How Climate Related Events Can Affect Rents & Migration

From wildfires in California to hurricanes in Florida and floodplains throughout the south and Midwest, climate-driven disasters are becoming more frequent, more destructive, and more disruptive to local housing markets. For property operators, these events aren’t just logistical nightmares or insurance headaches. They’re powerful market forces that can shift demand, drive migration, and destabilize rent trends overnight.

Renter behavior is becoming increasingly reactive to these events. Whether it’s a temporary surge in demand after a wildfire evacuation or a long-term trend away from high-risk coastal cities, natural disasters are shaping where and how people choose to live. For property operators, that means climate risk is now rent risk.

In this post, we’ll explore how recent disasters, like the LA wildfires, have impacted multifamily rents and migration patterns. We’ll also look ahead, identifying other high-risk rental markets and the strategies operators can use to navigate this volatile, climate-influenced reality.

Case Study: What We Learned from the LA Wildfires

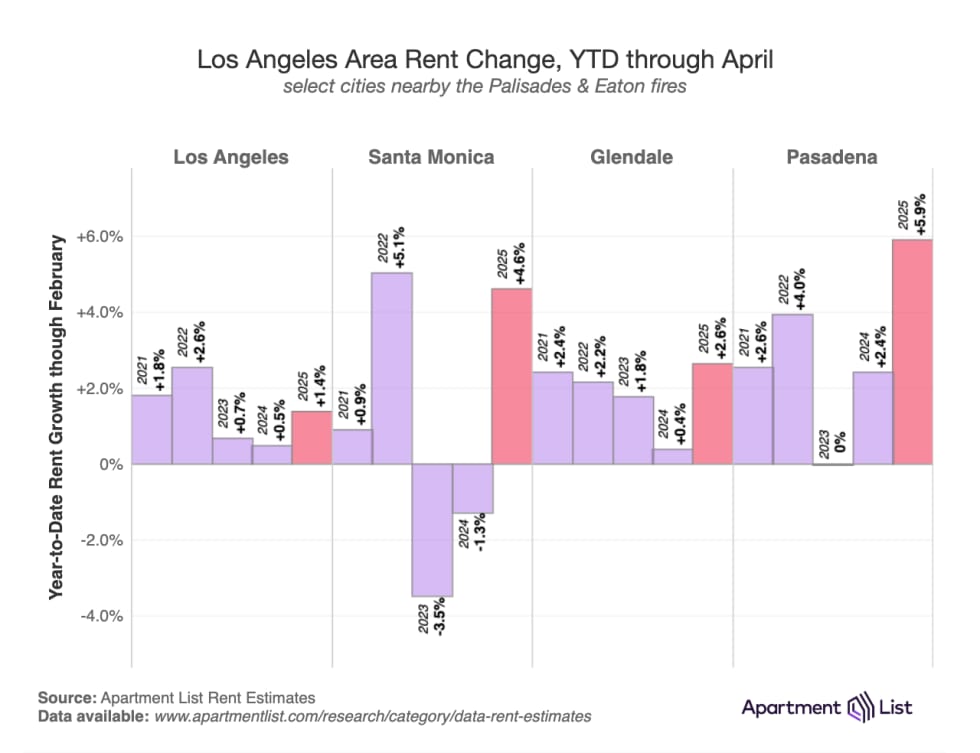

In early 2025, the Palisades Fire tore through Los Angeles County, destroying dozens of homes and forcing thousands to evacuate. It was one of the most destructive wildfires the region had seen in years and its impact extended well beyond the burn zone. The event offers a real-time example of how natural disasters can ripple through local housing markets.

Apartment List’s research team tracked the short-term impact on rents across affected zip codes and the broader LA metro. Read the full research here.

What the data showed was striking:

What the data showed was striking:

- Nearby areas saw modest rent increases, driven by a temporary spike in demand from displaced renters seeking immediate housing.

- Leasing activity surged in adjacent cities and safer zones, including West LA and parts of the San Fernando Valley – a trend supported by search data and application volume.

- Renter behavior showed early signs of climate reactivity: prospective renters in fire-prone zip codes increasingly began searching for apartments in less risky areas.

While the Palisades Fire did not dramatically alter metro-wide rent trends, it offered a clear reminder that localized disasters can cause short-term price swings and lasting shifts in renter confidence.

For operators, the implications are critical:

- Evacuation and displacement drive immediate demand shocks, both up and down.

- Perception matters: Even renters not directly impacted may rethink their housing decisions when disaster risk becomes top-of-mind.

