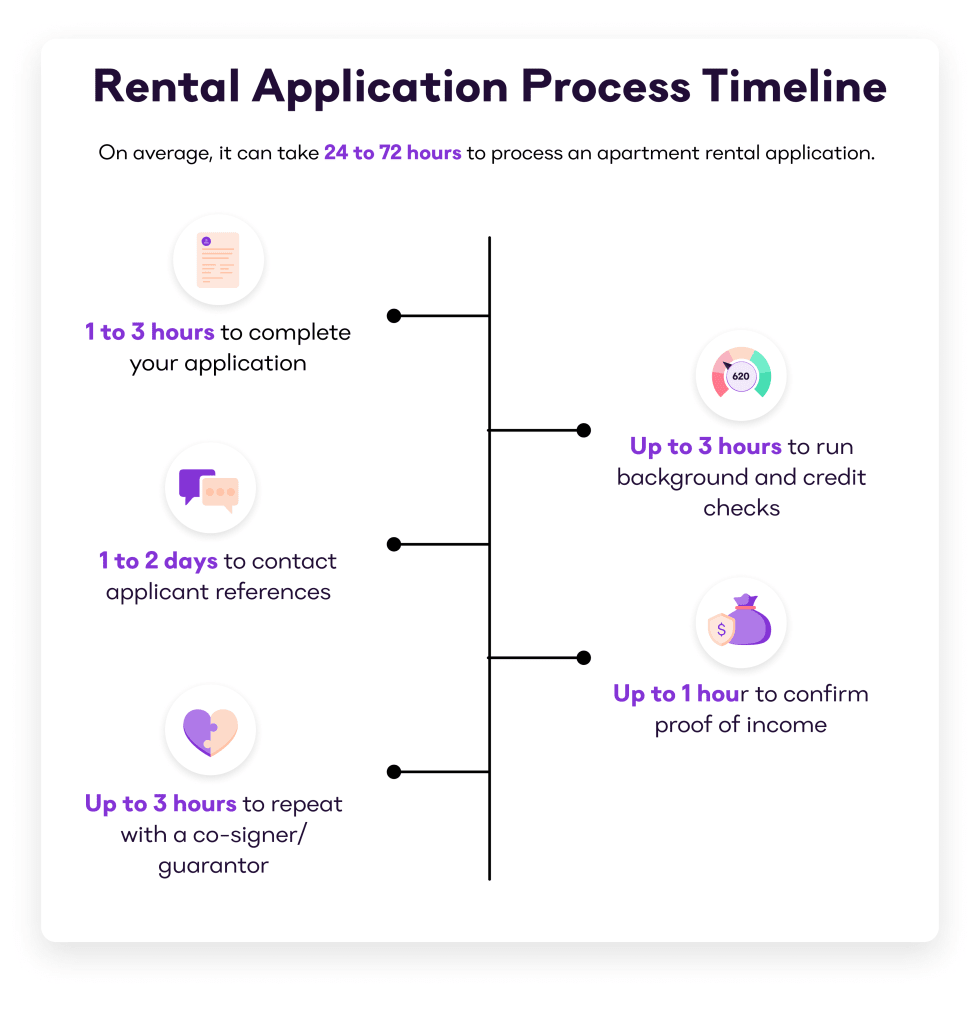

Filling out and submitting the apartment application with the correct documents is the first step. Once you apply for an apartment, the waiting period for apartment application approval usually ranges from 24 to 72 hours.

When filling out the paperwork, it should guide you through the process with questions and prompts. Answer everything as thoroughly as possible and submit supporting documents, such as references.

To rent an apartment, you’ll also have to pay a non-refundable application fee of anywhere between $30 and $100. The landlord charges this apartment application fee to cover the costs of screening renters, which may include background and credit checks.

Landlords or rental management companies will run credit checks and background checks on potential tenants. This helps them determine whether a candidate will be a good and reliable tenant.

Credit checks are typically included in the application fee and require your authorization. The landlord also conducts a background check to assess your criminal history and determine your reliability.

Providing proof of income is essential when applying for an apartment, as it demonstrates a reliable source of income to cover rent. Bring your tax returns, two to three pay stubs, and two to three months' worth of bank statements to include in your application to speed up the apartment rental process.

Documents to show proof of income:

You can treat showing your proof of income as a “mix and match” game. The key is to demonstrate that you can easily afford the rent each month and highlight your streams of income.

If your income (or credit score) isn’t high enough to secure the apartment or you have an unstable income, consider asking a trusted person to be your co-signer, such as a family member. A guarantor or co-signer is someone who signs the lease with you and is legally required to pay your rent if you fail to do so.

