The Great Wealth Transfer: How Inherited Wealth Could Reshape Renting

A financial shift is reshaping generational dynamics and poised to have far-reaching implications across the housing industry. Over the next 20 years, Baby Boomers will pass down an estimated $84 trillion to their heirs in what’s being called the Great Wealth Transfer. While most headlines have focused on its implications for financial services, the ripple effects on multifamily real estate could be equally transformative.

For property operators, this transfer arrives at a moment when younger generations, many of whom have been priced out of homeownership, are now on the brink of becoming more financially empowered. As this wealth begins to shift hands, a question emerges: Will these new resources push long-time renters toward homeownership, or will it deepen demand for premium rentals tailored to evolving lifestyle values?

The reality is likely to be more nuanced. What’s clear is that operators who prepare for multiple outcomes and prioritize the high-value segment of renters who continue renting by choice will be best positioned to win.

In this blog, we’ll cover:

- Today's Rental Landscape: Why Younger Generations Haven't Bought Homes (Yet)

- The Great Wealth Transfer: A Potential Turning Point in Housing Decisions

- The Rise of the Renter by Choice: An Opportunity Amid Uncertainty

- Redefining the Rental Offering Beyond the Unit

- Regional Variations: Inheritance Impact Isn’t One-Size-Fits-All

- Technology Integration & Meeting Elevated Expectations

- Strategic Planning for Multiple Possible Outcomes

- Position Your Properties for Tomorrow’s Renter… Today

Today's Rental Landscape: Why Younger Generations Haven't Bought Homes (Yet)

Millennials and Gen Z have redefined the rental landscape, not necessarily by preference, but by necessity. Over the past decade, a combination of economic headwinds has delayed homeownership milestones:

- Mortgage rates have more than doubled since 2021, reaching nearly 7% in early 2024.

- Median home prices have surged more than 40% over five years, outpacing wage growth and savings accumulation.

- Student loan debt continues to burden over 43 million borrowers, with average balances nearing $37,000.

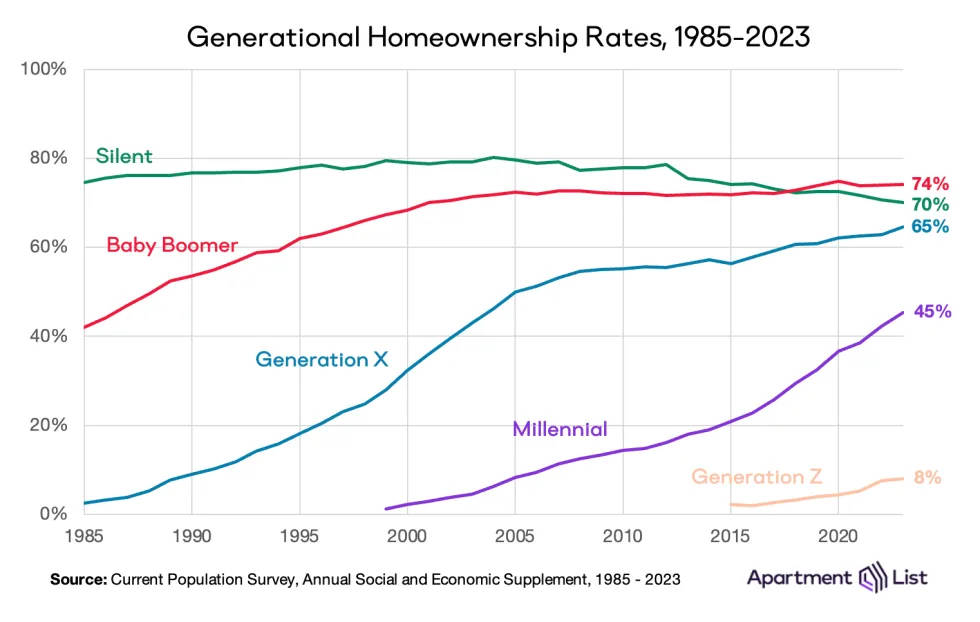

These financial barriers have left a clear mark: the Millennial homeownership rate stands at just 45%. But while affordability explains the initial delay, it doesn’t fully account for the long-term shift in values.

