The Renters Who Never Inquire: Why Your Best Leads Might Be Lurking

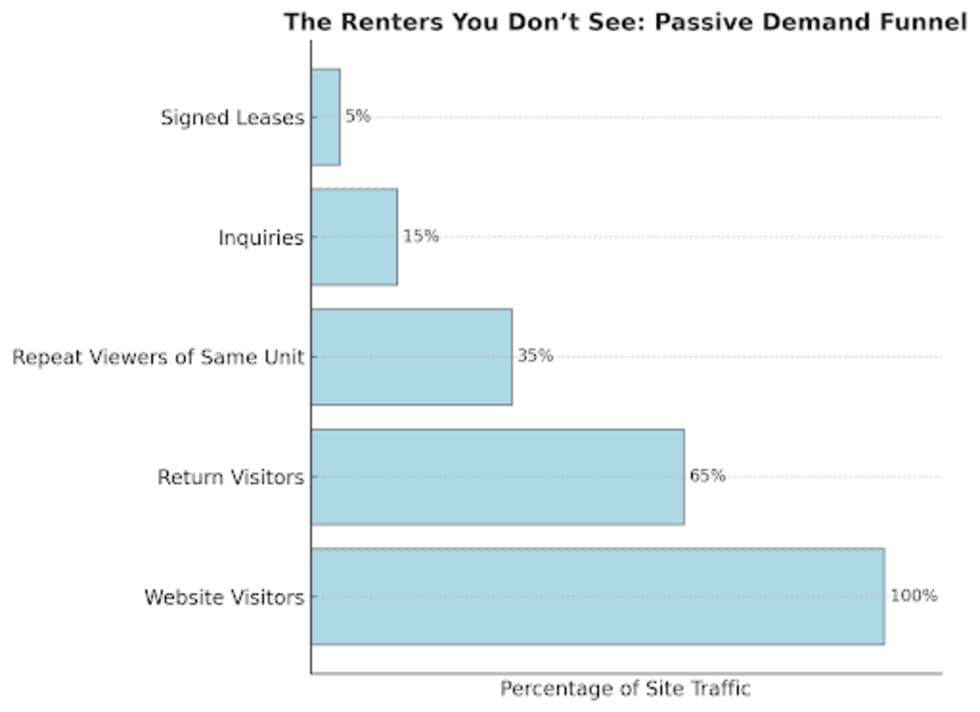

Not every renter knocks on your door these days, but many are still peeking through the window. Behind your pageviews are renters who return to listings again and again. They filter, scroll, compare, and then might vanish without ever submitting a lead. To some teams, they’re unreachable, but these so-called “lurkers” may represent your highest-value prospects.

They’re not intentionally flaky, it’s due to rising financial pressure, decision fatigue, and risk aversion, especially in high-cost markets where a single lease carries enormous economic weight.

The most adept multifamily operators are learning to spot, understand, and activate the demand that’s already right in front of them – demand that looks quieter, takes longer to convert, but often results in higher-quality outcomes.

In this post, we’ll:

- Unpack the psychology behind today’s hesitant renter.

- Explore the behaviors that signal hidden intent.

- Share actionable strategies for surfacing and converting prospects who never inquire, but might be ready to move.

Why Good Leads Stay Quiet: The New Renter Psychology

It’s easy to assume renters who don’t inquire aren’t serious. When you look at the numbers, a more nuanced picture emerges, one rooted in economic stress, not lack of intent.

According to a recent analysis by Self, powered by Apartment List data, the average U.S. renter now needs to work 38.3 hours each month just to afford the median rent. In major metros, the burden is far heavier:

- New York: 90.2 hours

- Miami: 89.4 hours

- San Francisco: 81.9 hours

States like Vermont, Hawaii, California, New Jersey, and Maryland all demand more than 50 work hours per month for rent alone. That equates to more than a full week of income, gone before food, transit, or utilities are even factored in.

This financial pressure shapes behavior. Renters aren’t browsing aimlessly, they’re evaluating cautiously. With budgets stretched thin, every housing decision feels high stakes. That leads to:

- Decision fatigue from endless options that aren’t quite affordable.

- Fear of wasted time or rejection due to credit checks, application fees, or being ghosted by leasing teams.

- The trauma of “almosts”: units that feel perfect until the math or timing doesn’t work out.

- Prolonged search cycles as renters research, wait, and weigh trade-offs.

