- 47 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

If paying a security deposit feels out of reach (or just unnecessary), you’ve got options. Security deposit insurance, installment plans, and even negotiating with your landlord can all cut down the upfront costs of moving.

In today’s rental market, paying a security deposit is still one of the biggest hurdles for renters. The good news? More than half of landlords (56%) now offer at least one security deposit alternative for renters. That’s a big jump from the 35% recorded in 2022, according to the National Apartment Association.

Knowing how to navigate these deposit alternatives can save you hundreds (sometimes thousands) of dollars ahead of move-in. In this guide, we’ll walk through strategies and insights to help you approach your next lease agreement with confidence. From negotiating tactics to leveraging new market trends, we’ve got you covered with expert advice to make your next move smoother and more affordable.

A security deposit is money paid upfront to protect a landlord against damage or unpaid rent. In most states, it’s equal to one month’s rent, though the amount and rules vary by location. State and local laws dictate how much landlords can charge, how deposits must be stored, and how quickly they must be returned when you move out.

These laws are designed to protect both tenants and landlords, ensuring that the deposit is used fairly and returned promptly if the property is left in good condition. That said, though, security deposits often create major barriers for renters budgeting for other move-in expenses.

Exploring alternatives to traditional deposits can make a big difference in your budget. Here are six options renters are using to ease the upfront costs of moving:

A surety bond is a three-party agreement between the tenant, the landlord, and a bonding company. Think of it as a deposit “shortcut.” You pay a small, non-refundable fee to a bonding company, which covers your landlord if something goes wrong. If the company pays out, you’ll still owe them back, but the upfront cost is far less than a full deposit.

Programs like Rhino, Jetty, and LeaseLock let renters pay a low monthly or annual premium instead of a lump sum deposit. These insurance policies, though non-refundable, help keep your move-in costs lower while covering potential damages or unpaid rent.

Some companies will front the security deposit on behalf of the tenant, and in return, the tenant pays a smaller monthly fee to the service provider. Like security deposit insurance, it’s non-refundable, but much easier on your budget.

In some cases, landlords may waive the security deposit for tenants who meet certain criteria, such as having a high credit score, a history of steady income, or excellent rental history. It’s less common, but worth asking about if your renter profile is solid.

Instead of one big upfront payment, some landlords let you pay your deposit in chunks over the first few months of your lease. It spreads out the cost without removing it entirely.

Renters who use credit reporting services (AKA: reporting on-time rent payments to bureaus) may be able to negotiate lower or waived deposits, since landlords view them as lower-risk tenants.

Your credit score can be a powerful tool in avoiding security deposits. From our research and experience, we've found that landlords often view a high credit score as a mark of financial reliability. A strong credit score suggests that you're less likely to default on rent or cause costly damages, making you a lower-risk tenant.

Even if your credit score isn’t perfect, some landlords will consider your overall credit history. Showing that you consistently pay bills, manage debt responsibly, and keep steady income can give you leverage when asking for a lower deposit.

