How Does Gen Z Feel About Homeownership?

Overview

- 87 percent of Gen Z respondents to our survey view homeownership as being at least somewhat important, similar to the rate for millennials. However, the share who consider homeownership to be “extremely important” is notably lower for Gen Z (26 percent vs 35 percent of young millennials).

- 77 percent of Gen Z view homeownership as being “at least somewhat attainable” within the next 10 years. However, Just 13 percent think that homeownership is “extremely attainable,” significantly lower than the shares for young millennials (21 percent) and older millennials (23 percent).

- When combining views of importance and attainability, we find that just 9 percent of Gen Z view homeownership as both “extremely important” and “extremely attainable.” This is significantly less than the comparable rates for young millennials (16 percent) and older millennials (17 percent).

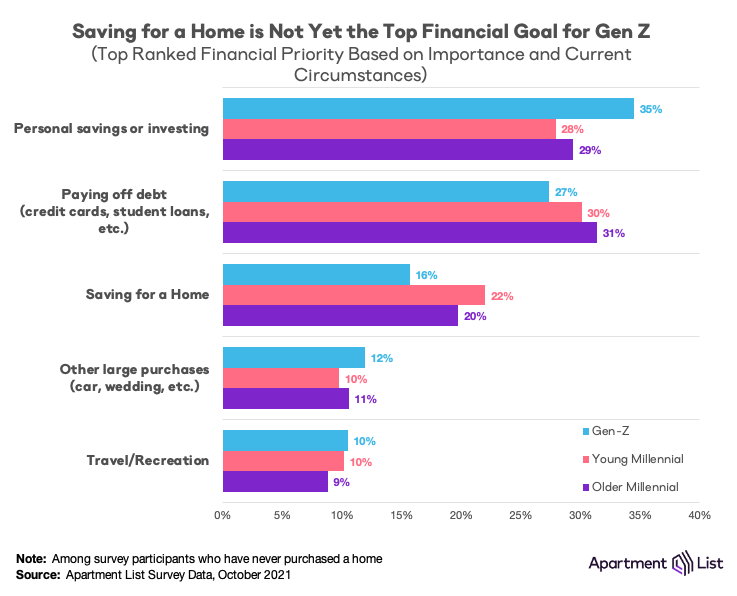

- Despite a generally positive outlook on homeownership, it’s not a goal that many Gen Z renters are actively working toward. Just 16 percent say that it’s currently their top financial priority, well below the shares that are prioritizing personal savings and investments (35 percent) and paying down debt (27 percent).

- 56 percent of Gen Z respondents say that they expect help from family with a future down payment. Among those with high confidence of down payment assistance, over 56 percent feel that homeownership is extremely attainable, but for those who do not expect any assistance, just 17 percent consider homeownership extremely attainable.

- Remote work is likely to shape future housing choices for Gen Z, but among Gen Z respondents, just 17 percent view remote work as an extremely desirable working arrangement, compared to nearly one-third of millennials.

- 30 percent of Gen Z state that being in an affordable housing market where home ownership is financially attainable is the most important factor determining where they would like to live in the future.

Intro

Although for-sale homes remain in high demand, the homeownership rate in the United States has been gradually declining for generations. Despite being in their prime homebuying years, a growing pool of millennials are continuing to rent, sidelined from the for-sale market by a lack of affordability. Will Gen Z follow suit? Comparisons of Gen Z and millennials tend to focus on their differences, but both generations have been shaped by the experience of entering adulthood amid a turbulent housing market. For millennials, it was the foreclosure crisis that triggered a global recession in 2008; for Gen Z it is the affordability crisis following the COVID-19 pandemic in 2020. Gen Z may also be the first generation to start their careers in an economy where remote work is widespread, with potentially significant implications for where they choose to live. Gen Z’s housing choices in the coming years will have a significant impact on the broader economy, so our team conducted a survey to get an early read on whether or not Gen Z will deviate from millennials in terms of their attitudes towards homeownership and their preferences about where they live and work.1

Gen Z still values homeownership, but with more ambivalence

Much has been made of how Gen Z is upending workplace norms, but when it comes to the housing market, Gen Z’s values aren’t so divergent from previous generations. 87 percent of Gen Z renters who took our survey say that it is at least somewhat important for them to one day own a home, which is nearly identical to the 88 percent rate for millennial renters. But we find Gen Z to be a bit more ambivalent about homeownership when we break down their responses into more detailed categories. Just 26 percent view owning a home as “extremely important,” compared to 35 percent of younger millennials and similarly 34 percent of older millennials.

