Navigating the 2025 Rental Landscape: Midyear Multifamily Outlook

As we enter the critical summer leasing window, Apartment List's latest Rental Market Insights webinar provides a timely pulse check on where the rental sector stands halfway through the year. After years of volatility driven by pandemic disruptions, supply surges, and macroeconomic swings, the rental market now sits at a delicate crossroads. Property operators are navigating a landscape defined by conflicting signals: stabilizing rents, surging vacancies, recovering renter budgets, and persistent uncertainty.

This midyear outlook unpacks the data behind today's market and offers practical insights to guide leasing strategies for the rest of 2025.

Access the Full Webinar Recording Here

Market Signals: Stabilization or Stagnation?

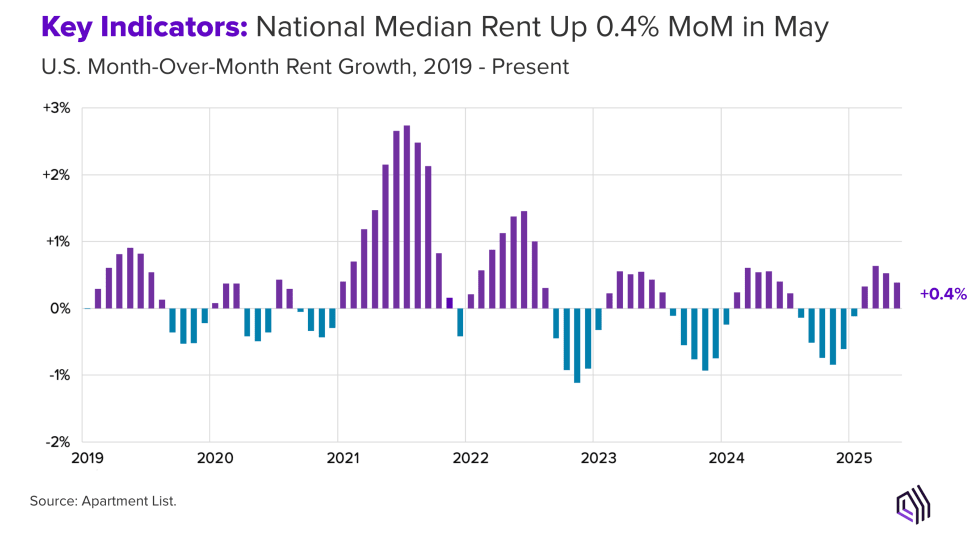

Rents have ticked up slightly month-over-month, reflecting a typical seasonal lift as leasing activity ramps up. In May, national median rent rose 0.4%, but monthly rent growth has been trending down slowly since March, suggesting that pricing leverage remains tenuous for property owners.

Key market indicators include:

- National median rent down 0.5% YoY, and still 3% below the 2022 peak.

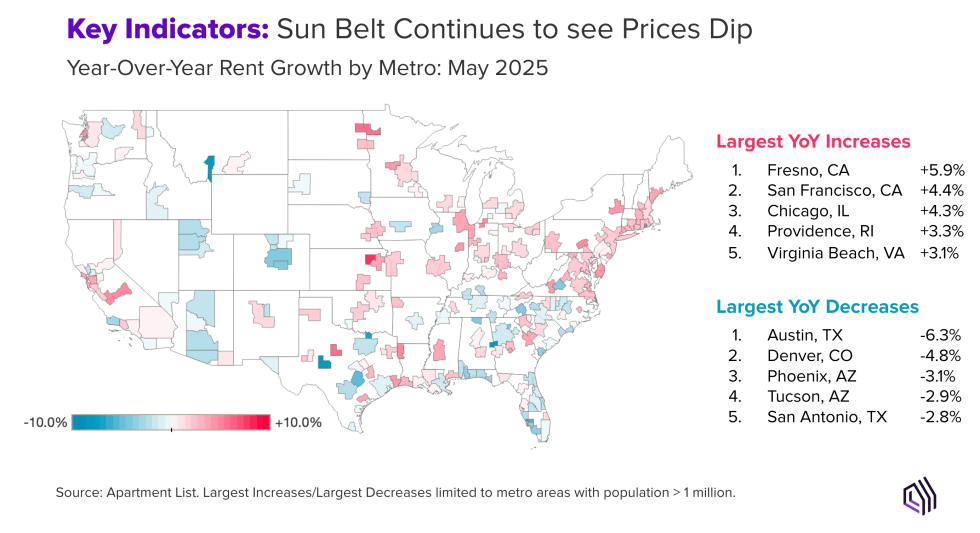

- Sun Belt metros continue to decline: Austin (-6.3%), Denver (-4.8%), Phoenix (-3.1%), Tucson (-2.9%).

