Navigating the 2025 Rental Landscape: August Update

In our latest Rental Market Insights webinar, Apartment List Senior Economist Chris Salviati offered a clear-eyed view of where the rental market stands today.

Operators are navigating a peak leasing season that feels more like a plateau. Rent growth is flat, vacancies are rising, and renters are taking their time, but beyond all that lies a more nuanced picture of evolving renter behavior, regional divergence, and slow-moving supply shifts that could reshape strategy heading into 2026.

If you're making leasing, pricing, or investment decisions for the back half of the year, this recap will walk you through:

- What the data says about rent growth, regional shifts, and supply pressure

- Where renters are compromising and where they aren’t

- Why single-family rental growth matters to multifamily teams

- What operators should do now to stay ahead of a market that rewards agility

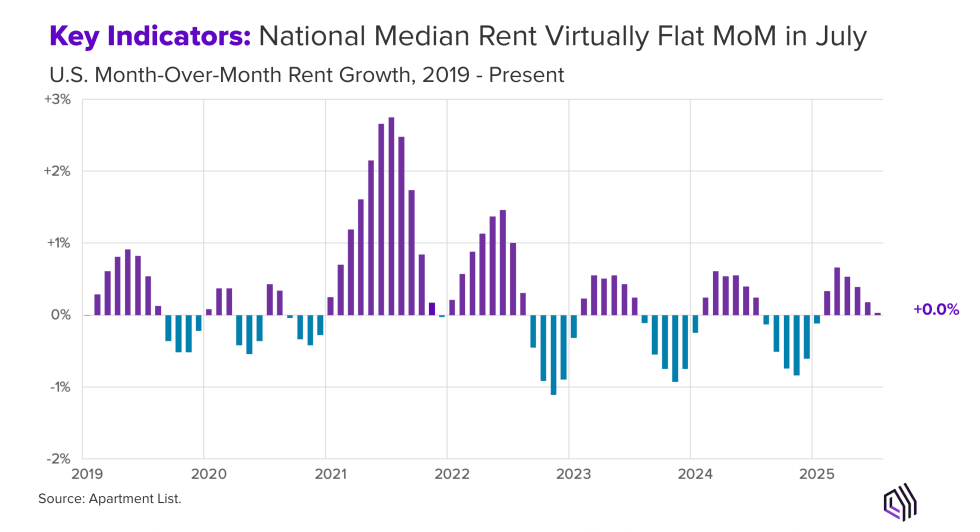

Rent Trends: A Lukewarm Peak Season

The summer leasing window typically delivers the biggest rent gains of the year, but this year, the season peaked early and flatlined fast.

Rent Growth Reality Check

Nationally, median rent was unchanged in July (+0.0% MoM) and is now down 0.8% YoY, continuing a soft stretch that’s defined much of the past two years. While some seasonal lift occurred in the spring, it wasn’t enough to reverse the broader cooling trend. In fact, March marked the high point for rent growth for the third consecutive year.

Today’s national median sits at $1,402, which is still 3% below the 2022 peak. Despite a wave of new supply and a return to stabilized household budgets, pricing power remains muted.

Key takeaway: Traditional seasonality no longer guarantees seasonal pricing leverage. Expect further softening into fall and plan accordingly.

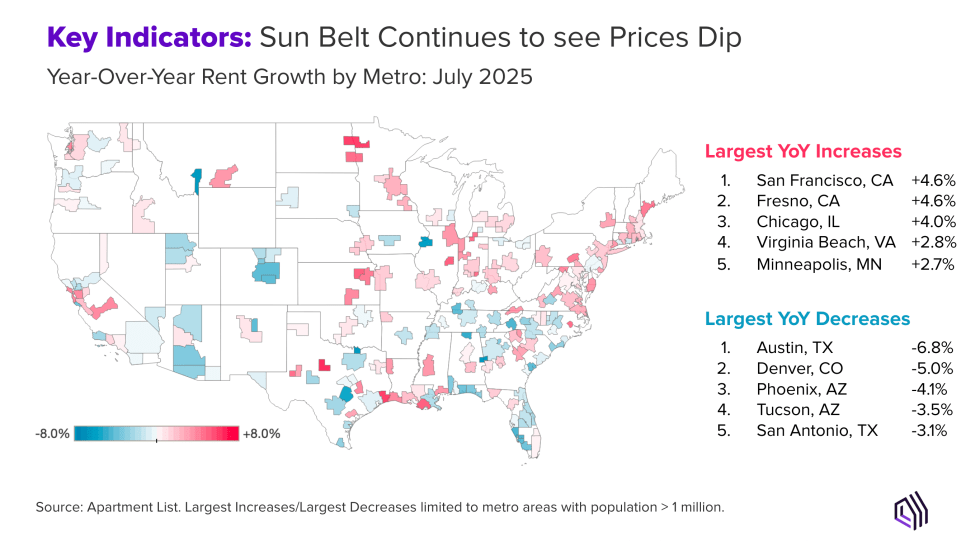

Regional Fragmentation Deepens

The national numbers mask a sharp divergence playing out across markets:

