Renter Stigma: Social and Economic Pressure In the Housing Market

- A new survey from Apartment List finds nearly 30 percent of Americans believe there is a negative social stigma against renters. This belief is prevalent among renters and homeowners alike (33 percent and 28 percent, respectively).

- Per data collected in our survey, we hypothesize this stigma is born of a) long-standing societal perceptions of success and homeownership and b) the present-day economic and emotional burdens of disappearing affordability.

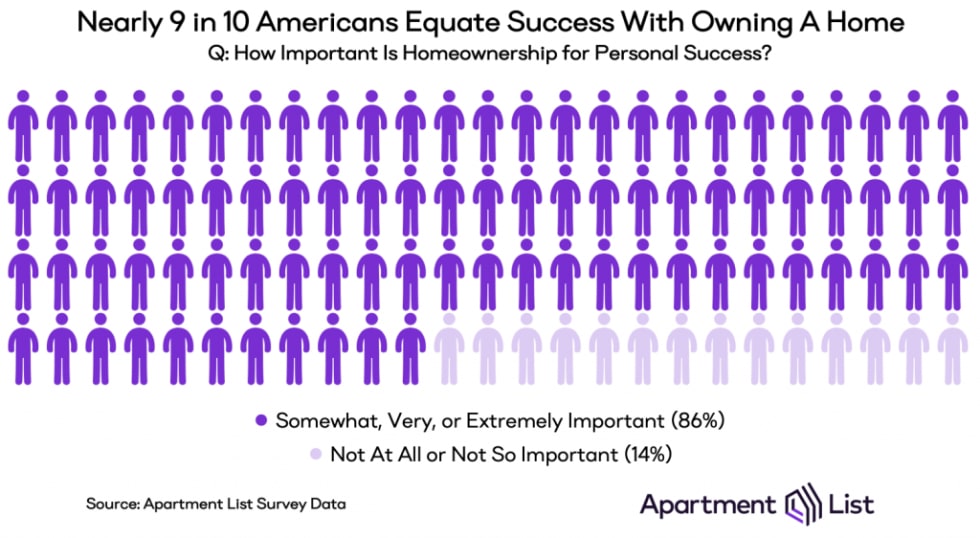

- Nearly 9 in 10 Americans equate homeownership with personal success and economic security, and the vast majority believe homeownership is the better financial decision, despite a growing body of evidence demonstrating this is not universally true. Belief in renter stigma is strongest among homeowners who go against this conventional wisdom and say they would actually be saving money by renting.

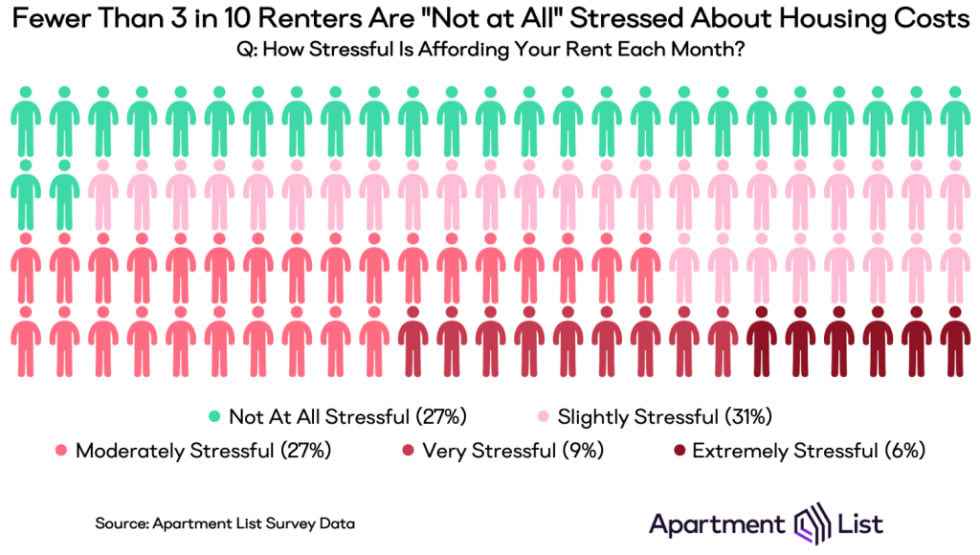

- Lacking affordable housing options, many renters make financial and emotional sacrifices to afford their housing costs. Most alarming are short-term sacrifices that greatly affect long-term economic security, such as withdrawing from personal savings, putting less money away for retirement, or taking on additional credit card debt. As a result, a majority of renters (73 percent) experience some level of emotional stress whenever rent becomes due. Belief in renter stigma is highest among this group of renters.

