The Pembroke

- 111 units available

- 1 bed • 2 bed

- Amenities

In unit laundry, Granite counters, Hardwood floors, Dishwasher, Pet friendly, 24hr maintenance + more

Whether you are moving out of your parents’ house or leaving your dorm room days behind, you likely need a first-time apartment renter checklist to navigate the ins and outs of apartment hunting, including applications, fees, budgeting, packing, and more.

To make the transition as smooth as possible, we put together a checklist for renters so you have everything you need to know about renting your first apartment for a successful move.

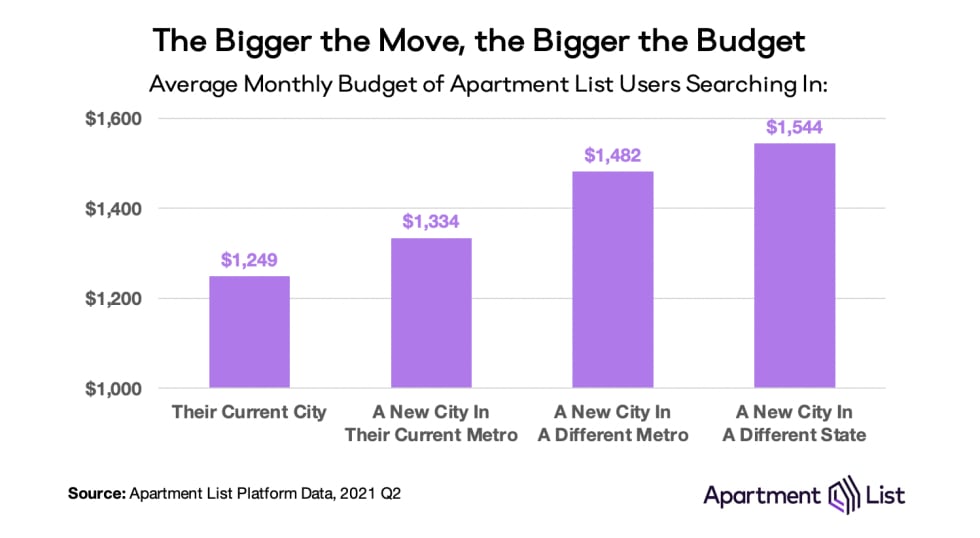

It’s common for first-time renters to overestimate how much they can spend on rent and other necessities. According to the U.S. Department of Housing and Urban Development, you shouldn’t spend more than 30% of your gross income on renting an apartment. However, because this rule doesn’t always work in expensive cities like New York, Boston, or San Francisco, you should do your best to keep your housing expenses to 30% or under. Teaming up with a roommate or creating an income-generating side hustle can help offset your living expenses when getting your first apartment.

A rent calculator can help give you a better idea of what you can and can’t afford. Plug in your location, your desired number of bedrooms, and your gross monthly income, and let the rent calculator do the rest. We’ll provide you with a recommended rent figure and apartment options in your area that fits your budget. Take the time to learn more about what you should include on your first apartment budgeting checklist.

When you’re new to renting, narrowing down your dream neighborhood can feel like one of the more daunting things to do before getting an apartment. But some of the best advice for first-time renters comes from narrowing down your choices and considering the following:

Another top first-time renter tip: If rent soars above the 30% recommended rule, consider looking for a roommate with whom to split the rental costs. But before you tap into your personal network or Craigslist, consider the pros and cons of having a roommate and whether or not you’re willing to make compromises along the way as a shared apartment renter.

Once you’ve decided that a roommate is suitable, it’s time to start finding a roommate. If it's your first time renting an apartment with another person, consider what makes a compatible roommate, what kind of lifestyle you want, and what you can’t tolerate. Here are some ideas:

Some neighborhoods like downtown Seattle or Boston rarely require personal vehicles, as they offer plenty of public transportation options. Suburban areas, on the other hand, require reliable parking, impacting what kind of apartment complex you choose.

Gauge your comfort level and the type of car you have when looking for an apartment. Consider whether you need a covered space, assigned parking, or if on-street parking is readily available and safe. It’s also important to look at your car insurance policy. You may discover your rates could go up or down depending on your long-term parking situation.

Always prioritize amenities and location as a first-time renter. In some areas, apartment complexes have options like swimming pools, on-site fitness centers, rooftop terraces, on-site laundry, and more.

Outdoor amenities can be essential for a first-time apartment. If your apartment community has private outdoor spaces with access to equipment like grills and lawn games, you can host some spectacular gatherings with your friends. Plus, you won’t have to worry about spending money on those items yourself.

The floor you choose in an apartment complex also matters. There’s no right or wrong answer regarding which floor you should live on, but you can narrow down your choices with a pros and cons list.

