December 2025 Rental Market Recap: What Should Multifamily Leaders Expect in 2026?

The rental market is closing out 2025 in a softer position than many operators anticipated earlier in the year. Rents are dipping again, vacancy has reached a new high, list-to-lease times continue to lengthen, and concessions have become more common, especially in metros absorbing new supply. At the same time, performance across the country has grown increasingly uneven, and shifting seasonality has begun to reshape the operational calendar.

Looking ahead to 2026, the market appears stable rather than volatile. Elevated supply is beginning to ease, job growth has cooled, and household formation is moderating. Competition from single-family rentals is strengthening, and local housing policies are becoming more influential in shaping operating conditions. In an environment that rewards preparation over prediction, operators who adjust early and execute consistently will be best positioned for the year ahead.

Here’s what we’ll cover:

- Market Conditions: Rents, vacancy, and where performance is diverging.

- Shifts in Seasonality: Why demand is moving earlier.

- Concessions & Renter Behavior: What rising incentives signal.

- Forces Shaping 2026: Supply, jobs, SFR, and policy.

- Operator Priorities: How to adapt and rebuild advantage.

How the Rental Market Is Closing Out 2025

Rents are softening, vacancy is elevated, leasing cycles are lengthening, and national performance is drifting back toward long-term trends rather than breaking them.

Even though the environment may feel unfamiliar compared to the frenetic pace of 2021 and 2022, the underlying conditions are steady. The market is not weakening so much as returning to a more sustainable rhythm. Operators who align their strategies with that reality will be better equipped to navigate the coming months.

Why Are Rents Declining Again?

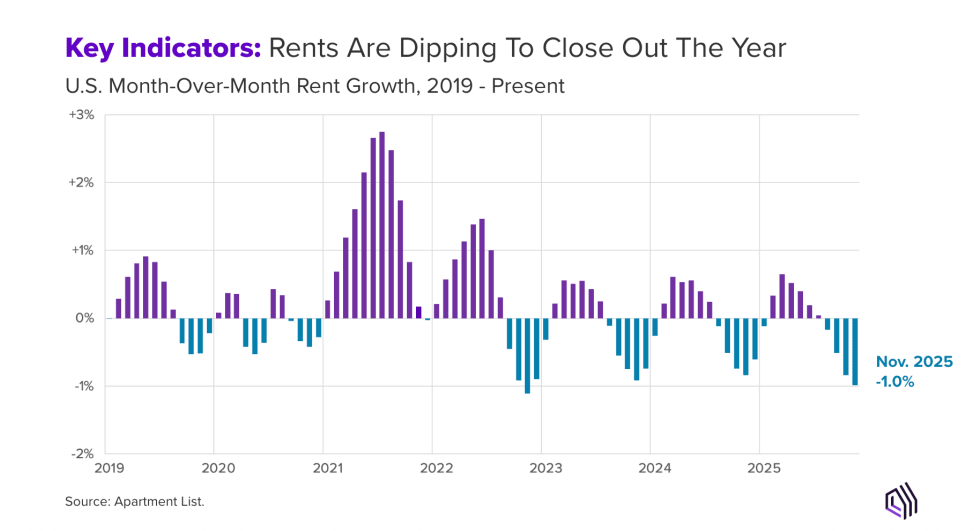

Rents fell 1% MoM in November, the sharpest decline since late 2022, and are now 1.1% lower than a year ago. This marks the third consecutive year that rents end lower than they began.

Even so, this trend reflects a controlled return to long-term patterns, not a downturn. National median rent remains only slightly above where it would have landed had pre-pandemic growth patterns continued uninterrupted. The extraordinary surge of 2021–2022 has now been largely unwound.

For operators, this shift carries important implications:

- Rent growth is no longer the primary revenue driver.

- Occupancy health and operational consistency matter more.

- Pricing must align tightly with local demand conditions rather than YoY targets.

- The story heading into 2026 is one of normalization, not contraction.

