2019 Millennial Homeownership Report: More Millennials Are Preparing For A Life of Renting

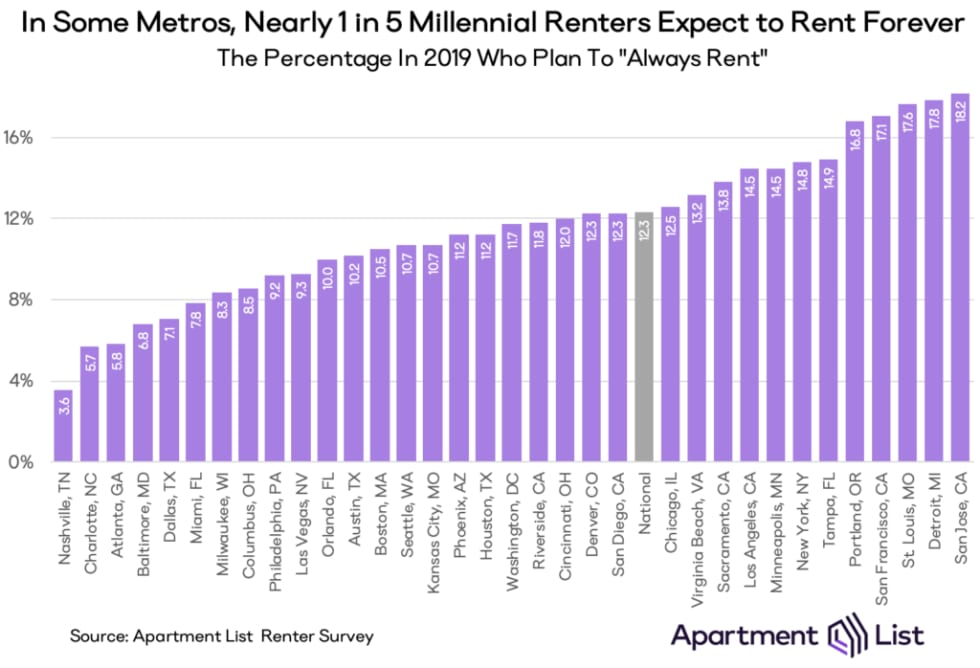

- Nationally, 12.3 percent of millennial renters say they plan to “always rent,” up from 10.7 percent just one year ago.

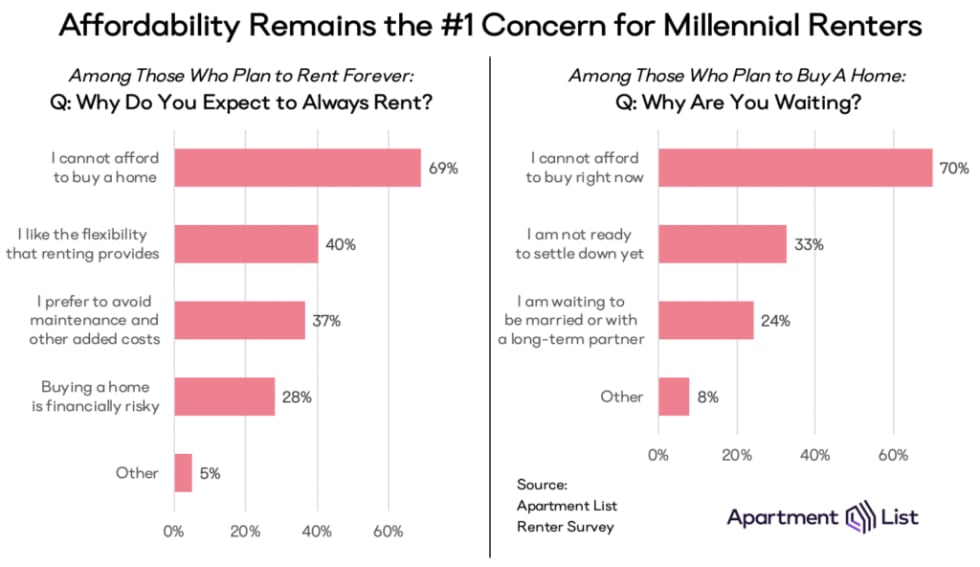

- Some millennials recognize the potential lifestyle and financial benefits of renting, but for the most part, the single biggest factor is a lack of affordability in the rental market.

