The State of Renting: 2026 Report

Renters didn’t create today’s housing market, but Gen Z and millennial renters are finding ways to live inside it.

While this generation gets a lot of flack for “delaying adulthood” until they “figure their lives out,” the headlines miss what’s actually happening: Gen Z and millennials aren’t delaying anything. They’re redefining everything in an economy where housing costs have fundamentally changed what’s financially possible.

To understand how renters are navigating this moment, we surveyed 1,000 Gen Z and millennial renters across the United States.

The Economy’s Changed. Renter Priorities Have, Too.

Let’s start with the reality we’re living in: housing costs keep rising, and wages aren’t growing fast enough to keep pace. And renters are feeling it across every life decision—who they live with, when (or if) they start families, how they save for retirement, and where they’ll move next.

In today’s economy, renters know something has to give. From our survey, we found that 86% of Gen Z and millennials have delayed major life milestones because of rising housing costs.

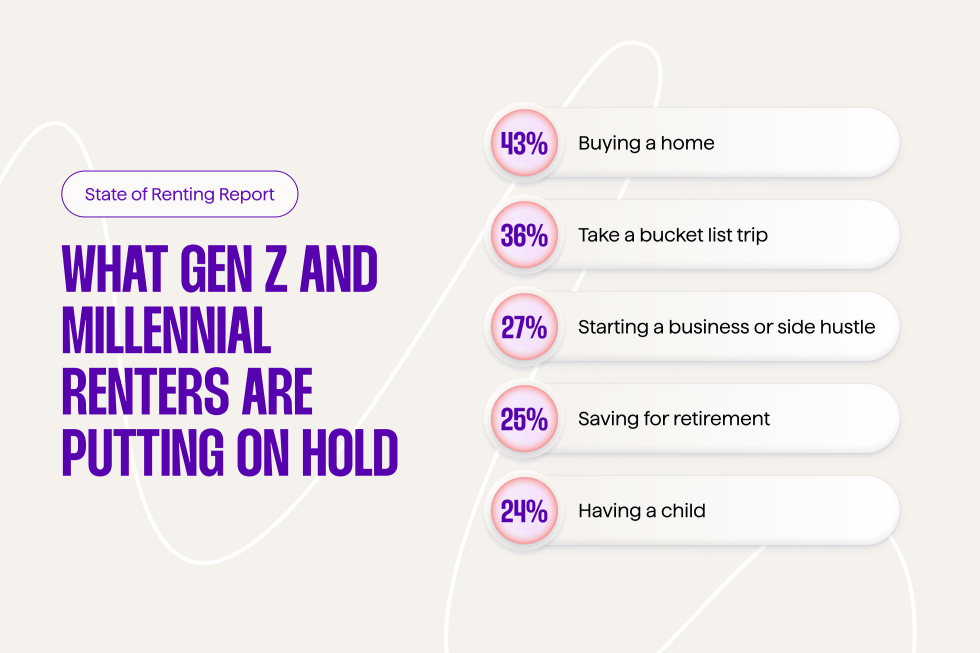

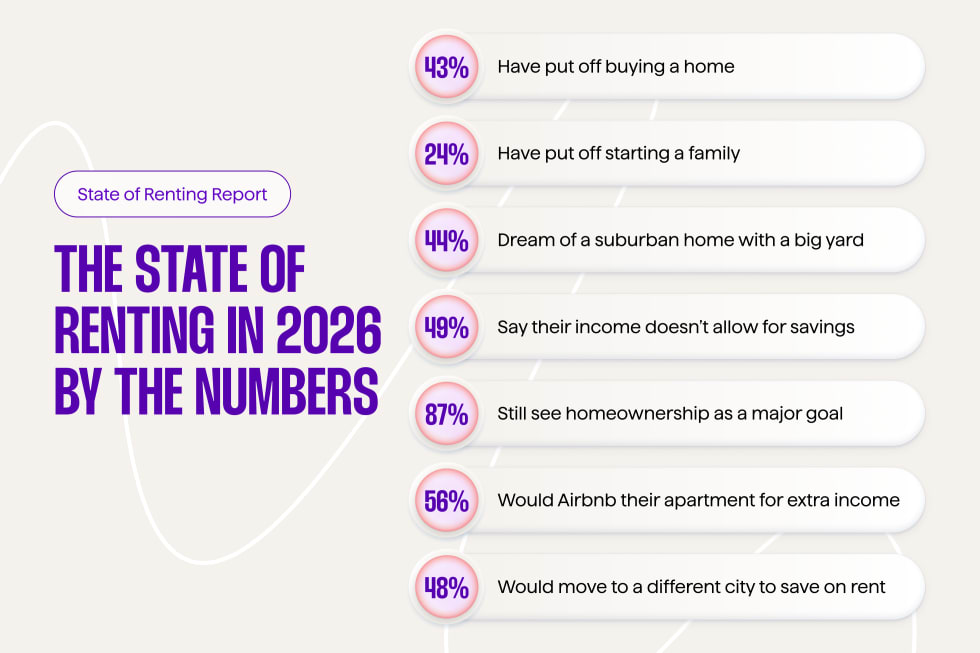

