- 46 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

You can rent an apartment after bankruptcy, but approval usually depends on showing financial stability and reliability through other means. Landlords may ask for proof of income, references, or a larger deposit.

Private landlords and smaller rental properties are often more flexible than large property management companies. Being honest, prepared with documentation, and proactive in explaining your situation will give you the best chance of approval.

In this article, we'll dive deep into the ways you can improve your chances of finding an apartment that accepts applicants with bankruptcies.

Yes, but not always. A bankruptcy on your credit report can raise concerns for landlords, since it signals past financial struggles. However:

Bankruptcy is a hurdle, but it’s not a dealbreaker. Many landlords will consider your application if you present a strong case.

When landlords review applications, they typically look at:

A bankruptcy may raise red flags, but you can offset those concerns by showing financial recovery and reliability since your filing.

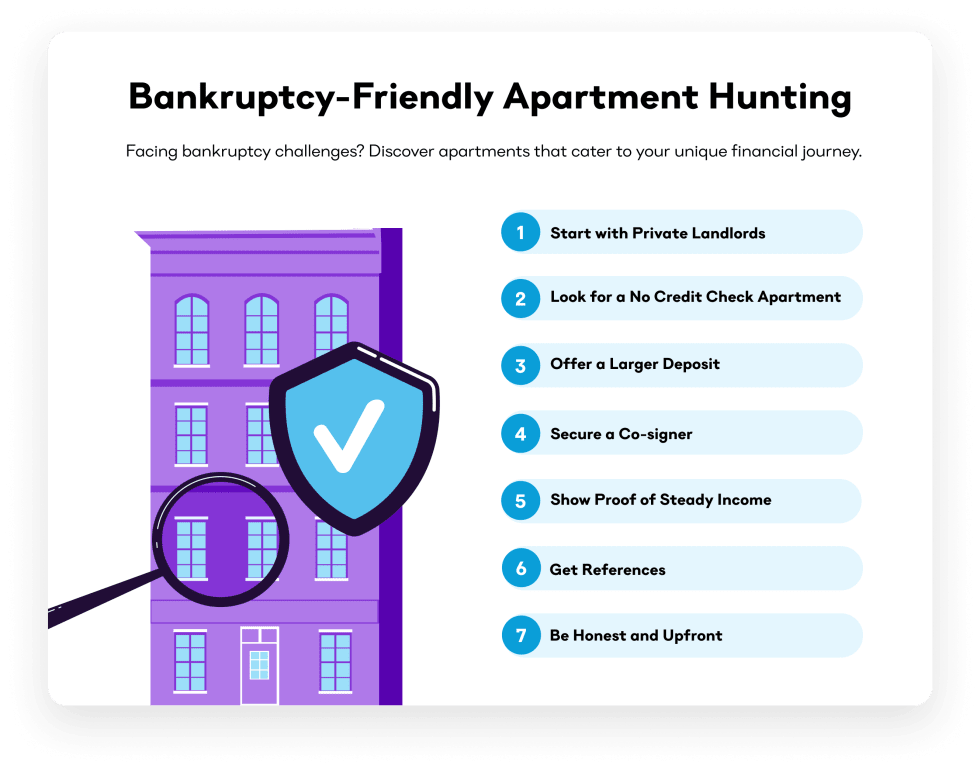

Most landlords will not advertise that they accept applications from renters with a bankruptcy history. However, such landlords definitely exist, and there are several ways to find them.

Be upfront about your bankruptcy and frame it as a turning point. Explain briefly what led to it (job loss, medical bills, divorce) and what you’ve done since to rebuild. Pair your explanation with proof, like steady income, on-time bill payments, or reduced debt.

Private owners are often more flexible than big management companies. They may be open to hearing your story and working with you if you demonstrate reliability. Start with smaller buildings, duplexes, or single-family rentals. You can also check out our guide to no-credit-check apartments.

A larger security deposit (or paying 2–3 months of rent upfront) reassures landlords you’re committed and financially capable. Be sure to confirm your state’s laws on maximum deposits.

If a trusted friend or relative with good credit cosigns, it reduces the landlord’s risk. Guarantor services are also available for a fee in many cities.

Check out our Guarantor vs. Cosigner guide to get a better understanding of the differences.

Your current ability to pay is often more important than past mistakes. Provide pay stubs, tax returns, or a letter from your employer confirming stable income or work. Many landlords use the “3x rent” rule (income = 3x monthly rent).

