- 97 units available

- 1 bed • 2 bed

- Amenities

In unit laundry, Granite counters, Hardwood floors, Dishwasher, Pet friendly, 24hr maintenance + more

Reletting fees are fees charged by landlords or rental companies to terminate your lease early. Renters move for all kinds of reasons, from new jobs and wanting to change roommates to simply deciding they need a fresh start.

However, if you’re considering leaving your apartment before the lease agreement ends, you may need to pay a reletting fee.

But what is this fee, and how is it different from breaking your lease, paying a penalty, or losing your security deposit? Here’s what you need to know before you make your exit.

If you terminate your lease early, landlords and property managers may charge a reletting fee. The cost of the fee serves to market the unit, screen applicants, process paperwork, and prepare the lease for the next renter.

The fee isn’t considered a penalty and doesn’t necessarily mean you broke the lease. In fact, your landlord may impose the reletting fee even if your lease agreement allows it or if you got permission in writing.

The reletting fee is typically outlined in your lease agreement under a section about early termination or reletting terms, shifting the burden of reletting back onto the tenant.

Reletting fees will vary by location and landlord, but they are usually equal to one month’s rent. Other apartment leases may specify a flat fee, such as $500 or $750.

Other reletting fees may be calculated as a percentage of your monthly rent, which is usually 85% to 100%. That means that if your monthly rent is $1,200, and the reletting fee is 100% of that amount, you’ll owe $1,200—even if the unit is rented out to someone else the very next day.

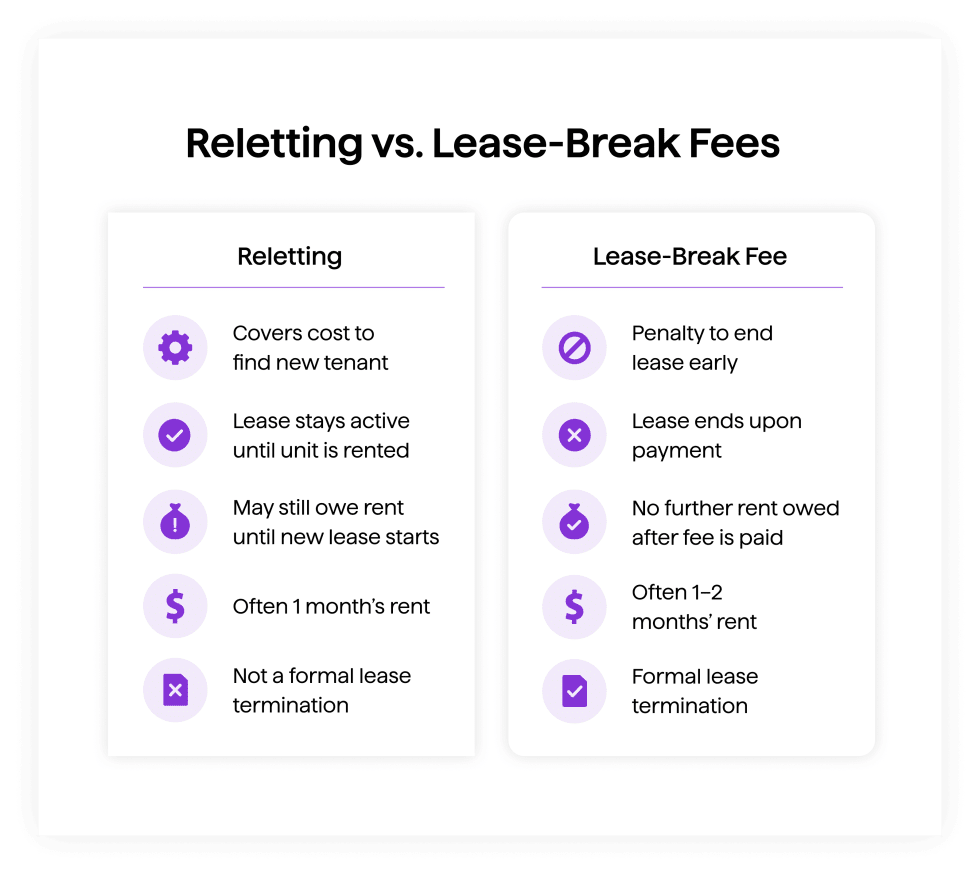

Some renters confuse reletting fees with penalties charged to break a lease, but they’re not the same thing.

Some landlords will charge both a reletting fee and a lease-break fee. Other landlords may use the terms “reletting fee” and “lease-break fee” interchangeably, so it’s important to read your lease carefully and confirm your landlord’s intent. In some cases, both fees may be combined, or you may be given the option to choose between paying rent until a new tenant is found or a flat termination fee.