So, what are they putting on hold, exactly? For starters, buying a home (43%), saving for retirement (25%), and starting a family (24%). Here’s a closer look by the numbers:

Nearly half of renters (49%) say their income doesn’t allow them to save at all. With one-in-four renters spending more than half their income on rent, calculated trade-offs take the place of traditional life choices.

One of the clearest signals of how constrained things feel: 42% are choosing to stay in relationships—romantic or platonic—longer than they wanted because breaking up would mean breaking the bank.

Instead of waiting for the market to shift in their favor, Gen Z and millennials are making renting work, while staying honest about what the current market allows. From our point of view, these renters aren’t settling. They’re strategizing their every move.

The Suburban Dream Can Wait—Really

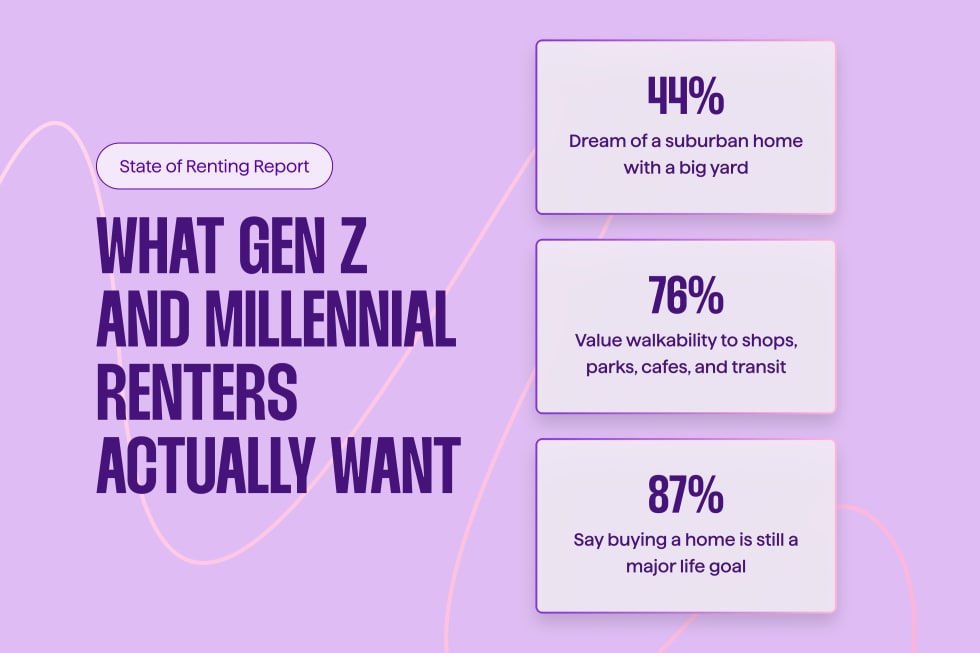

Renters haven’t abandoned traditional aspirations at all. In fact, the suburban dream is still alive and well. It’s just…on hold. Space, privacy, and comfort still matter, with 44% of Gen Z and millennials saying their dream living situation is a home in the suburbs with a big yard.

