- 47 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

If you're trying to figure out how to get renters insurance, you should know it's inexpensive, straightforward to get, and helps you manage financial risks. Some landlords even require renters insurance, which protects both the rental business and the tenant. But even if it’s not a mandatory part of your lease agreement, it’s still a must-have for any renter.

If you’re thinking about protecting yourself with renters insurance, you’re in good company. Research shows that 55% of U.S. renters, or 61 million people, currently have renters insurance policies.

In this article, we’ll dive into everything you need to know about how to find renters insurance and walk through how to find the best policy for you.

Renters insurance is a type of coverage designed specifically for people who rent their homes, apartments, or condos. It protects your personal belongings and provides liability coverage, but doesn't cover the actual building structure (that's your landlord's responsibility). Instead, it covers the contents within the rented space (those that mainly belong to the renter).

This type of insurance tends to be relatively affordable, ensuring that a renter's possessions are safeguarded against specific dangers outlined in the policy. A real-life example of this would be if there was a flooding incident in your apartment due to a burst pipe. In such circumstances, your renters insurance policy might not only compensate you for the damaged or lost items within your apartment, but could also cover additional associated costs, such as hotel bills, if your residence becomes temporarily uninhabitable.

Pretty much everyone who rents should consider getting renters insurance - it’s one of those things that makes sense for almost any renter’s situation.

You should definitely get it if you:

It’s especially smart for:

Even if you think you don’t have much worth insuring, you’d be surprised how quickly the cost of replacing everything adds up. Your clothes alone could cost thousands to replace, not to mention electronics, kitchenware, and furniture.

The reality is that renters face many of the same risks as homeowners, including fire, theft, water damage, or someone slipping. The difference is you’re only responsible for your stuff and potential liability, not the building itself.

At $15-30 a month, renters insurance costs less than most people spend on streaming services. For that small amount, you get protection that could save you thousands if something does go wrong.

Renter’s insurance isn’t legally required by law, but whether you need it often depends on your landlord and lease agreement.

Increasingly, many landlords are requiring tenants to carry renters insurance as a part of the lease agreement. This trend has been growing because it protects both you and your landlord - if there’s an accident in your unit, your renters insurance handles the liability instead of potentially coming back on your landlord’s policy.

What landlords typically require:

Not all landlords mandate renters insurance. Still, that doesn’t mean you should skip it. Even if your lease doesn't require coverage, you’re still vulnerable to the same risks.

Most standard renters insurance policies include these core coverage areas, though specific details and limits can vary between insurers and policy types. Understanding what’s typically included can help you choose the right coverage for your situation and know what to expect if you need to file a claim.

This is the core of renters insurance - it protects your belongings from covered disasters and incidents. Your policy will reimburse you for damaged, destroyed, or stolen items like furniture electronics, clothing, appliances, and other personal possessions.

Liability coverage protects your finances if you’re found legally responsible for someone getting injured at your apartment or incurring an injury. This type of renters insurance coverage could also help with potential lawsuits resulting from covered accidents and incidents in your rental.

Emergencies, accidents, and mishaps aren’t planned events, and they could lead to unforeseen damages. Your renters insurance covers perils including fire, theft, water damage, some natural disasters, accidents, and smoke.

If someone visits your apartment, and you accidentally break their phone or personal property, your renters insurance would come in handy. Many policies offer reimbursement for damage to others’ property, which could help you stay out of financial and legal trouble.

If someone gets injured while visiting your rental property, renters insurance can help cover their medical expenses, even if you weren’t technically at fault. This coverage typically pays for immediate medical costs like emergency room visits, ambulance rides, or urgent care treatment.

Also known as “loss of use” coverage, this protection kicks in when your rental becomes temporarily uninhabitable due to a covered event like fire, severe water damage, or other disasters. It can help pay for hotel stays, restaurant meals, laundry costs, and other extra expenses you incur while living elsewhere during repairs. This coverage typically has limits and time restrictions, but it ensures you won’t be stuck paying double housing costs when you’re already dealing with the stress of being displaced from your home.

Beyond all the ways renters insurance protects you, it also provides peace of mind. You can rest easy knowing that, if something were to happen, you would have a Plan B that doesn’t include emptying your bank account. It can also prove helpful if you plan to live with a roommate or regularly host guests and want to ensure you’re protected in case of an accident.

While these coverages are standard in monster renters insurance policies, it’s important to read the fine print carefully. Coverage limits, deductibles, and exclusions can vary significantly between insurers. Before purchasing a policy, review what’s included and consider whether you need any add-ons to fully protect yourself and your belongings.

