Apartment List Renter Migration Report: 2020 Q2

Welcome to Apartment List’s quarterly Renter Migration Report. In this report, we analyze data on millions of searches to see where our users are preparing to move, shedding new light on the migration patterns of America’s renters. This iteration of our migration report takes on added significance as it provides our first glimpse of how moving trends might be affected by the COVID-19 pandemic.

We look at which parts of the country are retaining their renter populations, which parts renters are ready to move on from, and which metros are attracting renters from other parts of the country. Although we expect that COVID-19 could have significant long-term implications for where Americans choose to live, those changes are not yet playing out in our data. In fact, given the scale of disruption to all facets of daily life, our renter migration data looks remarkably similar to what we were seeing prior to the pandemic.

Read on for our analysis of some of the key insights we observe and please explore the interactive map at the top of the report to draw insights of your own.

Is the COVID-19 pandemic impacting migration trends?

As orders to shelter-in-place and social distance continue to grip the nation, moving has become difficult or impossible, and in some cases is banned outright by local guidelines. This temporary pause on moving activity is the most salient near-term impact of the pandemic on the housing market. That said, the data we explore in this report reflects apartment searches rather than completed moves, and search activity is continuing even amidst the pandemic. Although Google trends data shows a notable dip in volume for searches related to apartment rentals, the majority of renters appear to be undeterred from at least getting the search process underway.

Digging into the data of users starting their searches on the Apartment List platform this spring, we observe temporary shifts in renter behavior, but not necessarily in the places renters are looking to move. Specifically, the share of renters with imminent move dates rose ten percent year-over-year as shelter-in-place orders started to go into effect in the latter half of March.1 At the same time, the share of renters that claim to be “just looking” on the site, rather than having fixed move-in dates, also rose rapidly throughout March.

This mix of urgency and uncertainty reflects the unprecedented nature of the current situation. On one hand, it seems that the renters who are most serious about moving are more likely to remain active in their searches, and that some renters may have even pushed up their move dates, perhaps to try to get in a move while it was still possible, or to try to take advantage of perceived softness in the market. On the other hand, even those renters who want to move soon are unsure that they’ll actually be able to do so, reflecting uncertainty that is likely tied to both public health and economic factors.

Another change that we observed in March was a dip in the share of renters looking to move to a different metro than the one where they currently live. Long distance moves are usually motivated by employment opportunities, and this data suggested that amid significant economic instability, renters were feeling more hesitant about big moves. However, this trend varied substantially, even across heavily impacted markets, and the data on this metric has rebounded in the most recent weeks, indicating a temporary aberration rather than a signal of a prolonged impact. Furthermore, when renters are looking to move across markets, the specific channels of migration have not been substantially altered, as can be seen more clearly in the specific examples discussed below.

