The Rental Market’s Peak Season is Becoming Less Pronounced

- The rental market has long been governed by a clear seasonal pattern: the greatest share of units turn over during the summer months, with peak rent growth occurring in tandem.

- In recent years, we’ve begun to see a flattening of these sharp seasonal swings – peak rent growth is occurring earlier in the year and leases are less concentrated in the summer.

- These shifts are due to a combination of factors including (1) the persistent impact of a one-time shock to the timing of moves due to the pandemic in 2020; (2) an intentional shift by multifamily operators to spread out lease renewal dates; and (3) a supply rich environment offering renters more optionality and flexibility in their moves.

The rental market is governed by a clear seasonal trend

The rental market tends to follow an established seasonal pattern. More people generally move during the spring and summer, and rent prices normally rise accordingly as multifamily operators increase rents in response to the spike in demand. During the fall and winter months we tend to see the opposite: less moving activity, and operators pulling back on rents to attract the dwindling set of renters still on the market for a new home.

This seasonality results from three practical factors: school, weather, and holidays. The summer is more favorable for all three: if you are a student or have young children, you don’t need to juggle school schedules; weather is generally more temperate; and moving expenses aren’t being eaten up by holiday spending. Renters who have the flexibility and means to relocate during the winter will generally find lower prices and more wiggle room for negotiating lease terms.

In recent years, rental market seasonality is flattening and trending earlier

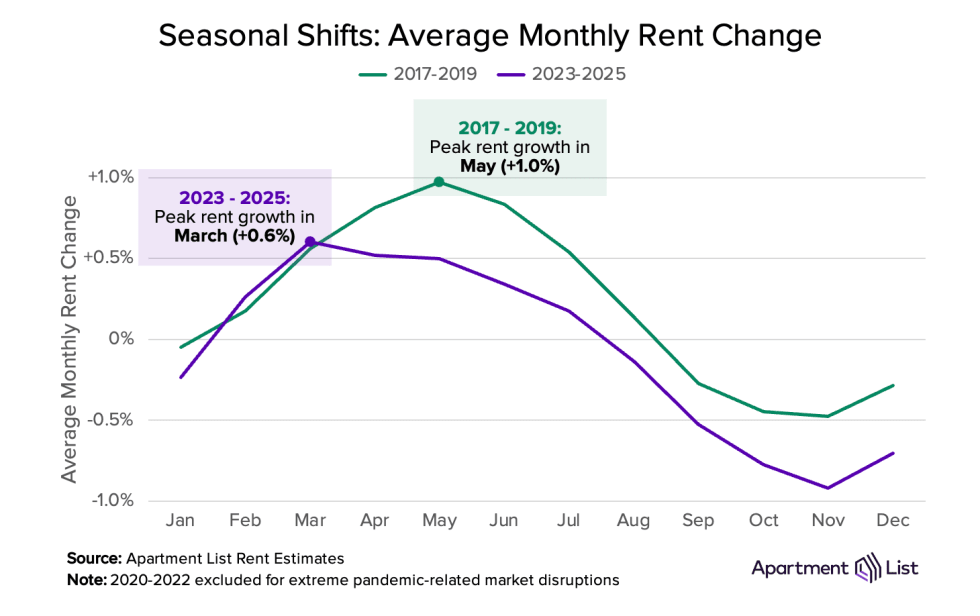

Over the past three years, we’ve seen a noticeable shift in the timing of this seasonality. Since 2022, rental activity is more evenly distributed throughout the calendar year, annual rent declines exceed annual rent increases, and peak rent growth has moved up earlier in the year. You can see all of this in the chart below, which shows average monthly rent change during two three-year periods: 2017-2019 (green) and 2023-2025 (purple).

From 2017-2019, the typical seasonal pattern was this: nationwide rents would rise for seven months from February through August, with peak rent growth (+1.0 percent) occurring in May. Since 2023, there has only been six months of rent growth each year, from February through July, with peak rent growth down to +0.6% and occurring two months earlier in March.

There are a few underlying forces driving these changes to seasonality:

- The COVID-19 pandemic caused a one-time shock to the timing of moves. Many moves that would have taken place during the summer of 2020 were either pushed up earlier in the year or delayed until later in the year, in both cases to avoid the height of shelter-in-place. Since most leases renew on a 12-month cycle, this created a ripple effect whereby in subsequent years, fewer apartments were turning over during the summer.