Markets Showing Strength vs. Markets Under Pressure

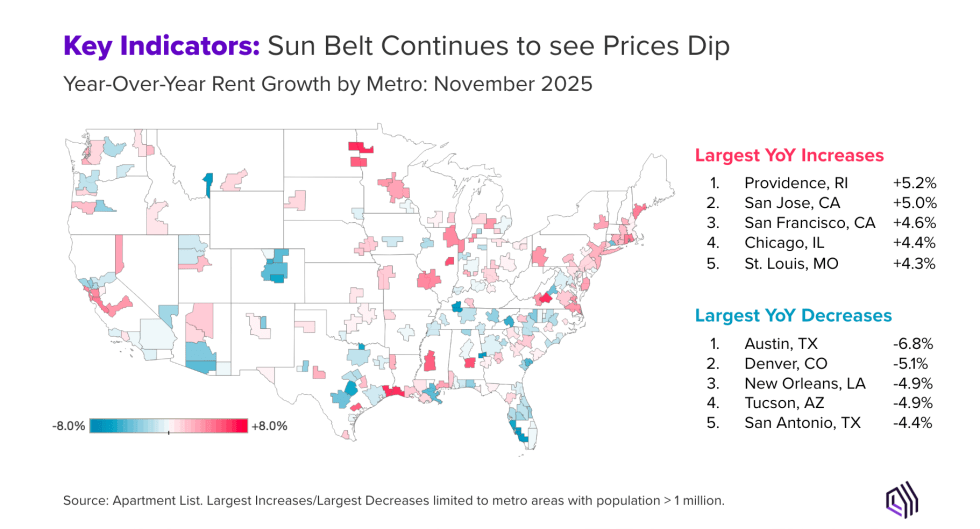

Differences across regional markets have become more pronounced. This is the most divergent landscape we’ve seen in several years.

Providence leads the country with roughly +5% YoY rent growth, with strong demand supported by its relative affordability compared to nearby Boston and New York and by shifting commuter and hybrid-work patterns. San Jose and San Francisco are also showing renewed strength as AI-driven hiring and in-person work policies shore up demand.

On the softer end of the spectrum, Austin is down roughly 7%, with Denver, Tucson, San Antonio, Jacksonville, and several Florida metros also experiencing declines. Many of these markets continue to work through large volumes of supply at a time when household formation has slowed.

What separates strong from soft markets?

- Recent construction volumes

- Job creation and confidence

- Affordability relative to nearby alternatives

National trends matter far less than these local fundamentals.