Positive recommendations from past landlords, employers, or community leaders can outweigh a negative credit report. Ask references to highlight your reliability, on-time payments, and responsible behavior.

Don’t try to hide your bankruptcy. Landlords will see it on your report. Address it directly and emphasize what’s changed. Proactive honesty can make you more trustworthy than avoiding the topic.

High-demand urban apartments are often stricter. In suburban or less competitive markets, landlords may be more flexible, especially private owners who want to fill vacancies quickly.

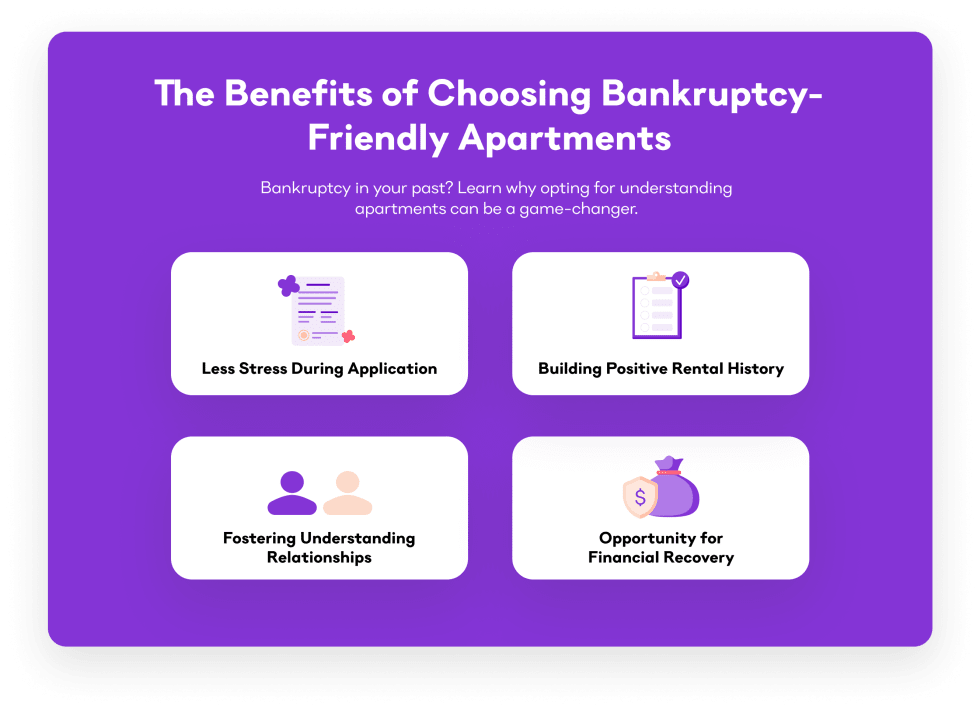

Renting after bankruptcy is part of financial recovery. There are plenty of reasons to do it:

The exact impact varies based on the credit profile, but it's not uncommon for scores to plummet by 200 points or more. This decline is because credit scores are designed to predict the risk of future non-payment, and a bankruptcy signals a history of not meeting financial obligations.

The duration a bankruptcy stays on your credit report largely depends on the type of bankruptcy you've filed:

It's essential to note that even though a bankruptcy may be listed on your report for several years, its impact on your credit score decreases over time, especially if you engage in positive credit behavior.