- Sun Belt softness continues: Austin (-6.8%), Denver (-5.0%), Phoenix (-4.1%), and Tucson (-3.5%) are still seeing YoY declines.

- Coastal and core markets rebound: San Francisco (+4.6%), Fresno (+4.6%), and Chicago (+4.0%) are posting solid growth, signaling renewed demand in some high-density metros.

This kind of fragmentation is the new baseline. Factors like local job growth, new construction volumes, and pandemic-era overcorrections are creating radically different rent environments even within the same state.

Key takeaway: National trends won’t help you price units. Submarket data and in-the-moment leasing signals are essential to striking the right balance between rent growth and occupancy.

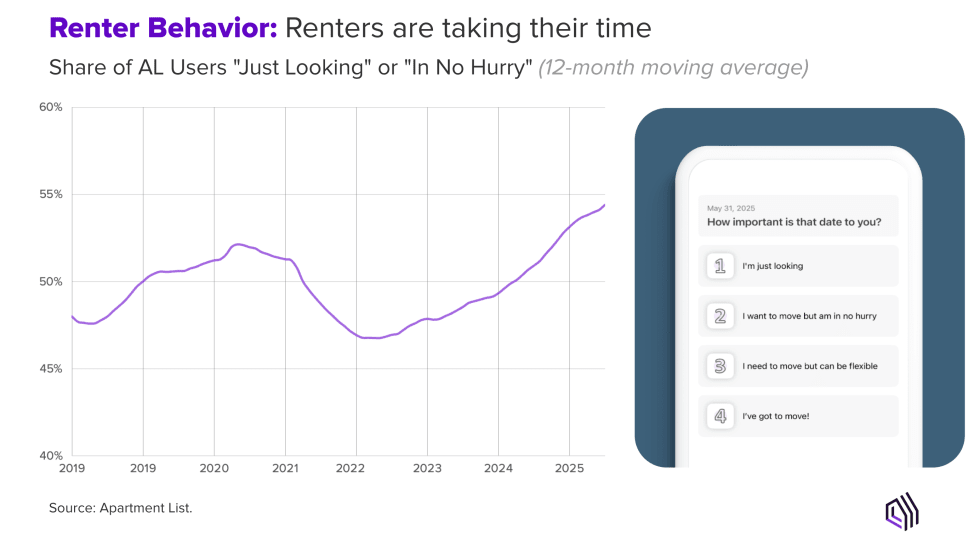

Renter Behavior: Picky, Deliberate, and Still Willing to Flex

Renters, depending on the submarket, now have considerable leverage. High vacancies and abundant supply are shifting the power dynamic. While renters aren’t necessarily rushing to sign, they’re doing their homework, taking their time, and making increasingly intentional decisions. However, that doesn’t mean they’re inflexible, most are compromising somewhere. The question for multifamily operators is: where?

Search Behavior Shifts

Low urgency is the dominant search mindset this summer leasing season. More than half (54%) of Apartment List users are browsing without a firm move-in date, an all-time high. It’s a sign of confidence and caution coexisting: renters know they have options, and they’re using that to their advantage.

Meanwhile, median list-to-lease time ticked up to 28 days in July, marking the first increase since January’s all-time high. That’s two days longer than this time last year and ten days longer than July 2021, when the market was at its tightest.

Key takeaway: Renters aren’t in a hurry, but they’re paying attention. Response time, clarity, and a seamless leasing process are now critical differentiators.