Vacancy, Time on Market & the Slower Pace of Demand

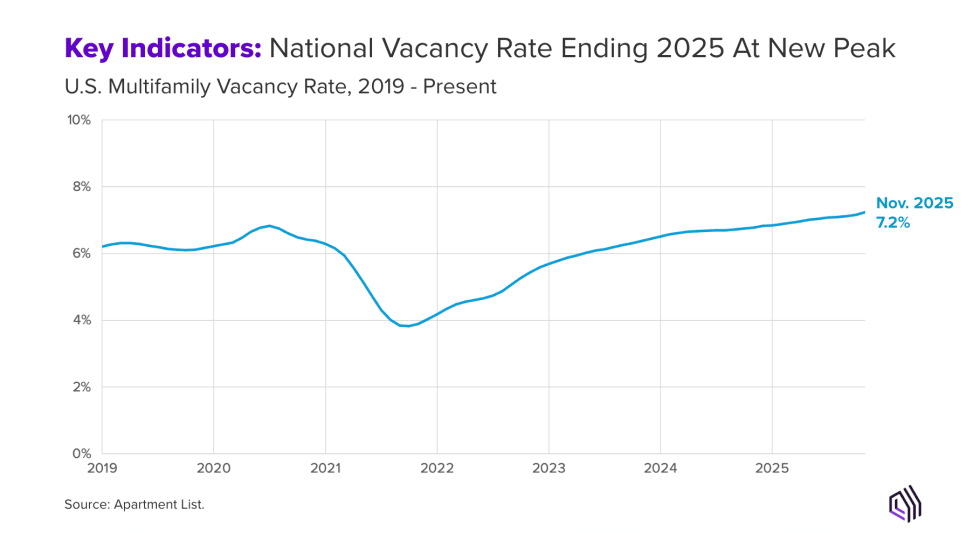

Vacancy has reached 7.2%, the highest reading in the Apartment List index’s history. This increase reflects not only elevated supply but also slower decision-making from renters.

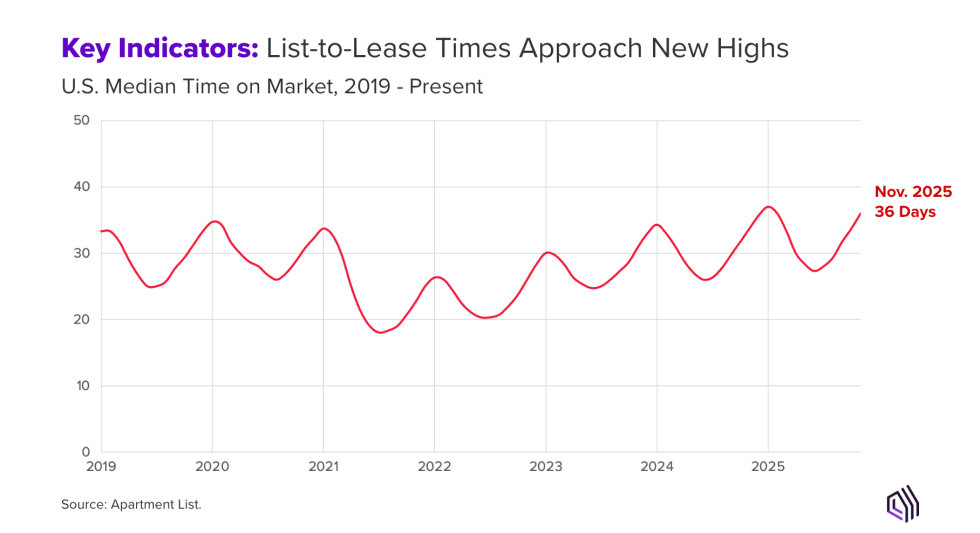

The median list-to-lease time now sits at 36 days, the longest November reading on record. Renters are taking more time, exploring more options, and moving with less urgency. Shifting job patterns and affordability considerations have encouraged more deliberate choices.

This environment elevates the importance of clean, confident execution:

- Every day of delay has a larger impact when demand moves at a slower pace.

- Clarity, speed, and communication are becoming as important as pricing.

- Experience quality is increasingly a competitive differentiator.

Why Has the Moving Season Shifted Earlier?