- Coastal and Midwest metros seeing gains: Fresno (+5.9%), San Francisco (+4.4%), Chicago (+4.3%), Providence (+3.3%).

- National vacancy rate reached 7.0%, marking a new high for this cycle.

For property operators, this fragmented landscape demands localized pricing strategies. Broad national headlines obscure the highly variable realities playing out at the submarket level. Understanding which neighborhoods have pricing power, and which require a defensive occupancy-first approach is more important than ever.

Renter Mindset: Cautious Optimism Meets Deliberation

Shifting from the broader market signals, renter behavior offers additional context for the leasing environment operators are navigating.

Notable renter behavior trends:

- 45% of Apartment List users report searching with high urgency – improved from winter but still below historical averages for this time of year.

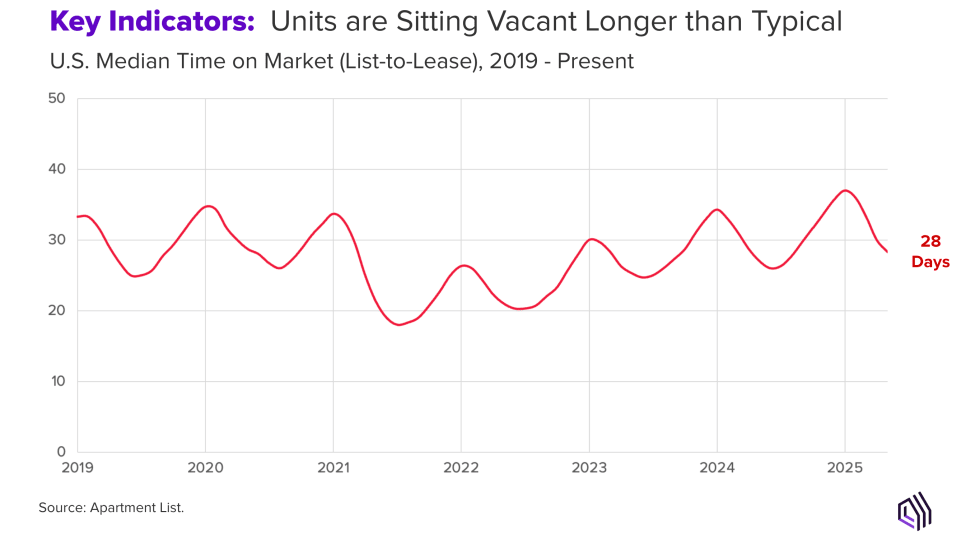

- Median list-to-lease time remains elevated at 28 days, reflecting deliberate decision-making.

- Budgets are recovering, with average targeted rent now at $1,488/month.

Today’s renters remain engaged but selective. While economic uncertainty lingers, stabilized employment and rising wages are giving renters more breathing room. However, the experience renters encounter when they engage with your property remains a key differentiator. Speed, clarity, and convenience can tip the scales for hesitant prospects.

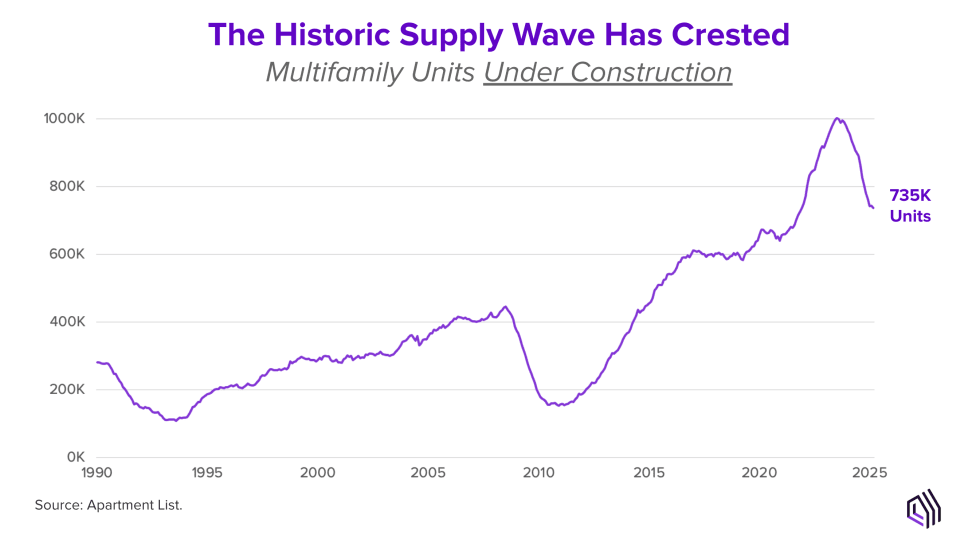

Supply Dynamics: The Construction Pipeline Tapers

As renter behavior evolves, the supply side is also entering a new phase.

