Apartment List Renter Migration Report: 2020 Q4

Welcome to Apartment List’s quarterly Renter Migration Report. In this report, we analyze data on millions of searches to see where our users are preparing to move, shedding new light on the migration patterns of America’s renters. We look at which parts of the country are retaining their renter populations, which places renters are ready to move on from, and which metros are attracting renters from other parts of the country.

Migration patterns amid COVID-19

The COVID-19 pandemic has upended our lives in myriad ways over the course of 2020, and housing choice is no exception. In a survey conducted in June, we found that 30 percent of renters were considering putting a pause on moving plans because of the pandemic. At the same time 17 percent of respondents said that the pandemic had made them more likely to move in 2020, either out of financial necessity, a desire to take advantage of falling rents, or because of changing preferences. But among the renters who are continuing to move, how have their housing choices been altered by the pandemic? We analyzed data from millions of Apartment List users to find out.1

More renters are looking for short-term leases, especially those moving someplace new

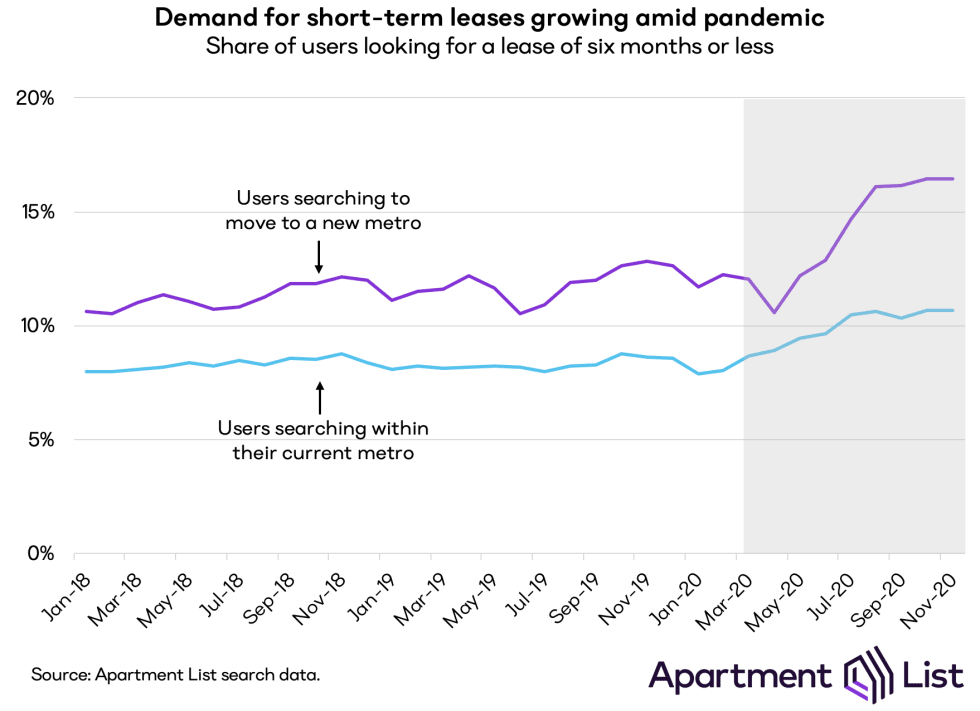

One of the more striking trends that we observe in the most recent data is that renters who are moving now seem less willing to make long-term commitments to their new homes. Since the start of the pandemic, we have seen a steady upward trend in the share of renters looking to sign a lease of six months or less. This is true both of renters who are looking to move someplace new as well as those who are searching close to where they already live.

Among users who searched on Apartment List in November and are looking to move within the metro where they currently live, 10.7% are looking for a short-term lease, compared to 7.9% in January of this year. Trends in rent growth suggest that the pandemic has led to a cooling of demand for rentals in the core city, while the suburbs have started to heat up. Perhaps some of those moving to the suburbs are simply testing the waters while leaving open the possibility of moving back downtown once city life begins to regain its vibrancy.

The spike in demand for short-term rentals is even more pronounced among renters looking to move someplace new. Those making cross-metro moves have always been more likely to be looking for a short lease compared to those searching within-metro, but that gap has widened since the start of the pandemic. As of November, 16.4 percent of renters searching to move to a new metro were looking to sign a lease of six months or less, an increase of 40 percent since January. Overall, 28.9 percent of renters searching from July through November were looking outside the metro where they currently live, up just slightly from 27.5 percent during the same period last year. In other words, cross-metro moves have not become significantly more common, but the renters making these moves are less certain that they will be permanent.

Who wouldn’t want to live in Hawaii for six months?

