- 44 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

To rent an apartment in 2025, you’ll typically need proof of income (pay stubs or bank statements), rental history, an offer letter, a government-issued photo ID, proof of renters’ insurance, references, your Social Security number, a credit report, and (if required) a cosigner or guarantor agreement. Landlords and property managers use these documents to confirm your financial stability, rental background, and identity before approving your lease.

Below, we’ll walk through each document, why it matters, and tips to help you prepare so you can secure your next apartment quickly.

A landlord needs proof that you're financially covered to make rent every month. It's not enough to just think you can swing it; they want to see that your income is stable and realistic.

What's realistic when it comes to rental payments? The rule of thumb is that your rent should be no more than 30% of your gross monthly income. If your potential rent costs $1,000 a month, landlords prefer that your income is at least $3,000 a month. However, there are exceptions in expensive cities like New York and San Francisco. (You can also use a rent calculator to determine how much rent you can afford).

Bring along at least two pay stubs to show your income stability. You should also review your apartment application carefully before submitting it to ensure you have written down the correct amount.

If you don't have pay stubs readily available, bank statements can help provide proof of income. Bring along at least two months' worth of bank statements to show your landlord that your finances are stable. Make it easy on your landlord by clearly highlighting any paychecks or other income sources, so they don’t have to review everything. They'll appreciate the extra effort, and it will make the process smoother.

Cities with a competitive market landscape sometimes require both pay stubs and bank statements. It's always better to come over-prepared when signing your next apartment lease.

Apartment applications will have a section where you can provide information about your rental history. You’ll provide information such as your previous landlords contact information, past addresses, start and end dates of leases, and why you moved.

If you have no rental history or a past eviction there are documents and information you can provide to hopefully secure a new rental unit.

Providing a job offer letter is a simple way to show landlords why you’re moving, and why you want to live in their apartment. They’re particularly helpful when you don't have pay stubs or bank statements yet.

Your new job can supply this information on a document with company letterhead. Showing your bank statements is still helpful in proving your past income stability and offer your landlord and property managers greater peace of mind.

Before you sign a lease for an apartment, you'll need to bring along a document verifying your identity. A driver's license, passport, or other valid identification is sufficient.

These days, many apartments require you to hold renters' insurance, which usually includes coverage for yourself and your property in the case of an unexpected event.

If that's the case, you will likely be asked to show proof of insurance on the day you sign your lease. Landlords often have an insurer that they work with or can recommend, or you can shop for one on your own.

Providing your Social Security number is part of the process when signing a lease. Of course, you might feel nervous about handing it out. We all know these nine digits should be protected from wandering eyes. However, landlords and property managers need a Social Security number to run a background or a credit check on you.

If you provide your own credit report, you may be able to complete the process without disclosing your Social Security number. In situations where it’s unavoidable, ask for any documents with your digits back and shred them.

Your credit report offers valuable insights into your financial past. Your landlord may request a fee to run a background check and credit report, or you may be asked to supply your own.

Regardless of whether you're responsible for handing over a report, you should still check it to know what to expect. Your credit report can be pulled for free from the three major credit bureaus.

Previous landlord recommendations can go a long way in securing your next apartment. Bring a list of prior residences and recommendations from your landlords whenever possible.

Although landlords run background screenings of your rental history, having recommendations in hand puts you ahead of the rental competition.

If it's your first time renting or you live in a competitive rental market, personal references are helpful, as they can speak to your character and reliability.

Make sure you're collecting quality references. Asking your buddies to write a reference letter isn't the best practice. Instead, focus on references from previous work colleagues, previous landlords, property managers, and job or volunteer supervisors.

Even with all the paperwork you gather, landlords sometimes request additional documentation.

It's smart to add extra documentation to your folder, in case they want more. Here’s what some landlords may ask for:

It's more common for landlords to request additional documentation in a hot rental market or in areas with high demand and low rental inventory.

A lease guarantor or co-signer can be an essential part of the apartment signing process if you don't earn enough to meet the landlord's requirements, have bad credit, or have gone through an eviction.

Lease guarantors and co-signers promise your rent if you are unable to pay. Because they're also financially responsible, they will need them to provide the same paperwork as you.