This is hesitancy born from economic reality. When rent consumes a week or more of wages, every step, from scheduling a tour to submitting a lead, carries emotional and financial weight.

And that weight isn’t always evenly distributed, a renter working 35 hours to afford rent in Kansas City behaves differently than one working 90 hours in New York. Understanding the local affordability context is crucial – multifamily operators can’t expect a one-size-fits-all approach to work when pressures can vary so widely.

The Behavior Behind the Silence: What the Data Reveals

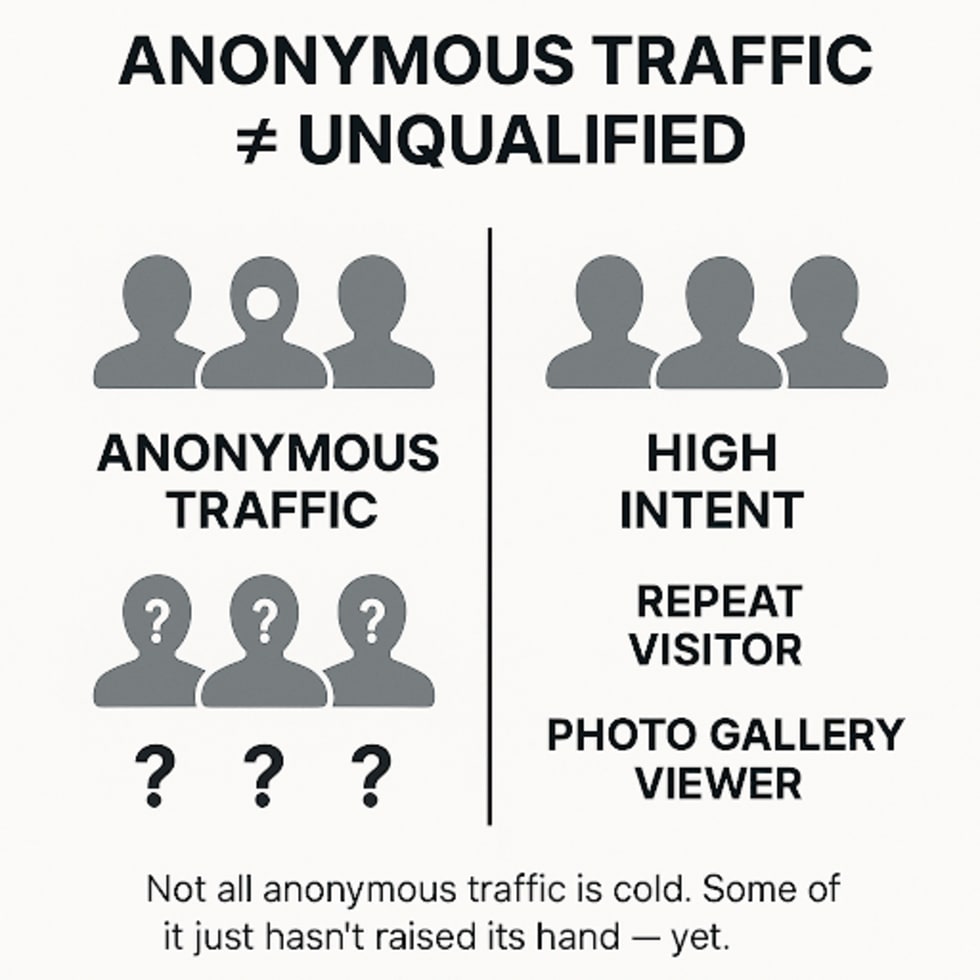

What looks like a passive browser may actually be a deeply engaged, highly motivated renter, just one who needs more assurance, validation, and clarity before they’re ready to act.

These are renters who return to the same listings, dig deep into photo galleries, toggle between unit plans and never submit a lead. On the surface, it might look like indecision, but these are actually intent signals.

Don’t think of these renters as flaky, they’re cautious, serious, and thorough. Some examples:

- Multiple return visits to the same property or zip code

- High time-on-page with specific floor plans or photo galleries

- Consistent filtering by price, amenities, or neighborhood

- Activity across devices mobile scrolling followed by desktop review

Think of them as “loyal browsers.” They treat listing sites like research tools, bookmarking options, comparing details, and building a mental short list. They’re often deeply familiar with your inventory even if they haven’t made contact yet.

