- 44 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

Considering rent reporting services, but aren’t sure if they’re safe or helpful? Learn why we love rent reporting and how to find a reputable service!

Rent reporting services send your on-time rent payments to credit bureaus so they count toward your credit history. Since rent is usually your biggest monthly expense, using one can help you build credit faster, qualify for loans, and strengthen rental applications.

In this guide, we’ll explain how rent reporting works, review the top services, break down costs, and share tips to maximize your credit-building potential.

Rent reporting services are third-party companies that verify your rent payments and report them to one or more credit bureaus (Experian, Equifax, and TransUnion).

Traditionally, rent hasn’t helped renters build credit. These services close that gap, giving you credit for consistent, on-time payments. Once reported, your rent history can positively impact your credit score—especially if you have a thin file or limited credit history.

If you’re looking for rent reporting services to consolidate your efforts by providing your information to all three credit reporting agencies at the same time, here are five that we recommend:

| Service | Cost Structure | Bureaus Reported To | Past Rent Reporting? |

|---|---|---|---|

| Self | Free (or $6.95/mo for utilities/phone) | All 3 | Limited |

| PayYourRent | Free (landlord signup required) | All 3 | No |

| RealPage | $4.99/month | All 3 | No |

| Rent Reporters | $94.95 setup + $7.95–$9.95/month | All 3 | Yes (up to 4 years) |

| Rental Kharma | $75 setup + $8.95/month | All 3 | Yes |

Our first option, Self, reports ongoing rent payments to all major credit reporting agencies for free with a sign-up. You can add the option to include utility and cell phone payments for $6.95 a month. Overall, it's a fantastic free rent reporting system with a straightforward monthly fee if you want to make it even better.

PayYourRent is a software service that landlords can sign up for in order to facilitate online rental payments and even additions like maintenance requests. Rent reporting is also included as a service free of charge, so landlords who choose this option are doing their tenants a big favor.

RealPage is part of a much broader tenant management software system that landlords can use to manage customer experience online. If you have access to RealPage as a tenant, then when you go to make your monthly rent payment, you should see an option to report your payments to credit agencies for a monthly fee.

Rent Reporters provides in-depth reporting that includes the past four years of your rental history as well as your latest and future payments. It reports directly to all 3 agencies.

Rental Kharma is a comprehensive rent reporting service that finds and reports both present and past rental payments to all 3 credit agencies, often leading to better results more quickly.

Yes—if you pay rent on time consistently. Benefits include:

Consider the trade-off: Paid services can cost $75–$100 upfront plus $7–$10 monthly. Weigh whether the expected credit score boost (often 20–40 points for thin files within six months) is worth the cost.

Reputable rent reporting services are safe and use security measures like encryption and identity verification. To protect yourself:

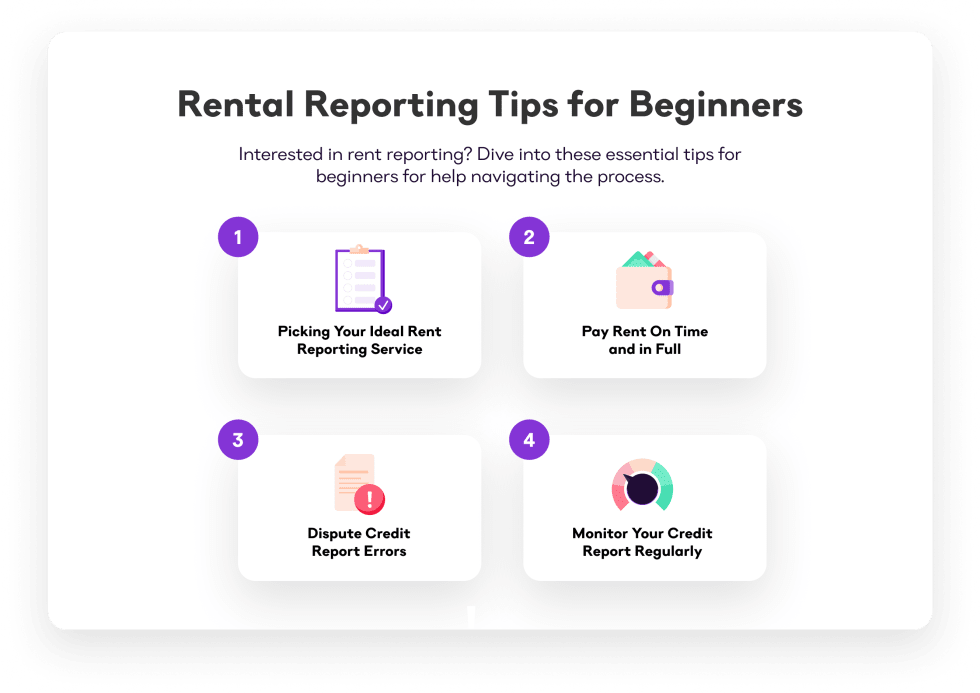

Note: Late or missed payments may also be reported, which could hurt your score.