For example, a bottom-floor apartment may prove cheaper than others, with less legwork to get to the main door and amenities. You also don't need to worry about a dog or children running around and disturbing neighbors below you. However, the views are usually the worst in the building.

If you have some flexibility on when you can move, there are certain times of the year when the rental market is less competitive and less expensive. Rent prices are subject to change based on seasonality, and you can save on rent by being strategic about your search.

Generally, getting an apartment for the first time in the winter will be the best for deals. This rule can even apply in warm-weather cities when families are reluctant to move their kids during the school year, college students are busy with exams, and people are busy with the holidays.

Learn more about renter tips, including the best time to rent an apartment.

New renters may ask themselves about the process of moving into an apartment — perhaps, “How long does it take to find an apartment?” It might take a few months to find the right fit, so start your search early, but first-time renters can also use these tips on how to find an apartment fast. If you’re moving from out of state, renting an apartment sight unseen is also completely possible thanks to virtual and video tours.

You may also discover that finding an apartment with a pet can make things a little more challenging. Learn the ins and outs of finding a pet-friendly apartment with our apartment rental guide.

Before signing a lease agreement for your starter apartment, ask as many questions as possible. Start with our apartment rental checklist of questions to ask when renting an apartment. Don’t forget to think about the noise levels when you tour, and ask about how hot and cold it gets there in summer and winter. Be specific regarding your concerns, and if anything needs fixing, ask before signing the lease. Here are some other questions you might want to ask:

Knowing how to rent an apartment on a budget is challenging, often complicated by listings that are too good to be true. Knowing how to identify rental scams comes with experience, and first-time apartment renters will be more susceptible than others. The FBI reported a 64% increase in real estate and rental scams in 2021 from the previous year.

Not sure what to look out for? Use these tips for first-time renters on how to spot and avoid rental scams.

Moving in with a roommate or your significant other? Don’t assume you’re on the same page about your living situation. Keep the lines of communication open. Get started with these tips for apartment hunting with a significant other.

Ideally, you want to operate under a “two yeses or no” premise for everything from furnishings to rent prices and neighborhood choices. If you don’t agree on a major decision, avoid confrontation and resentment by considering other options until you can find something you both like.

A first-time apartment renter doesn’t always realize the extent of the upfront costs involved. You’ll need to budget for a security deposit, the first and last months’ rent, and an apartment application fee. If you’re moving in with a pet, you may have to pay a pet deposit or fee, as well as the first and last months’ pet rent. Make sure to study your lease to determine how you get your security deposit back and any conditions for reimbursements.

Here are a few additional upfront costs to keep an eye out for:

Study your lease regarding conditions for reimbursements and terms to get your security deposit back. You can also learn more about how much an apartment really costs by spotlighting hidden rental costs.

Upfront expenses are only a portion of your apartment rental costs. Other costs may include utilities, parking, repairs, new furniture, and utility costs. If you’re not sure what to expect, here's how much the average utility bill costs for renters.

It’s common for renters to pay for gas, electricity, internet, and cable. You should also factor in any subscriptions and the cost of transportation or gas, food, gym memberships, and other ongoing expenses.

Most landlords and property managers require specific information from tenants in the rental application. This information may include your credit score, rental history, proof of income (pay stubs and/or W-2), personal references and contact information for past landlords, and your social security number. However, you don’t need to provide your social security number if you are completing a credit check. Learn more about the forms needed to rent an apartment.

Below are some of the most commonly required documents for renting an apartment:

Once you have your paperwork gathered, it’s time to prepare your apartment rental checklist.

Once all the legwork and paperwork are complete, it’s time to think about furnishing your apartment.

As a first-time apartment renter, you may feel there are endless details to remember, from linens to baking trays. Here's an apartment inspection checklist for renters to make moving day a breeze. Use this as your guiding light as you look for all your apartment essentials.

Renters insurance protects renters who live in an apartment, condo, or home and typically covers unexpected personal property damage from specific, pre-approved emergencies and mishaps, including:

A good renters insurance policy offers invaluable peace of mind for your next rental and can help sway your landlord in your favor. If your market is competitive, your landlord will probably be more willing to rent to someone with existing renters insurance or with the intention to purchase it.

When moving into a new apartment, few renters are dying to dig deep into their lease agreements. But they're hugely important and can make or break your experience. Study your lease to set yourself up for a smooth transition.

Look for essential aspects of your lease agreement as a first-time apartment renter, including:

Understanding your costs, such as utilities and security deposit, will help you plan for your budget. Fortunately, you can also furnish your apartment on a budget with a little creativity.

Moving out on your own as a first-time apartment renter requires an investment in new furniture and essential household items. However, you don’t have to break the bank to furnish your apartment on a budget. Check out our guide on how to buy cheap furniture for your apartment.