These behaviors are not random, but most traditional lead scoring systems aren’t built to detect them. Even more important, these behaviors shift based on local context. A repeat visitor in Kansas City may be weighing lifestyle fit. In New York, that same behavior could reflect extreme affordability pressure. Without that context, operators risk misreading valuable intent.

These quiet clues, when interpreted correctly, can reveal some of your most motivated prospects.

4 Challenges Multifamily Teams Face Trying to Capture Passive Demand & How to Solve Them

In a market where renters hesitate and marketing budgets face scrutiny, multifamily operators need systems that go beyond traditional lead capture. Below are four challenge-solution frameworks for turning passive browsers into active prospects.

Challenge 1: You don’t know who they are

The Problem: Anonymous traffic can feel invisible, you can see the pageviews but not the intent behind them.

The Solution: Behavioral Tagging + Session Analysis

Transform anonymous browsing into actionable intelligence by tracking behavioral patterns that signal high intent:

- Flag specific behaviors: Repeated views of the same unit, extended time in photo galleries, consistent search filters across sessions.

- Map return visitor patterns: Track frequency, recency, and depth of engagement over time.

- Integrate with your CRM: Layer behavioral data into your existing systems for systematic follow-up.

Real-world scenario: A renter views the same 2-bedroom unit five times over two weeks, spending 3+ minutes in the photo gallery each visit. Don’t think of this as indecision, think of it as research and flag them for targeted outreach.

Challenge 2: They’re not ready to talk yet

The Problem: Traditional lead forms feel too aggressive for renters who are still in research mode.

Solution: Soft conversion tools

Create low-friction ways for renters to signal interest without pressure:

- Save searches and "favorite" units: Let renters self-identify interest at their own pace.

- SMS alerts for availability changes: "The 1-bedroom you viewed just dropped $50/month".

- "Notify me" features: Perfect for renters interested in a specific unit type or price range.

This allows you to build permission to re-engage over time, warming prospects before they're ready for a leasing conversation.

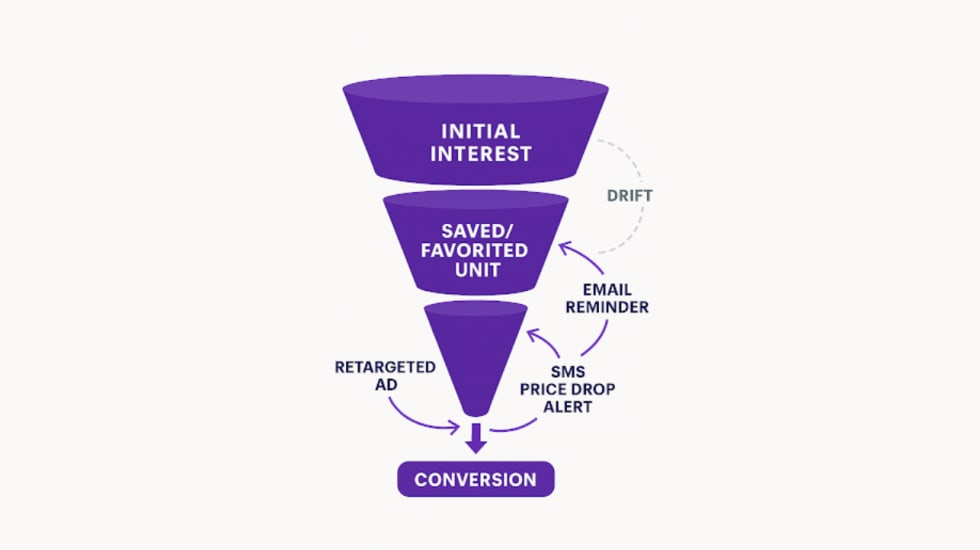

Challenge 3: They drift away

The Problem: Even high-intent renters get distracted, overwhelmed, or discouraged without the right follow-up.

Solution: Behavioral retargeting + market-specific nurture

Deploy contextual remarketing that speaks to local affordability realities:

For high-cost markets (50+ work hours for rent):

- Emphasize value propositions: "No application fees this month".

- Highlight flexible lease terms or move-in specials.

- Address affordability concerns with transparent cost breakdowns.

For moderate markets (35-45 work hours for rent):

- Focus on lifestyle benefits and community amenities.

- Emphasize move-in ease and leasing team responsiveness.

- Showcase neighborhood advantages and convenience factors.

