Facing Flat Rent Growth? How to Boost Performance in a Stabilizing Market

Multifamily professionals across the country are asking the same question: how do we deliver results when rents are barely moving?

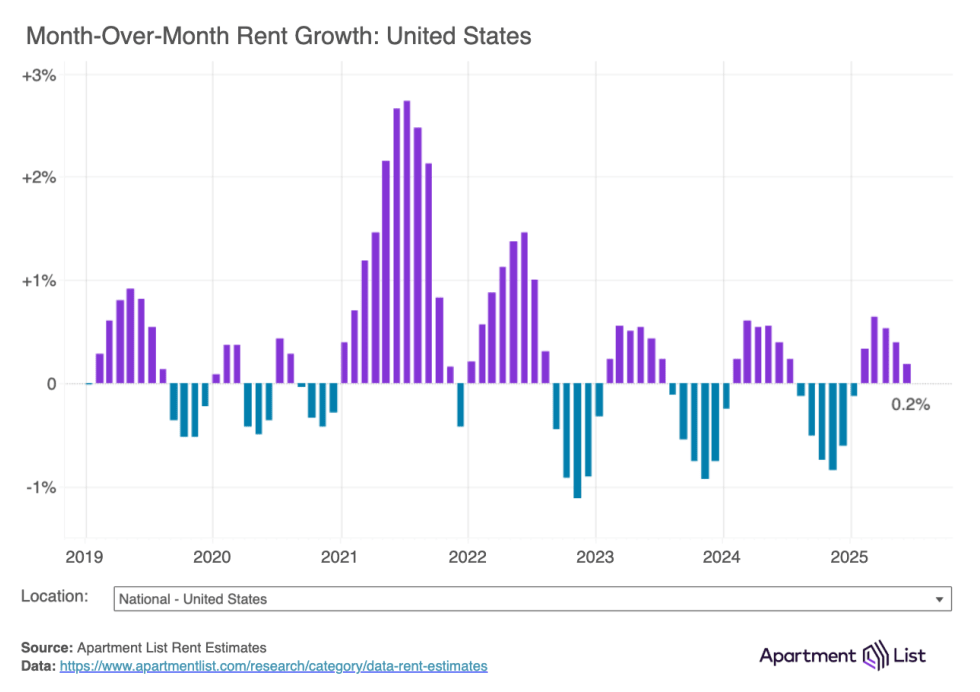

According to the latest data from our in-house research and economics team, national rent growth last month clocked in at 0.2%, despite summer being peak leasing season. Rents are down compared to last year, and the vacancy rate is the highest we’ve recorded. To put it simply: the easy wins are off the table.

Opportunity isn’t completely gone, but unlocking it will require sharper thinking, smarter systems, and greater operational rigor. In a flat market, financial performance is driven more by best-in-class operational execution rather than rent increases.

In this post, we’ll unpack what’s really happening in today’s rental landscape, using Apartment List’s latest data as our guide. Then we’ll outline clear, actionable strategies to help your portfolio stay competitive, drive stronger results, and build long-term advantages – even when the market is not doing you any favors.

What’s Happening in Multifamily Right Now?

The numbers tell a clear story: growth is softening, competition is rising, and multifamily operators are feeling the pressure to do more with less.

Let’s look at the data:

- National median rent rose just 0.2% in June, reaching $1,401 – marking the fifth straight month of sluggish growth.

- Year-over-year, rents are still down 0.7%, continuing a cooling trend that started mid-2023.

- Vacancy rates are holding at 7%, the highest we’ve recorded.

- Units are sitting longer, with a median 27 days from listing to lease, compared to 19 days during peak tightness in 2022.

The national story also isn’t telling the full story – across regions and submarkets, trends are diverging:

- Sun Belt metros are feeling the sharpest rent declines, with Austin down 6.4% year-over-year as new supply floods the market.

- Meanwhile, Midwest and Northeast markets like Chicago, Pittsburgh, and Providence are seeing modest but steady gains.

The market is stabilizing, not collapsing, but it’s clear that the conditions driving fast, easy growth are behind us for now. Multifamily property operators can’t count on rising rents alone to carry performance. The real differentiator moving forward is execution, meaning how effectively teams can lease smarter, retain residents longer, and control what’s within their reach.