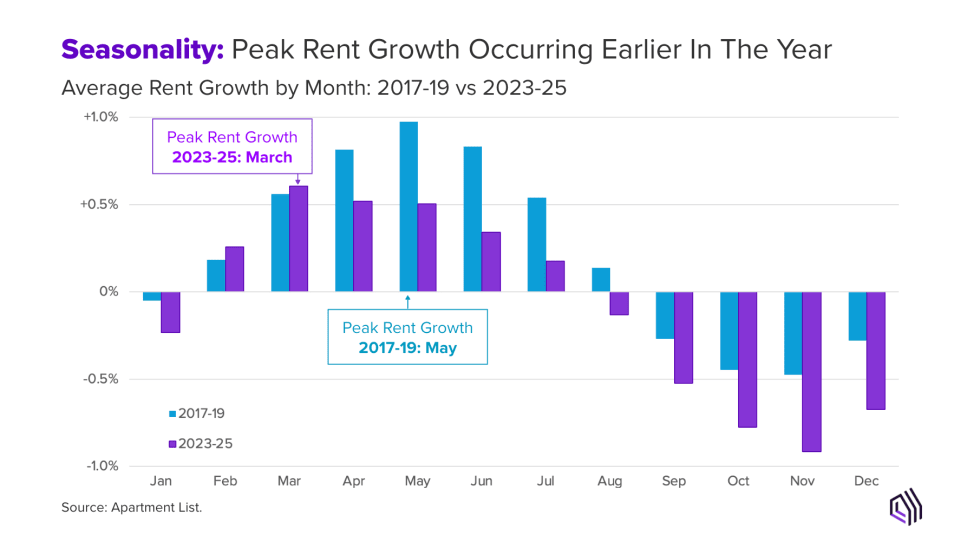

Peak rent growth has occurred in March, not May, for three consecutive years. Renter interest is now accelerating during the spring months,, and softening throughout the summer and fall.

This shift reflects earlier job movements, hybrid-work flexibility, and a general pull-forward of household planning. The late-spring surge that once defined the leasing year has become an early-spring crest.

Operators now need to recalibrate. Renewal outreach, pricing updates, nurture sequences, and marketing activation must move earlier. January through March is no longer preparation time, it is performance time.

The Rise of Concessions Across the Country

Concessions have become a central lever for maintaining leasing velocity in a softer, more competitive environment.

Operators are using incentives more frequently and more strategically, acknowledging that renters now have more time, more options, and more negotiating power. Concessions are shaping not just pricing, but perception.

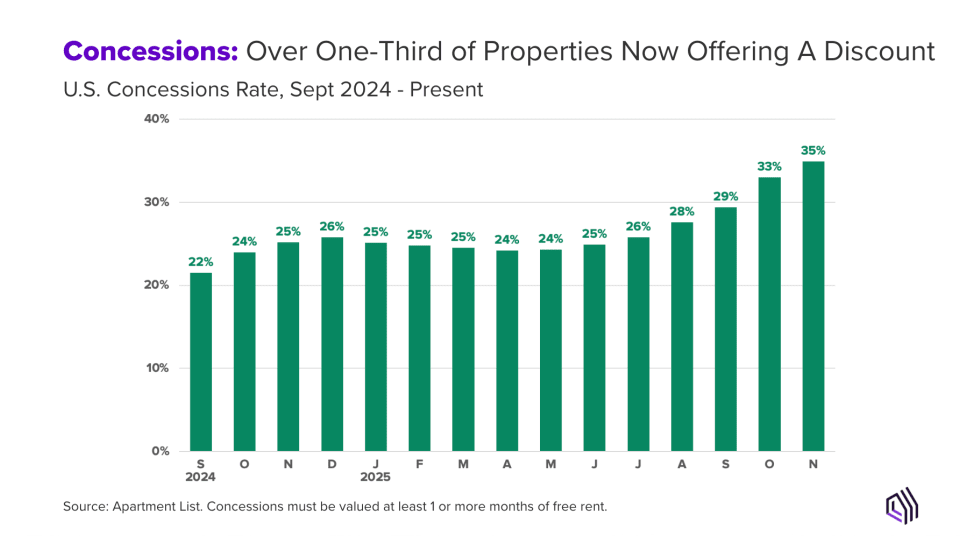

How Common Are Concessions Today?

35% of properties nationwide now offer a concession equivalent to one month free or more. This is the highest share in years.

The increase reflects a few realities:

- Renters are more deliberate and more price-sensitive.

- Operators are competing for slower-moving demand.

- Supply-heavy markets need tools that support absorption without long-term rate distortion.

Concessions have re-emerged as a core driver of leasing velocity.