- Today, the rental market is changing dramatically across the country, and the affordability crisis is bringing housing equity into the mainstream national political discussion. Going forward, this will hopefully put downward pressure on the existence of a negative renter stigma.

Introduction

Renters are “second-class citizens” who are “poorer because they cannot afford to buy a house” and who “waste their money when they should be earning equity in a home.” They are seen as “transient,” “less successful,” and “not fully invested in the location where they live.” Renting is merely a “short-term solution” that “points to a lack of commitment and responsibility.”

At least that is how some people perceive renters, and renting in general. These anecdotes are pulled from a new Apartment List survey that explores “renter stigma” - the idea that renting reflects negatively on those who cannot or choose not to own their home. We asked over 5,000 Americans about their current living situations, their attitudes towards homeownership versus renting, and challenges they face when it comes to affording housing. With this information, we characterize renter stigma and explore some of the societal conditions that foster it.

We find that nearly 30 percent of Americans believe renter stigma exists. This observation is not limited to just those who rent; in fact, 34 percent of renters and 28 percent of homeowners agree that America’s renters - all 109,000,000 of them - are stigmatized in today’s society.

Characterizing Renter Stigma

Our survey indicates that a substantial number of Americans believe a negative social stigma against renting exists. This belief is prevalent in both renter and homeowner communities, and while it is not strongly concentrated in any single socioeconomic group, it is correlated with a number of demographic factors.

Perception of renter stigma is not correlated with gender nor income, and the data do show no discernible patterns across broad geographic regions.1 But we did find stigma to be more prevalent in demographics and places where renting is more common, such as younger respondents and those living in larger metropolitan areas (particularly their denser, more expensive neighborhoods).2 33 percent of 18-29 year olds think renter stigma exists, compared to just 23 percent of those over 60. Meanwhile, over 35 percent of people residing in the dense urban cores of large cities observe renter stigma, compared to less than 25 percent of those living in non-metro areas.

Future iterations of our survey will tell us whether or not this sense of renter stigma is growing or shrinking over time. In the meantime, these preliminary results indicate that the stigma is common enough to warrant an examination of its origins. Using additional data captured by our survey, we explore two hypotheses.

Renter Stigma Is Fueled by Societal Perceptions of Success and Homeownership

One hypothesis is that renter stigma exists because renting is antithetical to traditional American notions of success and wealth through homeownership. Our survey uncovered how deeply-ingrained this notion is. The vast majority of respondents (86 percent) believe that homeownership is important for personal success, and even more (87 percent) say that it is important for financial security.3

