Apartment List's 2023 Millennial Homeownership Report

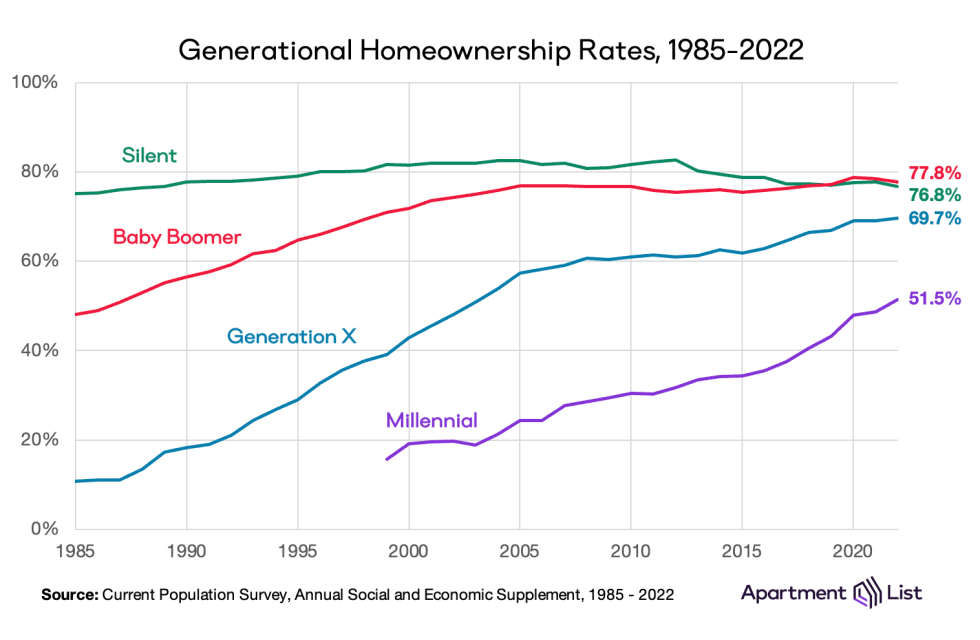

According to the latest data from the Census Bureau, millennials have finally reached a significant milestone: more than half own their homes. For a generation whose identity has been shaped by a tumultuous relationship with the housing market, homeownership has been a lofty goal, growing exceedingly expensive and competitive compared to when their parents were coming of age. But today the median millennial is a homeowner, with the latest millennial homeownership rate standing at 51.5 percent.

Older generations, unsurprisingly, have higher homeownership rates today.1 While millennials crossed the 50-percent threshold in 2022, generation X is on the cusp of reaching 70 percent. 77 percent of the silent generation owns their homes, but their homeownership rate is slowly declining as they age into their 80s and 90s and some members move in with younger relatives or into assisted living facilities. Baby boomers, born into the suburbs that emerged rapidly after World War II, maintain the nation’s highest homeownership rate today at 78 percent.

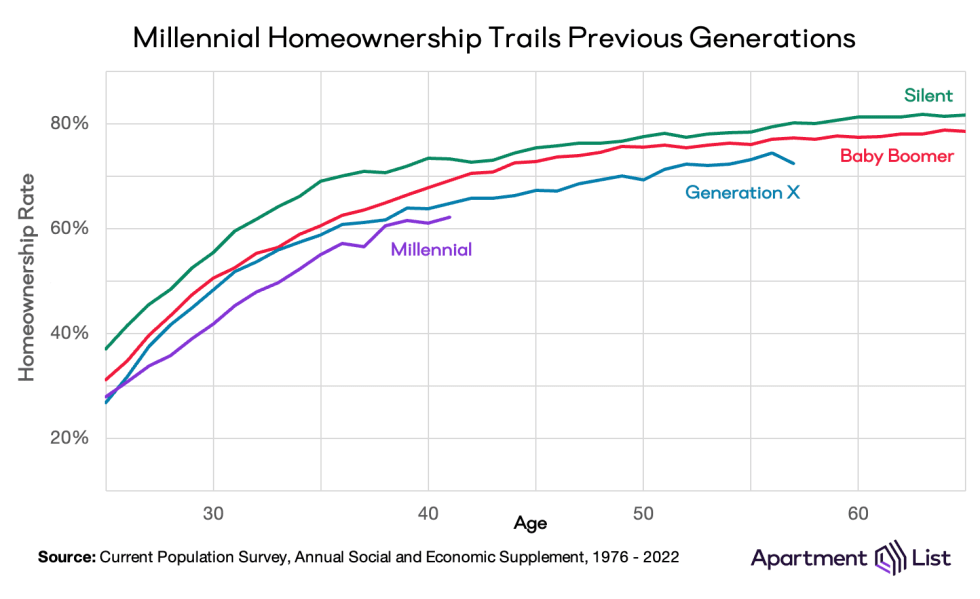

Millennials have reached 50 percent homeownership slower than previous generations