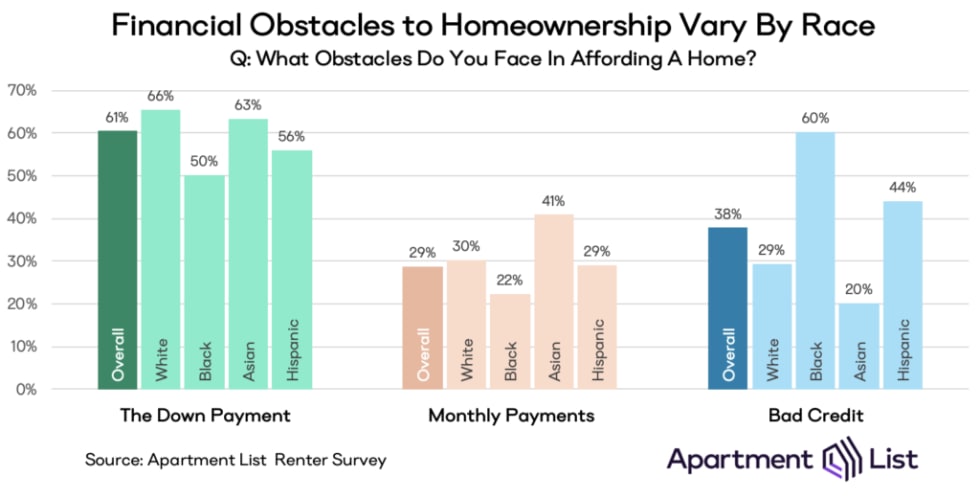

- The down payment is, for many, the largest expense and biggest financial obstacle to homeownership. But some groups—particularly minority black and hispanic millennials—say that bad credit is a greater barrier.

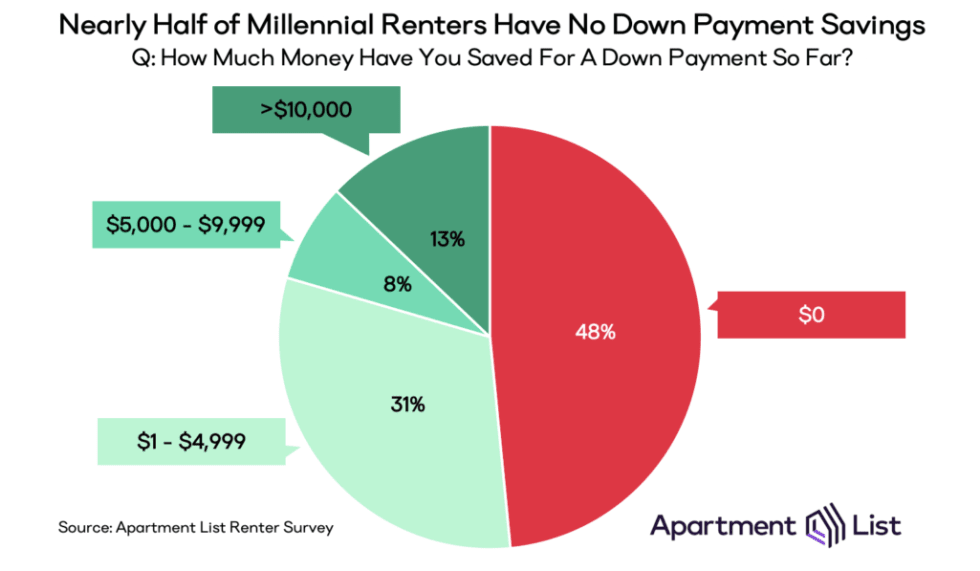

- Despite the overwhelming support for homeownership, nearly half of millennial renters have no down payment savings. Some are expecting financial support from their families, but compared to last year, that level of support is declining.

- Student debt remains another major barrier to homeownership. Debt-free millennials are saving roughly $100 more each month compared to those who are still paying off college loans. When it comes to saving for a home, there is a wider gap between those with and without student debt than between those with and without a college degree.

