The Economy's Growing Remote Work Divide

- In today’s “quarantine economy,” the ability to work from home has emerged as the strongest predictor of income and housing security.

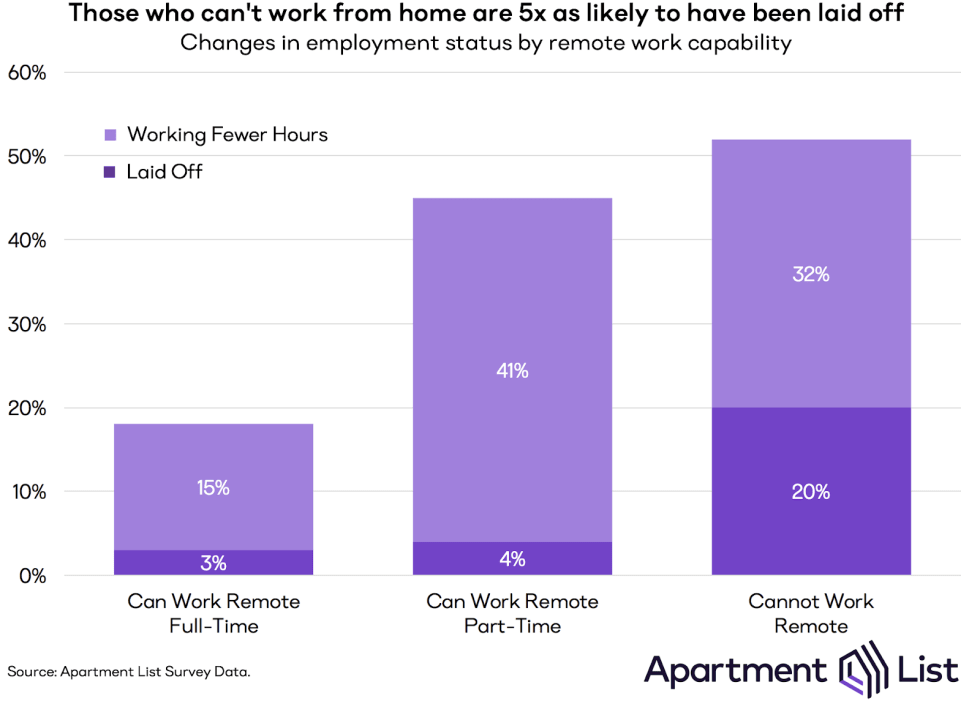

- Apartment List survey data suggests that nearly 40 percent of the American workforce experienced a layoff or a reduction in hours last month. These economic disruptions are heavily concentrated among those who do not have the flexibility to work from home.

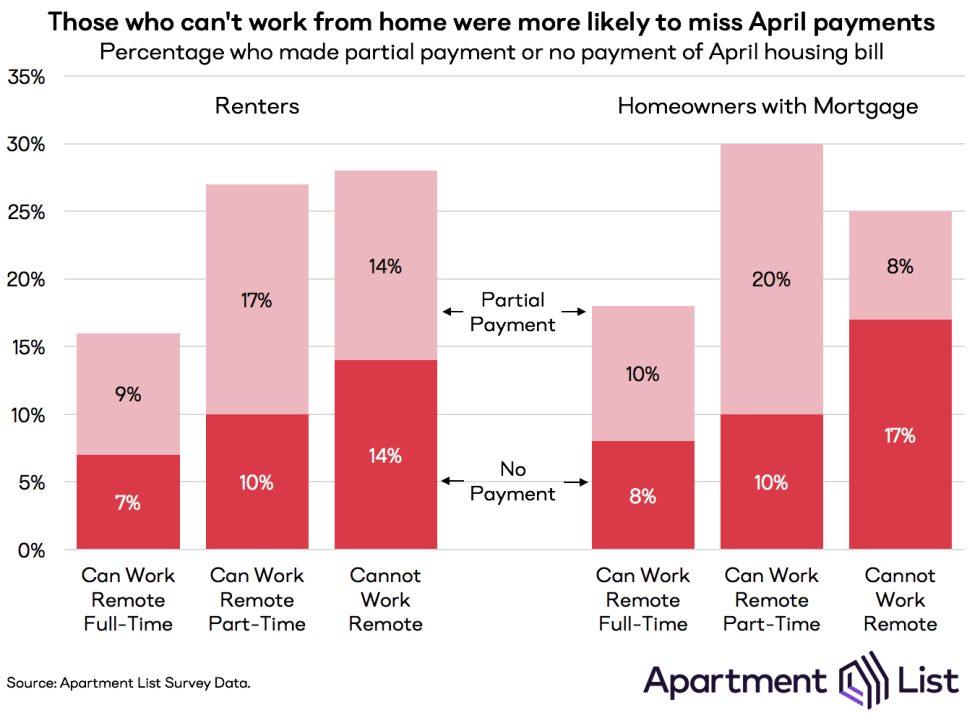

- Those who cannot work from home were over 50 percent more likely to be delinquent on their April housing costs than those with the capability to work remotely.