Securing an apartment takes some preparation, but it doesn’t need to be overwhelming. Always show up with all the required documents and any additional items you can think of that make it a smooth signing process.

Take Apartment List's easy quiz to get matches for your apartments in ideal locations with ideal amenities in your price range.

If you’re ready to rent an apartment, you’ll need a document folder with pay stubs or bank statements, rental history, offer letter, official photo ID, proof of renters' insurance, references, Social Security number, credit report, landlord or other references, and a cosigner or guarantor agreement (if necessary).

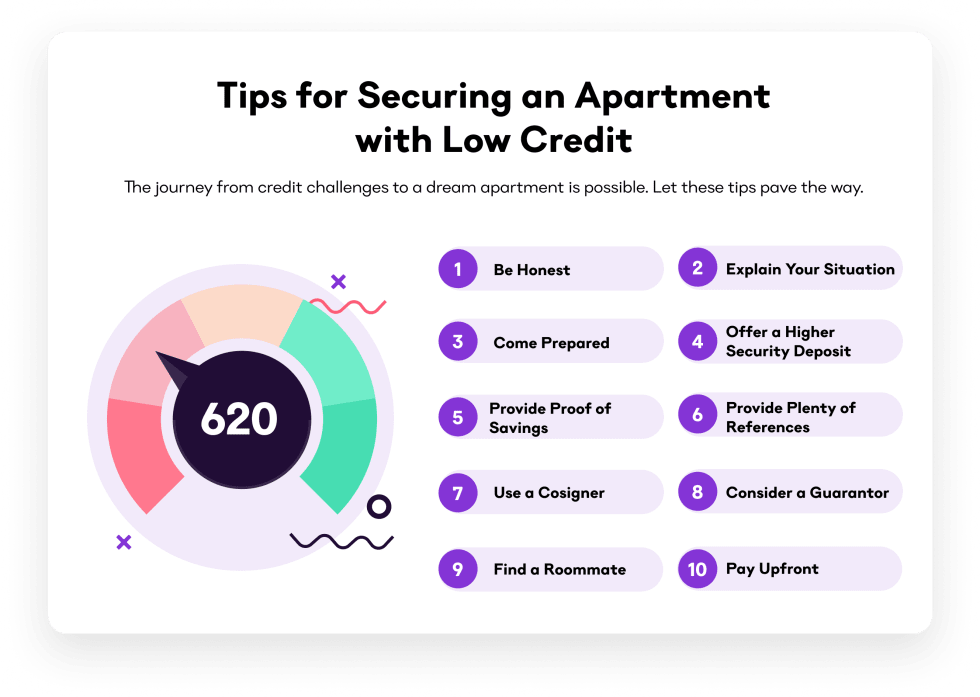

The average credit score for renters in the United States in 2020 was 638. Typically, renters need a credit score of at least 600 to 650 to qualify for an apartment. The average credit score for renters also varies based on location and building type.

Having all your documents prepared in advance means you can apply for an apartment on the spot. Sometimes a new apartment has a lot of interest, and the sooner you are able to apply for an application and commit to a lease, the more likely you are to be approved.

If you've never rented before, be upfront about it with your prospective landlord. First-time renters are required to provide the same documents as other tenants. At a minimum, you should bring:

When applying with one or more roommates, each of you brings the set of documents outlined in the article. Income and credit history for all roommates will be taken into consideration by your prospective landlord in determining whether you meet the minimum income threshold for renting.

Landlords require bank statements to assess a potential tenant's financial stability. This information helps them determine if you can afford the monthly rent and other associated costs:

By reviewing your bank statements, landlords can make a more informed decision about whether you're a suitable tenant.

No, generally, landlords can’t directly check your bank balance. While they can request bank statements to verify income and financial stability, they don't have the legal authority to access your account information in real-time.

To protect your sensitive financial information while still providing the necessary details for your landlord, you should black out the following on your bank statement:

Blacking out this information allows you to retain your financial privacy while still providing the landlord with the necessary proof of income and financial stability.

After submitting an application it can take between 24 hours and a week or more to get approved. Applications with all necessary documents can be approved in as little as one to three days, while those with more complicated or missing documents may take up to a week.

Most landlords have a screening process to find good tenants. They check things like credit history, background check, rental history, and income verification.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more