- 44 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

Renters can find income-restricted housing by researching local U.S. Department of Housing and Urban Development (HUD) programs, learning about local guidelines, and contacting their local public housing authority.

As rent prices increase, the demand for affordable rental housing also rises, making income-restricted or income-based apartments increasingly difficult to find. If you’ve tried looking for low-income housing, you’ve likely found it to be a challenge.

In this article, we’ll explore income-restricted apartment options, including how to find them and who is eligible for them.

Income-restricted apartments are developments reserved for low-income individuals or families, characterized by limitations on the maximum amount of income tenants can earn.

Income-restricted apartments are often privately owned, though they may receive state, local, or federal subsidies.

You will commonly find apartment communities that are fully designated as income-restricted apartments. In some cases, however, you will find communities with a blend of both market-rent and income-restricted apartments within them.

The Great Depression sparked widespread financial unrest, accompanied by a significant housing crisis. The concern was so considerable that the federal government became heavily involved in providing affordable housing during the financial hardship.

The federal efforts would become known as the Housing and Urban Development (HUD) agency, which eventually developed into the U.S. Department of Agriculture’s Rural Development department.

In 1937, the Affordable Housing Act was passed, introducing several measures to facilitate the development of new and affordable rental housing, while also subsidizing the costs associated with operating income-restricted apartments.

In the same year as the Affordable Housing Act, Section 8 housing was created under the Section 8 Housing Act of 1937. This section, still run by the federal government today, explicitly details the Housing Choice Voucher Program, which allows tenants to receive federal vouchers for housing in any development that participates in the program.

While Section 8 housing vouchers are still available, the Act has also evolved into Section 42 housing, which was a part of the Tax Reform Act of 1986. In this iteration, the IRS code provides incentives to investors building affordable housing in the form of tax credits.

Typically, income-restricted apartments are reserved for families who fall within the “Very Low” income threshold, as determined by the HUD. Families within the “Extremely Low” income threshold will receive preference between the two.

The HUD calculates the median income levels for each metropolitan area within the U.S. annually. After that figure is determined, the HUD details the maximum incomes and establishes qualifying categories as either “Low,” “Very Low,” or “Extremely Low” in each metropolitan area.

Unsurprisingly, this calculation reveals that eligibility for income-restricted housing varies significantly across the country. Since median income levels are different from one city to the next, the requirements for income-restricted housing in those cities change with it.

Don’t be discouraged if your household is in the “Low” threshold, as there might be options available in your area. You can learn more about the median income levels and thresholds through the HUD Public Housing Agency (PHA) Contact Information website.

The average rent prices for income-restricted apartments vary drastically depending on location and unit size. There are different methods used to calculate the maximum rent caps as determined by local officials. If you’re looking to find out how much income-restricted housing will cost in your area, it is recommended that you contact your local housing authority. Contact your local public housing authority office.

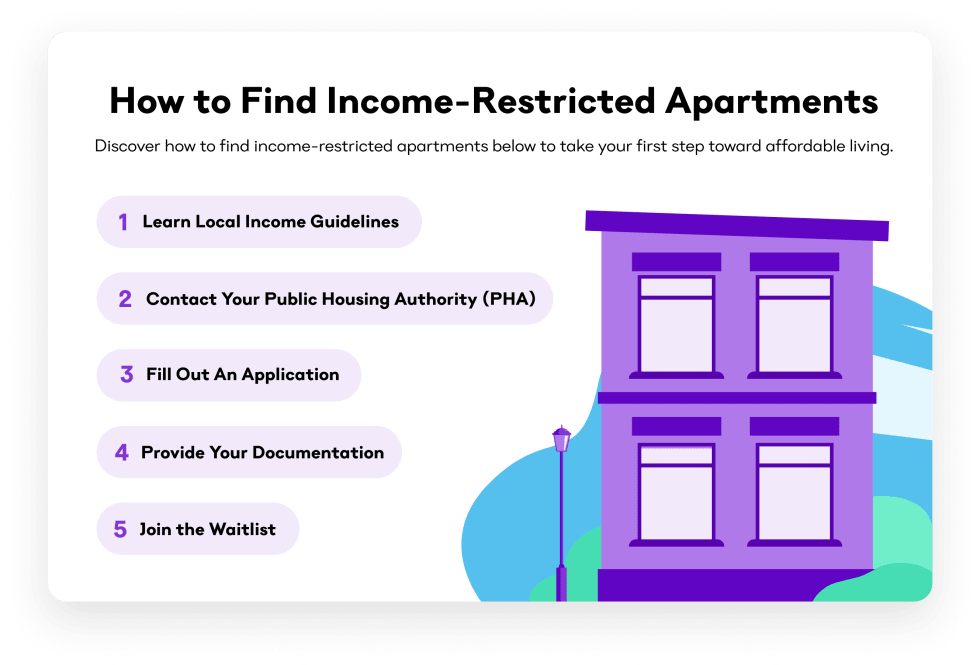

Below are the five basic steps to finding income-restricted housing.

First, do your homework to find out more about the income-restricted housing eligibility requirements specific to your area. Visit the HUD website and review the “Individual Income Limits” to determine whether you qualify for assistance using their threshold. If eligible, you’ll fall into one of the three categories: Low, Very Low, or Extremely Low.