The Compromise Equation

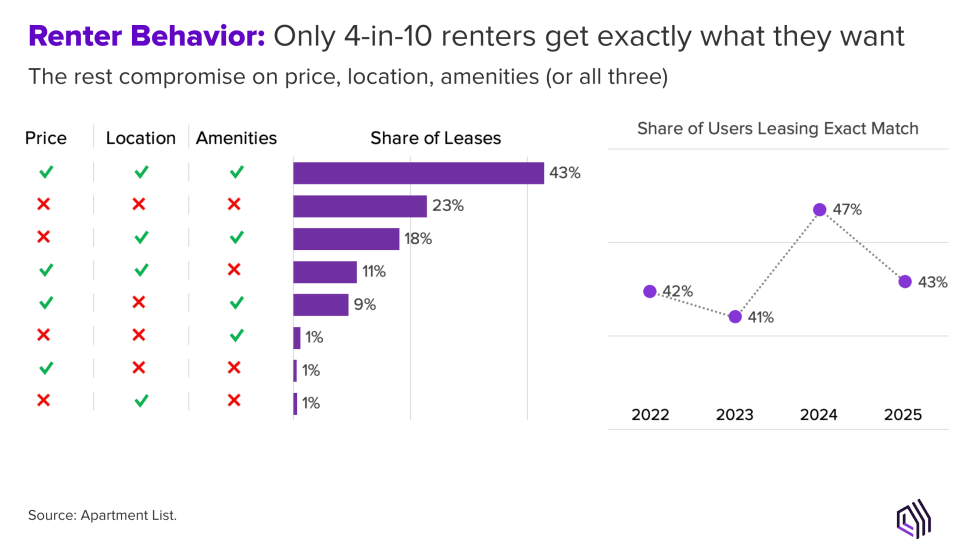

Renters say price is their top priority, but the data tells a more nuanced story.

- Only 43% of renters end up leasing a unit that matches all three of their stated preferences: price, location, and amenities.

- Another 43% go over their stated budget, with a median flex of $220/month. In high-cost markets like San Francisco or NYC, that flex is even larger.

This disconnect highlights a central truth: renters may start their search price-first, but they’ll flex if they find the right fit.

Key takeaway: Don’t assume budget is a hard line. If your property meets key emotional or lifestyle needs, many renters are willing to stretch, especially for location or in-unit comforts.

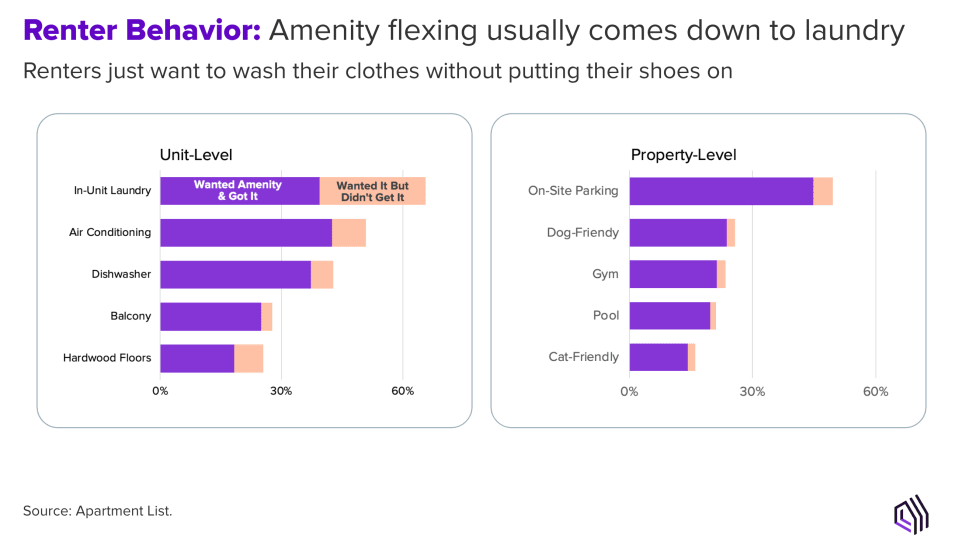

Amenity Insights: Laundry > Luxury

Operators often ask what features matter most. While flashy extras like pickleball courts or wine fridges get attention, the most frequently compromised amenity is in-unit laundry and it’s the one renters miss most. Roughly 25% of renters who wanted in-unit laundry ultimately leased a unit without it.

Other amenities (like air conditioning, gyms, or pet-friendliness) have lower compromise rates, suggesting that core functionality matters more than novelty.

Key takeaway: Amenity strategy doesn’t need to be extravagant, it needs to be aligned with actual renter preferences. When in doubt, invest in what simplifies daily life.

Supply & Macro Conditions: High Vacancy, Slow Stabilization

Even as new construction activity begins to taper, the market is still absorbing the supply wave of the past few years. Add macroeconomic pressure and homeownership hurdles into the mix, and multifamily operators find themselves in a stretched-out transition period, one that rewards patience, precision, and planning.