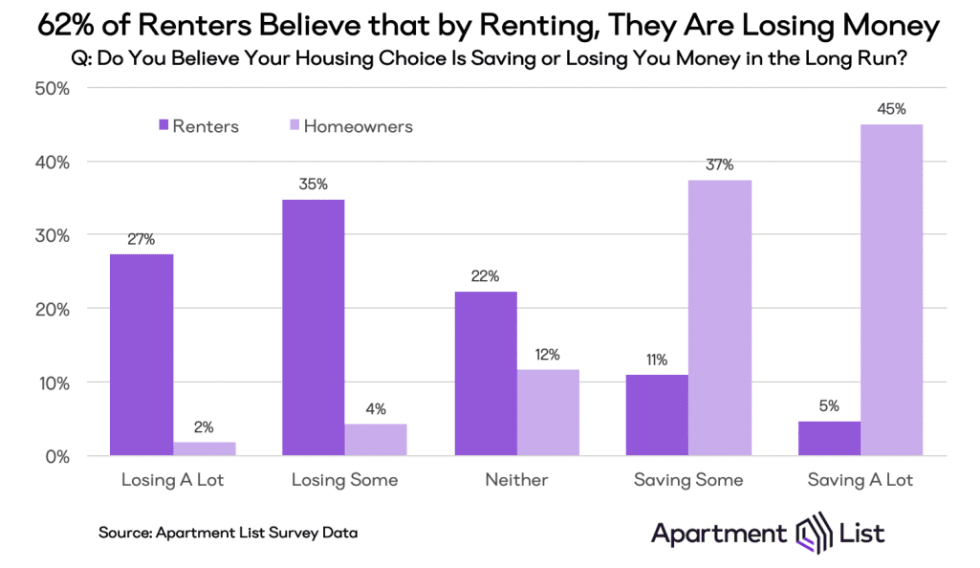

Furthermore, 82 percent of homeowners believe that owning their home is saving them money in the long run, while 62 percent of renters believe that by renting, they are losing money. Despite a growing body of academic research suggesting that many renters today actually have a wealth-building advantage over homeowners, many Americans assume that renting is a universally poor financial decision.4

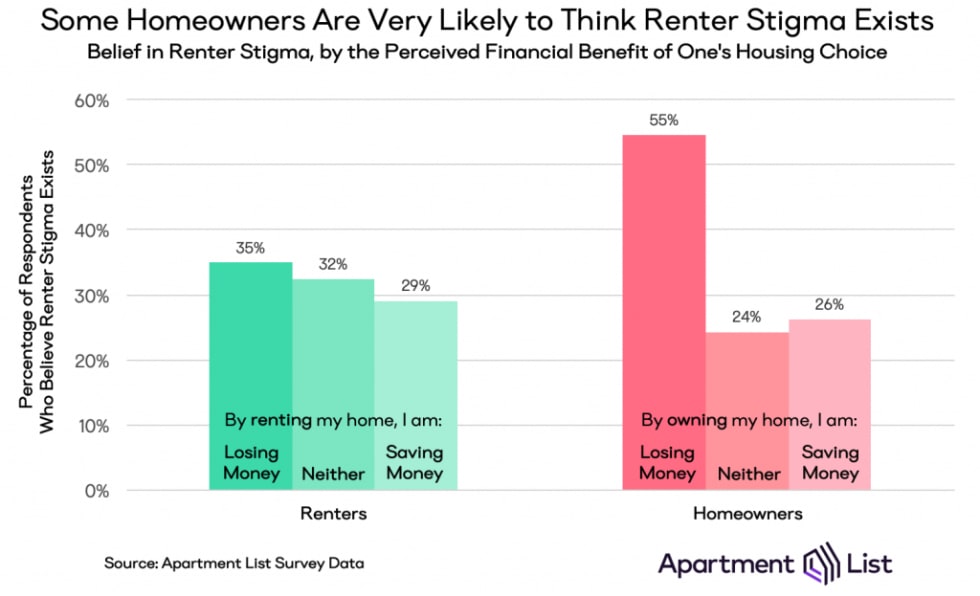

Among renters, a belief in renter stigma does not rely heavily on the perceived financial benefit of renting. In other words, those who say renting is costing them money are only 6 percent more likely to believe stigma exists than those who say renting is the more financially prudent choice. But among homeowners, those who buck conventional wisdom and say they are losing money by not renting are actually the most likely to believe renter stigma exists. 55 percent of these homeowners perceive a stigma against renting, more than any other group surveyed.

These 55 percent could represent homeowners who are willing to pay a premium just to avoid renting and the stigma associated with it. Alternatively, they could be people who are unsatisfied with homeownership and now see the perception of renting as unduly negative. A recent study from Bankrate showed that many homeowners - particularly younger ones - have regrets about their decision to buy a home, particularly because they have been hit with unexpectedly high costs. Responses from our survey tell a similar story about renter stigma. Belief in renter stigma is strongest among homeowners aged 18-29 (38 percent) and then declines steadily with age. It is also highest among homeowners who have incurred large unexpected housing costs (33 percent), more so than those who have incurred small costs (30 percent), or none at all (24 percent). For at least this small set of homeowners, the longstanding perception that renting is incongruent with financial stability may be crumbling.

