Rents Are Falling, but They're Falling Slower In the Suburbs

The rental market is taking a deep breath in 2023. Double-digit annual rent growth persisted in 2021 and 2022, but has swiftly fallen to -0.7% as of our most recent estimates for July, meaning apartments are renting for less today than they did one year ago. This is the first year-over-year price drop the rental market has experienced since the early days of the COVID-19 pandemic.

One of the defining features of the pandemic rental market is a gap that emerged between core and suburban cities.1 Since 2020, rapid rent increases have been concentrated in America’s suburbs, which saw huge influxes of new residents that in turn placed extreme pressure on existing housing supply. Core cities got more expensive as well, but there, rent increases came later and moved slower. Between March 2020 and July 2022, suburban rents increased 27 percent compared to 20 percent in core cities. One year later, pandemic rent growth sits at 25 and 18 percent respectively, following a modest drop in rent.

Use the interactive chart below to compare urban and suburban rent growth in some of the nation’s largest metropolitan areas.2

The Urban-Suburban Gap Is Widening Even As Rents Fall

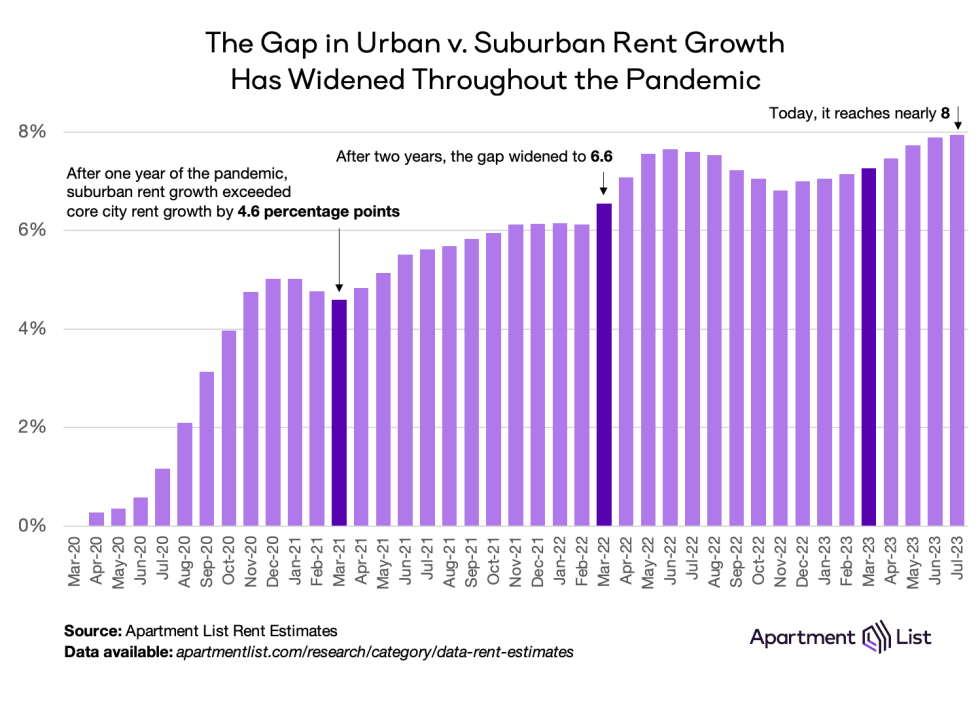

A quick glance at the national data shows that even though rents are down year-over-year, an affordability windfall is not reaching the suburbs. In fact, the urban-suburban gap has widened steadily for the past eight months because rent drops have been slower in the suburbs than in core cities.

The data here span 33 metropolitan areas: 33 core cities and 387 suburbs in total. Today, year-over-year rent declines have reached -1.7 percent in core cities and -1.2 percent in suburban ones. This means that over the course of the pandemic, suburban rent growth has outpaced core city rent growth by nearly 8 percentage points, the highest it has ever been. Most of the gap emerged within the first 12 months of the pandemic, but has widened steadily since then.

In some metropolitan areas, the urban-suburban gap is more than twice the national average. This includes a handful of dense, coastal metros like Seattle WA; Los Angeles, CA; and Washington, DC; where core cities experienced deep rent cuts early in the pandemic are just now returning to pre-pandemic prices.

New York City metro notably breaks this trend, and is one of just five metropolitan areas where the gap is reversed. There, pandemic rent growth is actually higher in the urban core than in the surrounding suburbs. Outside New York, this trend is most common in large but lower-density metros like Tampa, FL and San Jose, CA.

| Metropolitan Area | Rent Growth, Core City | Rent Growth, Suburbs | Gap |

|---|---|---|---|

| Portland, OR | 1.7% | 22.8% | 21.1% |

| Seattle, WA | 2.0% | 19.0% | 17.0% |

| Detroit, MI | 9.2% | 26.0% | 16.8% |

| St. Louis, MO | 10.4% | 26.5% | 16.1% |

| Atlanta, GA | 16.0% | 31.2% | 15.3% |

| Nashville, TN | 19.7% | 34.6% | 14.9% |

| Chicago, IL | 13.8% | 28.4% | 14.7% |

| Los Angeles, CA | 6.9% | 20.5% | 13.6% |

| San Francisco, CA | -11.8% | 1.7% | 13.5% |

| Washington, DC | 3.8% | 16.7% | 12.9% |

What’s Next for Suburban Rental Markets?

Rent growth should continue to cool in the coming months, as fewer moves take place during the winter and a strong construction pipeline creates new apartment vacancies. But it remains to be seen if forthcoming rent drops will remain concentrated in urban centers or if they will proliferate outwards to the suburbs.

As more workers return to downtown offices, some apartment demand should shift inward towards core cities. And a recent study found that the majority of last year’s new building permits were issued in suburban areas. These trends suggest that we are moving in the direction of better supply-demand balance in the suburbs. Nevertheless, rents in many suburbs are over 20 percent higher today than they were in 2020, so strong supply growth must be maintained for years to reclaim some of the affordability that was lost during the pandemic.

- Within a metropolitan area, we define the “core city” as the single largest city by population, while all other cities are considered “suburban.”↩

- This study includes data for 32 large metropolitan areas. These are the metros for which we have complete historical rent data for the core city plus at least three suburbs.↩

Share this Article