How Leasing Seasonality Has Changed & 9 Ways to Respond Accordingly

For decades, multifamily leasing followed a reliable rhythm: spring buzz, summer surge, fall slowdown. The seasonal playbook shaped everything from staffing calendars to marketing budgets. However, the old rhythm is starting to break and sticking to it could cost you.

Apartment List data shows that for the third year in a row, March, not July, marked the high point for rent growth. Pair that with Americans moving at the lowest rate on record (7.8% in 2023), and the old summer-spike playbook is delivering diminishing returns.

The pillars that once propped up seasonal leasing like job moves, school cycles, and housing upgrades are no longer as strong as they once were.

In this post, we’ll explore the ways you can adapt your operations to the “new seasonality” affecting the rental market (or lack thereof).

1. Understand the Forces Breaking Seasonal Leasing Patterns

The breakdown in multifamily seasonality is a symptom of America's broader mobility crisis. Americans are “stuck in place” at levels not seen since record-keeping began:

- Geographic immobility: Only 7.8% of Americans moved in 2023, the lowest rate since 1948.

- Job market paralysis: Worker job-switching rates have fallen from 2.8% monthly in the 1990s to 2.3% in the 2020s.

- Housing lock-in effects: Families with 3% mortgages won't move even when they need larger spaces.

- Golden handcuffs syndrome: Workers with stock options, bonus plans, and low-rate mortgages are staying put.

These trends are eroding the traditional seasonal demand drivers: job relocations, school-year transitions, and upgrade moves. Markets like Austin and Denver are feeling the downstream effects of reduced in-migration, while coastal markets like San Francisco are benefiting from the pool of renters who still relocate for work.

When those core demand triggers weaken, the calendar stops being a reliable guide for pricing, staffing, and marketing.

2. Use Local Data, Not National Averages, to Guide Decisions

Once you understand why seasonality is breaking down, the next step is measuring demand in a way that reflects today’s reality. National rent trends can set the context, but they won’t tell you if your 2BR units in Midtown are overpriced or your concessions are mistimed.

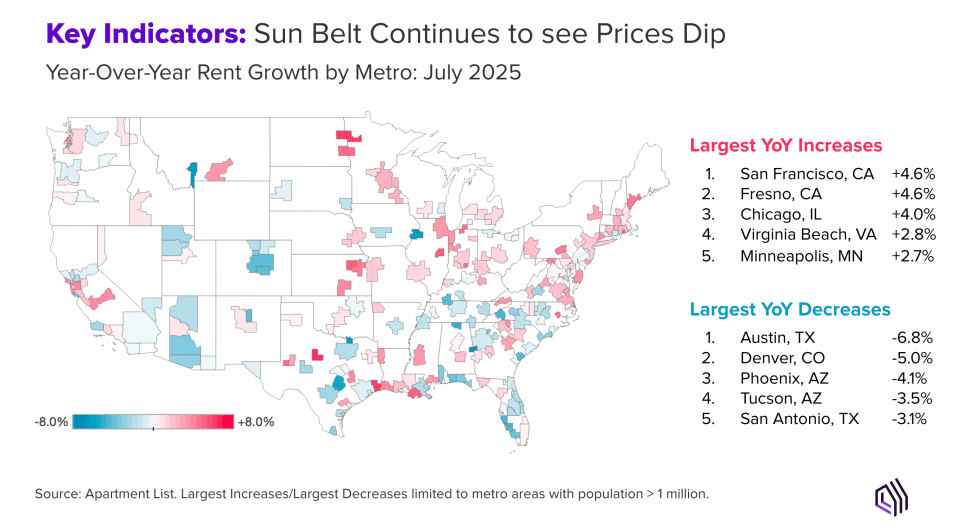

Apartment List data shows just how fragmented conditions have become:

- Sun Belt softness persists: Austin (-6.8%), Denver (-5.0%), Phoenix (-4.1%), and Tucson (-3.5%) are all posting year-over-year declines.

- Coastal and core markets rebound: San Francisco (+4.6%), Fresno (+4.6%), and Chicago (+4.0%) are seeing solid growth.

These are signs of a new baseline where local job growth, construction pipelines, and pandemic-era overcorrections dictate leasing conditions market by market. The implication is clear: national averages can frame the conversation, but submarket-level data and real-time conversion metrics are your true navigational tools.

3. Pinpoint Your Real Rental Demand Peak

If your highest leasing traffic hits in March but you forecast peak performance for July, you’re already playing from behind.

The fix starts with your own data:

- Audit the past 24 months of application volume, broken down by month, to pinpoint your real demand peaks.

- Align leasing schedules, renewal conversations, and concession strategies to those peaks, not the industry’s historical norms.

- Build pricing models that anticipate your busiest months so you can capture momentum instead of chasing it.

A simple shift in timing can create an outsized payoff. If March is your peak, start renewal offers in December, not February. It gives you a head start on retention, locks in high-value residents before they begin shopping, and frees up staff capacity to focus on incoming demand.

4. Stabilize Lead Flow with Smarter, Year-Round Marketing

If 60% of your budget goes to May - August and conversions are flat, then you’re gambling, not investing. Instead, build steady pipelines that deliver qualified leads year-round instead of chasing seasonal spikes.

How to shift from bursts to balance:

- Flatten your spend curve so you maintain consistent, high-quality traffic year-round.

- Layer evergreen channels like SEO, retargeting, and email nurture with short-term bursts during your actual peak months.

- Measure cost-per-retained-lease, not just cost-per-lead, so you’re funding the channels and timing that deliver lasting occupancy.

When your lead flow is stable, your pricing strategy is stronger, your teams are less reactive, and you can weather soft months without resorting to panic concessions.