- Many multifamily communities have started intentionally spreading out lease dates to make for more stable and predictable operations. For instance, a community may offer a discount for a non-standard lease lasting more than 12 months, in order to manage the timing of renewals and vacancies to be more evenly distributed, such that the business is less subject to the whims of a single season.

- Starting in 2022, a huge increase in multifamily construction tilted the rental market’s supply-demand balance in favor of renters. More than one million new apartments were built between 2022 and 2024, giving renters more options to choose from and communities more eager to fill vacancies. This has made landlords less aggressive in their pricing and more focused on tenant retention. For renters, increased optionality has allowed them to be choosier, and to extend the length of the search process.

Renters are starting & finishing their search earlier in the year

Equipped with remote work, better technology, and a favorable supply-demand balance, renters are more patient and more willing to seek out an off-season move for a better deal. We see this directly in the actions renters take on our platform, specifically interests and leases.

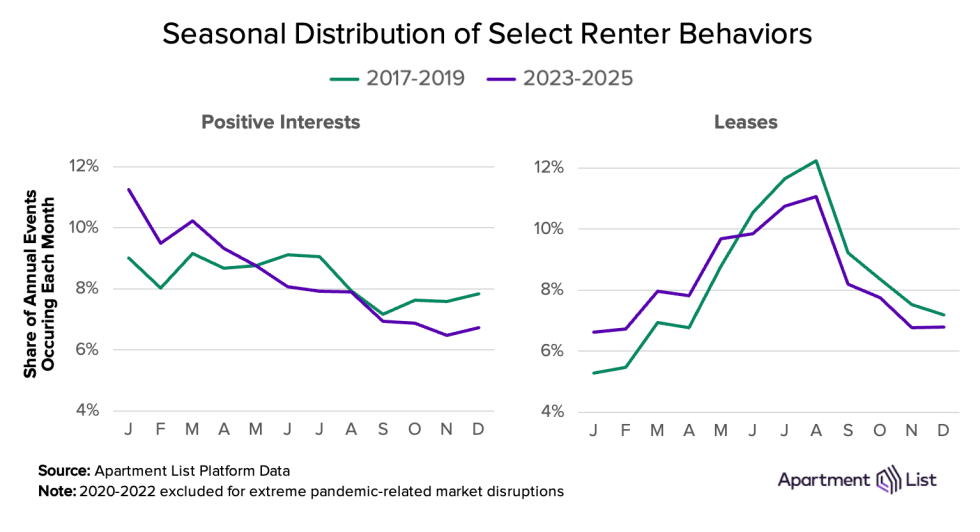

An interest occurs when a user adds a property to their shortlist of potential new homes. A lease refers to the move-in date for renters who do in fact sign that lease. The charts below show the distribution of interests and leases throughout the calendar year, again split between the three years before and after the pandemic.

Rather than being evenly distributed, we see interests concentrated in the first half of the year, and leases are concentrated during the summer. This is consistent with our baseline understanding of seasonality: the typical renter begins their search early in the calendar year (by expressing interests) and finishes it in mid-late summer (by signing a new lease).

But starting 2023, interests have become more front-loaded, with over 30 percent taking place in the first quarter of the year. Meanwhile, the share of interests occurring in the second half of the year is well below where it was pre-pandemic. Leases, while still concentrated in the summer, have also shifted earlier. Compared to pre-2020, more move-ins today are happening between January and May.