Once you have reviewed the guidelines and believe you qualify, you’ll want to contact your local public housing authority. Speaking with your PHA will help you determine approximate rent costs, apartment sizes, and see what’s currently available in your area.

If you are looking for a government-owned apartment, you can apply directly through the PHA. For privately owned properties, you will be able to apply for an apartment directly to the landlord.

Remember, everyone who will be living in the apartment for which you are applying may need to pass a criminal background check during this process. Some offenses may disqualify you from income-restricted housing, although this varies by location. Private owners are known to have stricter standards than government-owned apartments.

During your application process, you’ll need to provide all of your required documentation, including verified income for everyone in the household. Any adult will need to include a government-issued ID, and you’ll have to submit birth certificates for any children.

Be truthful when providing your documentation. Don't hide any of your assets, for instance. Check out this video from Affordable Housing Waiting Room explaining how fraudulent claims in your application can cause you problems even years later:

Unfortunately, the affordable housing market is often incredibly competitive. More than likely, you’ll need to be ready to sit on a waitlist. If you can be flexible with the size of your apartment, it might help you get into income-restricted housing sooner rather than later.

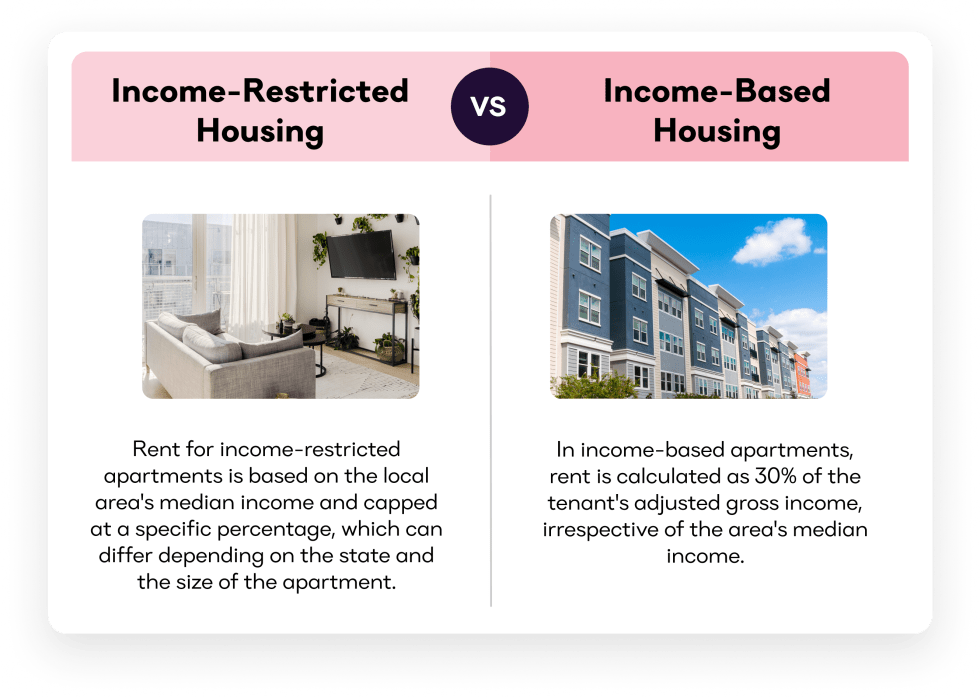

Although the names are similar, income-restricted and income-based housing are two distinct concepts. While the government subsidizes the remainder of the market value of rent in both types of housing situations, the tenant’s portion is determined using different figures.

When you use Apartment List, you can take our quiz to help you get matched with a place in your location and price range. We feature a variety of listings, including income-restricted, senior housing, military-discounted housing, and more. Use our internal messaging system to contact the landlord for additional information about rental options and assistance.

The main benefit of income restricted housing is that it allows you to live comfortably within your means so that you can afford other expenses such as utilities and groceries. The peace of mind you experience from being able to afford your bills is priceless.

Your tenants rights within income restricted housing are the same as they are in other rentals. These rights are largely determined by state and local ordinances, though there are some essential rights that are essentially universal: Your landlord is required to make major repairs in a timely manner.

Landlords cannot enter the premise without notice. Landlords must give a minimum amount of notice before eviction as stipulated by local law. You have a right to safe living conditions. You often have a right to quiet enjoyment of the property. Research your local laws to learn more about what your landlord is expected to do to care for the property.

Eligibility for income restricted housing is generally based on local regulations. However, a few common reasons why you might be removed from a housing voucher program include

If your income increases above the threshold of eligibility while living in an income-restricted apartment, you will not be immediately evicted. Families are generally allowed to occupy their housing for a further six months after their income has been reassessed.

You will also be given a hearing, and the PHA will be required to provide you with 30 days' notice to vacate after the termination of your contract. If your income is reduced again during this time period, you can request a new hearing and assessment from your PHA.

Income-restricted apartments typically verify income through income or tax-related documents. These documents may include tax returns, pay stubs, benefit statements, or bank statements.

Many students do not qualify for income-restricted apartments, but those who are over 24, don’t have full-time student status, and are independent from their families may qualify for assistance.

Yes, the main downsides are that most renters don’t have a choice in location, and some areas may have higher crime rates than desired.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more