Tactical examples: Email campaigns triggered by saved searches, retargeted ads featuring price drops on previously viewed units, SMS reminders when matching inventory becomes available.

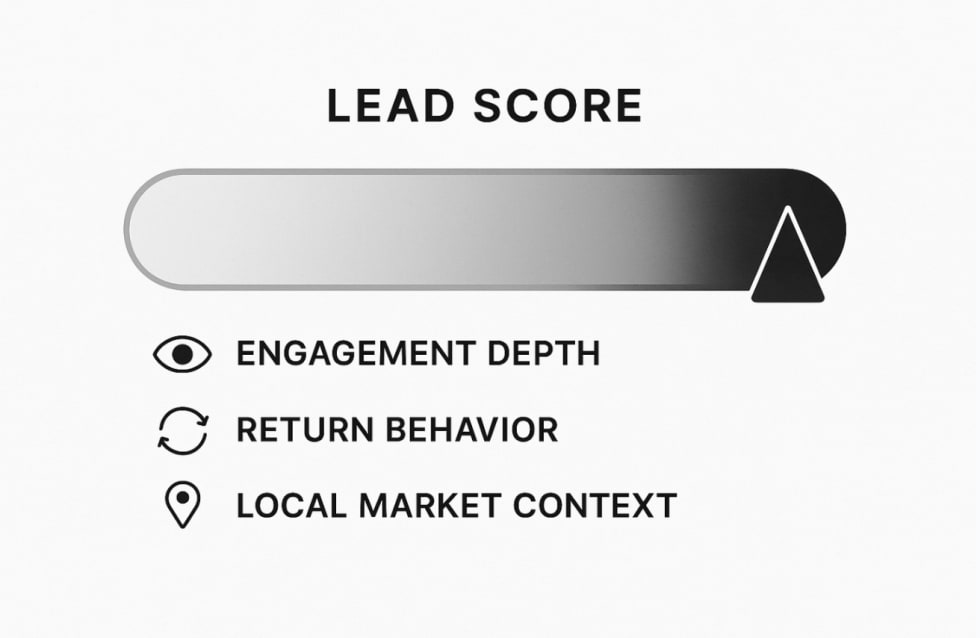

Challenge 4: You don’t know who to prioritize

The Problem: Not all prospects are equal, and some non-inquirers are more valuable than casual form fills.

Solution: Predictive lead scoring + quality-focused platforms

Move beyond "last touch" attribution to behavioral pattern analysis:

- Score based on engagement depth: Frequency of visits, time spent on specific units, search refinement patterns.

- Weight return behavior: A prospective renter who returns after a price change shows higher intent than a one-time visitor

- Factor in local market context: Browsing behavior means different things in different affordability environments.

The strategic shift: Partner with platforms that specialize in surfacing high-intent, move-ready renters rather than building complex tracking systems in-house. Not all inquiries are created equal, and some non-inquirers are your most likely conversions.

Why This Matters More in Today’s Market

In a hot market, visibility isn’t a problem. Renters are eager, leasing teams are flooded, and even a basic lead capture setup can deliver results.

But today’s market conditions are different… rent growth has flattened, vacancies are stabilizing. Demand is still there, but it’s harder to see, slower to act, and spread more thinly across your digital footprint.

The multifamily operators who win today are better at capturing "invisible" intent, the kind that hides behind saved searches, repeat visits, and cautious scrolls. They're doing it with smarter systems that don’t rely on old-school volume metrics alone.

Most property teams lack the internal resources to build sophisticated behavioral tracking and nurture systems from scratch. The solution isn't hiring more staff or spinning up custom analytics tools, it's partnering with platforms that already understand renter behavior patterns and can deliver higher-quality, move-ready prospects.

What If Your Best Renter Never Inquired?

At Apartment List, we've built our performance-based marketplace specifically for this new reality. Our platform doesn’t just generate leads, it surfaces demand that's already there, using GenAI, behavioral insights, and local market context to identify renters who are more move-ready.

The most successful operators in today's market are surfacing “hidden” demand by using behavioral insights, market-specific messaging, and the right technology partners to convert renters who might otherwise slip through the cracks.

Ready to capture the demand that's hiding in plain sight? Apartment List's performance-based marketplace is built for operators who want to connect with prospects who are ready to move.

Learn how Apartment List helps operators identify and convert high-intent renters more effectively.

Share this Article