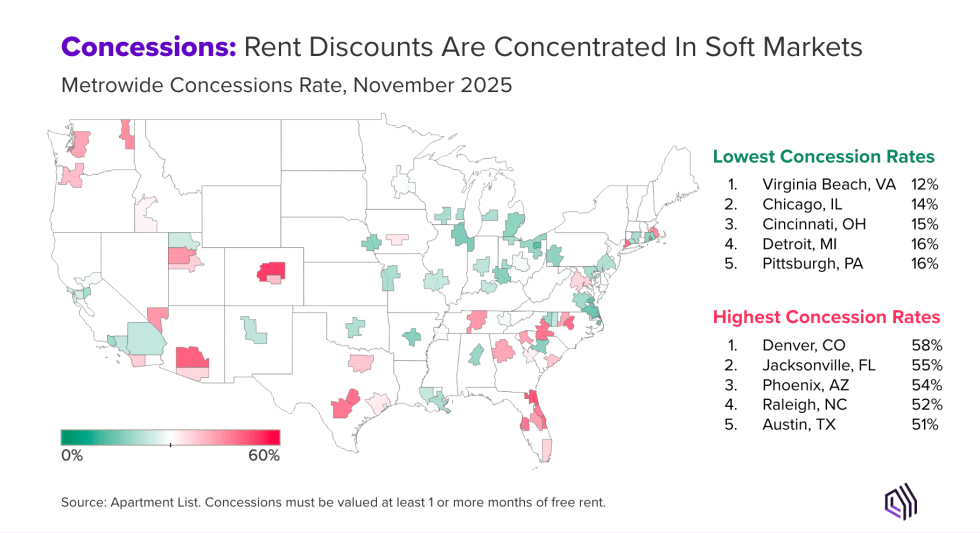

Where Discounts Are Deepest

The Sun Belt leads the country in concession activity. Denver tops the list, with roughly 58% of properties offering at least one month free. Phoenix, Jacksonville, Raleigh, and Austin also sit above the 50% threshold.

Some properties in the softest submarkets are offering two or even three months free on extended leases.

Meanwhile, markets such as Chicago, Cincinnati, and Pittsburgh typically sit closer to the mid-teen range. These metros are experiencing steadier demand and less acute supply pressure.

The distribution of concessions closely mirrors the distribution of new supply.

What Do Rising Concessions Reveal About Renter Behavior?

Concessions offer a close look at how renters make decisions in a slower market. They serve as a response to competition, a window into renter psychology, and a designation of the points of friction that matter most when demand moves at a more deliberate pace.

Renters today display:

- Lower urgency

- Greater willingness to compare communities

- Higher sensitivity to upfront costs

- Stronger preference for clear and simple pricing

In this environment, concessions help renters make sense of value at a time when choices feel abundant and timelines feel flexible. Those who win are not always the ones offering the largest discount, but they are the ones who remove confusion, respond quickly, and present a path to leasing that feels straightforward. When renters have time to think, clarity becomes a competitive advantage.

Key Market Forces That Will Shape 2026

Stability, not volatility, is the theme for 2026. The year ahead will be shaped by elevated but easing supply, softening labor conditions, moderating demand, expanding SFR competition, and a greater role for policy intervention.