Most standard renters insurance policies include these core coverage areas, though specific details and limits can vary between insurers and policy types.

| Coverage Area | What It Covers |

|---|---|

| Personal Property | Protects belongings (furniture, electronics, clothing, appliances, etc.) from covered disasters, theft, or damage. |

| Liability Protection | Covers legal and financial responsibility if someone is injured in your rental or you cause damage leading to a lawsuit. |

| Unforeseen Damages | Provides coverage for perils like fire, theft, water damage, smoke, accidents, and some natural disasters. |

| Damage to Others' Property | Pays for accidental damage you cause to a guest’s property (e.g., breaking someone’s phone). |

| Medical Bills | Helps cover guests’ medical expenses (ER visits, ambulance rides, urgent care) if they’re injured in your rental, even if you weren’t at fault. |

| Temporary Housing (Loss of Use) | Covers hotel stays, meals, laundry, and other living expenses if your rental becomes uninhabitable due to a covered event. |

| Peace of Mind | Provides financial security and reassurance, especially if living with roommates or hosting guests. |

⚠️ Note: Coverage limits, deductibles, and exclusions vary by insurer. Always review your policy details and consider add-ons for full protection.

While renters insurance provides valuable protection, it’s important to understand its limitations. Knowing what’s excluded from standard policies can help you avoid surprises when filing a claim and determine if you need additional coverage

Standard renters insurance doesn’t cover damage from floods, including overflow from rivers, heavy rainfall, or storm surge. You’ll need separate flood insurance through the National Flood Insurance Program (NFIP) or private insurers if you live in a flood-prone area.

Earthquake damage is excluded from most renters policies. If you live in an earthquake-prone region like California, you can purchase earthquake insurance as an add-on or standalone policy.

Your renters insurance only covers your personal property, not your roommate’s stuff. Each roommate needs their own policy to protect their belongings, or you can sometimes add them to your policy as an additional insured.

Renters insurance generally doesn’t cover items stolen from your car or damage to your vehicle itself - that’s what auto insurance is for. However, personal items stolen from your car might be covered under your personal property coverage.

Damage from insects, rodents, or other pests usually isn’t covered, as this is considered a maintenance issue rather than a sudden, unexpected event.

The key is reading your policy carefully and asking your insurance agent about any gaps in coverage that might affect you. Many exclusions can be addressed with additional coverage, so you can customize your protection to fit your specific needs and risks.

While renters insurance provides valuable protection, it’s important to understand its limitations. Knowing what’s excluded from standard policies can help you avoid surprises and determine if you need additional coverage.

| Not Covered | Explanation |

|---|---|

| Flooding | Damage from floods (river overflow, storm surge, heavy rainfall) is excluded. Separate flood insurance (NFIP or private) is required. |

| Earthquakes | Most policies exclude earthquake damage. You’ll need an add-on or standalone earthquake insurance policy. |

| Roommate’s Belongings | Only your items are protected. Your roommate must buy their own policy or be added as an insured party. |

| Car-Related Items | Damage to or theft of your vehicle isn’t covered. Auto insurance applies instead, though personal items stolen from your car may be covered. |

| Pest Damage | Damage caused by insects, rodents, or infestations is excluded, since it’s considered a maintenance issue. |

Renters insurance works by providing financial protection for your personal belongings and liability coverage in exchange for a monthly or annual premium. When you purchase a policy, you’re essentially transferring the financial risk of loss to the insurance company. If a covered event occurs - like a fire, theft, or water damage - you’ll file a claim with your insurer, who will then reimburse you for your losses according to your policy terms. Most renters insurance policies cover personal property, liability protection (if someone gets injured in your rental), and additional living expenses if you’re temporarily displaced from your home due to a covered loss.

Replacement cost coverage is a premium option that pays you the full amount needed to replace your damaged or stolen items with new ones of similar quality, without factoring in depreciation. This means if your three-year-old laptop gets stolen, your insurance company will give you enough money to buy a new laptop with similar specifications. While replacement cost coverage typically comes with higher premiums, it offers the most comprehensive protection and ensures you can truly replace what you’ve lost without dipping into your own savings.

Actual cash value (ACV) coverage pays you the replacement cost of your items minus depreciation - essentially what your belongings were worth at the time they were damaged or stolen. Using the laptop example again, if your three-year-old laptop originally cost $1,000 but has depreciated to $400, that’s what you’ll receive from your insurance company under ACV coverage.

According to NerdWallet, the average renter spends about $148 a year, or $12 a month, on renters insurance. The estimates assume a plan with $30,000 of personal property coverage and $100,000 of personal liability coverage, which is a common plan structure. Expect to pay more depending on how much coverage you need.