A more apples-to-apples comparison of the generational divides in homeownership can be made by controlling for age. The chart below shows that at each stage of life, the last three generations have bought homes slower than the generation that preceded them. Millennials have had the slowest transition from renters to homeowners. By age 30, 42 percent of millennials owned their homes, compared to 48 percent of gen Xers, 51 percent of baby boomers, and nearly 60 percent of silents. That gap persists through their 30s and into their early 40s.

A handful of economic and cultural factors explain these generational gaps. The most significant was the Great Recession, which suppressed homeownership across all generations but was particularly damaging to millennials, whose early career trajectories were shaped by a historically unstable economy. During the economic recovery that followed, many millennials were drawn to centrally-located jobs in cities where starter homes became increasingly scarce and expensive. While many millennials purchased homes during these years, others spent more time living at home or in rentals, delaying major life events like homeownership, marriage, and childbearing when compared to earlier generations.

In 2020, the COVID-19 pandemic drove an even deeper wedge between millennial homeowners and millennial renters. On one hand, millennials purchased an outsized share of homes during the first two years of the pandemic, when mortgage rates fell below 3 percent. On the other hand, housing inventory dropped to all-time lows and for-sale prices skyrocketed more than 40 percent. For millennial renters who could not afford to buy a home in the earliest stages of the pandemic, homeownership opportunities waned dramatically in the years that followed. Mortgage rates spiked, bringing modest relief to list prices but pushing monthly ownership costs even higher.

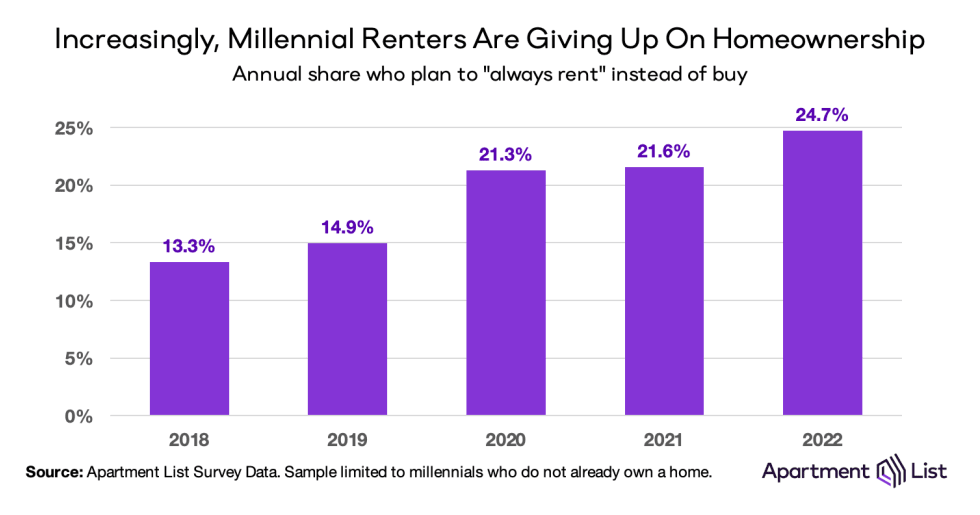

Millennial renters, now the minority, are increasingly left behind

What has resulted is a starkly bifurcated generation where more than half of millennials have achieved homeownership and the remaining renters are finding it increasingly out of reach. The Apartment List Renter Survey has been running continuously since 2018, collecting data on millennials’ plans and perceptions of homeownership. Over time, millennial renters have become more likely to say they will rent forever, almost doubling from from 13 percent in 2010 to 24 percent in 2022. The large jump in “forever renters” between 2019 and 2020 shows the immediate impact of the pandemic, when an already-challenging housing market reached a new level of unaffordability.