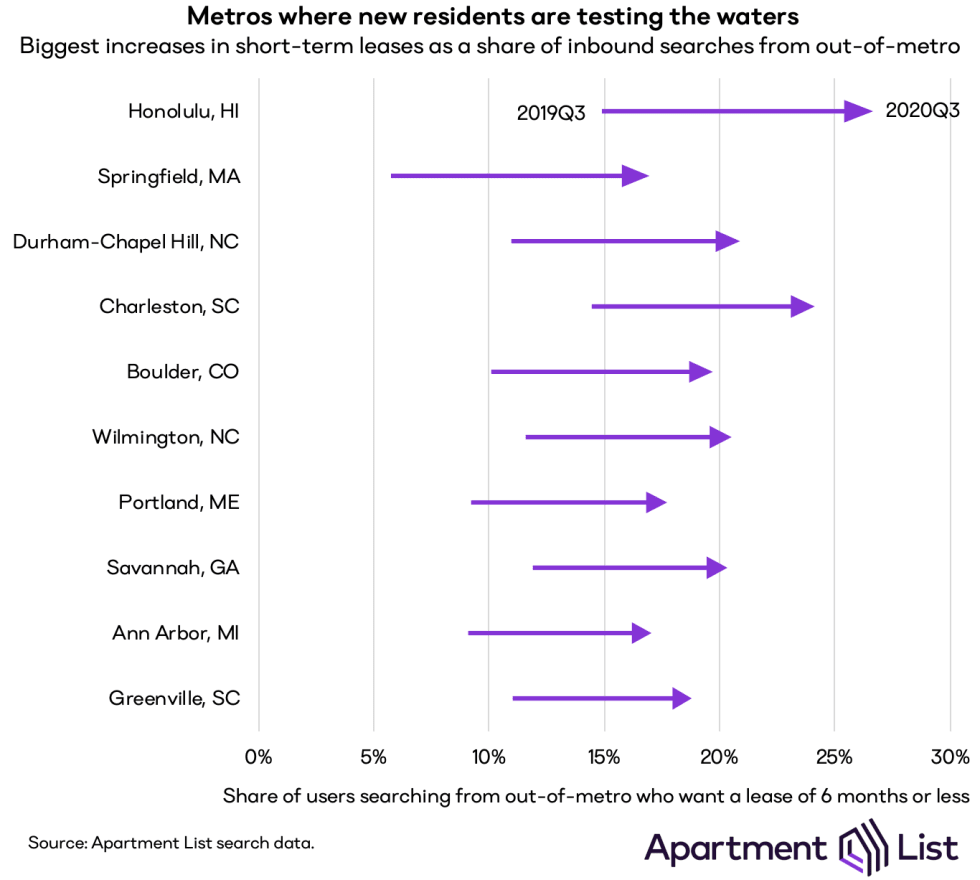

When we break down this data locally, we find that among renters looking to move to a new metro, Honolulu has seen the biggest increase in a preference for short-term leases.2 Since July, 26.8 percent of users searching in Honolulu from somewhere else in the country were looking for a short-term lease, up significantly from 14.9 percent at this time last year. In recent months, no other metro has had a higher share of out-of-towners looking for short-term leases. Furthermore, Honolulu has experienced the second biggest increase in the overall share of searches coming from other parts of the country. 42.2 percent of all users searching for apartments in Honolulu during the report period are currently living in a different metro, compared to 30.4 in the same months of 2019.

In other words, the pandemic seems to have spurred more interest in Honolulu from out-of-towners, but it seems that many of those renters are unsure if they will stay long-term. Among those looking for a short-term lease in Honolulu, the most common sources are Los Angeles, San Francisco, and San Jose. Los Angeles is the top source of all inbound searches to Honolulu, not just those looking for short-term leases, while San Francisco ranks number three.

Beyond Honolulu, the cities that have seen the biggest increases in the share of out-of-towners looking for short-term leases are primarily small to mid-sized cities, including a number of tourist destinations in scenic locations. Boulder, for example, attracts outdoors enthusiasts with its close proximity to Rocky Mountain National Park, while Charleston, SC and Savannah, GA are picturesque port cities known for their rich histories. Similarly, Portland, ME and the Western MA region encompassed by the Springfield metro are popular destinations for weekend trips from the Boston area.

As the pandemic continues to rage on, many companies whose employees can work remotely have signalled that they plan to keep offices closed until well into 2021. With the ability to work anywhere with an internet connection, it seems that some are taking advantage of this flexibility to temporarily relocate to areas that may offer more relaxation and recreation than where they currently live.