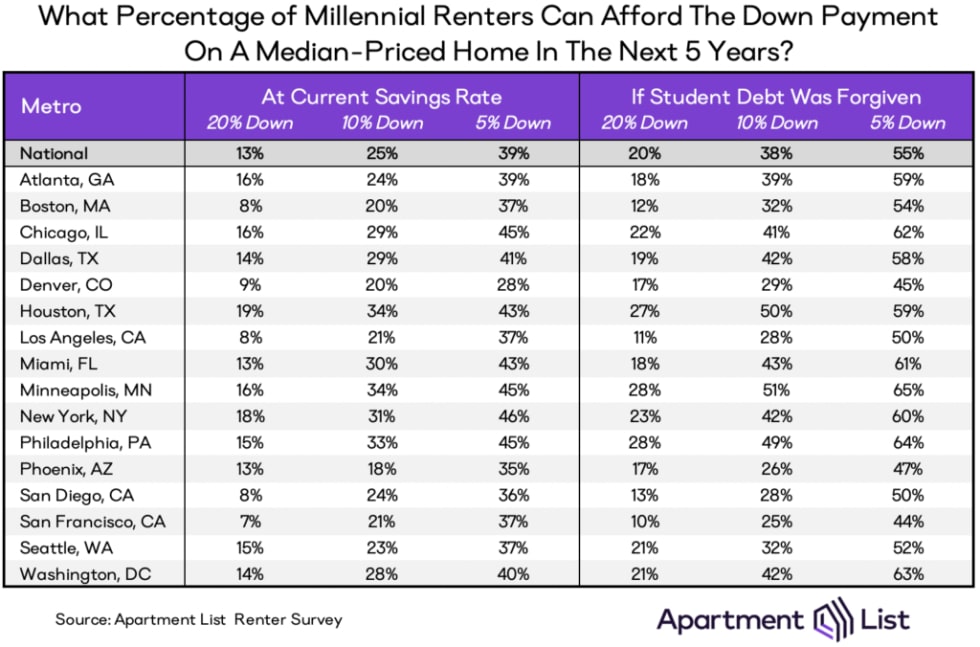

- We estimate that at current savings rates, only 25 percent of millennial renters will be able to afford a 10 percent down payment on a median-priced home in the next 5 years. If student debt obligations were dismissed, this would improve to 38 percent nationally, and more than 50 percent in some metropolitan areas like Minneapolis and Houston.

Introduction: Millennials & Housing

Millennials have a uniquely frustrating relationship with the housing market. When baby boomers and gen X hit their thirtieth birthdays, rapid construction and suburbanization were proliferating relatively affordable housing options. For most of the 20th century, purchasing a home was central to the American Dream. But millennials came of age in a very different climate. As young adults, the economy was characterized by the collapse of the housing market, quick growth in the cost of housing, and worsening income inequality. By the time millennials were old enough to want to buy a home, many were skeptical they could afford to do so. This economic uncertainty—characterized by relatively low homeownership rates, delayed marriages, and smaller families—has become a central tenet of the millennial identity.

The vast majority of millennials want to own a home, but millennial homeownership rates have significantly lagged previous generations. To better understand this discrepancy, Apartment List has been surveying millennials for the past five years (see our previous reports on the subject here and here).1 In our survey, we ask renters to describe their homeownership goals and the tangible factors influencing their ability to purchase their first home. This year we received responses from over 10,000 millennial renters across America. Several notable themes emerged. The share of millennials who plan to rent forever is on the rise. Even among those who expect to purchase a home in the future, nearly half have saved nothing for a down payment. Affordability concerns appear to overpower lifestyle preferences. And the enduring effects of student loan debt and a decline in family support are keeping homeownership out of reach for many millennial renters.

The majority of millennials still want to own a home, but the percentage is shrinking

In 2019, 12.3 percent of millennial renters said they plan to “always rent,” up from 10.7 percent just one year ago. Homeownership plans vary widely by geography. In five metropolitan areas — San Jose, Detroit, St. Louis, San Francisco, and Portland — more than 15 percent of millennial renters plan to always rent. In Atlanta and Dallas, the share is less than 10 percent. Unsurprisingly, rates are also high in expensive coastal cities like New York and Los Angeles, as well as other major metropolitan areas throughout California, a state characterized by its high housing costs.

Across renter demographics, black millennials stand out as disproportionately likely to expect to buy a home. Plans for homeownership are quite similar for most racial groups; between 12 and 13 percent of millennials who identify as white, asian, hispanic, or multi-racial expect to always rent. Only 8.7 percent of black millennials, however, responded this way.

Affordability remains the biggest obstacle for millenials who want to own a home

As millennials rent later in life, many are embracing the lifestyle benefits. Renters have more flexibility to explore living in new cities and neighborhoods, they can access new amenities at home, and they can avoid the hassle of home maintenance and unexpected housing costs. But are preferences for these lifestyle elements dissuading millennials from becoming homeowners?

