- 47 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

Simply put, the answer is yes - if you take the time to report your rent payments. Paying rent can be a great way for active renters to build a positive credit history. By reporting your rental payments, you are providing potential landlords with proof that you've been a responsible tenant in the past and this increases your chances of getting approved for a new unit.

In this article, we'll explore the question “Does paying rent build credit?” and what steps you can take to make sure your rent payments are contributing to a healthy credit score.

Let’s get started.

Why is good credit essential when renting an apartment? Whether you are just starting as a renter or you plan to buy a house, building a solid credit score is important, and adding rent to credit report information can be a great tool.

Can renting an apartment build credit? It can, but you need to know how to report your on-time payments.

Reporting your rent payments to credit bureaus can be a great way to improve your credit score and establish a positive rental history. Here’s a couple ways to go about it:

Asking your landlord to report your rent payments to credit bureaus can be a great way to build your credit history. If you've been consistently paying your rent on time every month, it's a missed opportunity not to have this reflected in your credit report.

To request this, you can approach your landlord and ask if they report rent payments to the credit bureaus. If they don't, ask them to start doing so with your payments, explaining the positive impact it could have on your rental journey.

To build credit by paying rent on time each month, explore rent reporting services. These allow you to independently submit monthly rental payments to help increase your credit score. Some allow you to upload rent payments from years past and even feature automated settings, so you don’t have to worry about keeping track of when you reported your rent last.

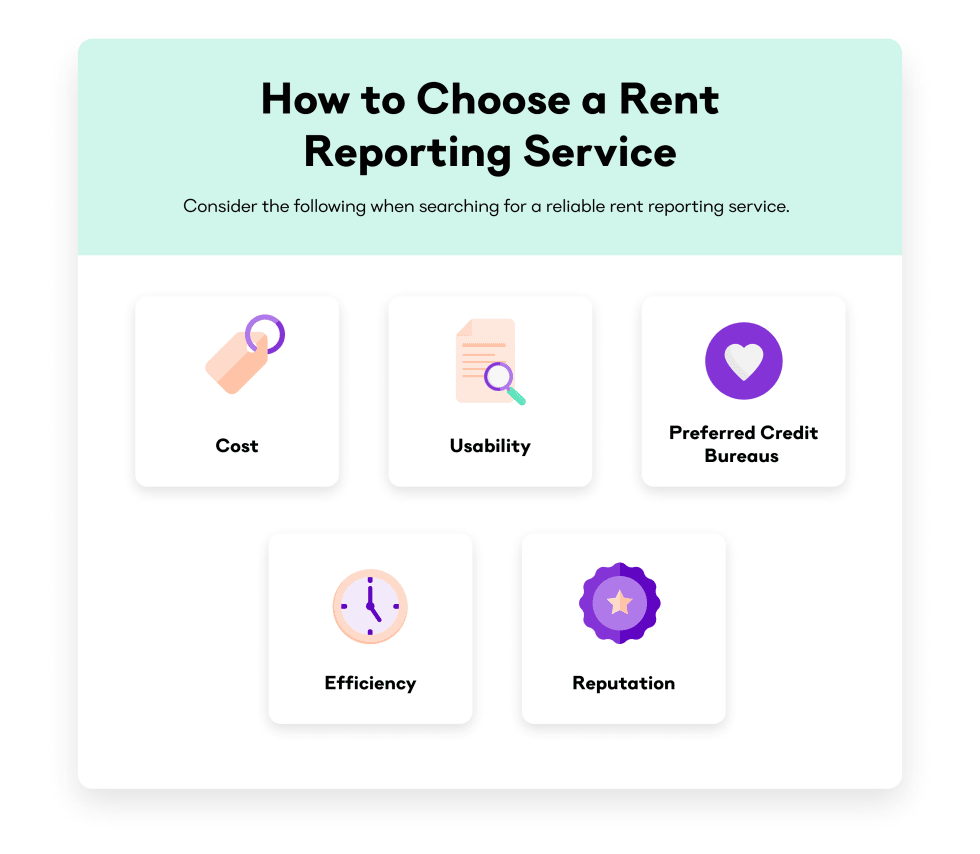

Using rent to build credit means ensuring you or your landlord utilize a rent reporting service. To use rent credit boost hacks, know what to look for in a reporting service.

You know what to consider, now it’s time to learn about one of the best rent reporting services offered to today’s renters.

By now, you can see that paying rent can build your credit health as long as you have the right tools to report your payments. You can easily start utilizing reporting services like Boom once your account has been set up, whether you prefer to have your landlord report your payments or do it yourself.

But don’t just take our word for it. Look at the stats. Boom users have seen their credit scores increase by over 105 points. Even better, Boom users have seen an average increase of over 28 points in just two weeks!

Does paying rent build credit? As a renter, you can build your credit score by making on-time rent payments on a month-to-month basis and reporting them. And now, you have the tools to do so! And when the time comes, continue to Apartment List to find attractive apartments with your new and improved credit score.

VantageScore 3.0 and 4.0 and FICO Score 9 are all credit scores affected by on-time rent payments. So, does rent affect credit score ratings? Yes!

While paying utility bills on time can help your credit score, it's not usually a big enough impact to make a noticeable difference.

Your credit score can drop as it is negatively impacted by missing rent payments or making late rent payments each month. However, rent reporting services like Boom will only report positive rent payments made throughout your lease.

You should always report on-time rent payments to credit bureaus to help improve your credit score. Even if a good credit score isn’t meaningful to you now, it will be at some point in the future.

Boom makes rent reporting easy with their automatic payment feature, which helps take the work out of building positive rental history.

You can increase your score over 28 points in two weeks by reporting positive rent and utility payments for two months, according to market research data.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more