The Systemic Shift: More Supply, More Choices

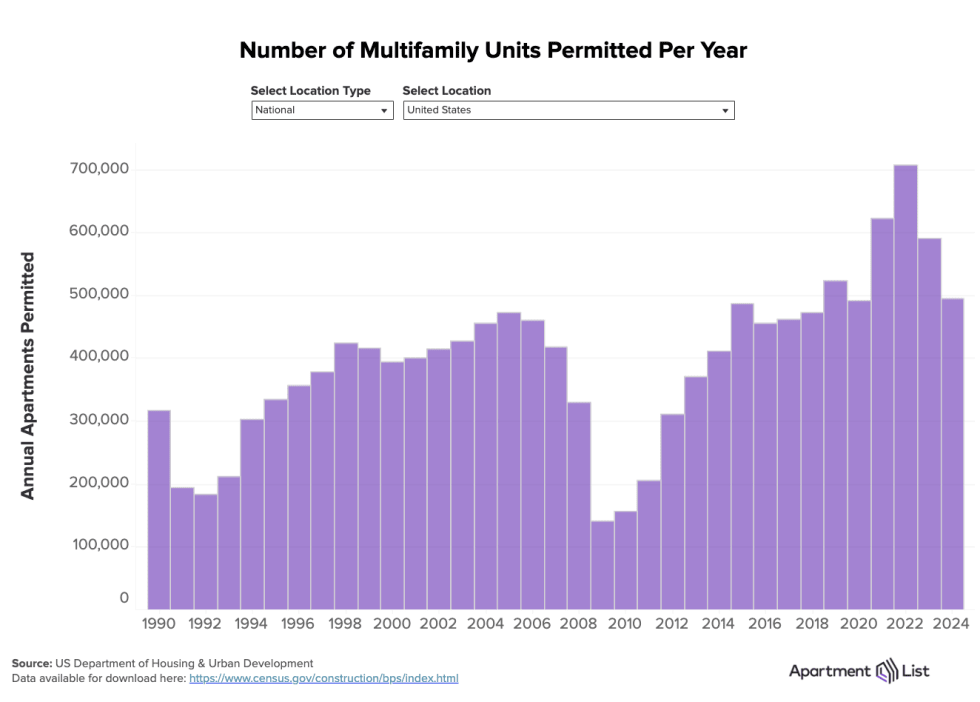

A historic flood of new supply continues to be one of the biggest forces shaping today’s flat rent environment.

In 2024 alone, more than 600,000 new multifamily units came online, a 65% increase from 2022 and the biggest construction year since the 1980s. And while development has started to slow, the market is still absorbing that wave.

Here’s what that means for operators:

- More options for renters = tougher competition for every lease

- Less leverage on pricing = growing pressure to differentiate beyond cost

- Rising vacancies = more units sitting longer, eating into performance

Even in metros where new construction has tapered off, absorption takes time. This is especially true in high-build markets like Austin, Phoenix, and Denver, where rent declines have tracked closely with permitting volume.

With more inventory and more informed renters, value is intrinsically tied to the full experience including leasing ease, responsiveness, flexibility, service. Gone are the days when value could mean updated floorplans and finishes. The teams that win in this market are offering great units and the reasons to choose them.

Bottom line: In a market flooded with choices, your competitive edge is performance, not pricing.

How Multifamily Teams Can Outperform the Competition in a Flat Market

When rent growth stalls, performance doesn’t have to. The best operators embrace the challenge, shifting from reactive mode to intentional, data-backed execution. Here’s how to take control of what you can.

1. Optimize for Retention, Not Just Leasing Velocity

When pricing power fades, holding onto residents becomes your strongest lever. Yet many teams still focus more on filling units than keeping them.

What to do:

- Start renewals early: Don’t wait until 60 days out, begin the conversation as early as 90–120 days to get ahead of competitor offers. Solutions like A-List Resident can help identify expiring leases, send personalized outreach, and capture intent, so your team can step in when it matters most

- Tailor your outreach: Use resident behavior and preferences to shape personalized incentives, not blanket discounts.

- Upgrade what matters: Residents notice maintenance speed, clear communication, and flexible billing far more than aesthetic perks.

2. Grow Revenue Beyond Rent

When rent growth is flat, ancillary income becomes a key lever. However this doesn’t mean just tacking on random fees. Think of it as packaging value in ways residents opt into, not push back on.

What to do:

- Repackage what matters: In-unit laundry, reserved parking, smart home tech… these things can drive leasing decisions. Unbundle where it makes sense, and price upgrades as opt-in tiers.

- Use pricing psychology: Tiered amenity packages give residents choice and boost perceived value. Frictionless add-ons often outperform flat fees.

- Expand your service stack: Partner with delivery lockers, security, or cleaning services to offer fee-based convenience without adding work for onsite teams.

- Revisit pass-throughs: Utility reimbursements and package fees should be regularly benchmarked and transparently communicated, not set-and-forget.

Why it works: Smart ancillary income design can create steady, incremental lift especially when base rent increases are hard to come by.

Why it works: Reducing turnover protects cash flow and it frees your team to focus on higher-impact work instead of constant backfilling.

3. Use Data to Guide Leasing & Marketing

Success in a soft market starts with better targeting, not louder shouting.