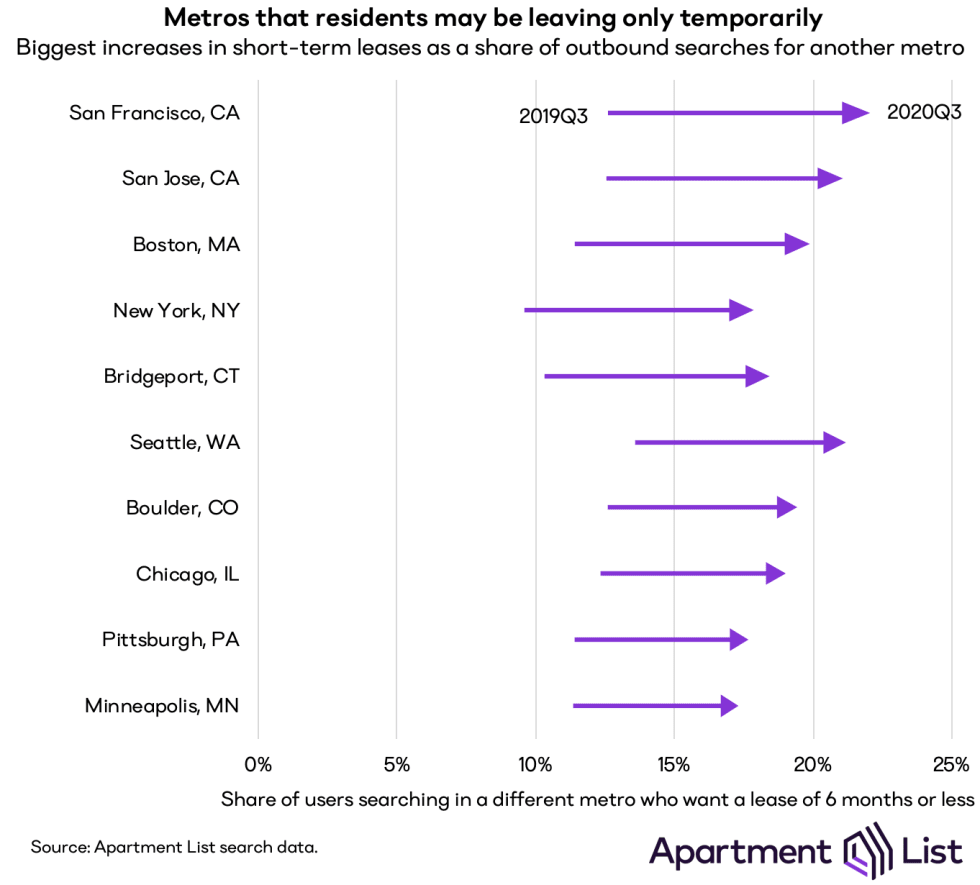

Those leaving expensive coastal metros might not be gone for good

To provide more context on the other side of this equation, we look at where demand for short-term leases has grown most on among outbound searches. On this metric, San Francisco has seen the sharpest increase -- among users currently living in San Francisco but searching for apartments in a different metro, 22.1 percent were looking for a short-term lease in recent months, compared to just 12.6 percent at this time last year.

That said, the overall share of San Francisco-based renters who are looking to leave has increased only slightly, from 29.6 percent in July through November of 2019 to 30.7 percent in the same months of 2020. Much has been made of the significant cooling in the SF rental market, and while rents in the city have fallen sharply, our search data suggests that softening demand may have more to do with a lack of newcomers rather than an exodus of current residents. Furthermore, this data hints that some of those who have left the area may not be planning on those moves being permanent.

Coming in second behind San Francisco is the neighboring Bay Area metro of San Jose. Looking beyond the Bay Area, the rest of the list is populated with many of the nation’s most expensive rental markets, which are also the markets that have seen some of the sharpest rent declines since the start of the pandemic. In particular, Boston, New York City, and Seattle, exemplify this trend.

With many of the local amenities that make city life appealing temporarily shuttered (e.g. bars, restaurants, museums), it seems intuitive that those who are working remotely may be questioning whether the sky-high rents in these cities are really worth it right now. But while some have predicted that the pandemic could represent a death knell for cities, the spike in demand for short-term leases among those leaving these cities would seem to imply that residents may return once the pandemic has passed.

Conclusion

Perhaps surprisingly, the pandemic does not seem to have significantly altered the well-worn migration channels that we observe in our search data. Although some smaller markets have certainly been heating up in recent months, those looking to leave San Francisco are still most likely to be searching in San Jose or Los Angeles. However, the pandemic does appear to be altering preferences in one important way -- an increase in demand for leases of six months or less.

On the outbound side, this spike in searches for short-term leases is concentrated among expensive coastal metros, while on the inbound side, the biggest spikes are happening in mid-sized tourist destinations. Taken together, this paints a picture of renters taking advantage of the geographic flexibility provided by remote work in order to test out life someplace new. But given the recent volatility in labor and housing markets, as well as the uncertainty around what life will look like post-pandemic, the renters moving now are less willing to make a long-term commitment. This evidence suggests that although the pandemic is impacting housing choice, the permanence of that impact is far from certain.

- For the purposes of this analysis, we determine each user’s current location based on IP address, and compare that to the location where they’re searching for an apartment. We aggregate these locations at the metro level to identify extended-distance moves. This report is based on data for all users who searched on Apartment List between July 1 and November 24 of 2020.↩

- Rankings are across the 100 metros with the greatest search volume on Apartment List.↩

Share this Article