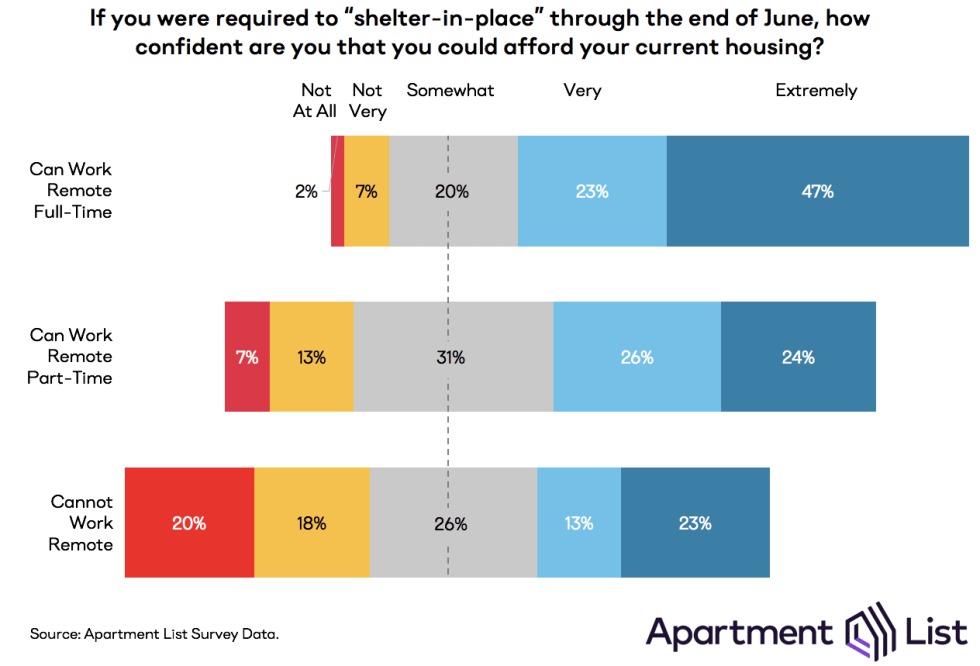

- Remote workers are also more confident in their ability to afford housing should social distancing requirements continue. 90 percent are at least “somewhat confident” they can afford housing if they have to shelter-in-place through June, compared to just 62 percent of those without remote flexibility.

- This imbalance may have lasting impacts on the United States housing and job markets as the COVID-19 pandemic accelerates the rise of remote work.

Introduction

In the past four weeks, all but a handful of U.S. states have issued stay-at-home orders aimed at limiting the spread of coronavirus. For many Americans, staying at home means temporarily not working, and in many cases, not earning income. Meanwhile, those who are lucky enough to be working from home have experienced far less financial disruption. As we encourage Americans to stay home to slow the spread of coronavirus, those who can continue to work remotely while sheltering in place are at a great economic advantage.

This imbalance in the quarantine economy compounds a trend that was playing out well before the need for social distancing. In fact, working from home has been the fastest growing commute type in America over the last fifteen years. Furthermore, the types of jobs that can be done from the safety of one’s home tend to offer higher pay and greater economic security. Today, this rise in remote work is taking on new importance.

In the first week of April, we ran a national survey that assessed the effect of the pandemic on the employment and housing outcomes of over 4,000 Americans. The results were alarming. Nearly 1 in 4 Americans with a housing bill in April failed to pay in full. In this study, we revisit these data to explore the remote work divide that is growing in today’s economy. We find that social distancing has the unintended consequence of widening existing economic divides, as low-wage workers whose jobs can’t be done remotely face the harshest impacts of the quarantine economy.

Working from Home & Unemployment

Unemployment is skyrocketing during the coronavirus pandemic. In an average month just over 1 percent of employees are laid off from their jobs, according to the Bureau of Labor Statistics.1 In our survey, however, 10 percent of respondents who were employed on March 1 have since been laid off, signaling the staggering and unprecedented scale of job losses taking place today.