Construction Pipeline Receding, But Not Gone

There are still more than 700,000 units under construction nationwide, a hangover from the recent building boom. While new permits and completions are declining, the sheer volume of units still working through the pipeline is keeping vacancy elevated, now at 7.1% nationally, the highest level recorded in Apartment List’s data history, which goes back to 2017.

This oversupply is contributing to longer lease-up timelines and limiting pricing power in many markets. But there’s a silver lining: as deliveries slow, the market is on track for tighter fundamentals in late 2025 and into 2026.

Key takeaway: Now’s the time to tighten your operations. Lease-ups will remain competitive in the short term, but disciplined marketing, strong on-site execution, and pricing agility will position you for gains as conditions rebalance.

Macro Pressures & the Ownership Gap

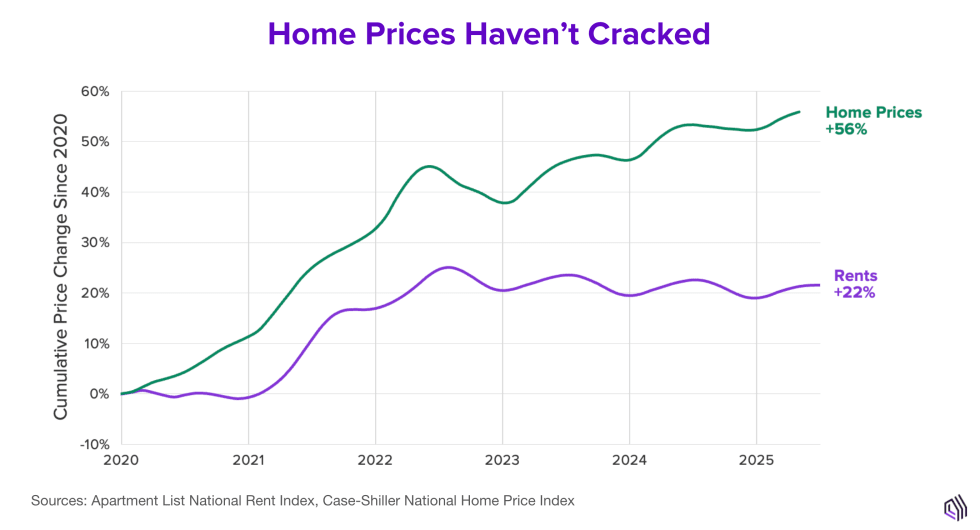

- The for-sale market continues to exert major influence on rental demand, just not in the way it used to.

- Home prices are up 56% since 2020, compared to a 22% increase in rents.

- Many potential buyers, especially Millennials, remain priced out – only 33% of Millennials own homes by age 30, compared to 42% of Gen X when they reached the same age.

- Elevated mortgage rates and a lack of seller movement are keeping the ownership market frozen, with low transaction volume and persistent affordability barriers.

This dynamic is forcing many would-be buyers to remain renters longer, a tailwind for demand, but one that’s increasingly shifting toward single-family rentals.

Key takeaway: Economic pressure is keeping younger renters in the multifamily ecosystem, but their lifestyle preferences are evolving. Understanding where they go and what they need is key to staying competitive.

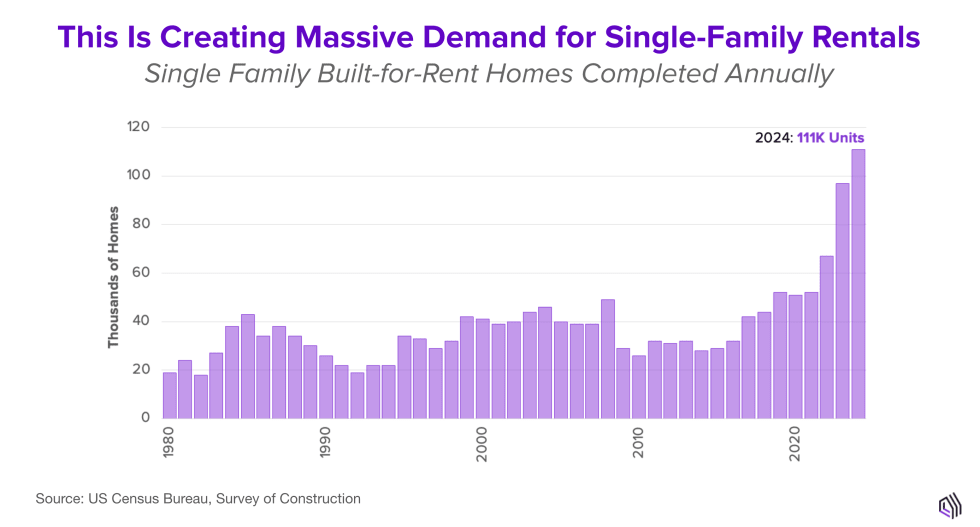

The Single-Family Rental Surge: Rethinking the Competition

In 2024, 111,000 built-to-rent single-family homes were completed, making up 10% of all new single-family construction. This segment isn’t niche anymore, it’s a fast-growing alternative for renters seeking more space, privacy, or a family-oriented lifestyle.