Renter Stigma Is Fueled by the Burden of Disappearing Affordability

A second hypothesis is that renter stigma is not born of long-standing cultural norms, but rather the economic reality of growing affordability challenges that have started to squeeze renter wallets. Today’s homeowners spend less of their income on housing than they did forty years ago. Renters, regardless of income level, pay more. On top of that, the federal government spends twice as much on mortgage subsidies than rent subsidies. The result is that for many, renting creates financial and emotional burdens that contribute to a sense of marginalization. Our survey asked renters to describe these burdens, specifically the sacrifices they make in order to afford housing and the level of stress they experience when it comes time to pay rent.

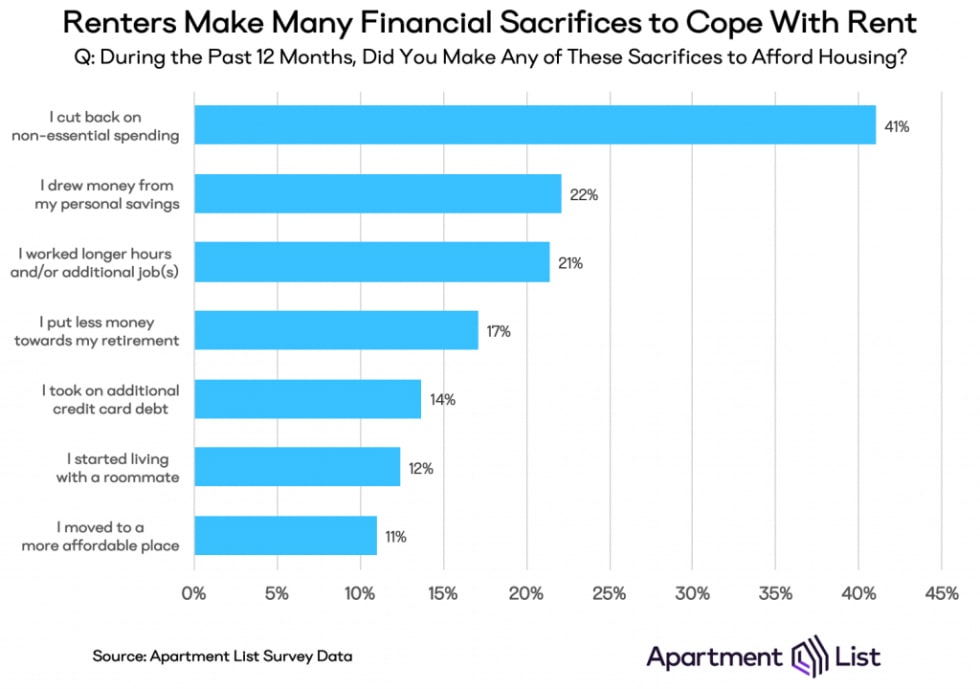

We asked: during the past 12 months, did you make any of the following sacrifices to afford housing? and learned that affordability affects not only renters’ lifestyles, but also their future financial security. The most common sacrifice (41 percent) is to cut back on non-essential spending, which could simply reflect a preference for housing in a particular location over other goods or services. More alarming are the sacrifices that actually worsen economic stability over time: drawing from personal savings (22 percent), saving less for retirement (17 percent), and taking on additional credit card debt (14 percent). Unfortunately, among the 41 percent who cut back on non-essential spending, 50 percent also had to make one or more of these longer-term sacrifices. In this way, many renters that are burdened by their housing costs need to take short-term actions that make it harder to get ahead financially in the long-run.

We also asked: how stressful is affording your rent each month? The majority of renters today (73 percent) experience at least some level of rent-related stress, and 42 percent describe their rent as moderately, very, or extremely stressful.5 We found this to be common across all types of renters, even those with high incomes. Over one quarter of those with six-figure household incomes are at least moderately stressed by their rent each month.