And despite a historically tight for-sale market with skyrocketing prices, we find that Gen Z is surprisingly optimistic about their ability to actually achieve the goal of homeownership. 77 percent of Gen Z renters say that they consider homeownership at least somewhat attainable within the next ten years. While lower than the share who view homeownership as important, these views on attainability are again generally in line with those of the millennial renters who took our survey. Here too though, the more granular breakdowns show that Gen Z is somewhat less confident than their millennial counterparts. Just 13 percent of Gen Z consider homeownership to be “extremely attainable” over the next decade, compared to 21 percent of millennials. It’s also worth noting that the share who view homeownership as at least somewhat attainable (77 percent) is significantly higher than the actual homeownership rate (65 percent), implying that some of our survey takers are likely being overly optimistic with respect to their future housing prospects.

When we compare these two sentiments -- the perceived importance of homeownership versus the practical attainability of it -- we find a strong correlation between the two. Those who view homeownership as financially attainable are also those who consider it most important. But at the intersection of the two is where we also find the greatest divergence between generations. Just 9 percent of Gen Z renters said that owning a home is both “extremely important” and “extremely attainable,” compared to 16 percent of millennials. So while homeownership continues to be held in high regard by young adults, skyrocketing prices and the financial realities of homeownership are having an effect on Gen Z optimism.

Homeownership is not yet a top financial priority for Gen Z

While most of Gen Z still consider homeownership a goal worth working towards, few of them are currently making saving for a home a top priority. We asked survey takers to rank a series of financial goals, and 35 percent of Gen Z said “personal savings and investing” was their top priority, compared to just 16 percent who are prioritizing “saving for a home.” Paying down debt fell between the two, with 27 percent of Gen Z prioritizing credit cards, student loans, and the like. While it has been reported that young adults tend to value experiences over possessions, just 10 percent of Gen Z respondents listed travel and recreation as their top financial priority.

The share of Gen Z renters prioritizing down payment savings (16 percent) is notably lower than the comparable shares among millennials young and old (22 percent and 20 percent, respectively). Some of this differential is likely driven by the fact that Gen Z are younger, and may not yet be at the stage of life where purchasing a home is an immediate or feasible goal. Gen Z are also earlier in their careers, and likely have less disposable income to put towards home savings than millennials. That said, Gen Z respondents were actually significantly more likely to prioritize personal savings or investing, and slightly less likely to prioritize paying down debt, compared to millennials. The data also highlight the pervasive burden of consumer debt among young Americans, as nearly one-third of our entire sample ranked debt as their top financial priority.

For prospective Gen Z homeowners, family assistance is critical

In light of skyrocketing homeownership costs, an increasing share of young homebuyers are relying on financial support from family to afford their down payments. According to our survey, the majority of Gen Z renters (57 percent) think that they are at least somewhat likely to receive this assistance, slightly higher than millennial renters (51 percent). These expectations may be slightly optimistic, given that among millennials who already own homes, only 44 percent say they received help from family with their home down payment.

But in either case, the survey highlights the growing importance of generational wealth in homeownership, as home prices continue to rise significantly faster than incomes and fewer first-time homebuyers can afford the up-front costs on their own. This dynamic becomes particularly clear when we look at Gen Z renters who are most confident about receiving (or not receiving) financial support. Among those who believe family assistance is “extremely likely,” 56 percent say homeownership is “extremely attainable.” By contrast, among those who say that financial support is “not at all likely,” just 17 percent consider the prospect of homeownership “extremely attainable.” Given that homeownership is still the primary vehicle for wealth creation for most Americans, the lack of attainability among those from lower-income backgrounds leads to persistent intergenerational wealth gaps. This finding also has important implications for racial equity -- given existing wealth gaps, the typical minority family has less ability to offer financial assistance to their children than the typical white family.