As renter behavior evolves, the supply side is also entering a new phase.

Key supply developments:

- Approximately 735,000 units remain under construction nationally.

- New multifamily permitting has slowed significantly, impacted by rising costs and tighter financing.

- Completions are now trending down as well, and should continue to do so through 2025 before stabilizing in 2026.

This transition creates a complex operating environment: intense competition in the short-term lease-up market, with the potential for tighter conditions emerging as new supply dwindles in future years. Leasing teams must sharpen their positioning now to stand out but also prepare to seize emerging pricing power as supply-demand fundamentals begin to shift.

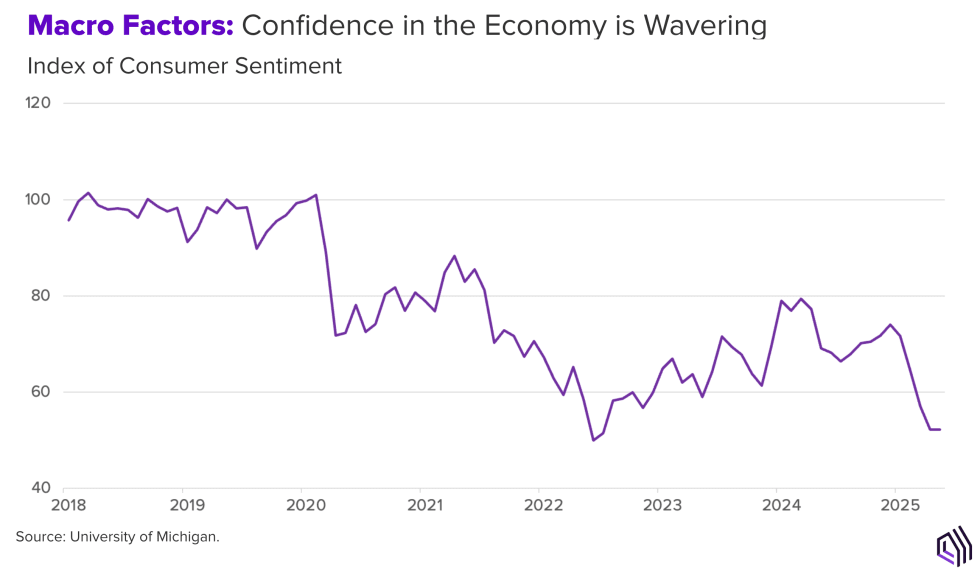

Macro Factors: Uncertainty Clouds the Outlook

External economic forces continue to weigh on multifamily performance.

External economic forces continue to weigh on multifamily performance.

Broader macro dynamics include:

- Consumer sentiment remains fragile due to inflation, recession fears, and global uncertainty.

- Slower household formation and mobility patterns are tempering demand in some metros.

- Rising construction costs and new tariffs are further suppressing new housing supply.

For operators, this environment underscores the importance of agility. Submarket conditions will continue to diverge. Conservative pricing strategies balanced with proactive leasing and renter experience investments will set high-performing properties apart.

For-Sale Market Dynamics: Pressure Builds in Single-Family Rentals

Beyond multifamily, ownership affordability challenges continue to drive rental demand.

Key trends shaping the for-sale market's impact:

- Home prices remain high despite elevated mortgage rates, pushing ownership out of reach for many younger households.

- Homeownership rates among young adults remain low compared to prior generations.

- Built-for-rent single-family housing completions continue to rise to meet this shifting demand.

As these trends unfold, the single-family rental sector will increasingly intersect with multifamily demand. Operators positioned to diversify into or compete alongside this product type may find opportunity, particularly in suburban and family-oriented submarkets.

Outlook: Navigating Uncertainty in the Back Half of 2025

As we move through the second half of 2025, the multifamily rental market remains finely balanced. Modest rent gains provide some optimism, but elevated vacancies, elongated leasing timelines, and economic headwinds temper the outlook. Market conditions remain highly fragmented, demanding close attention to local dynamics.

Operators who stay disciplined on pricing, nimble in leasing strategy, and invested in renter experience will be best positioned to navigate this transitional period. The second half of 2025 may not deliver dramatic shifts, but it will reward those prepared to adjust to the nuanced realities emerging across markets.

How Apartment List Can Help

Want to stay ahead of evolving trends? Get more of Apartment List's research updates for ongoing data, insights, and market analysis: apartmentlist.com/research.

Ready to explore how Apartment List’s performance-based marketplace can help you navigate leasing in the second half of 2025? Connect with our team to learn how we can help you convert more leads and maximize ROI in a shifting market.

Share this Article