- 44 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

Rental scams are out there to steal the money of unsuspecting renters. Sadly, there are always people out there ready to take advantage of you when you are confused and vulnerable.

When looking for their next apartments, renters share sensitive information and pay a lot of money upfront, which can be tempting for scammers. And according to a recent report, it costs unsuspecting renters nearly $16 billion each year. To help you avoid becoming another victim of rental scammers, we put together this guide with tips on spotting and avoiding rental scams.

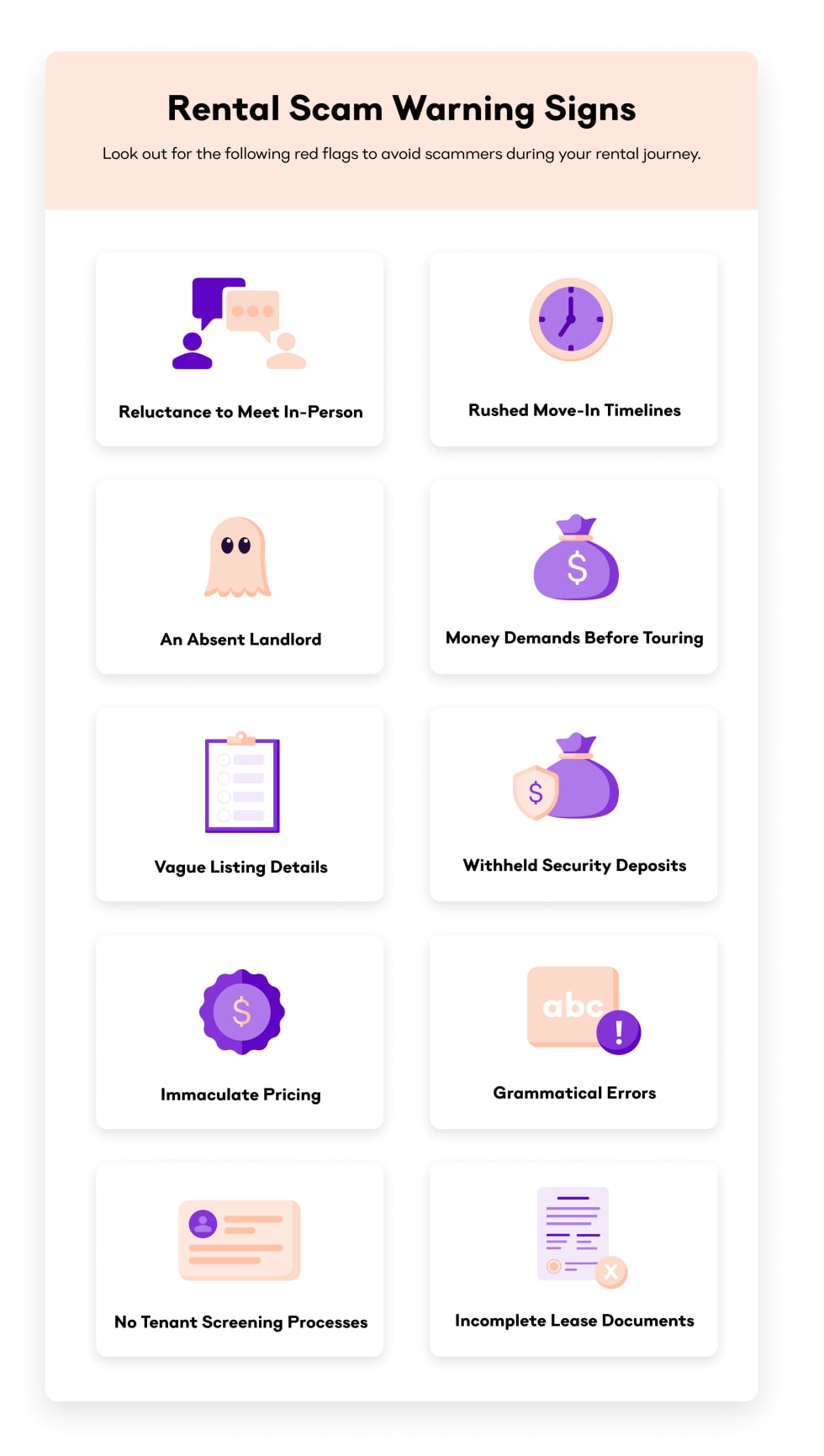

Unfortunately, common rental scams have become so prevalent that there are trends renters have started seeing. Here are the ten most common signs of rental scams to look out for.

A person tells you they are out of the country and can’t show you an apartment.