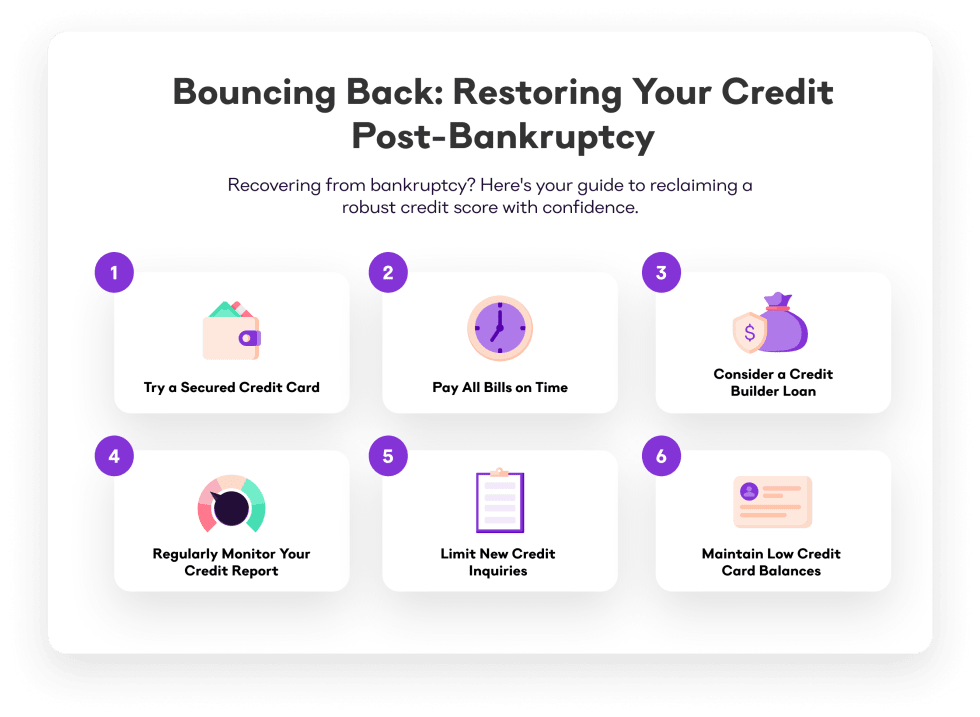

| Strategy | Why It Helps |

|---|---|

| Pay bills on time | Payment history is one of the biggest factors in a credit score |

| Try a secured credit card | Requires a deposit, easier to qualify for, helps build history |

| Use rent reporting services | Some services report rent payments to credit bureaus |

| Keep credit use under 30% | Low credit utilization signals responsible borrowing |

| Check your credit report | Correct errors that may hurt your score |

With consistent effort, many renters see noticeable improvement within 6–12 months.

When you find a bankruptcy-friendly apartment, clarify the terms upfront:

Ready to embark on your next rental journey? By answering a few simple questions, you'll be matched with apartments that fit your location, budget, and desired amenities. You can use our internal messaging system to reach out to prospective landlords and ask them your questions about the application process and how they review credit history.

Bankruptcy is a legal process that allows individuals or businesses to reduce or eliminate debts they cannot pay. Under court supervision, debt may be discharged (Chapter 7) or repaid through a structured plan (Chapter 13). While it offers financial relief, bankruptcy remains on your credit report for 7–10 years, which landlords often consider during rental applications.

Bankruptcy covers multiple types of debt, including credit cards, loans, and medical bills. Foreclosure is specific to mortgages, where a lender reclaims a property due to missed payments. A renter may file bankruptcy without ever going through foreclosure. However, both negatively affect credit scores and can make landlords cautious when reviewing rental applications.

While it might be easier to secure an apartment after your bankruptcy is discharged, you don't necessarily have to wait. Some landlords or property management companies may be willing to rent to you before the discharge, especially if you can provide evidence of a steady income and other positive financial behaviors. It's crucial, however, to be transparent about your situation during the application process.

If you're denied an apartment due to bankruptcy, don't be disheartened. Start by asking the landlord or property manager for a reason in writing, as this can provide clarity and potentially help in future applications. Next, consider finding a co-signer or offering a larger deposit as an act of good faith. Continue your search, focusing on private landlords or specialized platforms that cater to individuals with financial challenges.

In the United States, it is not illegal for landlords to deny applicants housing based on their bankruptcy filing history. However, there are some important exceptions to this rule.

Federal Law

The Bankruptcy Code does not explicitly prohibit landlords from discriminating against applicants based on their bankruptcy filing history. However, the Fair Housing Act (FHA) does prohibit landlords from discriminating against applicants based on certain protected characteristics, such as race, color, religion, national origin, sex, familial status, and disability. In some cases, a landlord's decision to deny housing to an applicant based on their bankruptcy filing history could be considered a form of disparate impact discrimination under the FHA.

State and Local Laws

Some states and municipalities have their own laws that prohibit landlords from discriminating against applicants based on their bankruptcy filing history. For example, California's Fair Housing and Employment Act (FEHA) prohibits landlords from denying housing to applicants based on their bankruptcy filing history if the applicant can demonstrate that they are capable of paying rent and complying with the terms of the lease.

Yes. Many landlords and rent-reporting services now share on-time rent payments with credit bureaus. Consistently paying rent in full and on time can improve your score and show financial responsibility, helping offset the impact of bankruptcy over time.

It varies. Some landlords will rent to applicants immediately if they provide proof of income, references, or extra deposits. Larger property management companies may require at least 1–2 years post-bankruptcy. In general, your approval odds improve steadily each year as you rebuild credit and maintain a positive rental history.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more