You’ll usually pay a reletting fee when:

You usually don’t need to pay a reletting fee if your lease is ending on normal terms or you’re employing a legal opt-out clause. For example, military personnel who are deployed are generally exempt from penalties and fees associated with breaking their lease.

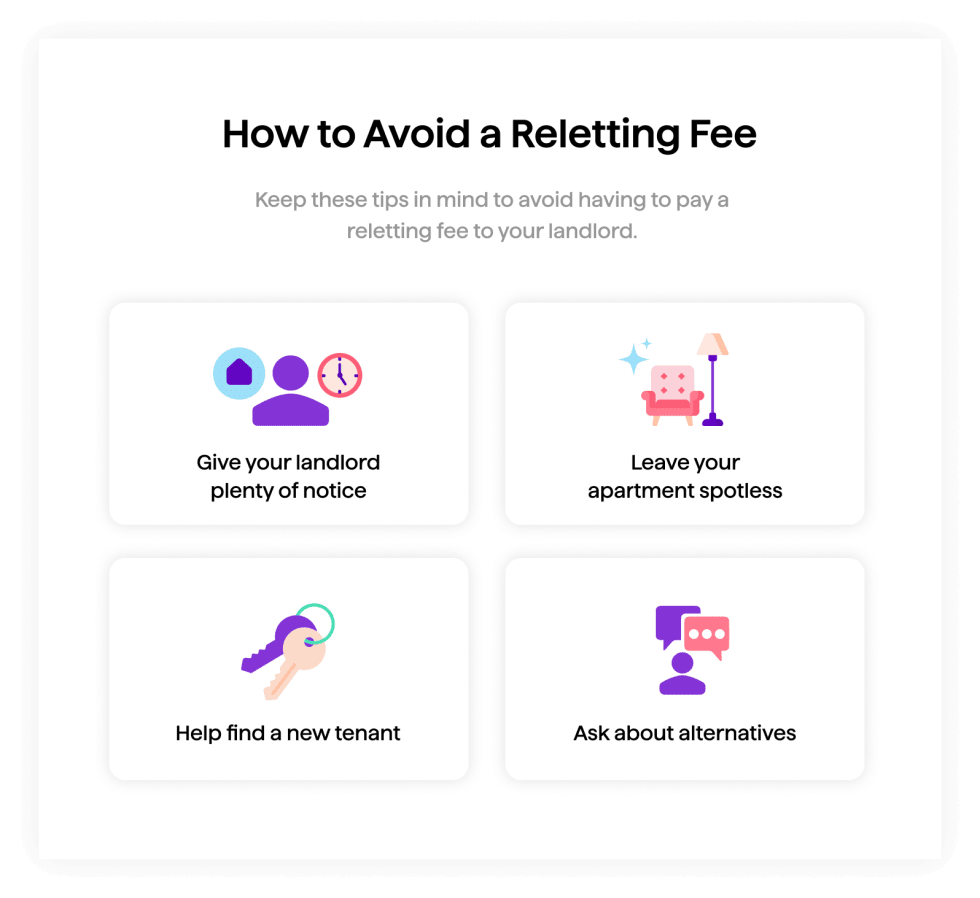

Unfortunately, there’s no way to guarantee skipping a reletting fee entirely, but you may be able to negotiate or reduce it by doing the following:

Keep in mind that everything hinges on your lease terms. You may be legally required to pay a reletting fee regardless of what you offer or how cooperative you are with your landlord.

