Those Struggling with Housing Costs are Least Likely to Vote

Introduction

With less than a month until election day, the COVID-19 pandemic and the resulting economic fallout continue to be defining issues of the campaign. Over the past week, the president himself has contracted the virus and subsequently called off talks for additional stimulus. Amid this continued volatility, we find that widespread struggles with housing costs have been troublingly stable since the start of the pandemic. And despite their pressing needs, we find that those who are struggling most are least likely to make their voices heard at the ballot box on November 3rd.

Payment rates improve, but just barely

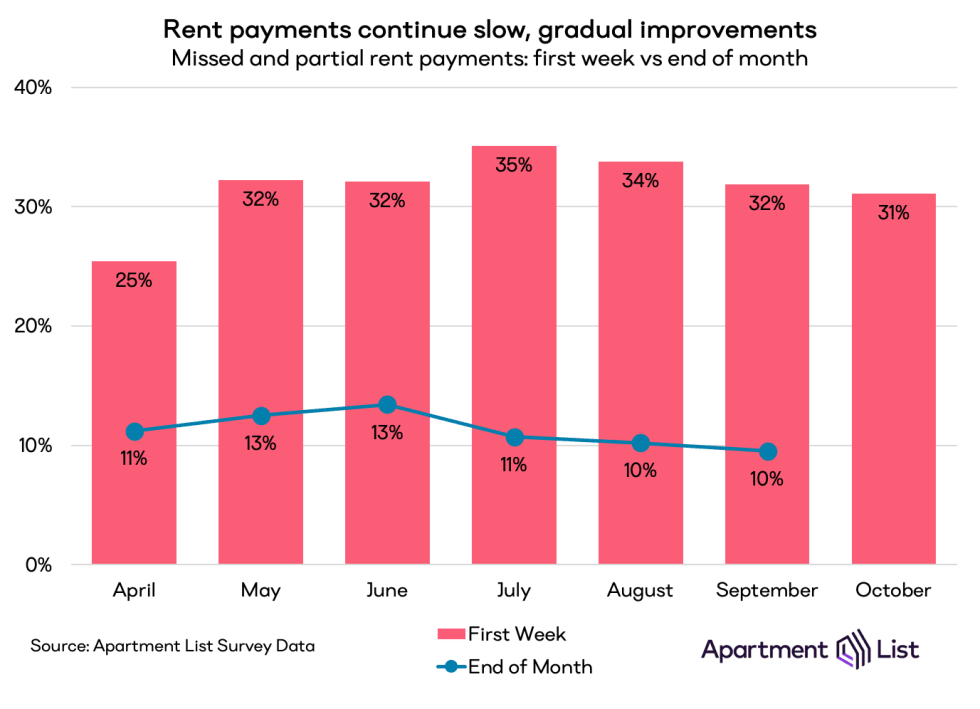

In the first week of October, 31 percent of renters failed to make a complete on-time payment of their rent bill.1 This represents the third straight month that we’ve seen improvement in this figure and the best rate of on-time payment since April. The changes here have been extremely slow and gradual, but as talks for additional stimulus continue to stall out in Congress, any improvement whatosever can be taken as a positive signal. That said, this improvement may also be driven by a composition effect if those renters who are struggling most have moved back in with family or friends and are simply no longer appearing in our renter sample.

Although nearly one-in-three renters failed to pay their full rent in the first week of the month, we continue to find that the majority of these missed payments are made up with late payments by the end of the month. As of the first week of October, 10 percent of renters had not yet paid their September rent in full. This still indicates a significantly elevated rate of non-payment, but not nearly to the extremes that the first-week figures might suggest. The end-of-month payment rate for September was unchanged from August, and based on the consistency of this trend in prior months, we expect that a similar share of renters will pay their October rent in full by the end of the month.

Meanwhile, the figures for homeowners moved in the opposite direction over the past month -- 71 percent made a complete on-time payment in the first week of October, down from 73 percent in September. The most recent October data for homeowners still reflects an improvement over August, which had the highest rate of missed mortgage payments since we began running our survey in April. Homeowners are also a bit more likely than renters to complete their housing payments by the end of the month, with only 8 percent having failed to make a full mortgage payment for September as of the first week of October.