- Disaster preparedness is now a business strategy, not just a safety measure affecting everything from leasing flexibility to pricing resilience.

As climate events grow in frequency and severity, they are poised to become regular disruptors in rental markets especially in high-risk metros like LA.

Climate Hot Zones: Where Property Risk and Rent Volatility Collide

The Palisades Fire is just one example in a growing pattern. Across the country, a new class of real estate risk is emerging, not from market fundamentals, but from climate volatility. For property operators, understanding where the next disruption might occur is no longer just a question of "if," but "when."

Certain rental markets are becoming increasingly vulnerable to climate-related events, and the data shows that the impacts on rent prices, leasing velocity, and renter migration can be swift and unpredictable. Here are some other examples of high-risk regions where climate-related risks could reshape the housing landscape and where operators should be paying close attention:

- Miami, FL – Hurricanes & Sea Level Rise: Regular storms, rising seas, and soaring insurance costs are putting pressure on Miami’s housing market. Elevated inland areas are seeing rising rents, part of a broader trend of “climate gentrification.” Tampa and Orlando are experiencing similar shifts.

- Houston, TX – Flooding: With annual major flood events since Hurricane Harvey, Houston’s housing stock faces persistent water risk. FEMA floodplain expansions and surging insurance premiums are reducing development viability and increasing resident churn. New Orleans shares many of the same challenges.

- Phoenix, AZ – Extreme Heat Phoenix experienced 54 days over 110°F in 2023, with hotter years ahead. The heat strains infrastructure, drives up energy costs, and accelerates outbound migration. Las Vegas, with similar temperatures, may see growing renter churn as remote workers seek cooler climates.

What This Means for Property Operators

These “climate hot zones” are active case studies in how potential environmental shocks could shape demand, pricing, and operational strategy. Unlike traditional market cycles, these events are harder to forecast, making resilience and agility essential components of portfolio management.

Renter Migration Trends: Following the Climate

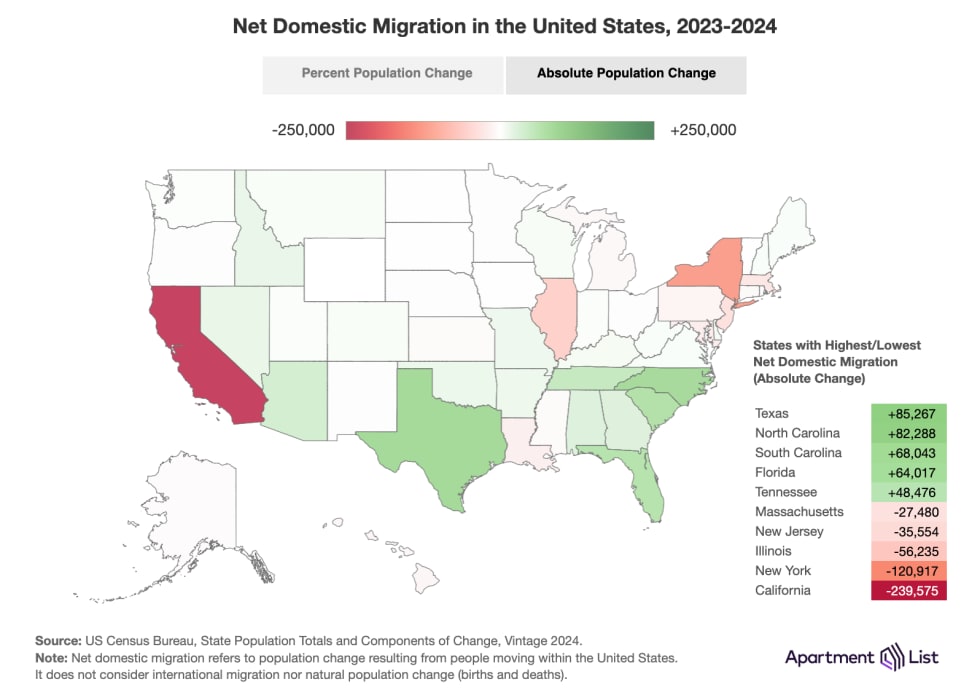

Climate migration is no longer a hypothetical, it’s already reshaping how renters make decisions about where to live. While affordability and job growth remain primary factors, concerns about environmental stability are becoming increasingly influential.

Our 2025 Renter Migration Report reveals where renters are migrating most recently this year.