What to do:

- Price hyper-locally: Use street-level rent comps and absorption data. Block-by-block pricing beats citywide averages.

- Test and learn: Not all concessions are created equal. Try flexible move-in dates or free parking and measure retention, not just clicks.

- Speed wins: If your list-to-lease time is lagging behind the market 27-day average, find the bottleneck. Fast response = higher conversion.

- Why it works: Informed decisions make your spend go further and ensure you’re not burning days or dollars chasing the wrong leads.

4. Control the Controllables

When growth slows, efficiency becomes your margin engine. Every controllable detail adds up.

What to do:

- Audit expenses: Renegotiate vendor contracts, trim tech that doesn’t earn its keep, and revisit turnover processes for speed.

- Shorten downtime: Identify which units are dragging and deploy targeted marketing or pricing adjustments quickly.

- Benchmark obsessively: Compare not just against your comp set, but against your own internal performance and act on what you learn.

Why it works: You can’t always control the market, but you can control how efficiently you operate inside it.

Thinking Beyond the Unit: Macro Signals & Future Moves

Flat rent growth can feel like a ceiling, but it’s really a signal. The market is shifting, and the smartest teams are already adjusting how they plan, invest, and operate based on what’s coming next.

Watch for Absorption Signals

Vacancy can be a lagging indicator and a strategic compass.

- The 7% national vacancy rate reflects the flood of new units still being absorbed.

- But absorption is happening unevenly and faster in some markets than others.

- Expect a gradual tightening, especially in oversupplied metros like Austin, Phoenix, and Denver, where construction is finally tapering.

Why it matters: Knowing when your market is likely to rebalance helps you time pricing changes, hiring plans, and capital improvements, so you’re not caught off guard.

Think Regionally, Not Just Nationally

Some markets are already turning the corner. The Midwest, Northeast, and parts of California are seeing year-over-year gains as supply pressure eases.

- San Francisco: Up 4.9% year-over-year

- Chicago, Pittsburgh, Hartford: Seeing steady growth and tighter inventory

What to do:

- Adjust marketing and pricing strategy based on regional dynamics, not national headlines.

- For multifamily operators with national portfolios, shift attention and investment toward regions showing early signs of strength.

Build Now for the Recovery Later

In flat markets, it’s easy to focus only on short-term survival, but downturns are where operational advantages are built.

Where to invest now:

- Staffing and training: Ensure your leasing teams are set up to convert effectively before demand returns.

- Tech that scales: Implement systems that improve performance today but scale seamlessly as leasing volume rebounds.

- Reputation and reviews: Residents are paying attention. Strong service today turns into trust (and leads) tomorrow.

Takeaway: Flat growth doesn’t mean it's time to stand still. Now is your window to refine operations, reposition your portfolio, and prepare to outperform when the market rebounds.

Your Competitive Advantage: It’s All in How You Execute

When rent growth is booming, it’s easier to look like a top performer. However, in a flat market, performance is earned, not inherited.

That’s what makes this moment an opportunity. With rents leveling off, the advantage shifts to the operators who run smarter, move faster, and adapt with intention. This is when the best teams separate themselves and stand out as market leaders.

- By tracking what others overlook: Monitoring lease performance by unit type or floorplan, not just by building to spot gaps and act early.

- By retaining residents others lose: Engaging early on renewals, solving issues before they escalate, and offering real reasons to stay.

- By converting leads others waste: Following up faster, nurturing more effectively, and using performance-based tools that prioritize quality over quantity.

- By controlling costs others ignore: Auditing operational spend, optimizing turnover processes, and squeezing more value from every partner and platform.

Flat growth shouldn’t be a dead end for multifamily teams. As our research and economics team said in our June rent report: “All of our key indicators are pointing toward a sluggish summer moving season... A return to tighter market conditions should still be on the horizon as the supply wave continues to recede.”

The rebound will come, but it won’t arrive evenly. Teams with the right systems and habits in place now will be the ones best positioned to seize the upswing when it does.

Ready to Refine Your Team’s Performance?

Conditions have changed and so must the playbook. Flat rent growth, rising vacancies, and slower lease-ups mean performance requires more strategic execution.

There are levers your team can pull right now like heightened retention strategies, refined positioning, and more efficient operations. None of these require reinvention or overhaul, but can be developed through continuous execution with intent.

Your next move should involve picking one strategy from this post, whether it’s a proactive renewal plan or an audit of your list-to-lease times, and formulating the steps to act on it within the next week. Small shifts now can lead to bigger performance gains later.

If you’re ready to level up how you lease in this market, Apartment List is here to help. Explore how our Smart Leasing Platform can help your team lease smarter, even in a flat market.

Share this Article