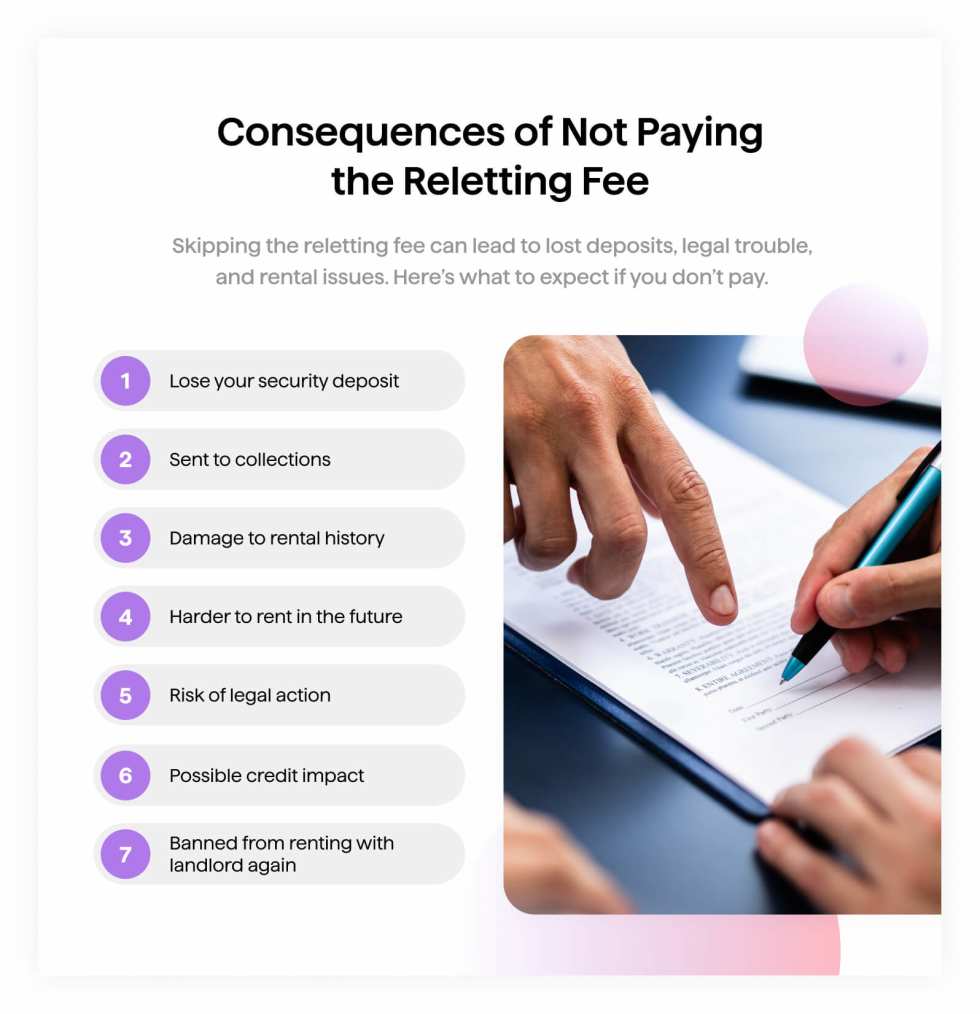

If you don’t pay the reletting fee you could lose part or all of your security deposit, damage your rental history, face collections or legal action, and have a harder time getting approved for future apartments. If you're unsure whether you can afford the fee, reach out to your landlord early—they may be open to a payment plan or alternative arrangement if you're proactive and transparent.

Consequences of breaking a lease depend on your lease terms. You may need to pay termination fees and also may be held responsible for rent until a new tenant is found. It's also possible you'll forfeit your security deposit or face litigation from your landlord.

But one of the most serious consequences renters don’t think about when they break their lease early is their credit report. Your score could go down and ultimately make it harder to rent your next apartment.

You may be able to break your lease if you're an active-duty military member, you can present your landlord your change of station orders or paperwork showing you're being deployed for 90 days or longer. Check your local laws, but most states also require tenants to provide written notice along with a copy of their military orders.

Renters who are victims of domestic violence or stalking can also legally break their lease without penalty. However, tenants must provide a protective order that was issued within the last 90 days or a police report as evidence. Tenants must also submit a written request to terminate their lease.

Uninhabitable living conditions, such as structural damage, persistent mold, and lack of essential utilities, are also grounds to break your lease. It’s also possible that you can terminate your lease agreement due to landlord retaliation or harassment. Renters may need to pursue a court order to terminate their lease.

No one loves paying fees, but a reletting fee can actually be a savvy compromise if you need to move out before your lease ends. Instead of being on the hook for multiple months of rent, you pay one flat rate and relinquish the process to your landlord.

Before signing your lease, ensure you understand the terms, verify your local laws, and have everything in writing.

No, a reletting fee typically covers the cost of finding a new tenant, whereas breaking a lease often involves additional penalties or payment of the remaining rent.

You can be charged a reletting fee and remain responsible for rent only until a new tenant takes over. After that point, your landlord generally cannot collect rent from both you and the new tenant—unless your lease explicitly allows it. Even then, it may not be legally enforceable. Certain states, such as Texas, have laws prohibiting landlords from double-dipping on rent.

No. Reletting fees are nonrefundable, as they cover the cost of marketing the unit and administrative expenses associated with finding a new tenant.

If your lease doesn’t mention a reletting fee, your landlord may not have legal grounds to charge one. Instead, they may demand you continue paying rent until a new tenant is found or impose a steep penalty for breaking the lease.

Reletting fees shouldn’t affect your credit score as long as you pay them, but if you cannot pay and it goes to collections, it may affect your credit score.

Yes, in most situations you are able to rent again after breaking a lease. You may need to pay a lease-break fee or other fees to get out of the lease.

In unit laundry, Granite counters, Hardwood floors, Dishwasher, Pet friendly, 24hr maintenance + more

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more