But wait, aren’t these renters anti-suburbs, and pro- urban, trendy, walkable neighborhoods? The data’s telling us a different story.

Walkability is still important—76% of renters say it matters, with Gen Z (44%) more likely than millennials (39%) to call it “very important.” But many renters are prioritizing space over proximity. Fifty-three percent would rather rent a bigger place, even if it meant driving more.

Even with affordability challenges, 87% of Gen Z and millennial renters still consider buying a home a major life goal, despite 57% saying they don’t have enough saved for a down payment. Renters haven’t given up on ownership—they’re just not pretending it’s realistic right now.

Luxuries Are Out. Essentials Are In.

Forget the rooftop pool, assigned parking spot, or high-end finishes. In 2026, renters are less interested in premiums, and more focused on what’s practical.

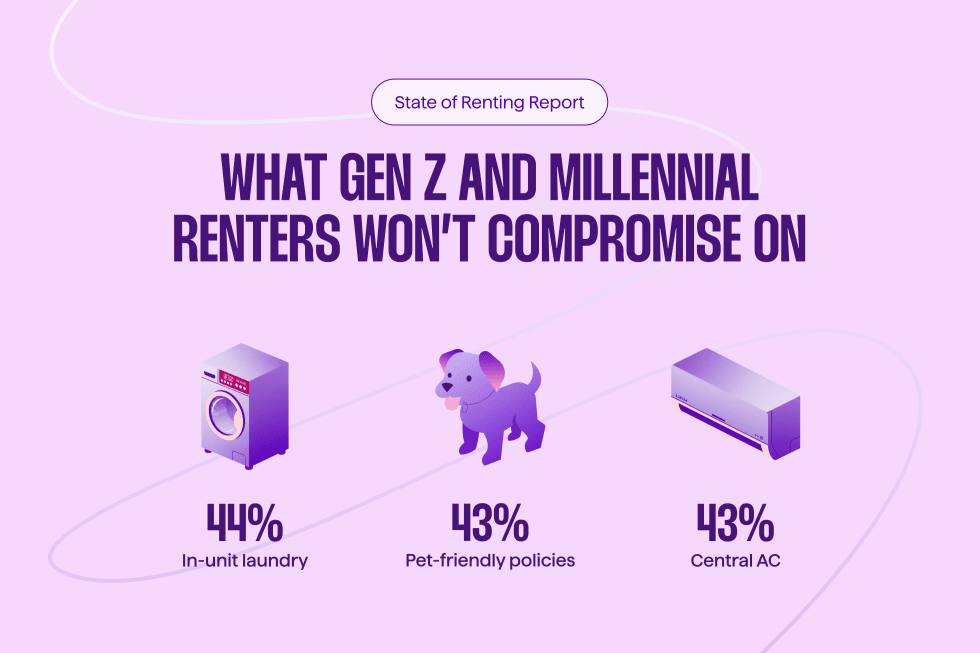

When looking for a home, the top three non-negotiables among Gen Z and millennials are in-unit laundry (44%), pet-friendly policies (43%), and central AC (43%). They’re clearer than ever about what makes their day-to-day lives better, and refuse to pay extra for the rest.

Pet-friendly policies, in particular, play a major role. Sixty-three percent of renters we surveyed own a pet, and nearly half say they’ll always have one. For many, their pet is their roommate. No matter how nice an apartment looks on paper, a “no-pet” policy is often a dealbreaker.

Changing Scenery is the New Survival Strategy

As costs rise and wages struggle to keep pace, renters facing today’s affordability challenges are willing to make big, bold moves to make their income stretch further. And we mean big moves.