For traditional multifamily operators, this shift represents both a threat and an opportunity. In suburban markets, SFRs are direct competitors. But in others, they offer insight into what features matter most to long-term renters: storage, layout flexibility, parking, and neighborhood feel.

Key takeaway: Don’t dismiss single-family rentals, learn from them. Whether by adapting your marketing, exploring partnerships, or adjusting amenity and unit mix, operators who engage with this shift proactively will be better positioned to retain renters through life transitions.

Operator Playbook: Navigating the Second Half of 2025

The first half of 2025 confirmed what many operators suspected: this isn’t a typical recovery cycle. With rent growth flat, vacancies elevated, and renters holding more cards, the path forward requires sharp focus and strategic flexibility.

Here’s where to prioritize your attention and your resources as you move through the back half of the year.

1. Rethink Timing: Peak Season Is Evolving

In the past, rent growth traditionally peaked in June or July. But for the third year in a row, March delivered the strongest gains, suggesting a meaningful shift in leasing behavior and renewal patterns.

For multifamily operators, this means realigning internal calendars and marketing efforts to frontload demand earlier in the year and smoothing out leasing activity through non-peak months via creative incentives and renewal strategies.

What you can do now: Review renewal cycles, lease expirations, and marketing timelines. Planning around a March-April peak, rather than June-July, can help you capture momentum earlier.

2. Win on Experience, Not Just Features

With list-to-lease timelines stretching and renter urgency declining, the operator-renter relationship matters more than ever.

Speed of communication, clarity of information, and a seamless leasing process now carry as much weight as finishes or amenities. Renters may be browsing casually, but when they do engage, they expect responsiveness and will walk if they don’t get it.

What you can do now: Audit your lead response workflows. Are follow-ups timely? Are tours frictionless? Invest in systems (and team training) that make your process as seamless as your product.

3. Price for Precision

This is no time for broad-brush pricing. With fragmented performance across regions and even neighborhoods, submarket-level data is the only reliable guide.

In high-vacancy metros, a defensive pricing strategy may be needed to protect occupancy. In tightening markets, modest increases may be back on the table, but only with real-time validation. Pricing discipline is no longer optional.

What you can do now: Use both comps and performance data to guide decisions. Monitor concessions, tour-to-lease ratios, and submarket rent trends weekly, not monthly.

4. Prepare for 2026 Now

While conditions remain soft today, the data suggests a slow rebalancing is underway. Construction is tapering, supply will tighten, and when it does, those with leaner operations, more flexible teams, and a stronger renter experience will emerge ahead.

What you can do now: Treat H2 2025 as a training ground. Shore up staffing, invest in renter-facing tech, and revisit your long-term strategy before the market starts moving again.

Final Thoughts & Next Steps

If you’re waiting for a sharp rebound to reset the market, don’t hold your breath. The back half of 2025 won’t deliver dramatic shifts. Instead, it will reward operators who can stay light on their feet, tuned into local dynamics, and laser-focused on execution.

Here’s what the data (and experience) tells us:

- Act on local data. Don’t wait for national trends to validate pricing decisions.

- Stack small wins. Faster response times and better renter experience = compounding ROI.

- Keep it simple. Renters value clarity, comfort, and ease over complexity.

- Stay ready. Supply-demand dynamics are rebalancing; be the team that’s already prepared.

Want to dive deeper into the data or discuss how to apply these insights to your leasing strategy? We’ve got you covered.

Watch the full webinar recording.

Catch the full session with Apartment List Senior Economist Chris Salviati for a more detailed look at the charts, market breakdowns, and Q&A.

Stay informed with ongoing market insights.

Stay up to date with the latest data drops, economic commentary, and renter behavior trends.

Explore leasing solutions tailored to your market

From performance-based marketing to renter nurturing tools, our platform is built to help you navigate today’s challenges and convert more leads, faster. Connect with our team.

Share this Article