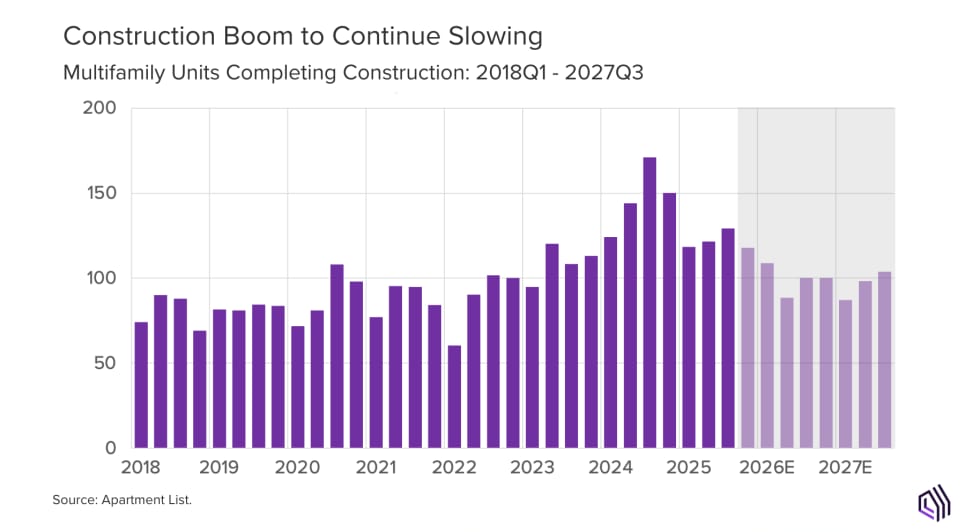

Will New Supply Continue Pressuring the Market?

While the construction pipeline has begun to cool, elevated completions will continue into 2026. More than 600,000 units were delivered in 2024, followed by roughly another 500,000 in 2025. Deliveries remain above pre-pandemic norms.

High-growth metros will continue experiencing competitive lease-ups, but the national picture is trending toward stabilization.

How Will Labor Market Conditions Affect Demand?

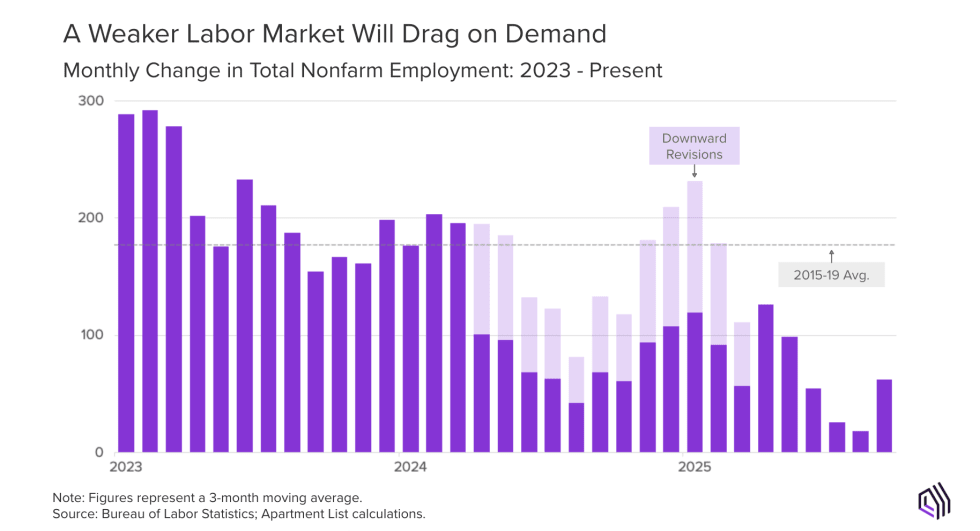

Job growth throughout 2025 remained below the 2015–2019 average. When workers feel less confident, household formation slows, and that softness flows directly into demand. Operators feel it first, long before the macro headlines catch up.

This shows up as:

- Fewer young renters forming new households

- More doubling up

- Lower move-out rates

- Softer absorption in supply-heavy metros

Demand is steady enough to fill units but not strong enough to create broad pricing momentum. In this kind of labor market, operators need sharper exposure management, quicker adjustments, and a closer read on local demand signals. With the supply pipeline still elevated in 2026 and demand showing signs of softness, vacancy will likely remain above 7% through much of the year.

Pricing performance will vary widely by metro and will be shaped by local economic conditions and supply dynamics rather than national trends. In this environment, revenue outcomes hinge on execution, not market acceleration.