The pandemic is not scaring renters away from New York

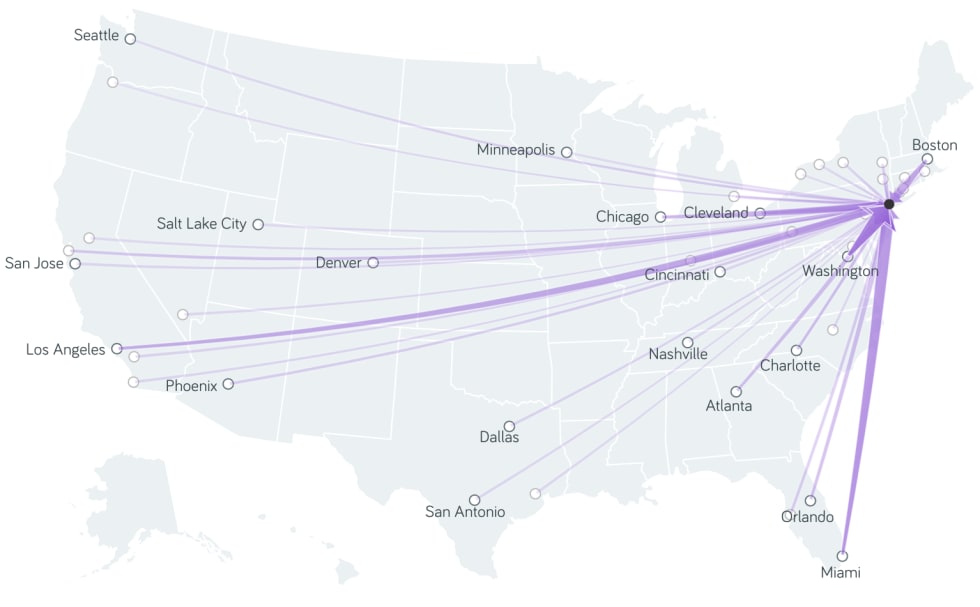

In recent weeks, the New York City metro has emerged as a global epicenter of the pandemic, to the extent that the state of New York now accounts for more COVID-19 cases than any single country outside the U.S. It might reasonably be expected that the severity of the situation would make the prospect of moving to New York appear far less attractive, but this intuition is not borne out in our data. We observe that prior to the pandemic, 20.3 percent of users searching for apartments in the New York metro were searching from a different part of the country. In more recent data, however, that share has increased to 26.4 percent.2

It may appear counterintuitive that a greater share of renters are looking to move to New York from elsewhere during the pandemic, but there are likely a couple of explanatory factors at play. Given the degree of disruption to the daily lives of those living in the New York metro, apartment hunting is likely not top of mind for them right now. Meanwhile, those who had already been considering a move to New York from elsewhere still seem to feel that it will be a good idea once things settle down. Some of these renters may even be wondering if the pandemic has started to impact rent prices, such that the prospect of finding a good deal could motivate increased activity among those searching from afar.3

On the outbound side, we observe a small increase in the share of New Yorkers looking to move elsewhere, from 27.9 percent in the first part of the year to 29.4 percent in March and April. In terms of the places they’re looking to move to, Philadelphia jumped from the third most common outbound destination in the pre-pandemic period, to the first most popular. That said, the share of outbound searching going to Philadelphia did not change substantially, increasing from 5.6 percent to 6.6 percent. All-in-all, renters searching to move away from the New York metro are largely looking in the same places that they were prior to the pandemic. Similarly, we observe little change in the places from which renters are looking to move to New York, with Philadelphia and Washington, D.C. being the most common sources.

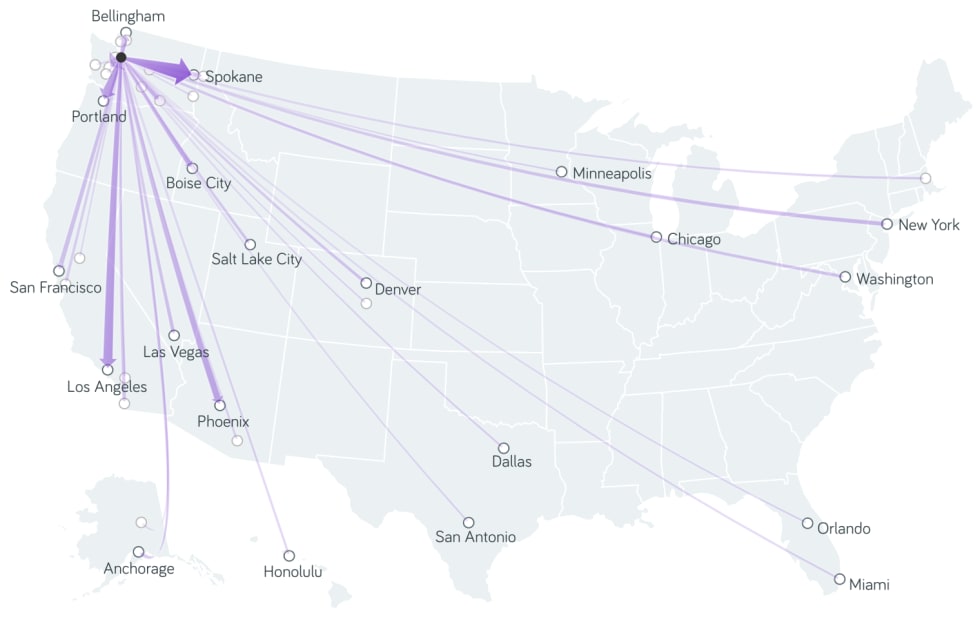

Seattle renters want to stay in the Pacific Northwest

The Seattle metro is another region where we might have expected to see changes in renter search patterns. Given that it was the first region in the U.S. to have a major coronavirus outbreak, the Seattle rental market has perhaps had more time to react to COVID-19 than any other market in the country. That said, here too we see patterns that are overwhelmingly consistent with prior iterations of this report.