Even as some Millennials gain the financial capacity to buy, many continue renting out of lifestyle preference. Remote work, urban walkability, experience-first consumption habits, and a general aversion to long-term financial commitments have reshaped what it means to feel "at home."

This raises a critical question for property operators: When financial constraints are lifted, will lifestyle preferences still lead many to choose renting?

The Great Wealth Transfer: A Potential Turning Point in Housing Decisions

Between now and 2045, the Great Wealth Transfer will place trillions of dollars in the hands of Millennials and Gen Z, two generations that have never experienced this level of liquidity. Of the estimated $84 trillion in total transfers, more than $53 trillion is expected to pass directly to heirs.

This unprecedented influx of capital could reshape housing decisions in several ways:

- Some renters will transition into homeownership. With inheritance acting as a down payment or eliminating debt, a segment of renters will finally pursue the traditional path of owning a home. For operators in specific markets, this could mean a measurable decline in renter demand.

- Another segment will become renters by choice. These individuals choose to retain the flexibility and experience-driven lifestyle that renting affords, even with new financial means. They’re making housing decisions based on quality of life, convenience, and identity alignment.

- A third group may use inherited wealth to invest, launch businesses, or pursue personal goals, all while continuing to rent. In this scenario, renting is a platform for mobility and optionality, not a fallback plan.

For property operators, the imperative is to meet this new class of renter where they are and deliver value that ownership cannot match.

The Rise of the Renter by Choice: An Opportunity Amid Uncertainty

While it remains unclear exactly how many inheritance recipients will transition to homeownership, forward-thinking property operators should position themselves to capture the valuable segment of renters by choice, those who have the financial means to buy but deliberately choose not to.

This growing demographic offers several advantages for property managers:

- Exhibit higher financial stability, with fewer risks of delinquency.

- Stay longer when their expectations are met, improving retention and NOI.

- Demand premium services and amenities, creating opportunities for differentiation.

- Engage more meaningfully with their communities, contributing to resident satisfaction and reputation.

Understanding and serving this audience is no longer a bonus, it’s a strategic necessity.

Redefining the Rental Offering Beyond the Unit

To attract and retain renters by choice, operators must evolve beyond “units and square footage” and instead deliver holistic living experiences that rival or exceed what homeownership provides.

1. Lifestyle as a Value Proposition

For the next generation of renters, flexibility isn’t a feature, it’s the foundation. They expect homes to adapt to their lives, not the other way around. Tomorrow’s communities will likely offer features like dynamic leasing models that shift with the seasons, seamless transfers between sister properties across cities, and turnkey, furnished units ready for instant move-in.

Flexibility will begin to extend beyond lease terms, too, with subscription-style living options and built-in mobility pathways that match a renter’s evolving ambitions. In a world where personal and professional lives change fast, renters by choice are looking for housing that can move as freely as they do.

2. Community That Feels Curated, Not Manufactured

Renters by choice seek more than a place to live, they seek a sense of belonging that feels authentic, effortless, and personal. Operators can create value by offering:

- Curated experiences like pop-up wellness retreats, culinary residencies, or artist showcases.

- Work and innovation hubs with podcast studios, creator spaces, and startup accelerators.

- Exclusive partnerships with local brands for VIP access, private tastings, or cultural events.

- Resident-driven councils that shape amenities, programming, and even neighborhood initiatives.

In short: communities that don’t just house residents, they amplify their lifestyle and identity.

3. Amenities That Redefine Convenience

To meet the expectations of financially empowered renters, operators must move beyond traditional amenities and deliver next-level convenience, wellness, and personalization.