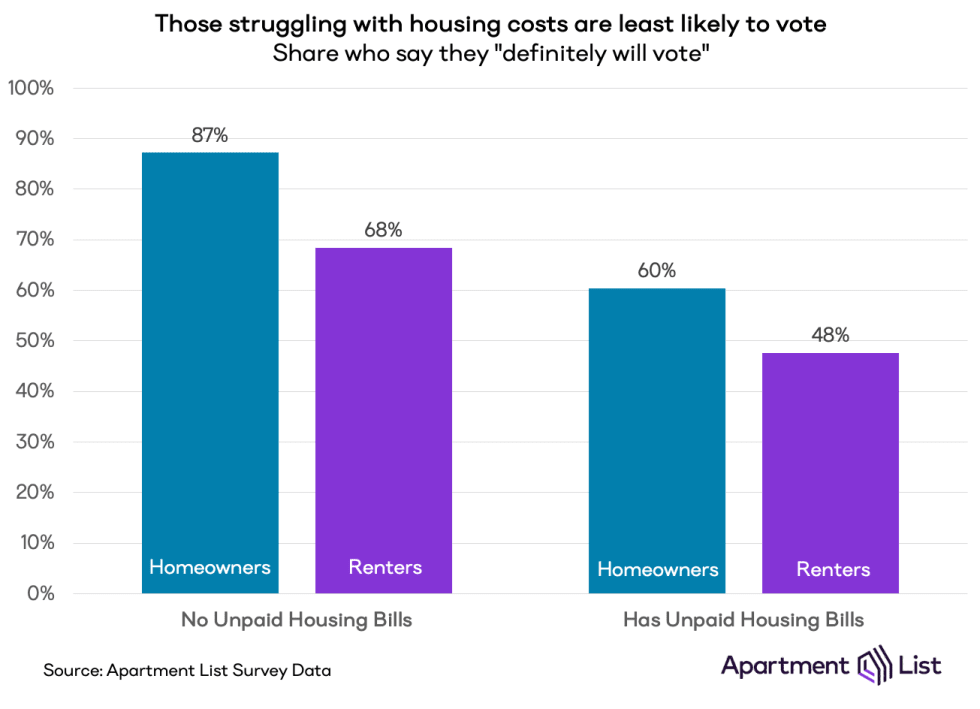

Those struggling with rent are less likely to vote

As the election rapidly approaches, we asked this month’s survey respondents about their intent to vote on November 3rd. The results point to a concerning trend in the way that economic hardship interacts with political participation. We find that those who entered October with unpaid housing bills from prior months are significantly less likely to say that they “definitely will vote” in the upcoming election. Among homeowners, 87 percent of those who started the month without any unpaid mortgage bills plan to vote, compared to just 60 percent of those who had unpaid bills.2 We observe a similarly large gap between renters who are fully caught up on their rent payments and those who have outstanding rent debt.

This gap is not explained by political party preference. We find that rent debt and missed housing payments are common across the political spectrum, and missed payment rates were consistent across respondents in counties that Trump won and counties that Clinton won in 2016. Those with no unpaid housing bills report being more likely to vote regardless of whether they report leaning Democrat or Republican.

In addition to finding that those who are struggling with housing costs are less likely to vote, we also observe a significant gap in expected voter turnout between renters and homeowners, a phenomenon which we’ve explored in detail in the past. Although the gap between renters and homeowners is partially driven by demographics, homeowners are also motivated by a significant financial interest in policies that could affect local property values.

Among the four groups displayed in the chart above, renters with unpaid rent bills are by far the least likely to say that they plan to vote. This finding implies that those Americans with the most pressing needs are least likely to have their voices heard in the political process. While we did not explicitly ask why respondents do or do not plan to vote, we have previously found that renters are more likely to be non-citizen immigrants, and therefore ineligible to vote.

However, prior analysis of Census data has also shown that renters have lower turnout than homeowners even when limiting to the voting-eligible population. This is likely at least partly driven by the difficulty of their circumstances. For example, these renters are more likely to work hourly wage jobs, and voting may require taking time off work that impacts their paychecks in a way that salaried workers need not worry about. Furthermore, low-income renters are more likely than homeowners to be members of minority groups that may be subject to voter suppression tactics.