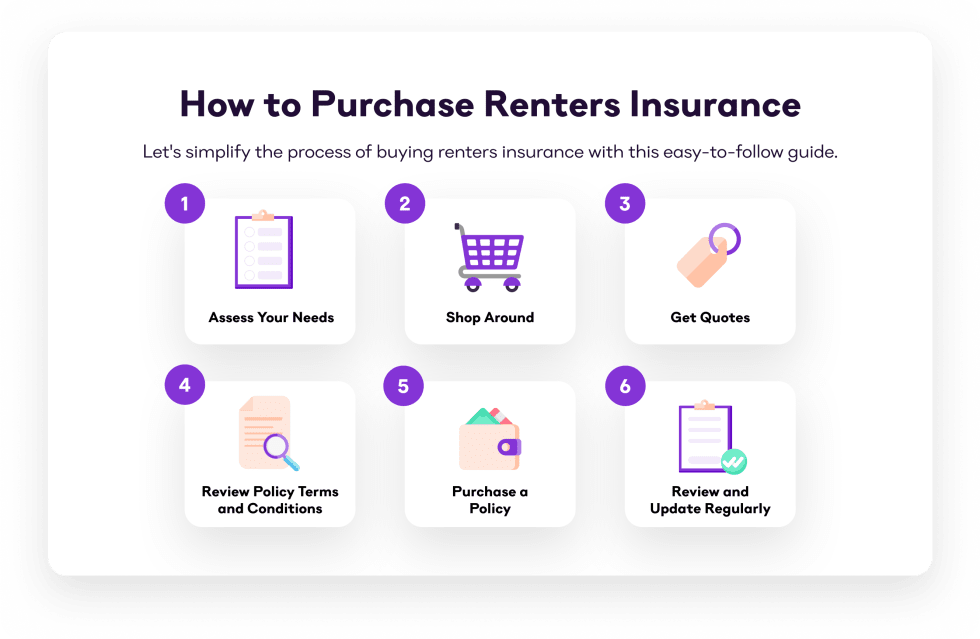

If you’re sold on the idea of buying renters insurance, here’s how to find the right policy for you.

Your landlord is legally required to have insurance on the apartment building, but it might only cover the structure itself and nothing relating to your dwelling. It may also offer little to no coverage for bodily injury or problems like the water that backed up and leaked all over your electronics. Ask for a copy of their policy to assess what type of coverage you need.

As we noted above, a typical policy offers $30,000 of personal property coverage and $100,000 of personal liability coverage. If the total value of your property is greater than $30,000, you should of course purchase more insurance.

There's no need to go with the first renters insurance policy you find. Shop for renters insurance by comparing different companies to see what's covered and what's not. It's also important to pay attention to your deductible and the value of your belongings. The more valuables you have, the more you'll probably pay for a good policy.

Once you've looked at different renters insurance providers and policies, get a free renters insurance quote online or over the phone. An insurance agent can also provide a quote and help walk you through your options. However, if you want a low deductible, you'll pay a higher monthly premium, and vice versa. You can keep a high deductible if you don't have many valuables, but your monthly premium will be lower and could help your budget.

Once you receive your quotes and compare the deductibles against the monthly premiums, carefully review the policy terms and conditions. Make sure you know what your policy covers, from personal property to liability protection, covered perils, exclusions, and any limits to your coverage.

When you're ready to buy renters insurance, it’s time to settle on how often you want to pay for it. You can usually choose to pay your premiums every month, once a quarter, every six months, or annually. Many providers offer a discount if you pay for your insurance six months to a year in advance.

Take time to review and update your renters insurance on a regular basis. How often should you shop around for renters insurance? Aim to review your policy at least once a year or just before it expires. You may be able to get a better deal on more comprehensive coverage from another company in the future.

Getting renters insurance is a simple process, but it requires some diligence to avoid the following common mistakes. Otherwise, you could end up leaving your finances vulnerable.

Many renters fail to purchase the right amount of insurance, leaving themselves open to risk. Having a skimpy policy is almost as bad as having none at all. Here’s a good rule of thumb: If you have a total loss of belongings, make sure you can manage the financial fallout in case your insurance doesn't cover it.

When you get rental insurance, you usually start with the basics and explore additional coverage. You may need additional liability coverage beyond what's offered. For example, if you have a furry friend, you may benefit from pet liability coverage. Look through the additional coverage options available to ensure you have the protection you want for your unique needs.