Seattle is one of the markets that renters are least likely to leave. Of all users currently living in the Seattle metro, just 20.7 percent were looking to leave during the first few months of 2020, the 7th lowest rate among the 50 largest metros. The pandemic has not changed this fact; the share of Seattle residents looking to move elsewhere has remained stable in recent weeks, and this metric is actually lower in the first quarter of 2020 than it was during the second half of 2019. Even those renters who are looking to leave Seattle still seem to love the Pacific Northwest. Nearby Spokane is the most common outbound destination, accounting for 10.1 percent of renters looking elsewhere, while Portland, OR ranks third at 6.1 percent.

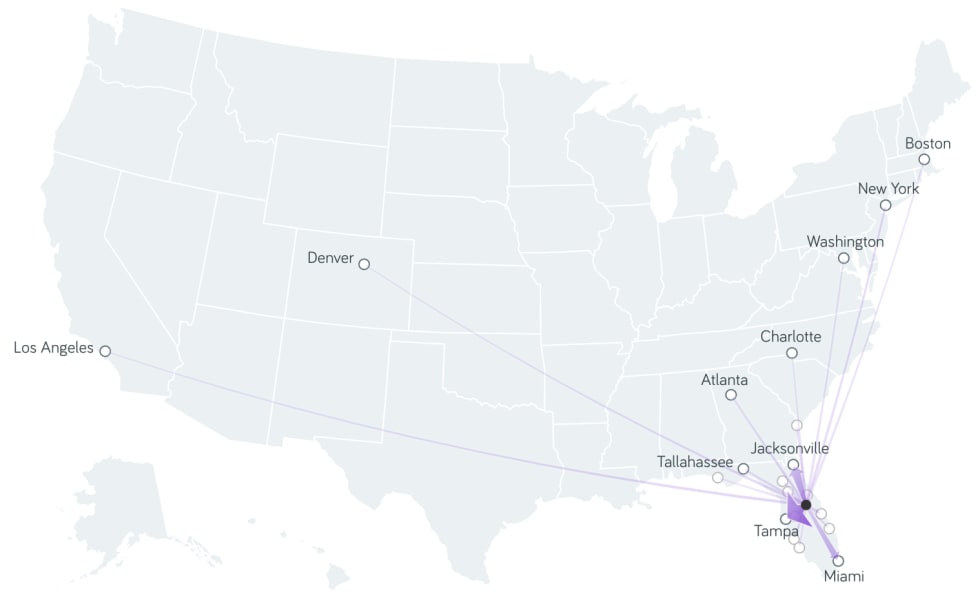

Orlando losing renters to other parts of Florida

In contrast to Seattle, Orlando has the 4th highest share of renters looking to move elsewhere among the 50 largest metros, at 46.3 percent. Despite the high share leaving, Orlando is also doing a fairly good job of attracting renters from elsewhere, indicating that the region is not losing renters, but is rather characterized by a high rate of turnover. The Orlando area economy has actually performed quite well in recent years, but much of its job growth has been concentrated in low-wage tourism-related occupations.

Due to its dependence on the tourism industry, we’ve identified Orlando as one of the regions set to be hit hardest by the quarantine economy. That said, the share of renters looking to move elsewhere is actually a bit lower than it was in the previous edition of this report. While we might expect to see renters fleeing a heavily impacted economy, this data likely indicates that Orlando area workers are having difficulty finding new career opportunities elsewhere. For many, the industry in which they’ve built up professional experience faces extreme uncertainty. Among those who are looking to leave Orlando, Tampa is the most common destination, followed by Jacksonville, and Miami. Orlando renters are not generally looking to travel far, but are being drawn to other parts of the state that offer more diversified local economies.