They might offer a lower rent for your inconvenience and send you fake keys, as long as you pay that security deposit before signing a lease.

You may experience a landlord who is rushing your move-in timelines. They’ll be using hard-selling techniques and saying that the rental is top-rated and there are a lot of potential applicants.

Similar to finding a listing where they are reluctant to meet in person, you may encounter an absent landlord. In these situations, the person who posted a listing is away on a business trip or vacation abroad.

They may also be pretending to be someone's landlord as a part of these rental apartment scams.

Be cautious if they want you to sign a lease or pay a deposit before seeing an apartment. Always make sure you see an apartment before you agree to make any type of payment.

Look out for a listing that lacks details, such as an address or photos of the property. Why would you pay big bucks for something you haven’t inspected beforehand?

Scammers know you can verify the rental by searching it on Google Maps and other rental websites. So put some effort into verifying listings to avoid rental fraud.

The scams regarding withheld security deposits may claim that the funds you sent never actually arrived. Or, in other circumstances, even though you left the place in great shape, they'll claim they need to keep the deposit to cover damages.

Picture this: you find THE perfect rental - in a great location with upgraded amenities. And the best part? It’s significantly cheaper than any other apartment in the area.

Great deal? Sorry to disappoint you, but it’s likely a scam.

Another red flag to look out for is if the spam listings contain too many grammatical errors or uncommon spellings of words.

Using the word “theatre” instead of “theater” doesn’t necessarily mean that they are fake apartment listings. However, we would advise you to proceed with caution.

Be on the lookout if there is no background check or credit checks. The lack of a screening process should make you suspicious.

Identifying a fake rental application is a quick way to figure out how to spot rental scams. A scam apartment rental will target people with criminal records and bad credit who struggle to find an apartment.

Lastly, be vigilant about lease documents that look incomplete. Fake rental leases are a scam that will collect your funds without any intention of ever renting you an apartment. Any documents from a verified renter should be complete.

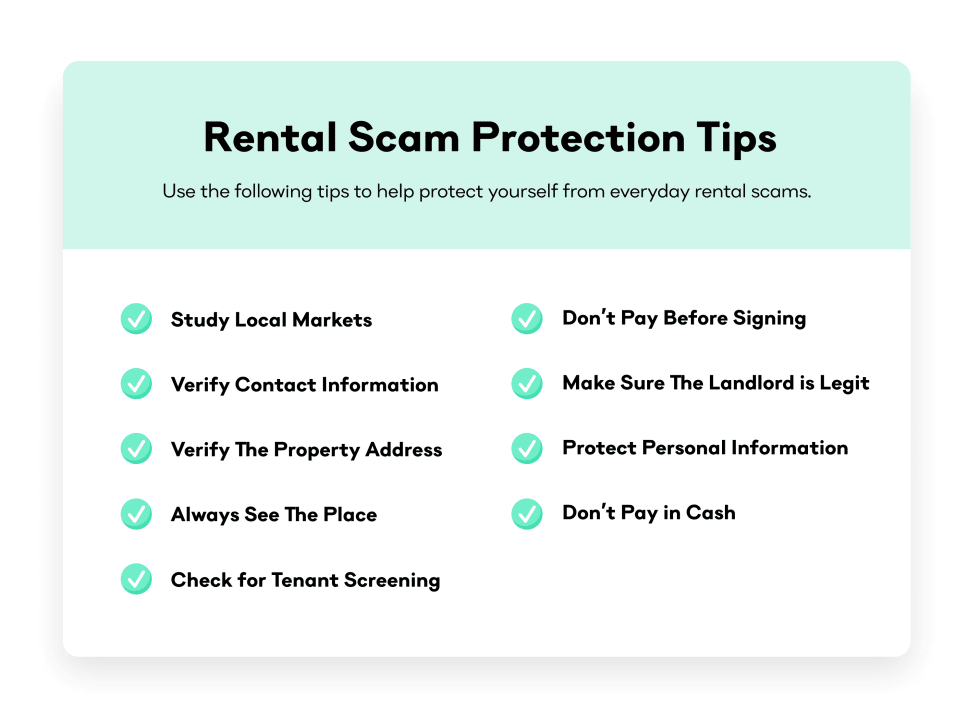

Although it can be frightening thinking about falling victim to a rental scam, there are ways you can remain vigilant. Here are some tips:

If you think you may have encountered a rental scam, report it immediately. Here are a few tips on how to catch a rental scammer and stop them from ripping anyone else off by reporting rental scams:

Renting an apartment can be stressful, especially with the threat of rental scams. Be sure to know what questions to ask when renting an apartment so you can remain vigilant throughout your apartment hunting process.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more