In the workplace, Gen Z is somewhat hesitant about the remote revolution

One thing that sets Gen Z apart from older generations is that the widespread adoption of remote work has coincided with the beginning stages of their careers. Since the start of the COVID-19 pandemic, remote work is no longer restricted to entrepreneurial freelancers or intrepid “digital nomads.” Good-paying remote jobs are coming online across industries and have grown steadily more popular for more than a year and a half, with many companies planning for remote options to outlast the pandemic. As more people sever ties between where they work and where they live, this remote revolution could have major impacts on the housing market, and this change is occurring before many members of Gen Z have set down roots.

However, our survey indicates that Gen Z is actually less enthusiastic about remote work than their millennial counterparts. Among currently employed non-students, remote work is less common among the younger generation (53 percent of Gen Z respondents are currently working remotely versus 58 percent of millennials), although this may simply reflect the fact that younger members of Gen Z are more likely to work in service occupations, for example. More telling is that Gen Z simply seems to have less of a preference for remote work. Among members of the labor force (non-students who are working or unemployed and looking for work), only 17 percent of Gen Z consider remote work “extremely desirable,” compared to 31 percent of younger millennials and 33 percent of older millennials. It may be that for young people in the early stages of their careers, the social aspects of in-person work have greater importance than they do for those whose careers are already more established. And for the members of Gen Z who have had their college years marked by the pandemic, the drawbacks of doing things virtually may be particularly front-of-mind.

It is possible that the perceived benefits of remote work are simply more valuable in later stages of life. Today, millennials are more likely than Gen Z to be preparing for homeownership, starting families, or experiencing burnout, all things that would drive someone to want to spend less time commuting or living in expensive, close-to-work neighborhoods. Particularly for those who are looking to buy homes, remote work has the benefit of expanding the range of viable options, which can often mean access to more affordable markets.

Even though Gen Z is less bullish on remote work, housing affordability is still very much top-of-mind. When asked to rank the most important factors in considering where to live in the future, the most popular answer for Gen Z was “access to a housing market where I can afford to buy a home.” But while remote workers have greater flexibility to seek out affordable housing markets, it is on-site workers who are most concerned about cost (34 percent of on-site workers rank affordability as their top factor, compared to 26 percent of remote workers). Gen Z may be less likely to be prioritizing homeownership currently, but it is nonetheless a goal that is already shaping their plans for the future.

Beyond affordability, we also found that Gen Z are more likely than millennials to prioritize proximity to work (22 percent versus 19 percent of millennials) and less interest in living closer to nature (14 percent versus 17 percent of millennials). Separately, we found that Gen Z is more open to living in denser urban communities, with 35 percent of Gen Z preferring multi-family apartments for their future home compared to just 22 percent of Millennials, who overwhelmingly favor single-family homes.

Conclusion

Knowing that homeownership remains an important financial goal for most of Gen Z, it is possible that with time they will age into a profile that more closely resembles millennials today. That is, they may shift their financial goals away from savings and towards homeownership, and shift their work and lifestyle preferences towards more flexible arrangements that provide greater homeownership opportunities. But at the same time, worsening affordability is continuing to put homeownership further out of reach for middle- and low-income families who are unable to relocate to the low-cost parts of the country that remain. Over the next decade we will see if Gen Z’s optimism about the housing market comes to fruition as they establish careers and begin laying down roots.

- Our survey was distributed to adults aged 18-40 between October 14-16, 2021. In total, over 8,000 responses were collected and age- and gender-balanced according to the US Census distributions. Surveytakers were categorized into three generational groups of roughly equal size: generation Z (born 1997 or later), younger millennial (born 1989-1996), and older millennial (born 1981-1988). These definitions are consistent with those used by the Pew Research Center.↩

Share this Article