Financial sacrifices to make rent are increasingly common

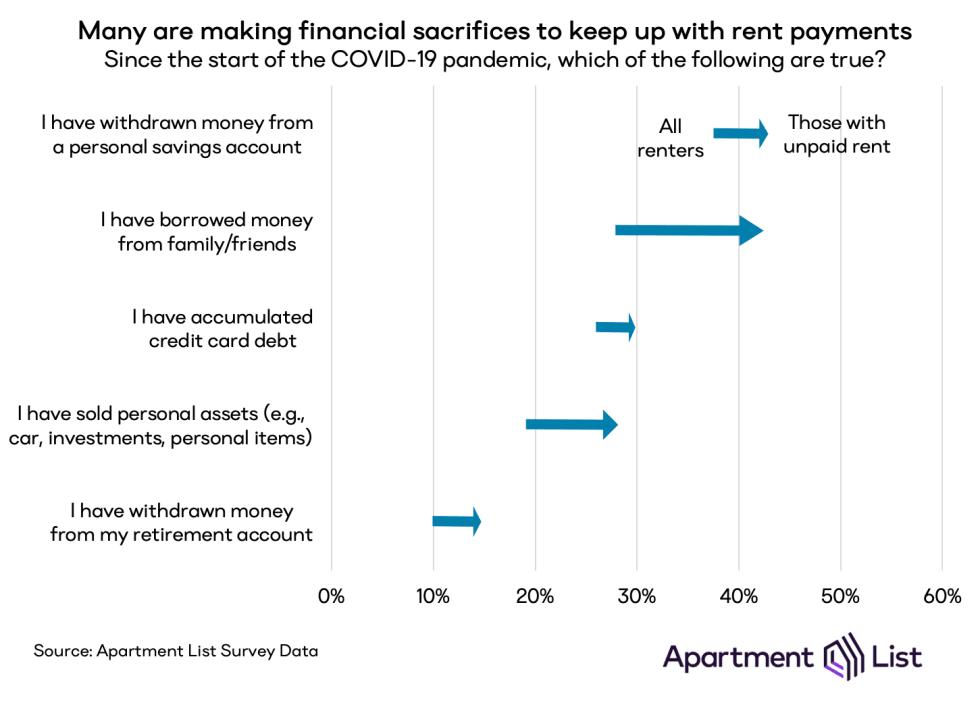

As the pandemic stretches past the six month mark, those who are struggling with rent payments are increasingly making significant sacrifices to keep up with their payments. 61 percent of the renters we surveyed say that they have cut their spending since the start of the pandemic, while an even larger share (64 percent) have taken more extreme measures, such as drawing on savings, borrowing, or selling assets. These financial sacrifices have also become more widespread compared to last month.

37 percent of all renters have drawn money from their personal savings since the start of the pandemic, up one percentage point from last month. 26 percent have accumulated new debt on a credit card and 28 percent have borrowed money from family or friends, both up three percentage points from September. One-in-ten have taken the extreme measure of withdrawing money from a retirement account -- since these transactions generally entail significant penalty fees, retirement funds are usually tapped only as a last resort.

As expected, each form of financial sacrifice that we asked about is more prevalent among renters with outstanding unpaid rent. That said, the high overall rates indicate that even those who have managed to stay current on rent may not be in great financial health. Renters are more likely than homeowners to have made each of the sacrifices we asked about, with the exception of withdrawing retirement savings (likely because fewer renters have such savings to draw on). The fact that financial sacrifices have grown more common since last month is indicative of the persistence and pervasiveness of financial hardship caused by the pandemic.