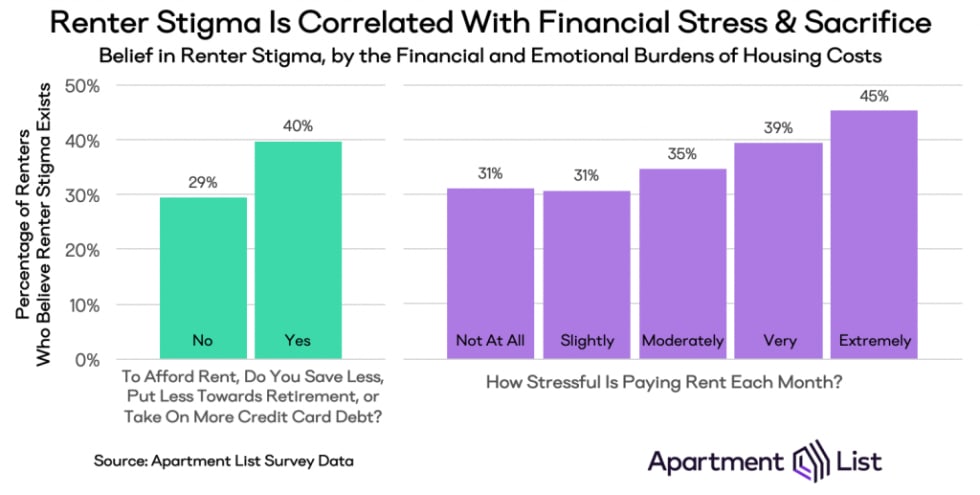

Most importantly, renters who make the financial and emotional sacrifices above are more likely to believe in renter stigma. 40 percent of renters who sacrifice their savings, retirement, or credit sense stigma, compared to only 29 percent of renters who do not. So do 37 percent of renters who experience moderate to extreme levels of rent stress, compared to only 31 percent who do not.

Conclusion

No family should feel stigmatized or marginalized because of how they choose to pay for their home. Nevertheless, renter stigma feels real to nearly one in three Americans. It is not limited to a particular group, although we find it is more commonly among those who are skeptical of traditional notions about homeownership, as well as those who make major financial and emotional sacrifices to afford their housing. With time, we can hope renter stigma diminishes as changing preferences and economic realities normalize both the costs and benefits of renting.

Renting is evolving, as many new demographics enter the market in record numbers. The number of high-earners who rent instead of own is surging, and seniors are increasingly more likely to rent their homes each year. Single-family homes are increasingly occupied by renters, making it harder to tell renters and homeowners apart. Meanwhile, on-demand services and the sharing economy are enabling renting of more goods and services across new domains.

Even the federal government’s focus is shifting towards the rental market. To date, four presidential hopefuls have authored bills and/or policy platforms that directly target housing inequalities.6 All of these trends put negative pressure on the existence of renter stigma, potentially challenging assumptions and beliefs about who rents and why. As a result, the future of renting may look quite different from its past.

Footnotes

- With 5,176 total responses, the data provide a nationally-representative sample of renters and homeowners but are not granular enough to make comparisons across smaller geographies like cities, metropolitan areas, or states. Nevertheless, across Census Bureau Regions and Divisions (aggregations of neighboring states), we find little variation when it comes to belief in renter stigma.↩

- Large metros are defined as having more than 500,000 residents. Medium metros have a population between 250,000 - 500,000. Small metros have a population less than 250,000. Non-metro refers to those who live outside a metropolitan area. Density is calculated for each respondent's Zip Code Tabulation Area (ZCTA): High density ZCTAs have >10,000 residents per square mile. Mid-density is 5,000 - 10,000, and low density is <5,000. This is an adaptation of a methodology originally developed by Jed Kolko and used here.↩

- Respondents were asked "How important is homeownership for personal success?" as well as an analogous question about financial security. Responses were allowed on a five-point scale: not at all important, slightly important, somewhat important, very important, or extremely important. Here, "important" refers to anyone who answered somewhat, very, or extremely important.↩

- This discussion focuses on comparing the long-term financial returns of "buying and holding" versus "renting and investing." See Florida Atlantic University's Buy vs. Rent Index or this paper by Jordan Rappaport for more information.↩

- For comparison, homeowners were asked a similar question about their mortgages (if applicable). 28 percent of mortgaged homeowners described the cost being moderately, very, or extremely stressful.↩

- See Elizabeth Warren's American Housing and Economic Mobility Act; Kamala Harris's Rent Relief Act; Cory Booker's Housing, Opportunity, Mobility, and Equity Act; and Julián Castro's People First Housing platform.↩

Share this Article