Online shopping that sells bulk or overstock items is a win for saving money. You can also scour local discount retailers or secondhand stores for inexpensive hand towels, cleaners, and sponges. Remember to personalize your new apartment with plenty of decor and unique artwork. Here's a resource for where to buy cheap art for an apartment and outfit your new home in style.

Now that you finally signed the lease and are ready to decorate your apartment, it’s time for the big move. Skipping the stress and prioritizing a smooth transition are key. Here’s how to do it: \

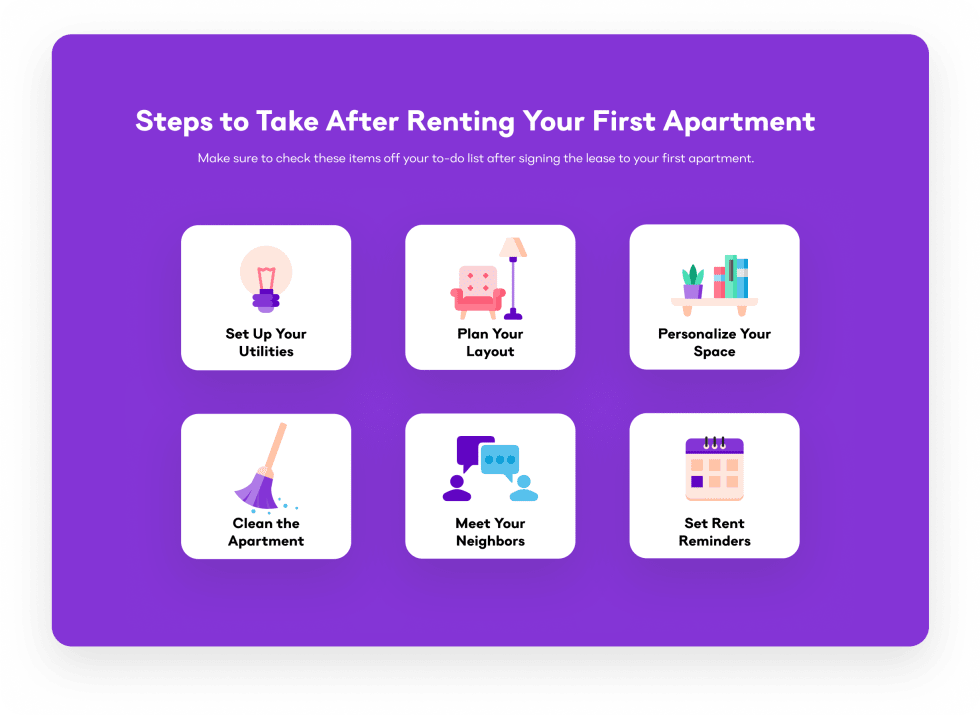

Once you’ve gotten your move organized, prep your apartment before you arrive for a seamless move-in experience.

If possible, schedule a deep cleaning of your apartment before you move in. A cleaning company can take care of everything for you, although they will charge a premium for the service. You can also do it yourself with this ultimate apartment cleaning checklist.

When you’re a first-time apartment renter, you need a proactive, organized approach to finding the perfect place for you. This apartment rental checklist will keep you focused on everything you want and need to make your move to your next place while staying on alert for rental scams.

If you’re ready to take the next steps toward your first apartment, sign up with Apartment List. With us, you’ll spend 5 minutes and save 50 hours searching.

As a first-time apartment renter, you’ll need to:

As a general rule of thumb, a household should spend no more than 30% of its monthly income on rent. Use our rent calculator to determine how much you can afford to spend on rent.

Most landlords may ask for your credit score, rental history, proof of income, references, and social security number to conduct a credit check. Give the landlord a call to ensure you have all the proper documents.

Depending on the apartment complex, tenants may be responsible for certain utilities. These utilities should be outlined in your lease agreement.

When touring an apartment, make sure to ask your future landlord or property managers which utilities they'll be covering and which ones you'll have to pay for.

The 30% rule states that no more than 30% of your net income should go to rent each month. Using this rule, you should make at least $3,000 net each month to afford an apartment that is $1,000 per month.

Across the country, the standard is that you must be 18 years old to rent an apartment. Landlords may have the right to refuse to rent to anyone under 18 years old.

Landlords will typically ask for the following items when renting:

Most landlords will conduct a credit check during the rental application process. A credit score of 650 or higher is typically ideal for a first time apartment renter.

In unit laundry, Granite counters, Hardwood floors, Dishwasher, Pet friendly, 24hr maintenance + more

In unit laundry, Patio / balcony, Granite counters, Pet friendly, Stainless steel, Walk in closets + more