Our survey finds that the lifestyle benefits of renting remain dwarfed by the burden of affordability. Among millennial renters who plan to own a home, 70 percent are waiting because they cannot afford to buy, compared to just 33 percent to say they are not ready to settle into a more permanent lifestyle. Similarly, among those who do not plan to buy, 69 percent say they will always rent because they cannot afford not to, compared to just 40 percent who cite the benefits of a more flexible lifestyle. While lifestyle benefits play an important role, more millennials still rent because they have to rather than because they want to.

We also find that homeownership continues to be viewed as the financially superior choice. In the wake of the Great Recession, some analysts explored whether the market crash shook millennials confidence in homeownership. The theory is that renting has become more attractive because homeownership, once a secure investment, now carries more risk given the threat of another downturn in the market.2 A growing body of literature also posits that renting can be a powerful wealth-creation tool that, at times, outperforms the housing market.3 But our surveys indicate that most millennial renters don’t share these perspectives. Only 28 percent who plan to always rent are doing so because they perceive homeownership to be a financially risky decision. And in a separate survey from earlier this year, 62 percent of renters stated that in the long run, they believe renting instead of owning is losing them money.

Financial obstacles to homeownership vary significantly by race

We asked millennials who want to own a home to tell us more about the financial obstacles that stand in their way. By far the biggest obstacle is affording a down payment. 60 percent of millennial renters cited this concern, compared to 38 percent who cite poor credit and 29 percent who cite the burden of future monthly mortgage payments. But these concerns are not universal to all groups of millennials. When we divide the responses by race, for example, we uncover barriers to homeownership that disproportionately affect certain minorities. White and asian millennials are much more likely to be concerned about the upfront cost of a down payment, while black and hispanic millennials are more concerned that poor credit will prevent them from securing a mortgage.4

Down payment savings remain low, and family assistance is declining

There is good reason for so many millennial renters to be concerned about affording a down payment. Putting money down can be the single most expensive moment in the home-buying process. But unfortunately in 2019, millennial renters made little progress towards saving for this important first step. Like last year, nearly half who say they want to buy a home actually have no savings set aside for a down payment. And only 12.9 percent (up slightly from 12.2 percent last year) have over $10,000 saved.

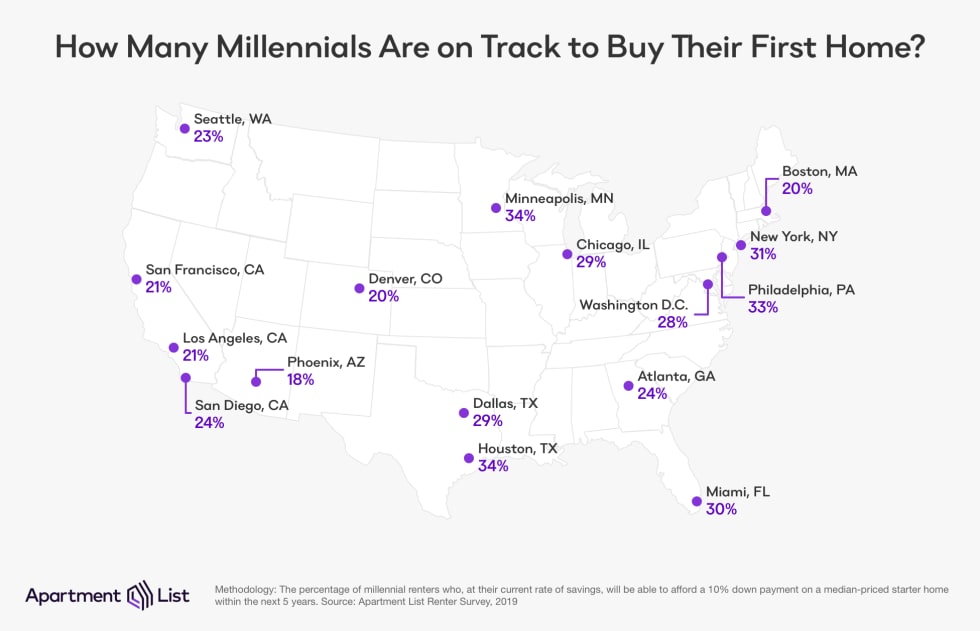

Survey respondents also report how much of their monthly income is put aside for down payment savings. Using these two metrics—total savings to date, plus total additional savings each month—we can estimate how long it will take each millennial to afford the down payment on a median-priced condo in their local metropolitan area.5 Across the country, only 13 percent of millennial renters will be able to afford a traditional 20 percent down payment within the next 5 years. This rises to 25 percent if we cut a down payment in half, and even when we assume just 5 percent down, homeownership is still readily accessible to only 39 percent of millennial renters. In every major metropolitan area covered by our survey, fewer than half of aspiring millennial homeowners will be financially ready in the next five years, even if we assume everyone qualifies for a loan that requires just 5 percent down.