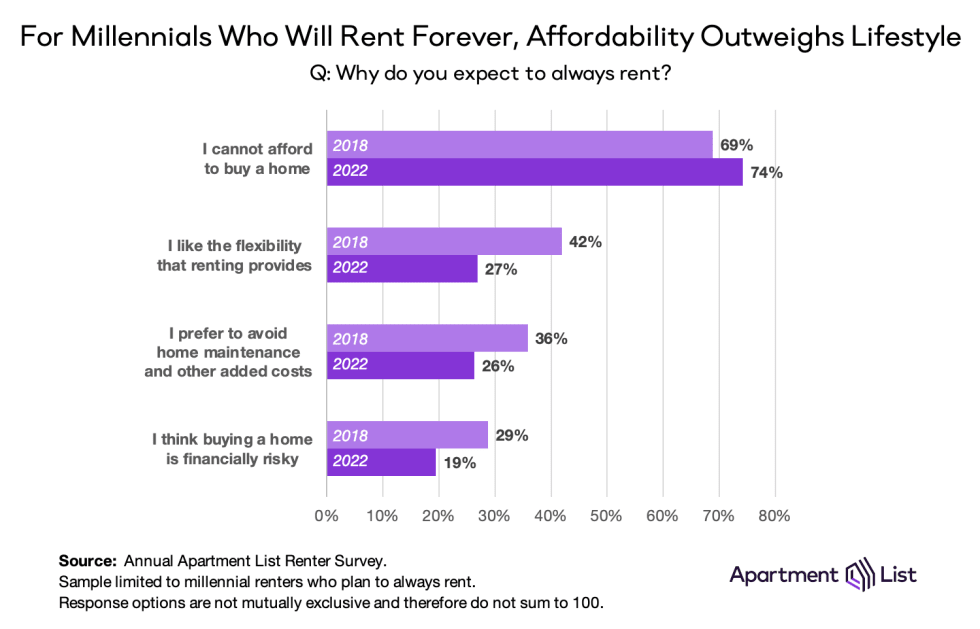

There is of course a selection effect at play; the cohort of millennial renters is shrinking and aging every year. So while affordability has consistently been the number one reason these millennials plan to rent forever, the lifestyle benefits of renting have become less of a factor. The share telling us they will rent forever because they expect to never be able to afford homeownership has increased from 69 to 74 percent over the past five years. Meanwhile, the share wishing to avoid homeowner costs or financial risk have fallen steadily. A flexible lifestyle, one of the main draws of renting instead of owning, is also becoming less of a factor as millennials get older.

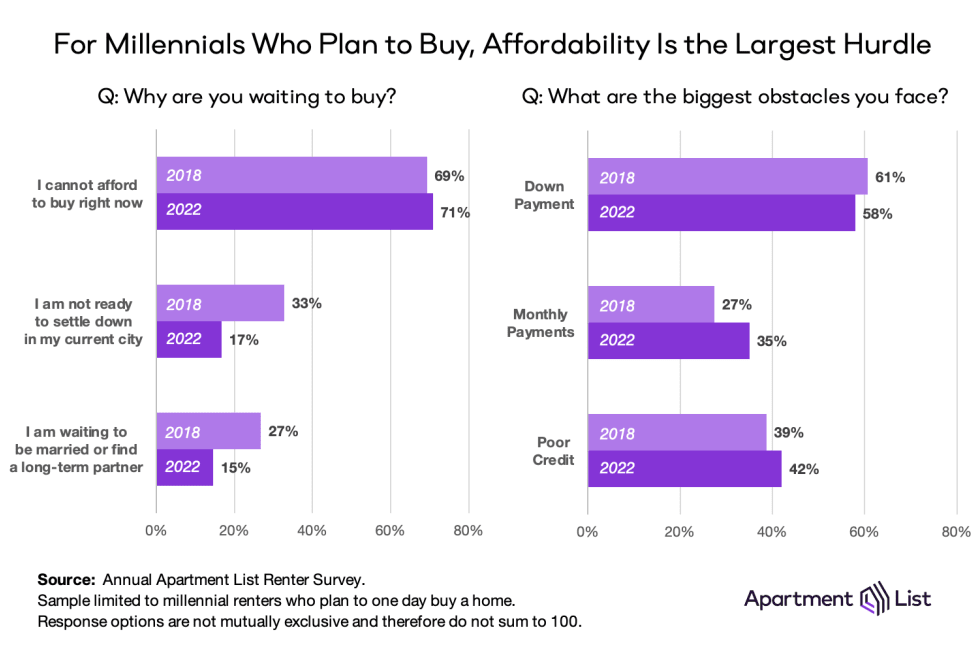

The same trends are playing out in the other group of millennial renters: the 76 percent who still plan to buy a home even as the affordability crisis worsens. 71 percent say affordability is causing them to wait, while fewer are waiting to settle down in their current city or with a long-term partner. Over the course of the pandemic, as interest rates have spiked to their highest levels in a generation, millennials’ financial concerns are shifting somewhat from down payments to monthly payments and credit scores.