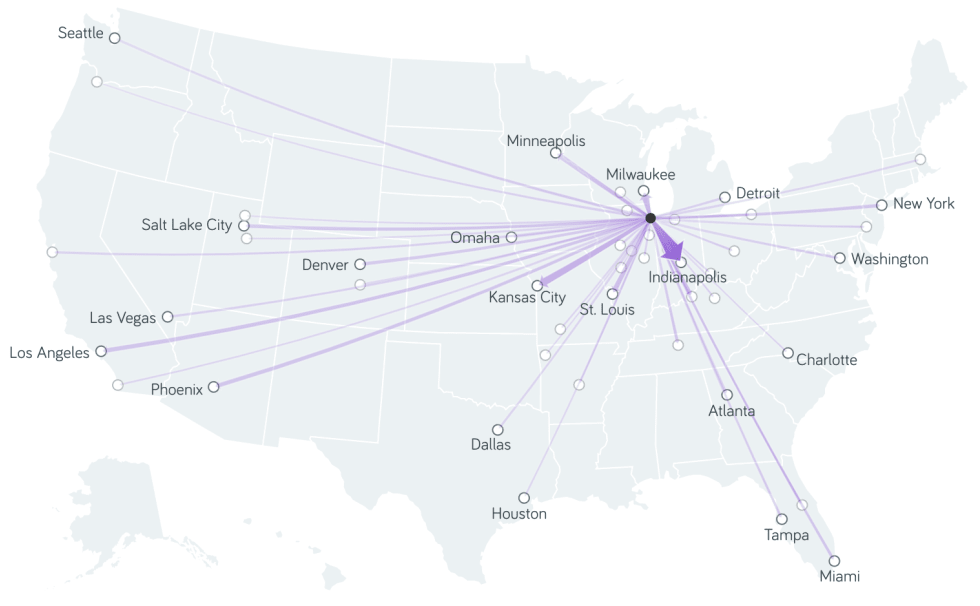

Chicago shows no signs of reversing population loss

While the high share of renters looking to leave Orlando is offset by a high share cycling in from elsewhere, the Chicago metro is an area where the net number of renters really does appear to be declining. Despite its status as the nation’s third-largest city, the Chicago area has been losing population for a number of years, and based on our data, this trend is not likely to change in the near term. Just 15.4 percent of users searching for an apartment in the Chicago area are looking from outside the metro, the lowest rate among the 50 largest metros.

Meanwhile, 34.9 percent of those currently living in Chicago are searching elsewhere, the 20th highest rate among the 50 largest metros. Those looking to leave Chicago seem to favor smaller Midwestern cities -- Indianapolis, Kansas City and Milwaukee are the top destinations.