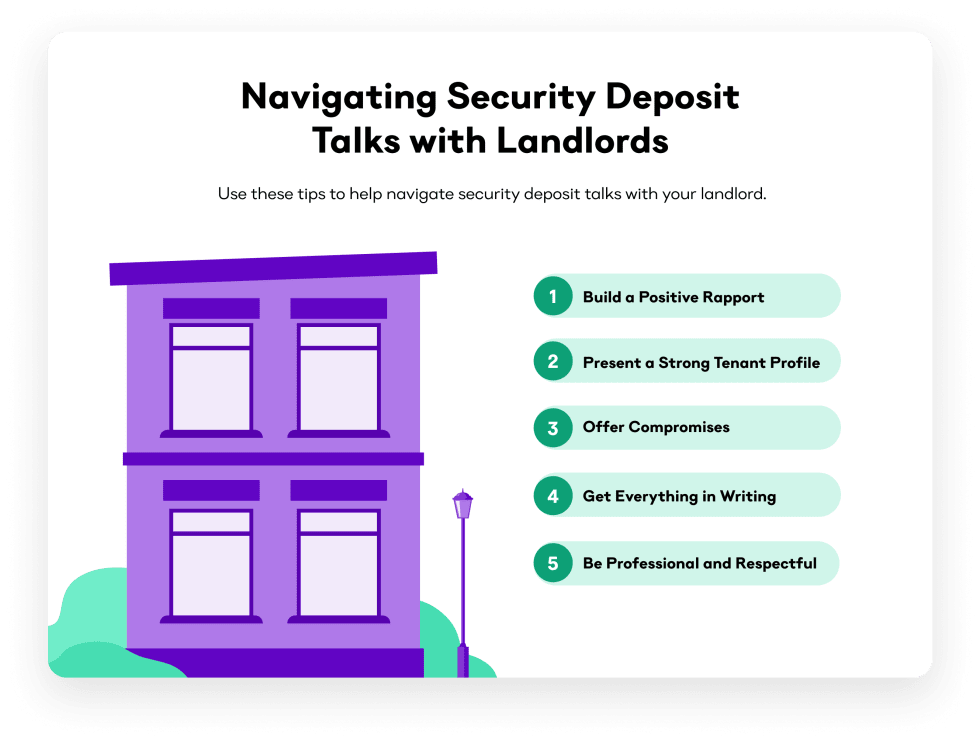

Asking a landlord to lower or waive a deposit can feel intimidating, but it doesn’t have to. A little preparation goes a long way:

Bring proof of stable income, excellent rental history, and a strong credit score. A solid tenant profile reassures the landlord of your reliability and financial responsibility.

Establish a good relationship with your landlord. If you're a new tenant, provide references from previous landlords. If you’re renewing your lease, remind them of your consistent track record in maintaining the property and paying rent on time.

Flexibility can often lead to a win-win situation. This might mean agreeing to a slightly higher monthly rent in lieu of a security deposit, or proposing a smaller, non-refundable deposit.

Once you reach an agreement, make sure it's documented in the lease agreement. This protects both you and your landlord, and helps prevent future misunderstandings.

Approach negotiations professionally and respectfully. Clear, polite communication can make all the difference in how your landlord perceives and responds to your requests.

Rental assistance programs provide extra safety nets for renters who want to lower their upfront costs. If you’re struggling with the financial burden of moving, checking into these resources can open doors to more affordable housing options.

In cities like Baltimore, Cincinnati, and Seattle, security deposit alternatives are required.

Check with your local housing authority to see what renter protections and deposit alternatives are available.

Certain nonprofits and community organizations provide grants or zero-interest loans to help renters cover move-in costs. A quick search of “renter assistance programs” in your city or state is a great place to start.

Some employers and universities partner with housing providers to reduce or eliminate deposits. This is especially common in high-cost markets, where housing perks help with recruitment and retention.

Renting comes with plenty of upfront costs: application fees, pet deposits, and yes, security deposits. That’s why sticking to your budget matters from the start.

Apartment List’s personalized quiz helps you skip the endless scrolling and get matched with budget-friendly apartments that have everything you want—from location and amenities, to security deposit alternatives. Spend five minutes with us, save yourself 50 hours of searching, and give your wallet a break from hefty move-in costs.

To avoid paying a security deposit with bad credit, consider offering references from previous landlords to demonstrate a history of responsible tenancy. Another option is to find a cosigner with good credit to guarantee your lease.

Some landlords may also accept a larger first month's rent instead of a security deposit. Additionally, rental insurance products or programs like Rhino, which offer an alternative to traditional security deposits, can be a solution.

If a landlord refuses to waive the security deposit, try negotiating a lower amount or propose an installment plan for paying it. It's important to understand that landlords often require security deposits to cover potential damages or unpaid rent.

If negotiations fail, you might need to look for properties with more flexible security deposit requirements or consider using a security deposit guarantee program.

Yes, many states and localities have laws that limit the amount a landlord can charge for a security deposit, typically not exceeding one to two months' rent. Some jurisdictions also regulate how landlords must store these deposits and specify the timeline and conditions for their return. It's crucial to research the specific laws in your state or local area to understand these limits and ensure that your landlord is complying with them.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more