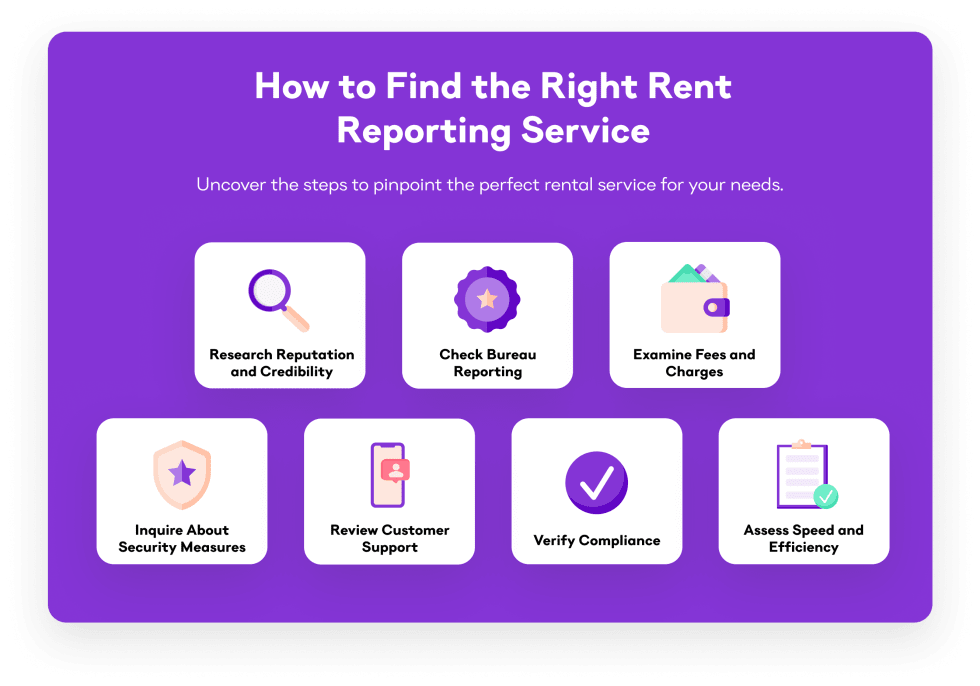

When evaluating services, consider these factors:

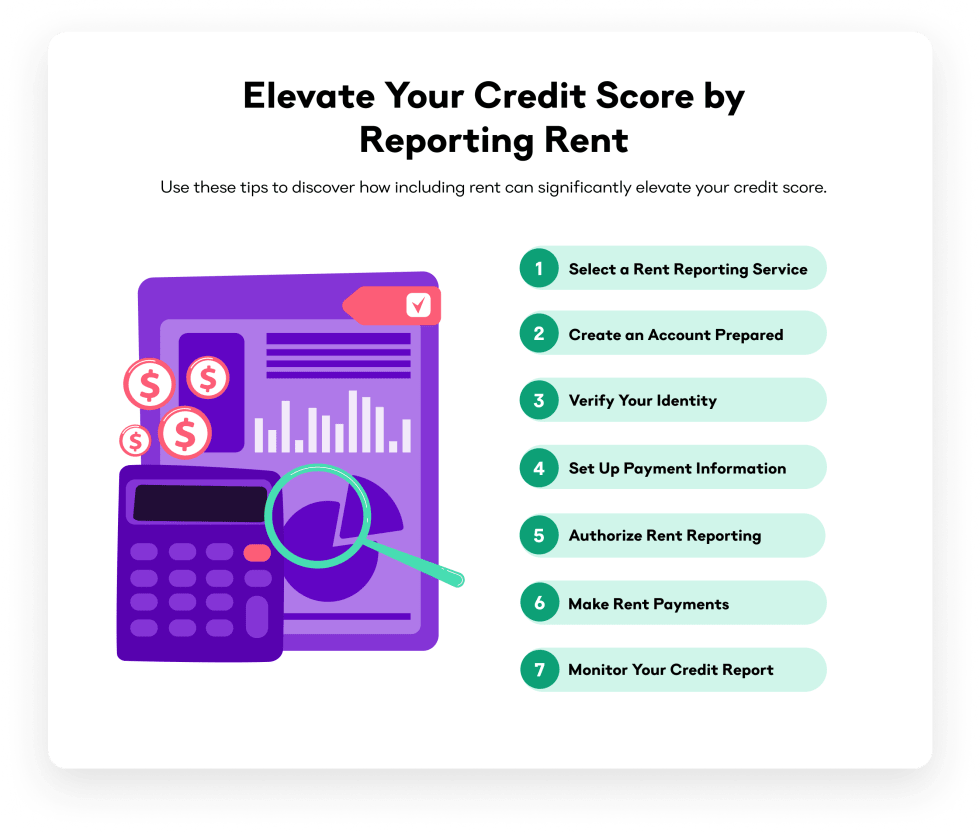

The process is simple:

Costs vary depending on coverage and features.

| Type of Plan | Typical Price | What’s Included |

|---|---|---|

| Free (limited) | $0 | Report to one bureau (e.g., Experian Boost) |

| Standard monthly | $6.95–$9.95 per month | Report ongoing rent to all 3 bureaus |

| Premium monthly | $10–$20 per month | Adds past rent reporting + credit monitoring |

| Setup/enrollment fee | $25–$95 (one-time) | Verification and onboarding |

Rent reporting can influence your credit score in several ways, from helping establish history to determining how different scoring models treat your payments.

Rent reporting is most helpful for:

Not ready to pay for a service? Try these options:

Rent reporting services turn your largest monthly expense into a credit-building tool. The best services report to all three bureaus, include past history, and offer fair pricing. For renters with limited credit, these services can provide a quick boost and open financial doors.

Ready to rent smarter? Find apartments on Apartment List and start building credit with every payment.

Usually 30–60 days, depending on the service and bureau processing times.

Yes. Services like Rent Reporters and Rental Kharma include past rental history, often up to 24–48 months.

No, adding rent to your credit report through a rent reporting service should not hurt your credit score; in fact, it’s intended to help improve it. On-time payments help, but if late payments are reported, they may lower your score.

You can sign up independently with a third-party service and link your bank account to verify payments.

VantageScore and newer FICO models (FICO 9, FICO 10) use rental data. Older FICO models may not.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more