Unpaid rent bills piling up for minorities

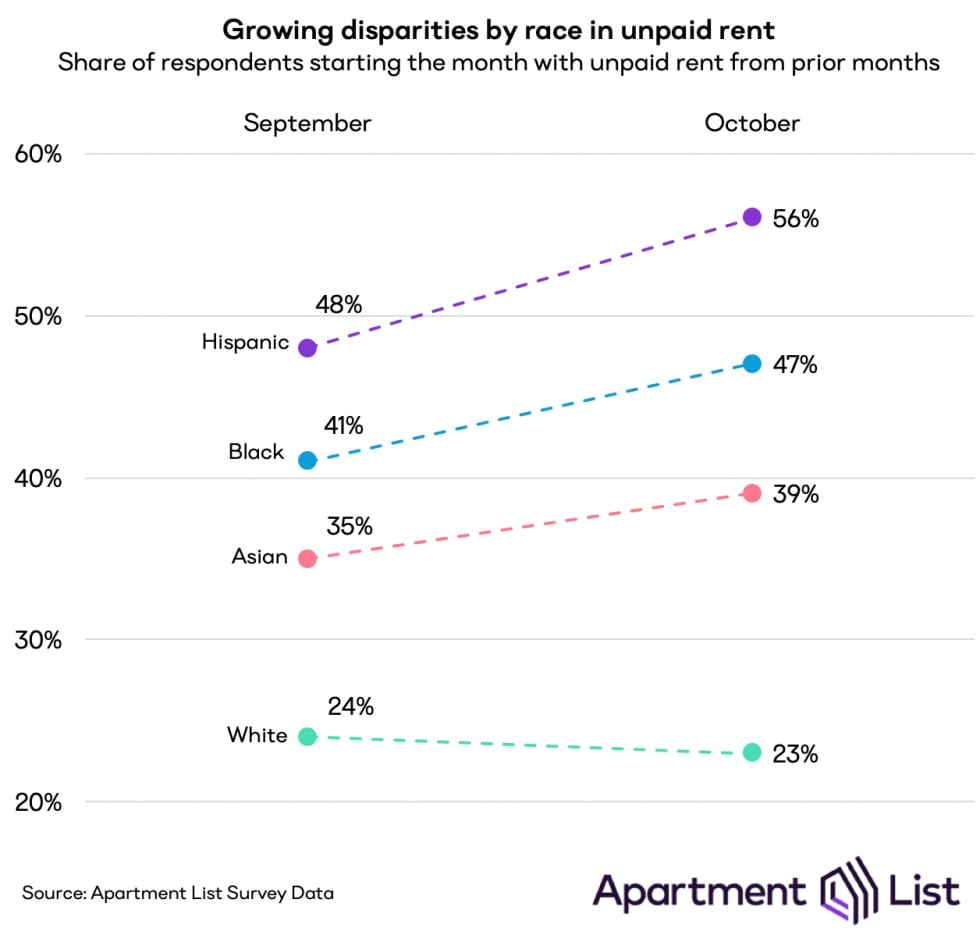

As we noted last month housing payment struggles are not spread evenly across different segments of the population. Breaking down the results by race shows that the pandemic may be exacerbating long-standing inequities in housing security. The most recent data not only reaffirms this trend, but shows it growing more extreme.

Hispanic renters are most likely to be struggling with their housing costs, as 56 percent of them started October with unpaid rent from a prior month, an eight percentage point jump from the September rate. The rate for Black respondents jumped six percentage points from 41 percent to 47 percent, while the rate for Asian respondents increased from 35 percent to 39 percent. Meanwhile white respondents, who already had by far the lowest prevalence of rent debt at 24 percent in September, were the only group to see that rate fall in October.

Conclusion

As the COVID-19 pandemic continues with no clear end in sight, persistently elevated rates of missed housing payments are also becoming a fact of life in 2020. The leadup to next month’s election has been dominated by the various ways the pandemic has disrupted our society, and the results will serve at least in part as a referendum on President Trump’s handling of the crisis. That said, we found that those who are currently bearing the brunt of the economic pain are actually least likely to vote. While partially driven by demographics, this result also reflects the fact that voting often entails an extra burden for many low-income minority renters. Once again, our payment survey is elucidating the various ways that societal inequities play out in the housing market.

- Each nationally-representative monthly survey reaches over 4,000 Americans, and is distributed on the third day of the month. The surveys are administered through SurveyMonkey and the samples match the gender and age distributions of the United States as a whole.↩

- Note that the implied voter turnout rates we capture are well above historic levels. This likely reflects a phenomenon known as “social desirability bias.” Since the prevailing social norms impart a positive connotation on voting, respondents are likely to overreport what is perceived as a desirable behavior. This question likely also suffers from “projection bias,” whereby respondents are overly optimistic in predicting their own future behavior. For these reasons, these figures should not be taken as projections of voter turnout. However, despite these limitations, comparisons across groups are still instructive.↩

Share this Article