While layoffs are the worst outcome a worker can experience, they don’t capture the full extent of the current instability in the labor market. Beyond the businesses that have closed entirely, many others are staying open but cutting payroll costs in response to lower revenues. Our survey asked respondents to compare their employment status at the beginning of March to the beginning of April. We found that 28 percent still have a job but are working fewer hours than before, while only 63 percent who were employed on March 1 continue to work the same number of hours today. Nearly 40 percent of the labor force experienced a reduction in work last month.

This economic disruption is not spread out evenly across the workforce. Certain occupations are taking the brunt of the effects because they are not amenable to remote working arrangements. Those who can work from home, on the other hand, are largely shielded from income loss. Among survey takers who can work fully-remote, 83 percent were unaffected last month and just 3 percent lost their jobs. Among those who can perform some job duties from home, 41 percent saw a reduction in hours but still only 4 percent lost their jobs outright. But among those who cannot work from home at all, one in five were laid off, more than five times the rate for those with at least some remote work capability. Though fewer than forty percent of respondents stated that they cannot work remotely, this group accounted for eighty percent of the March layoffs captured in our data.

Working from Home & April Housing Costs

Given how many workers lost some (or all) of their hours in March, many families were under increased economic duress when their rent and mortgage bills came due on April 1. Twenty-four percent of renters and homeowners were unable to pay in full.2 There was surprisingly little difference between the renter and homeowner delinquency rates (25 and 23 percent, respectively), but there is a wide gap among those who can and cannot work from home.

Among those who can work remotely full-time, the April delinquency rate is 17 percent. The share rises to 28 percent for those with part-time flexibility and 26 percent for those with no option to work from home. The type of delinquency also shifts slightly with different working arrangements. Partial payments were most common among those who can perform some job duties from home (17 percent of renters and 20 percent of homeowners), while missed payments were most common among those who cannot perform any duties at home (14 percent of renters and 17 percent of homeowners).

Families with low incomes and little job flexibility are feeling especially burdened in today’s economy. For households making less than $50,000 annually with no remote work options, April delinquency rates reached nearly 30 percent. That said, under the current circumstances, remote work capability has emerged as perhaps the most salient factor in determining who left their April housing bill unpaid. Entirely unpaid rent checks were more common among higher earners unable to work from home than among low earners who could carry out at least part of their jobs at home.3

Working from Home & Housing Affordability Expectations

Depending on how long social distancing guidelines remain in effect, the impact of remote work capability on housing security could become more pronounced going forward. We asked all respondents about their ability to afford their current housing bills if their local economy were to be under a “shelter-in-place” order through June. Among respondents who can work remotely, 90 percent are at least “somewhat confident” that they can pay their bills through an extended period of social distancing. For those who can work remotely part time, this number falls to 81 percent, and for those who cannot work remotely at all it falls to 62 percent.

Two factors likely account for this optimism gap. For one, those unable to work from home are more likely to experience layoffs or loss of income during extended shelter-in-place. Compounding this effect is the fact that those with the ability to work from home tend to have greater savings to rely on. Survey responses indicate that 46 percent of those who can work from home can continue to afford their housing for more than three months after losing their income. Among those who cannot work from home, the share drops to 33 percent. The disparity in responses to this question serves as an illustration of the fact that remote work capability correlates strongly with income. The workers who are being hit hardest right now are precisely those with the least financial buffer.

Lasting Consequences

The COVID-19 pandemic has arrived in an age of rapid technological innovation. It is easier than ever to virtually connect with people and services over great distances. This innovation has enabled tremendous growth in sectors and companies whose employees can largely get their work done anywhere with a strong internet connection. As a result, those who are able to work through a stay-at-home mandate are not randomly distributed. They tend to be younger, wealthier, and more likely to live in dense urban areas. Their advantage in the era of social distancing will have ripple effects throughout the recovery from the pandemic as well.

Today’s large-scale “remote work experiment” has the potential to further accelerate a trend we observed prior to the pandemic -- the rise of working from home. As shelter-in-place orders are lifted, many companies may see fewer benefits in returning to centralized operations (and the expensive office spaces they must rent to do so). Such decisions at scale would facilitate the rise of a new remote class, which is characterized by high earnings and tremendous mobility. Those with occupations that necessitate immediate contact with others will not enjoy these benefits, and the small businesses that employ them will be the ones hit hardest in the meantime.

- BLS Economic News Release, Table 5: Layoffs and discharges levels and rates by industry and region, seasonally adjusted↩

- This calculation excludes homeowners who report not having a mortgage. A 24 percent delinquency rate is abnormally high. We use the 2017 American Housing Survey data to estimate that delinquency in a typical is six times lower, at roughly 3.9 percent.↩

- For the purposes of this analysis, we split the sample into those respondents whose households earn more vs. less than $50,000 per year.↩

Share this Article