Seasonal shifts also depend on local market dynamics

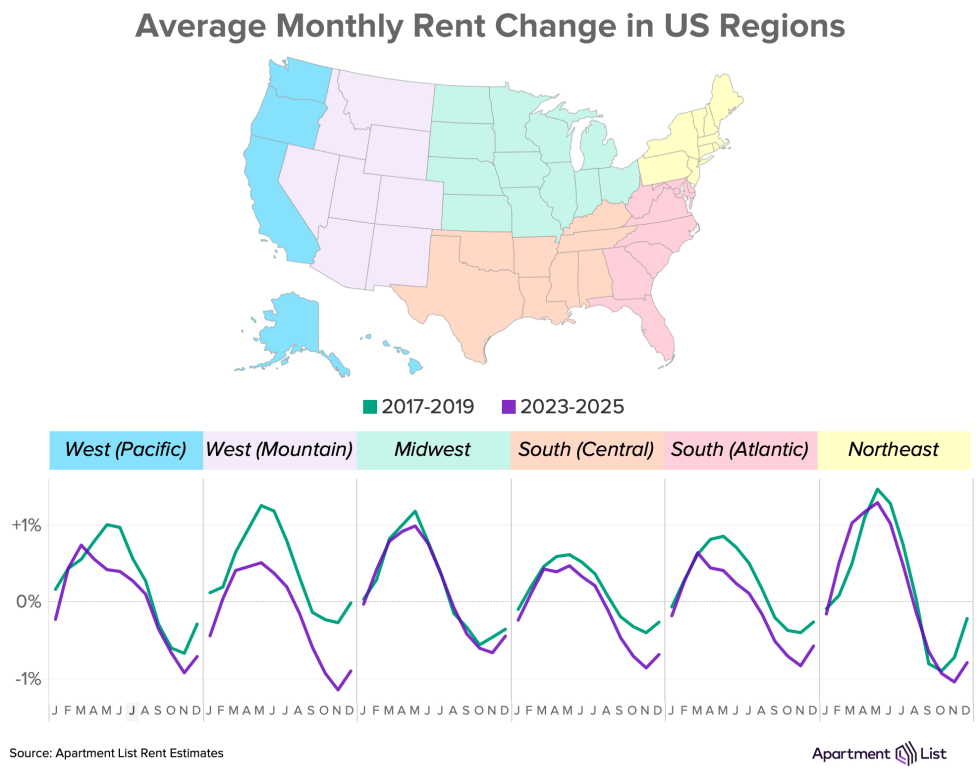

One recurring theme of the post-pandemic rental market is regional variation: trends in one part of the country may be totally different than in another. The most visible example of this has been the construction boom discussed earlier. Markets in the Sun Belt have built an outsized share of new apartments compared to, say, markets in the Midwest. And as a result, rents are falling in the Sun Belt but rising in the Midwest, as operators in those regions deal with drastically different market dynamics.

Seasonality is no different. Some regional variation is brought on by weather; we see larger seasonal swings in Northeastern states that have extreme winters, compared to Southern states where renters can move year-round. And as seasonality evolves, some markets are experiencing bigger changes than others. Across the Midwestern United States, for example, seasonality is largely unchanged since 2023; just a slightly muted summer peak in May and a slightly steeper winter dip in November. In the Mountain West, the shape of the seasonal curve has held stable, but rent growth in all seasons is down significantly compared to pre-pandemic. It is along both the Pacific and Atlantic coasts, as well as the Southern United States, where we really see seasonality shift earlier in the calendar year.

The interactive chart below provides a detailed look at seasonality in some of the nation’s largest rental markets. Some examples of dramatic seasonal shifts can be found in:

- Austin TX, which leads the nation in construction and rent declines. Since 2023, March is the only month of the year where rents are reliably going up.

- Orlando FL, where the rental market ramps up in the first quarter just as it did in the past, but now stalls in March and decelerates for the rest of the year.

- Chicago IL, one of the nation’s hottest rental markets, where new rent growth has been unlocked in February, March, and April.

- Portland OR, where a once-predictable summertime jump in rents has all but evaporated.

- Boston MA, a relatively stable market where seasonal patterns haven’t shifted dramatically, but we observe big swings in summer vs. winter rent growth due to weather.

Are the shifts in seasonality here to stay?

Seasonality is changing due to a combination of factors, some temporary and some lasting. Today’s supply-rich rental market, for example, will inevitably pass as the construction industry slows down. This will shift some negotiating power back from renters to landlords, and limit the steep winter price drops we’re currently seeing in builder-friendly markets like Austin and Denver. But other factors have more permanence, like remote work which gives renters more flexibility in choosing when and where to move. And perhaps more importantly, it appears some multifamily operators value a more evenly-distributed timing of lease renewals, and are actively pursuing it. It will be crucial to see in the coming years if these renter and operator behaviors continue to flatten seasonal swings, even as the market heats up.

Share this Article