Austin boom continues to attract renters from around the country

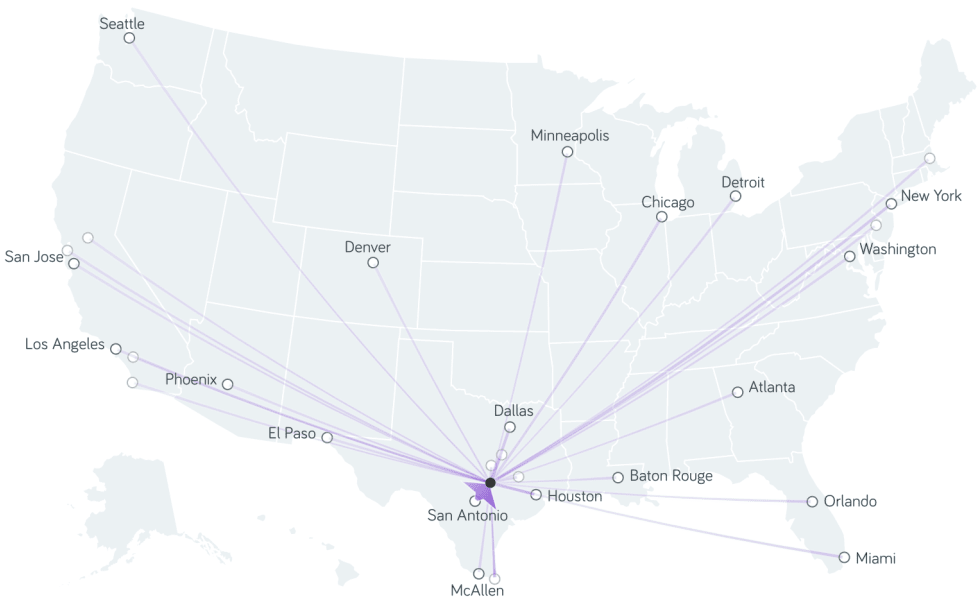

At the other end of the spectrum, Austin has experienced one of the nation’s biggest population booms in recent years. Our data indicates that this trend is showing no signs of slowing, as a staggering 70.9 percent of searches for apartments in Austin come from outside the metro, the highest share among the nation’s 50 largest metros. Much of this interest is coming from other major markets in Texas, particularly San Antonio, which accounts for 25 percent of searches from outside the metro.

That said, a continued tech boom is attracting renters not just from Texas, but from around the country. With Austin now boasting plentiful job opportunities across a range of high-paid knowledge economy occupations, the region is increasingly being seen as an alternative to the expensive coastal metros where these jobs have historically clustered. 4.2 percent of renters searching for apartments in Austin from elsewhere are currently living in the New York City metro, nearly the same share as we see coming from Houston. Furthermore, 2.5 percent of inbound searches to Austin are coming from Los Angeles and an additional 2.5 percent are coming from the San Francisco Bay Area. In addition to these examples, Austin is drawing interest from a broad set of major markets around the country, potentially creating a situation in which longtime residents may find it more challenging than ever to “keep Austin weird.”

What will be the long-term impacts of COVID-19 on migration trends?

While we’re not yet seeing significant pandemic effects in our renter search data, we still expect that the lasting impacts of the crisis will have long-run implications for where many Americans choose to call home. Although the exact dynamics and magnitudes of those changes are far from clear, a couple of potential channels stand out.

For one, the country’s long-run trend of urbanization may be put on pause, at least temporarily. Although urban cores have boomed over the past decade, downtown density has become a liability during the pandemic, putting city-dwellers at increased health risk by virtue of their close proximity with others. Meanwhile, the easy access to restaurants, entertainment, and cultural institutions that make cities so attractive has been temporarily shut down, and may be slow to recover. A prolonged period of time stuck at home in tight urban apartments could also foster a craving for more space. All of these factors may lead to a shift in preferences away from the biggest densest cities and toward more affordable suburbs and smaller, less dense cities.

Perhaps even more significant will be the outcome of the vast remote work experiment that is currently playing out across large swaths of the economy. Although we were already observing a significant increase in the number of Americans working remotely prior to the pandemic, these employees still made up a fairly small share of the overall workforce. Now, however, virtually all workers who are able to do their jobs from home are being forced to do so until social distancing guidelines can be safely loosened. If companies find that their employees are able to continue working productively and collaboratively from home, many will start to question the need for expensive office space. Similarly, many workers will likely start to question the need to live in expensive housing markets simply for the sake of being close to the office. After a decade defined by the increased clustering of knowledge workers in superstar cities, we may see an accelerated shift toward these workers choosing to distribute themselves across a range of smaller and more affordable cities.

The long-run impacts of the COVID-19 pandemic on the American housing market are likely to play out over the course of years rather than months. Although major shifts are not yet showing up in our data, we’ll be monitoring things closely as the situation continues to evolve.

- For the purposes of this analysis, we define an “urgent” move-in date as one less than thirty days away from the start of the rental search on the Apartment List platform.↩

- For this breakdown, we use a cutoff of March 11, the date that the World Health Organization officially declared COVID-19 to be a pandemic.↩

- Our rent estimates do not yet show any recent dip in prices related to COVID-19, either nationally, or in New York City.↩

Share this Article