Despite the fact that over three-quarters of today’s millennial renters plan to buy a home in the future, many are still a long way from realizing their goal. As list prices soar, our survey finds that two-thirds of aspiring homebuyers have no dedicated down payment savings, and only 15 percent have saved over $10,000.

Where have millennials found success in the housing market?

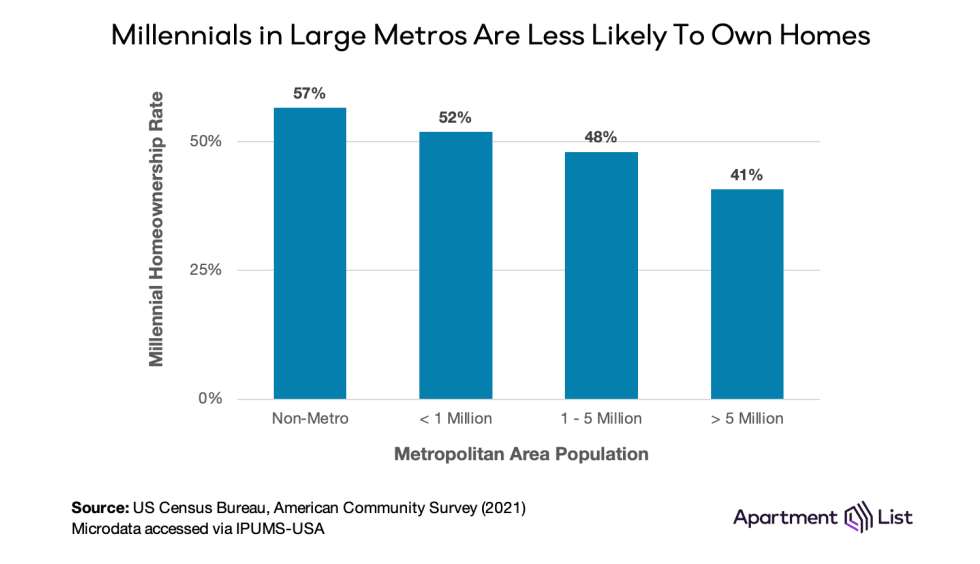

One of the defining features of the pandemic housing market was a migratory shift away from dense, expensive cities and towards smaller, more-affordable ones. Facilitated by a number of diverse but interconnected factors that emerged in 2020 – high unemployment, greater remote work opportunities, a temporary pause in urban vibrancy, a desire for more physical space – this migration put tremendous strain on the housing supply in smaller markets and fueled rapid rent growth. It also served as an opportunity for many millennials to buy homes. Today, we find that millennials living in non-metropolitan areas and smaller markets with fewer than one million residents are the most likely to be homeowners. In metros with 1 to 5 million residents, homeownership falls to 48 percent, and across the nation’s largest metros it falls to 41 percent.