Affordability + Climate Resilience = Long-Term Appeal

Climate risk is becoming a key layer in the renter decision-making process, especially when combined with affordability. Rather than driving migration on its own, climate viability is amplifying the appeal of metros that already offer lower costs and livable conditions. Regions once overlooked as slower-growth markets are seeing increased inbound migration. Their relative insulation from extreme weather, paired with more affordable housing and infrastructure capacity, positions them as emerging “climate-smart” destinations with long-term upside.

Multi-Pronged Migration Trends

Today’s renter isn’t just chasing affordability or escaping climate risk, they’re seeking cities that balance both – regions that are increasingly attractive because they offer a mix of economic opportunity, relative climate resilience, and housing accessibility. These hybrid destinations reflect a broader shift: renters are prioritizing long-term livability across multiple dimensions, not just cost or safety, but both.

What Operators Can Do Now: Strategy & Risk Mitigation

For property operators, climate change isn't just an environmental issue, it's a business imperative. The growing link between natural disasters, rent trends, and renter migration means operational strategy must evolve to keep pace with a more volatile reality.

Here are five proactive steps operators can take to protect portfolio performance and meet renter expectations in a climate-influenced market:

1. Build Climate Risk into Market Analysis

Traditional market due diligence often focuses on economic fundamentals: job growth, supply pipelines, demographic trends. But in a climate-impacted world, environmental risk is a financial risk and it needs to be part of every underwriting model.

Operators should layer climate vulnerability data into their acquisition and expansion strategies. Tools like FEMA Flood Maps, First Street Foundation’s Risk Factor, and NOAA's Billion-Dollar Weather Events Tracker allow you to assess flood, fire, storm, and heat risk down to the property level.

2. Invest in Resilient Infrastructure

Climate-resilient upgrades are no longer “nice to have”. Properties located in high-risk zones should be assessed for their ability to withstand increasingly frequent extreme events. That might include:

- Fire-resistant roofing and landscaping

- Improved stormwater drainage and sump systems

- Backup generators and battery storage

- HVAC systems optimized for extreme heat events

These investments create operational continuity, support renter well-being, and demonstrate your commitment to long-term stewardship.

3. Embrace Flexible Leasing + Disaster Contingency Plans

Disasters often force renters to make rapid decisions and properties that can offer flexible, empathetic responses stand to earn both goodwill and occupancy gains. That means building contingency planning into both your leasing operations and resident communications.

- Have pre-approved short-term lease structures that can be deployed quickly in crisis zones or to incoming evacuees.

- Train teams on emergency communication protocols, relocation assistance, and coordination with local agencies.

- Consider adding language to leases regarding force majeure or temporary displacement accommodations.

When disaster strikes, renters remember how they were treated. Being prepared can make the difference between losing a resident and earning a long-term advocate.

4. Monitor Renter Behavior Closely

Disasters often catalyze sudden, unpredictable changes in renter behavior. Property operators should proactively monitor leading indicators like:

- Search origin data from ILS platforms

- Tour-to-lease conversion changes

- Competitor pricing shifts

- Application patterns by ZIP code or region

In post-wildfire LA, for example, Apartment List data showed a surge in inbound searches from affected areas toward lower-risk neighborhoods, insights that helped inform local leasing strategy. Tapping into real-time demand signals lets you adjust marketing budgets, unit availability, and pricing strategy ahead of the curve.

5. Reevaluate Geographic Concentration

A diversified portfolio has always helped hedge against market fluctuations, but in the age of climate volatility, geographic diversity becomes a frontline defense. Operators with too much exposure to a single risk-prone region (e.g., fire zones in California, floodplains in the Southeast, or drought zones in the Southwest) may face compounding risks: physical damage, insurance hikes, and softening demand.

That doesn’t mean divesting from strong markets, but it does mean balancing high-risk holdings with investments in resilient metros. Some institutional investors are already shifting capital into so-called “climate havens” as a long-term hedge against environmental uncertainty.

Climate Is Now a Market Force: Apartment List Is Your Partner to Thrive in This New Landscape

` From the Palisades fire in Los Angeles to hurricanes on the Gulf Coast, natural disasters are no longer isolated events, they are part of a broader shift that’s reshaping where renters go, how rents move, and how operators must adapt.

For today’s property teams, this means evolving from reactive crisis management to proactive climate readiness. And that starts with data-driven strategy, resilient infrastructure, and a renter experience built to flex with the unexpected.

At Apartment List, we’re building tools to help property operators thrive in this new landscape, from smarter leasing workflows to market intelligence and AI-powered renter engagement. Let’s talk about how we can support your leasing and retention strategy. Reach out to our team here.

Share this Article