Things like wellness labs with cryotherapy and IV therapy; AI-powered fitness centers; on-demand concierge services that handle everything from pet care to personal shopping; drone delivery hubs for packages and groceries; and immersive entertainment spaces like VR lounges and chef-curated dining events.

Future-ready communities will also weave in hybrid work infrastructure with private Zoom pods, onsite content studios, and access to sister properties in other cities – blurring the line between home, office, and travel. Smart unit tech that adapts lighting, temperature, and even music to residents' preferences will become standard.

The goal isn’t just to offer convenience. It’s to make renting feel more dynamic, more personalized, and ultimately, more valuable than owning.

Regional Variations: Inheritance Impact Isn’t One-Size-Fits-All

As with all housing trends, context matters. The impact of inherited wealth will vary based on geography, cost of living, and local housing supply. Operators should tailor their strategies accordingly.

In high-cost urban markets like New York, San Francisco, and Los Angeles, even inheritance may not be enough to afford homeownership. In these places, operators should double down on:

- Creating “ownership-like” control (design input, long-term security)

- Offering exclusive experiences that money alone can’t buy

- Providing stability in premium locations with limited inventory

In fast-growing secondary markets like Raleigh, Austin, or Denver, inheritance could tip the scale toward buying. Here, operators should position renting as the smarter investment – liquidity, diversification, and flexibility all play well with this narrative.

And in remote-work-driven “Zoom towns”, from Tahoe to Asheville, operators should focus on attracting high-income professionals with:

- Remote work infrastructure and social onboarding

- Flexible leases that encourage exploration

- A strong sense of place and identity

The key is to understand how inherited wealth affects desire, not just ability and tailor offerings accordingly.

Technology Integration & Meeting Elevated Expectations

Financially empowered renters expect seamless digital experiences across every touchpoint. They’ve grown up with on-demand everything, from ride shares to mobile banking, and they expect the same level of responsiveness from their housing provider.

For operators, this means technology is no longer a differentiator. It’s the baseline.

To meet rising expectations, today’s communities need to:

- Enable virtual and self-guided tours for frictionless leasing

- Offer digital lease signing, billing, and communications

- Provide one-touch maintenance requests via mobile

- Integrate smart home features like remote access, climate control, and security

- Use data to personalize experiences and anticipate resident needs

But beyond ease and convenience, expectations around service response times are accelerating. Residents don’t just want to submit a maintenance request, they want immediate acknowledgment and transparent follow-up.

That’s where Apartment List’s A-List Resident can be transformative. With AI-powered tools that triage and route maintenance requests, automate follow-ups, and assist with renewals, it helps onsite teams deliver the responsiveness renters expect.

Strategic Planning for Multiple Possible Outcomes

The exact impact of the Great Wealth Transfer on housing decisions remains uncertain. Will half of financially empowered renters become buyers? Will most stay renters longer but demand more?

Rather than waiting for the answer, savvy operators are building flexibility into their strategy now, with moves like:

- Analyzing demographic data to identify inheritance likelihood across properties.

- Segmenting portfolios to serve multiple renter profiles.

- Designing modular upgrades to evolve amenities over time.

- Creating financial models that explore renter-to-owner migration.

- Embedding resident feedback loops to stay attuned to changing needs.

Being ready for multiple futures means being resilient, adaptive, and proactive.

Position Your Properties for Tomorrow’s Renter… Today

The Great Wealth Transfer represents more than just a financial windfall. It’s a moment of strategic inflection for the multifamily industry. While some renters will use their inheritance to buy homes, many will seek elevated rental experiences that offer more freedom, more value, and more meaning.

At Apartment List, we help property operators stay ahead of the next generation of renters with our smart platform – AI-powered solutions designed to attract, nurture, and retain residents at every stage of their journey.

Ready to align your portfolio with the renters of tomorrow? Find out how.

Because the Great Wealth Transfer won’t just change who rents, it will change how they expect to live. Make sure you're ready.

Share this Article