5. Develop Rolling Forecasts to Prevent Occupancy Dips

Soft months are inevitable, the crux of the issue is when you wait until you’re already in the dip to respond. By then, the playbook usually looks something like: slash rents, stack concessions, and scramble to plug the holes. However, that is more akin to damage control than strategy.

Think of occupancy stability like an insurance policy; planned, funded, and ready to deploy.

Build a proactive framework:

- Run 90-day rolling forecasts so you’re spotting occupancy dips before they happen, not after.

- Pre-approve tiered concession strategies so you can act quickly without bottlenecks.

- Set renewal incentive calendars to target residents three months before projected softness.

- Offer flexible lease terms that help you capture demand whenever it surfaces.

In a market where demand patterns keep shifting, market leaders aren’t waiting for problems to show up in the data; they’re solving them before they start. This kind of foresight is most powerful when paired with tools that automate follow-up, optimize tour scheduling, and re-engage prospects so you’re never starting from zero when demand returns.

6. Leverage Submarket Intelligence to Outpace Competitors

Citywide rent growth figures won’t tell you why your specific 2BR units in one neighborhood are sitting empty while a competitor down the street is full, but hyperlocal data will.

Make your intel actionable:

- Audit competitor pricing weekly within a 0.5-mile radius – market shifts can happen faster than monthly reports.

- Monitor local hiring trends and new construction deliveries as leading indicators of demand swings.

- Gauge competitor conversions by tracking how quickly their available listings disappear. If they consistently come off the market faster than you, they’re likely converting at a higher rate.

- Watch lead-to-lease efficiency at your own properties. If a unit type converts at half the rate of comps, seasonality isn’t the issue; it’s pricing, positioning, or qualification.

When you can connect these dots in real time, you stop making reactive, “just match the market” moves and start setting the pace yourself.

7. Assess Your Market’s Stage in the Seasonality Shift

Understanding your market's maturity level determines how urgently you need to adapt and what opportunities you can capture.

Phase 1: Traditional Seasonal (Rare)

- Clear spring/summer demand spikes still reliable

- National trends roughly predict local performance

- Calendar-based planning still generates results

Phase 2: Fragmenting Seasonal (Most Common)

- Seasonal patterns weakening but not eliminated

- National trends increasingly misleading for local decisions

- Mixed results from traditional seasonal strategies

- Your current data shows: Rent growth peaks shifting earlier, summer performance underwhelming

Phase 3: Post-Seasonal (Emerging)

- Demand patterns driven by local factors, not calendar

- National seasonal trends irrelevant for local strategy

- Calendar-based budgeting actively counterproductive

- Your current data shows: March peaks, flat summers, unpredictable quarterly swings

Diagnostic Questions:

- Has your rent growth peak shifted earlier in 3+ of the last 4 years?

- Do your seasonal marketing spends generate lower ROI than previous cycles?

- Are submarket variations larger than citywide trends in your area?

If you answered "yes" to two or more questions, you're likely in Phase 2 or 3, and every quarter you operate with Phase 1 assumptions will cost you.

8. Capitalize on Low-Mobility, High-Selectivity Renter Dynamics

WSJ data shows 47% fewer Americans are moving within their own counties compared to three decades ago. While this signals a broader slowdown in economic mobility, it creates a clear advantage for multifamily operators who adapt.

When people move less, the residents you do attract become more valuable – they stay longer, invest more in their homes, and are less sensitive to moderate rent increases. However, they’re also more selective, making efficiency-based leasing and targeted marketing essential. In this environment, data-driven operations aren’t optional, they’re the differentiator. Superior timing, smarter pricing, and strategic resource allocation are now must-haves.

In practice:

- Market fragmentation creates pricing power for operators who understand their demand patterns while competitors guess.

- Weaker seasonality rewards consistency over boom-and-bust marketing cycles.

- Data advantages compound faster when others rely on outdated assumptions.

Those who will win in the next cycle aren’t waiting for seasonal “normal” to return, they’re performing year-round, no matter when demand appears.

9. Execute a 90-Day Plan for Sustained Performance

Insight without action won’t change occupancy. Use the next quarter to put these shifts in motion.

In the next 30 days:

- Audit 24 months of lead-to-lease conversion rates by month to pinpoint your real demand peaks.

- Benchmark current pricing against submarket comps, not city averages.

- Review marketing spend by channel and month, flagging where cost-per-retained-lease is highest.

In the next 60 days:

- Realign team goals and renewal offers to match actual peak periods.

- Pre-approve your tiered concession strategy and flexible lease term options.

- Implement weekly competitor pricing and conversion audits.

In the next 90 days:

- Test a “steady state” marketing spend model with targeted bursts in your true high-conversion months.

- Begin tracking local hiring and new construction activity as early demand indicators.

Your future performance depends on decisions you make now, not when the market is already moving. Winning in a “seasonless market” requires having the most timely data to guide your every move.

Ready to Turn Seasonality’s Decline Into Your Advantage?

Success in a seasonless market is about aligning staffing, marketing, and pricing to capture demand whenever and wherever it surfaces. This will require actionable data, smarter resource allocation, and a partner who shares your end goal: signed leases.

Apartment List is built for this new reality. Our unified, AI-powered platform spans the entire resident lifecycle, from attracting qualified renters to converting them into leases and retaining them long-term.

In a market where timing, efficiency, and conversion matter more than ever, we align our success with yours; no hidden fees, no rigid subscriptions, just performance-based results.

If you’re ready to adapt your operations to today’s demand patterns, connect with our team to learn more about how Apartment List can help you perform in every season.

Share this Article