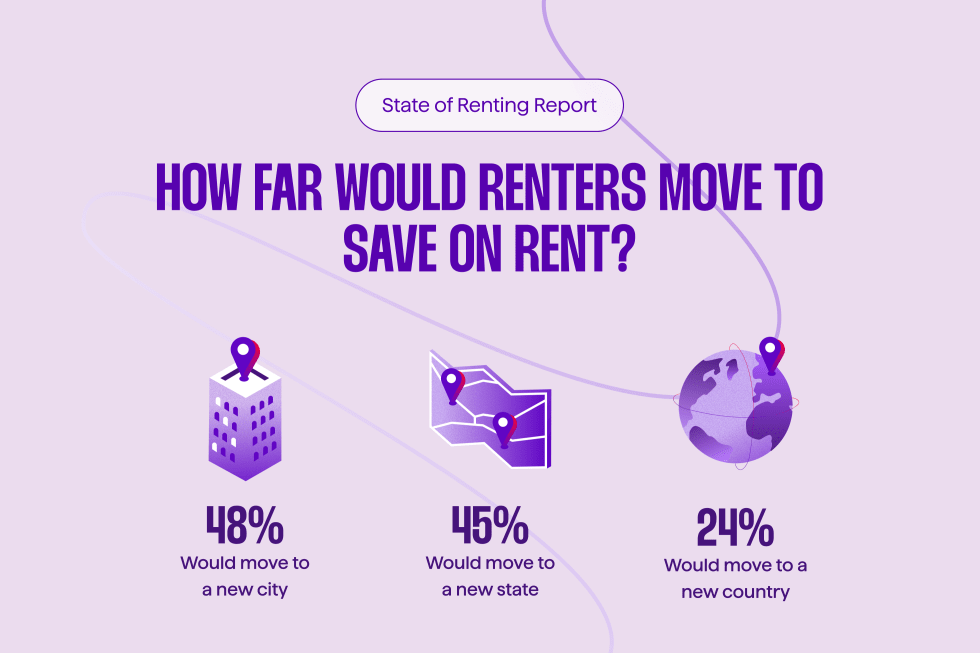

To save on rent, almost half of renters (48%) would consider moving to a different city, 45% to a different state, and 24% said they’d even move to a different country. Nearly a quarter of renters we surveyed said that finding a cheaper place to live is the single biggest factor driving their next move.

Remote and flexible work has changed the equation, too. Renters are increasingly asking a practical question: if work isn’t tied to one place, why should rent be? And if rent's not going down, why not move somewhere more affordable?

For renters navigating higher housing costs, regaining financial control means regaining control of their quality of life. Moving from a high-cost city to a lower-cost one can mean more space, less financial stress, and the ability to actually save more for those major life milestones.

Staying put is no longer the default choice. It’s just one option among many.

Income, Flexibility, and Finding a Home That Works Harder

The gig economy has reshaped income, and now, it’s reshaping how renters live. In 2026, renters want their homes to work for their financial goals.

More than half of Gen Z and millennials (56%) said they’d rent out their apartment on Airbnb for short-term stays to make extra income. For these renters, living in an Airbnb-friendly apartment can add more freedom and flexibility to their lifestyle, open up a new source of income, and make rent feel more manageable.

Where previous generations followed a straightforward model—pay rent, live there, repeat—today’s renters are looking for ways to optimize what they’re already paying for. It’s smart, it’s resourceful, and it’s exactly the kind of creative thinking that sets Gen Z and millennials apart.

Renting Isn’t the Backup Plan. It’s the Right Now Plan.

For renters navigating career changes, figuring out family choices, and building financial stability in an unpredictable economy, renting offers exactly what they need: flexibility, mobility, and the freedom to make changes when life demands it.

Yes, housing costs have reshaped everything, from relationships and retirement savings, to starting a family. But Gen Z and millennial renters aren’t opting out of life while they wait for conditions to improve. They’re making the most of what’s available now, adapting to the market on their terms.

In 2026, renting is an intentional strategy shaped by financial awareness, flexibility, and realism.

About this Report The State of Renting: 2026 Report was made in collaboration with Talker. Our survey was conducted between December 15-22, 2025, and includes responses from 1,000 Gen Z and millennial renters across the United States. The survey explores how housing costs are shaping life decisions, what renters prioritize in their living situations, and how this generation is adapting to today’s affordability challenges.

Share this Article