San Francisco’s Rental Market Is Booming Again

- Since the pandemic, the San Francisco Bay Area has done little to accommodate a future surge in rental demand.

- That demand surge appears to have arrived, and as vacant apartments fill, prices across The Bay are rising quickly.

- Today, the Bay Area is home to the nation’s fastest-growing rents: +4.6% metrowide and +10.6% in San Francisco proper.

San Francisco’s recovery was slow, until it wasn’t

Perhaps no rental market in America was hit harder by the COVID pandemic than San Francisco. At one point rents were down as much as 25%, and since then recovery has been slow. The effects of out-migration were felt acutely in downtown neighborhoods, and a tech-enabled workforce that quickly embraced remote work has been reluctant to return.

But in the last year and a half, San Francisco’s rental market has roared back to life. With AI, the city finds itself again at the center of the next big revolution in technology, and apartment buildings that once struggled to attract residents are filling quickly. While markets are heating up across the Bay Area, San Francisco is by far the hottest. The city’s apartment vacancy rate has fallen to a low of 3.5%, ranking second-tightest nationwide. Meanwhile rents are up 10.6% year-over-year – faster than any other large city in the country.

Despite the recent surge, the Bay Area is still making up lost ground from 2020. We estimate the median rent in San Francisco is still below its March 2020 level by 3.7 percent in the city proper and by 0.3 percent across the broader metropolitan area. This makes San Francisco the only major metro that has yet to overtake early-2020 rent levels, though if current trends continue, that threshold will be overtaken soon.

In San Francisco, a demand boom has collided with a lack of supply

For San Francisco’s rental market, the writing was on the wall for years.

The pandemic created a highly lucrative environment for multifamily developers. In 2021, rent prices soared while interest rates were at historic lows, and investment poured into the construction industry. In a three-year period, more than 1.5 million new apartments were built across the country.

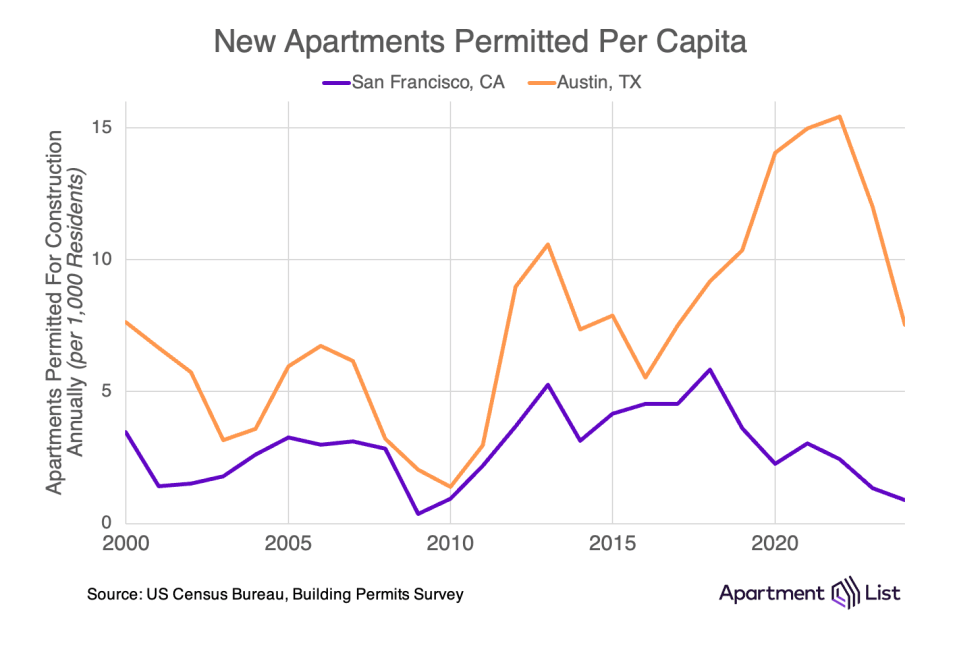

San Francisco, however, did not participate in this boom. We see this clearly in the number of building permits issued across the city. Since 2021 they have declined every year in San Francisco, while soaring in builder-friendly markets. Take for example Austin TX, a city that shares many commonalities with San Francisco: both have strong job markets that attract new residents, both have tech-driven economies where remote work is common, both have vibrant cultural scenes, both share liberal local politics. Yet the two cities take opposing approaches to growth: while San Francisco permits plummet post-pandemic, Austin has built more new apartments than anywhere else. At peak investment in 2022, when Austin permitted 15 new apartments for every 1,000 residents, San Francisco permitted just two.

The relationship between supply growth and rent growth is clear: the markets that build more apartments see fewer rent increases. Here again the gap between San Francisco and Austin is stark. Today as rents are up 10.6 percent in San Francisco, they are down 6.6 percent in Austin. This scenario is playing out across the country, especially in development-friendly markets like Denver, Phoenix, and Dallas, which are all witnessing price declines.

Where will the market go from here?

For affordability in San Francisco, a turnaround is unlikely. With higher interest rates, the development landscape has shifted and new permits are sinking across the country (just look at how sharply they have declined in Austin TX). And despite many public voices in San Francisco calling for more housing (including the new mayor), the lack of permits today tells us there is no construction boom on the horizon. Of course we cannot predict what will happen with the local economy, and if it slows, so too will demand for housing. But any supply-driven improvements to affordability are, unfortunately, far off.

Share this Article