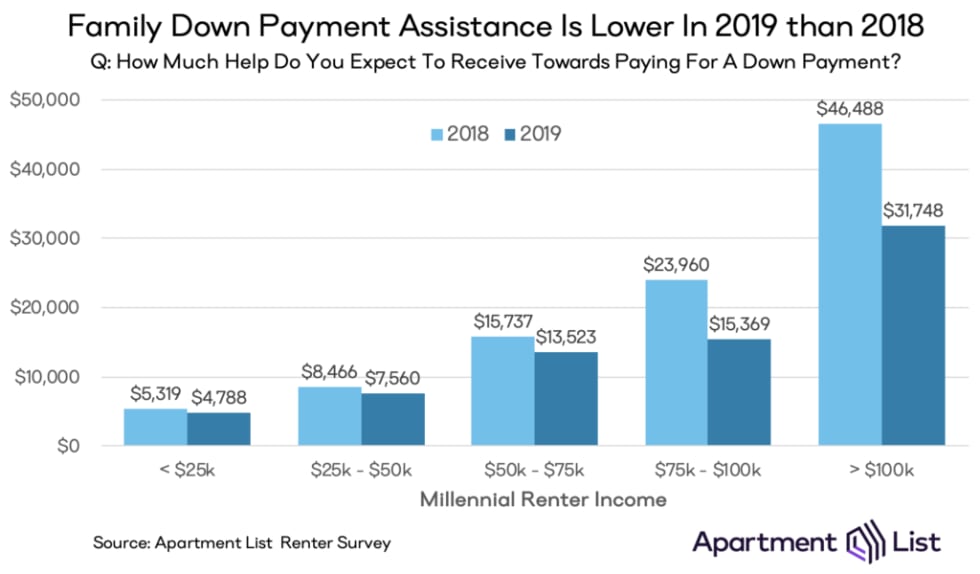

Some millennials who struggle to save enough on their own can turn to family for support. This can be the difference-maker for those on the cusp of affording their first home. But not only did personal down payment savings stagnate this year, expectations for family assistance also declined. 17.4 percent of millennials are expecting support, down from 19.1 percent a year prior. The value of this support is also shrinking; those who expect help in 2019 are expecting less ($8,928) than they did last year ($9,878).

Family support is also not equitably available, and like last year, the majority of it is reserved for higher-income millennials. We find a positive correlation between personal incomes and parental down payment assistance. Millennials who already earn over $100,000 expect over twice as much support as those making between $75,000 and $100,000, and over six times as much as those at the lowest end of the income distribution. This trend highlights the disproportionate, cyclical effect of generational wealth: poorer millennials who cannot afford to buy a home today may have more trouble building wealth in the long run, may be incapable of providing financial assistance to their children, and so forth.