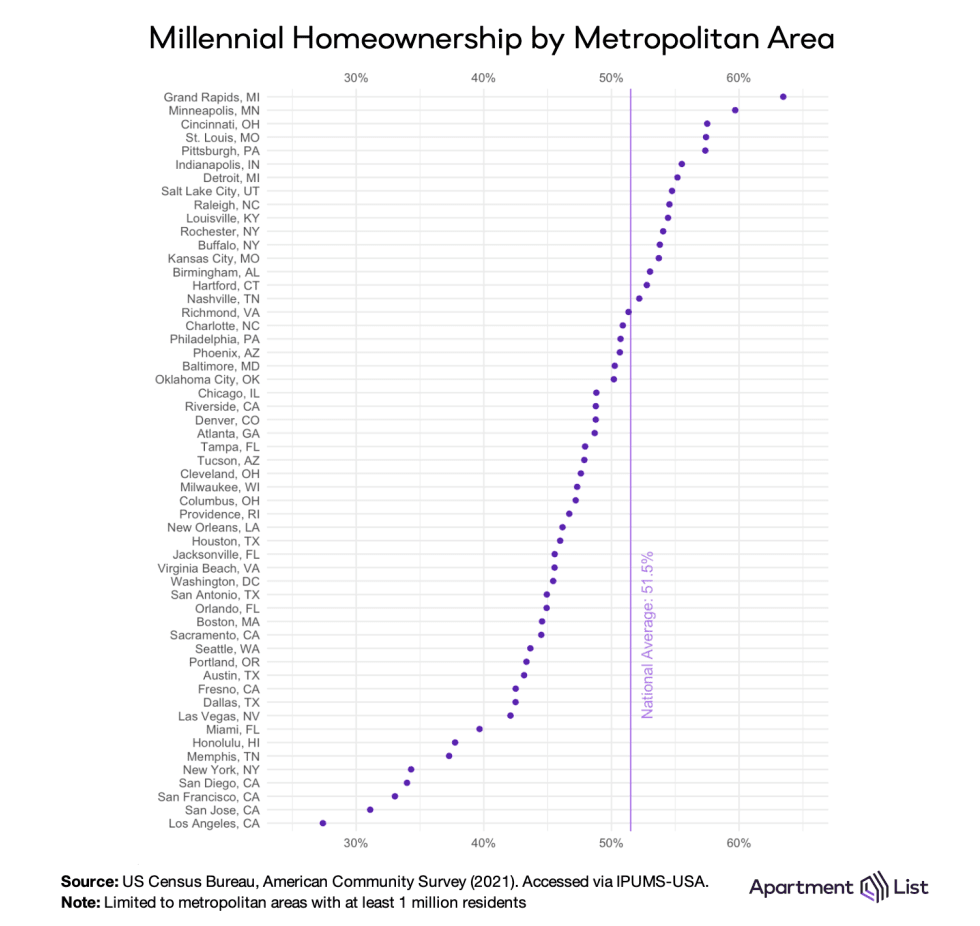

In fact, only a handful of the nation’s large metropolitan areas have a millennial homeownership rate above the national average of 51.5%. The chart below displays 56 metros with a population of one million or greater. Led by the Grand Rapids, MI metro, where 63 percent of millennials own their homes, the markets with the highest rates are concentrated in the Midwest and Great Lakes regions, which offered some of the country’s lowest cost of living and highest residential vacancy rates (at least before the pandemic shook up the housing market).

It should come as no surprise that expensive coastal markets dominate the other end of the list. California is home to the four metros with the lowest millennial homeownership rates: Los Angeles (27 percent), San Jose (31 percent), San Francisco (33 percent) and San Diego (34 percent). The New York City metro comes in fifth, also at 34 percent. Notoriously pricey coastal markets like Miami, Portland, Seattle, and Boston, also find themselves towards the bottom of the list. Despite offering relatively high incomes, these regions remain unaffordable to a majority of millennials.

Conclusion

As millennials slowly find their footing in the housing market, the homeownership challenges that have emerged over the past decade are now falling squarely on the shoulders of the next generation, Z. Currently ages 25 and younger, the majority of gen Z renters have never known a healthy housing market, and in our renter survey already 20 percent describe themselves as “forever renters.” A recent softening in home prices is providing some relief, but it is also discouraging existing homes from being listed for sale, and discouraging new single-family homes from being developed, so it is likely a persistent supply shortage will keep prices from falling to widely-affordable levels.

This highlights the growing importance of multi-family housing, the industry sector that rebounded fastest after the Great Recession and has continued to receive steady investment over the past year even as rising interest rates tempered single-family development. The record number of new multi-family units currently under construction are expected to bring some relief to the rental side of the housing market this year and beyond. Historically, the vast majority of these units have been built for rent, but as YIMBY-backed zoning reforms and densification slowly gains traction, we may see more of them built for sale in the years ahead. It is possible that if attitudes towards homeownership shift to de-emphasize single-family homes, multi-family could provide an alternate path to homeownership as gen Z reaches their homebuying years.

- A generation's homeownership rate is defined as the share of households headed by a member of that generation that are owner-occupied. Generations are assigned according to birth year. Millennial: 1981-1996, Generation X: 1965-1980, Baby Boomer: 1946-1964, Silent: 1928-1945.↩

Share this Article