Prospective landlords typically request references from previous landlords to verify your rental history and assess your trustworthiness as a tenant.

Additionally, they may try to assess your responsibility by contacting your previous landlord to inquire about your reliability and ability to pay rent on time.

If you are renting your first apartment and don’t have a previous rental history, bring personal references from a boss or superior who can attest to your trustworthiness and reliability. Make the process easier with these rental reference letters as an example.

A security deposit is required when moving into an apartment and is typically equivalent to one to three months' rent. It’s a sum that a new tenant pays to a landlord or property management company before moving in.

Security deposits provide landlords with extra insurance to cover tenant damage beyond normal wear and tear.

Your landlord or property manager will send an email or call to let you know about your apartment approval and arrange a time to sign the lease. Make sure you read through everything and understand every detail.

Remember, a lease is a legally binding document, so note any existing damage or issues in the apartment so you’re not held liable when you move out.

Look out for any holes in the walls, scuffs on the floors, damage to the windows or major appliances, and any noticeable exterior wear. Document everything carefully with a camera and let your landlord know as soon as possible.

Now, you can move into your new apartment! While moving into your new apartment may seem overwhelming, it’s also an exciting experience.

You’ll also want to prep for move-in day by hiring movers or planning a DIY move with friends and family.

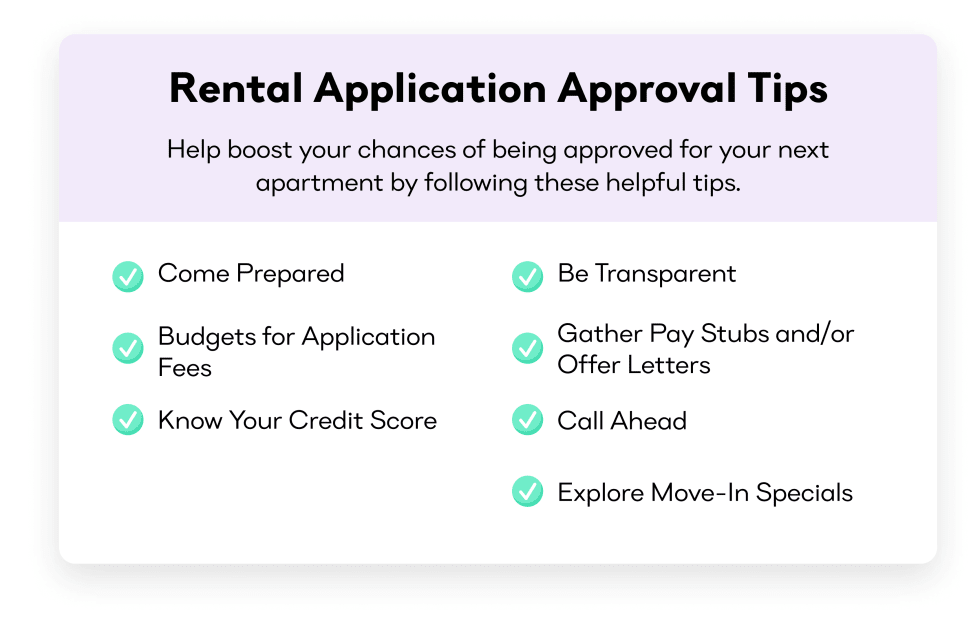

If you want to get approved for an apartment quickly, there are a few main factors to consider, including on-time rent payment history, reliable income, and good communication.

Seven tips to help speed up the renting process:

When you’re ready to apply for an apartment, you’ll need to gather and submit the right documents.

Documents needed to apply for an apartment:

Always provide complete applications with the correct documents. Failing to provide this information is the number one cause of slowing down the application process.

If you’re ready to rent an apartment today, use online platform listings with real-time listing data so you can find apartments that are actually available. Apartment List allows you to filter by bedroom, commute time, amenities, maximum budget, and more, allowing you to find an apartment quickly while still meeting your needs.

Depending on the landlord or property management, waiting for apartment application approval should only take up to 72 hours.

Once you’ve fulfilled all of your apartment rental requirements, you will hear if you’re approved by email or phone. Your landlord will also schedule a time to sign the lease and review any questions or next steps.

Typically, you must be 18 when renting an apartment because leases are legally binding contracts. In some situations, a landlord may rent to an underage tenant, although this is rare and usually requires a guarantor or cosigner.

When your apartment application is approved, you can decide whether or not you still want to sign the lease or decide to pursue a different option.

Yes, you can apply for multiple apartments, and it’s encouraged in competitive rental markets like New York City or San Francisco. However, you should ask if applying to more than one apartment in the same building will affect the rental application process time or if you will need to pay additional application fees.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more