Student loan debt continues to curtail millennial home-buying opportunities

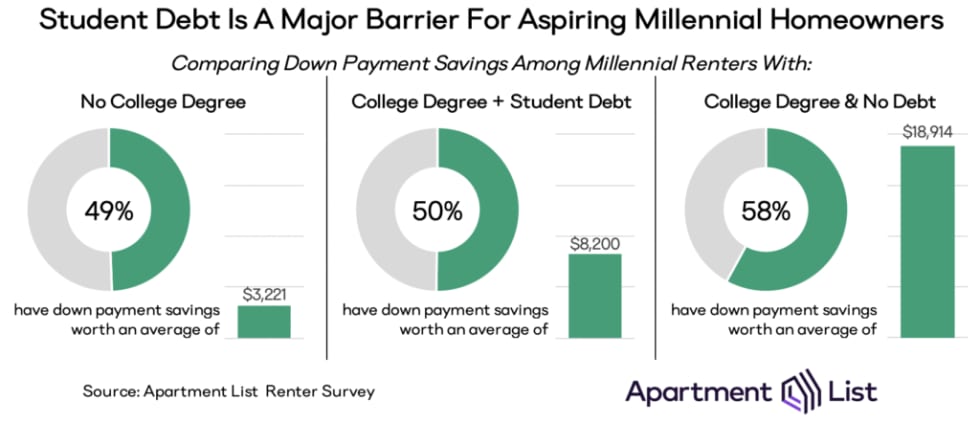

This year’s survey highlights once again the impact of student loan debt on millennials’ ability to save for a house. In addition to asking about monthly down payment savings, we ask respondents how much of their monthly income goes towards paying off student loans. 57 percent of college-educated millennials report having outstanding debt, and those who do are saving nearly $100 less each month for a down payment. This difference adds up quickly. Not only are college-educated, debt-free millennials the most likely to have down payment savings in the bank, they average more than twice the total savings of those who are still paying off student loans. In fact, when it comes to saving for a home, there is a wider gap between those with and without student debt than between those with and without a college degree.

Total student loan debt has increased by millions of dollars every quarter since the Federal Reserve started releasing data in 2006. Economists have drawn causal links between this mounting debt and a declining homeownership rate among young adults. In turn, political leaders are feeling pressure from young voters and some are pushing harder than ever to mitigate the burden. Senators and progressive Democratic candidate hopefuls Bernie Sanders and Elizabeth Warren have offered the most dramatic proposals: the former arguing that all student debt should be forgiven outright, the latter targeting debt forgiveness to lower-income households. To better understand the barrier created by student debt, we simulate Senator Sanders’s proposal with our survey data, assuming that all monthly student debt payments are instead committed to down payment savings. The effect is significant; across the country the percentage of millennials who would soon be able to afford a 10 percent down payment on a median condo would rise from 25 to 38 percent. For those wanting to minimize up-front cost, we estimate that more than half could afford a 5 percent down payment. In some metropolitan areas, this represents a full 20 percentage point increase in the number of millennial renters who can afford to buy their first home.

Conclusion: What’s next for Millennials, and what about Gen Z?

The national homeownership rate is rising again after more than a decade of decline. But according to our renter survey, millennial homeownership opportunities have not improved over the last year. A greater percentage of millennial renters believe they will rent forever, and while some acknowledge the lifestyle benefits that come with renting, the majority tell us that the main reason for renting is that they cannot afford to buy. Without a dramatic turn of events, it appears unlikely that millennial homeownership will catch up with previous generations anytime soon.

As millennials continue renting through their 20s and 30s, we will also be monitoring the next generation, Z, who are currently ages 22 and younger. Millennials and gen Z have already distinguished themselves in several ways; the younger generation is more diverse, on track to be more highly-educated, and more likely to grow up in a rented home. What remains to be seen is how gen Z interacts with the housing market as they come of age. Will they also face bleak homeownership opportunities? Or will changes in perspective, lifestyle, or the external economy relieve housing stress? Because few members of gen Z have reached the age at which Americans start considering buying homes, data on their perspectives are scant. But a recent Apartment List survey found that 85 percent of gen Z believes homeownership is important for personal success, compared to 88 percent of the millennial generation. While teenage attitudes are telling, the next generation’s housing market experience may still be formed by the next recession, whenever it comes, much like the Great Recession shaped the early outcomes of many millennials.

- Methodology note: This year we updated our definition of millennials to be defined by year of birth, per the Pew Research Center. In this report, millennials span the ages of 23-38, whereas in last year’s report they spanned the ages of 18-36. We account for this inconsistency throughout this year’s report. In order to compare results with last year, we applied the new generation definition to last year’s data and recalculated the number. Therefore, 2018 results in this report may not match what was presented in last year’s report, which relied on the outdated definition.↩

- For more information, see Bracha & Jamison (2012) and Rohe & Lindblad (2013).↩

- This discussion focuses on comparing the long-term financial returns of “buying and holding” versus “renting and investing.” For more information, see Florida Atlantic University’s Buy vs. Rent Index or Rappaport (2010).↩

- It should be noted that there is a lot of variation in how much each group expects to need for a down payment: Asian/Pacific Islander: $53,723; White: $24,395; Hispanic: $19,697; Black: $13,119.↩

- To estimate how long it will take each renter to save for a down payment, we project forward their current savings levels, adjusted by historic indices of inflation and wage growth. These projected savings are then compared against median metro-level condominium prices from the National Association of Realtors, which are adjusted for historical home price appreciation.↩

Share this Article