The Growing Influence of Single Family Rentals

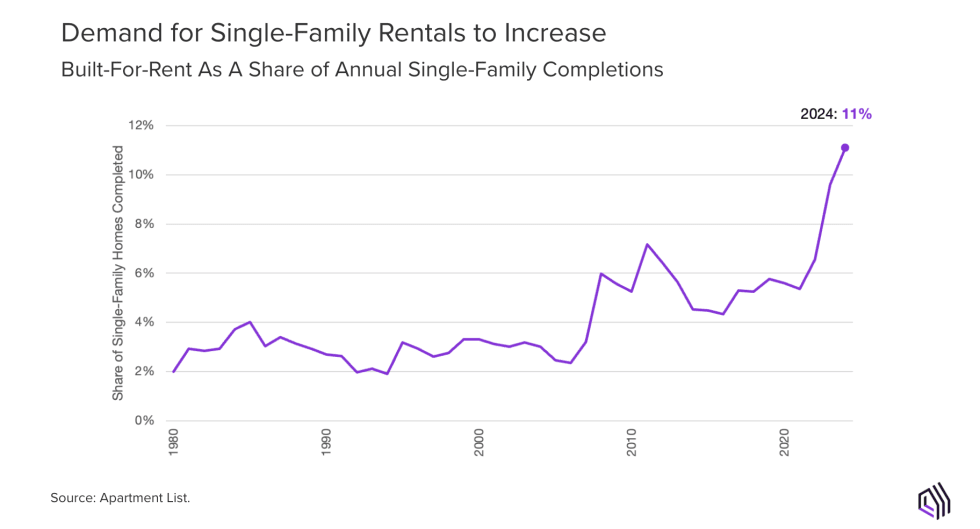

Built-for-rent single-family homes now make up more than 10% of all new single-family construction. These homes appeal to older millennials, families, and remote workers who want additional space and privacy without the cost of homeownership.

Built-for-rent single-family homes now make up more than 10% of all new single-family construction. These homes appeal to older millennials, families, and remote workers who want additional space and privacy without the cost of homeownership.

This segment is becoming a full-fledged competitor to multifamily. Operators can respond by strengthening amenity positioning, enhancing customer experience, and clarifying the value proposition of multifamily living.

Policy Shifts to Watch in 2026

Despite the soft rent growth of recent years, housing affordability is still a top concern for renters in many of the nation’s largest markets, and local politicians are taking notice. Across the country, we’re seeing high profile examples of local legislation aimed at addressing rental affordability. Cities nationwide are weighing:

- Rent caps and freezes

- Broker fee reforms

- Density-focused zoning updates

- Short-term rental restrictions

Policy is becoming a bigger factor in how demand flows, how units are marketed, and how pricing guardrails are set. These shifts aren’t uniform and won’t move in the same direction, but they will shape operating reality. The operators who stay informed will move faster and with more confidence than those reacting after the fact.

Why 2026 Is a Year to Rebuild Your Advantage

Most cycles push operators into constant reaction: pricing shifts, demand cools, and supply delivers in waves. Teams spend the year sprinting just to stay even. Nationally, though, 2026 is different. The market is softer, slower, and clearer than it has been in years, and that clarity is an opening. Conditions will vary by submarket, but the broader trend gives operators something rare in this industry: space to rebuild.

This window will not last. Markets will tighten again, competition will shift, and demand will accelerate. The operators who use this moment to simplify, sharpen, and strengthen their foundations will enter the next cycle with real advantage, not because conditions improved, but because their systems did.

Final Thoughts & Next Steps

The rental market is steadying – momentum has cooled, urgency has softened, and the center of gravity for demand has shifted earlier in the year. That slowdown creates clarity. Operators who move early, sharpen their systems, and deliver a frictionless renter experience will be the ones who convert this softening into strategic advantage.

National conditions point to a rare reset window, but how it shows up will vary by submarket. The throughline is the same: teams that simplify, strengthen their processes, and act with discipline today will be positioned to outperform when the market tightens again.

Watch the full webinar recording. Experience the complete breakdown from Senior Economist Chris Salviati, including market trends, data deep dives, and live Q&A.

Stay informed with ongoing market insights. Follow our economics team for new data releases, commentary, and the trends shaping renter behavior.

Share this Article