When you purchase renters insurance, you should investigate all additional coverage and consider your unique needs. Do you live in a high-risk area for flooding or earthquakes? You may need additional coverage relating to natural disasters that are unique to your area.

It's a smart move to ask about available discounts. You may find that bundling together auto insurance and renters insurance could reduce your overall premium. Some companies also offer nonsmokers discounts because it decreases the risk of fire-related accidents and damage.

Adding your landlord to your coverage is the safest move for both parties. In fact, if your landlord requires renters insurance, there's a good chance they also require you to add them to your policy. Your insurance company will have a process specifically for adding a landlord to a renters policy (and it's often something you can do easily online).

Now that you know the ins and outs of how to get rental insurance, it’s time to start looking for your dream apartment. If you live in a competitive rental market, having renters insurance will make you a more desirable tenant and help you negotiate on rent.

Ready to find the perfect rental for you? Sign up with Apartment List and take our personalized quiz to find your next place. With us, you’ll spend 5 minutes and save 50 hours searching.

Sometimes renters insurance is a mandatory part of your lease. But even if it’s not, it’s a smart move to cover yourself completely and enjoy the peace of mind. Renters insurance can cover your belongings and protect your finances in a lawsuit if someone has an accident and damages their belongings or sustains an injury.

Getting renters insurance is fast and usually takes five minutes to a half-hour to get accepted. Most policies will take effect the next day but could take up to three days, depending on their underwriting guidelines. Buying renters insurance online is the fastest way to secure your policy.

No, you don't need a policy before applying for an apartment. However, if a policy is required, you may need to purchase renters insurance after signing your lease before you're allowed to move in.

It's a good idea to shop around for renters insurance once a year to see if you find a better deal with another company. You can usually switch providers pretty easily. You may be able to find a better deal by bundling your renters insurance with your auto insurance policy.

Flood damage from a natural disaster is often excluded from a standard renters insurance policy. However, it usually does cover flood-related losses if a pipe bursts in your apartment and consequently floods. Take the time to review your policy to ensure you understand what type of coverage your policy offers.

Earthquake insurance is usually offered as additional coverage on your renters insurance. It will increase your monthly premium and deductible, but it is vital if you live in an earthquake-prone area such as California.

Buying renters insurance typically doesn’t cover vehicle theft. However, if your car is broken into while sitting in your apartment complex’s parking lot, your renters insurance may cover the theft of the personal belongings inside your car. You'll need a separate auto insurance policy to cover the actual theft of your car.

Yes, most renters insurance policies cover personal belongings stored in off-site storage units, typically up to 10% of your personal property coverage limit. However, you should verify this coverage with your specific policy and consider whether you need additional protection for high-value items

Renters insurance covers hurricane damage to your personal belongings from wind and rain, but it typically excludes flood damage. Your policy may also include temporary if your home is damaged and it’s unsafe to live in it. If you live in a hurricane-prone area, it’s recommended to get separate flood insurance through the National Flood Insurance Program (NFIP) or your insurer to cover losses.

Renters insurance doesn’t cover veterinary bills or pet injuries, but it does provide liability coverage if your pet injures someone else or damages their property. Some policies may exclude certain dog breeds, so make sure to check the fine print.

Yes, renters insurance typically covers dog bite liability, including medical expenses and legal fees if your dog bites someone. However, some insurers exclude certain breeds or may cancel your policy after a bite incident, so it’s important to review your specific coverage.

Renters insurance covers mold damage only if it results from a sudden, covered peril like a burst pipe, but it excludes mold caused by long-term moisture issues or neglect. Most policies have limited coverage amounts specifically for mold remediation.

Yes, fire damage is one of the most commonly covered perils in renters insurance policies, protecting your personal belongings if they’re damaged or destroyed by fire or smoke. This includes fires caused by cooking accidents, electrical issues, or neighboring properties.

Yes, renters insurance includes “additional living expenses” coverage that pays for temporary housing, meals, and other costs if you’re displaced from your rental due to a covered loss. This coverage typically has both dollar limits and time restrictions.

Yes, renters insurance covers bicycle theft as part of your personal property coverage, whether the bike is stolen from your home, car, or elsewhere. However, expensive bikes may exceed sublimits for certain categories, so you might need additional coverage for high-end bicycles.

Renters insurance covers your personal appliances (like microwaves, coffee makers, or portable air conditioners) but typically doesn’t cover appliances that belong to your landlord, such as built-in dishwashers or refrigerators.

No, renters insurance only covers the policyholder and their immediate family members living in the same household. Each roommate needs their own separate renters insurance policy to protect their personal belongings and liability.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more