- 46 units available

- 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

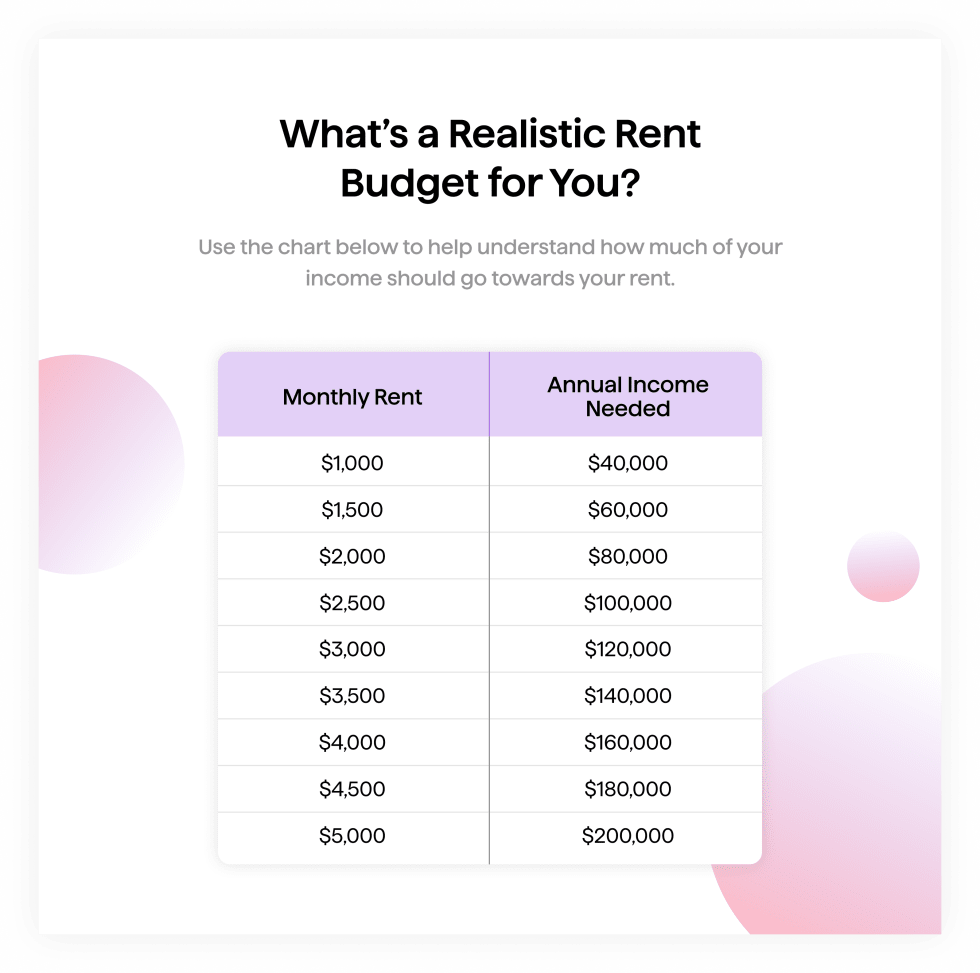

Most people can afford to spend about 30% of their gross monthly income on rent, but the real number depends on your debt, lifestyle, and location. In other words: there’s no one-size-fits-all rent rule, even if the 30% guideline is a good place to start.

The problem? Many renters blow past their budget without realizing it. Maybe you fall in love with a place that’s just a little over. Or maybe you didn’t account for extras like utilities, parking, or that security deposit that’s somehow 1.5x your rent. It adds up fast. And if you're not careful, your apartment can become more financial stress than a personal sanctuary.

In this guide, we’ll show you how to calculate rent based on income, break down the costs you shouldn’t overlook, and share what to do if rent is eating up more than it should. Ready to figure out how to find an apartment in your budget? Let’s get into it.

Aim to spend no more than 30% of your gross monthly income on rent. If you bring in $4,000 a month before taxes, that means capping rent around $1,200.

But real life isn’t a math problem, and what works on paper might not work in your city (or your wallet). In a lower-cost area, locking in a great place for 20% of your income is a win. Meanwhile, renters in high-cost cities may find that 30% just isn’t realistic.

Want a quick gut check? Use our Rent Calculator to see what works for your income and priorities.

The 30% rule is a helpful starting point to budget for rent, but it’s not the only way to think about your rent budget. Another approach is the 50/30/20 rule. It splits your take-home pay (that’s after taxes) into 50% for needs, 30% for wants, and 20% for savings or debt payoff.

Say you take home $3,600 a month. That breaks down like this:

This method gives you a more realistic view of how rent fits into your day-to-day, not just your paycheck on paper. It’s also a useful way to assess your rent to income ratio and figure out what percentage of income should go to rent based on your lifestyle.

Let’s stick with the 50/30/20 rule and that $3,600 monthly take-home pay. Your target is to keep all your “needs,” including rent, utilities, groceries, insurance, minimum debt payments, under $1,800 total. That’s doable, but depending on your other expenses, it might feel tight.

Here’s a breakdown of what that could look like:

That adds up to $1,050, leaving you about $750 for rent and utilities. Unless you’re splitting rent or living in a lower-cost area, that probably won’t stretch far. For context, the national median rent across the U.S. is currently $1,398, according to Apartment List’s June 2025 data. So if your must-haves push you over that 50% needs threshold, you’re not alone.

Budgets are a tool, not a rulebook. It’s okay to flex them when life demands it, like if you’re dealing with a tough living situation, starting fresh in a new city, or simply need a little more breathing room. If 50% feels too tight, the 60/30/10 rule (where 60% of income goes to essentials) might be a better fit for your renting budget.

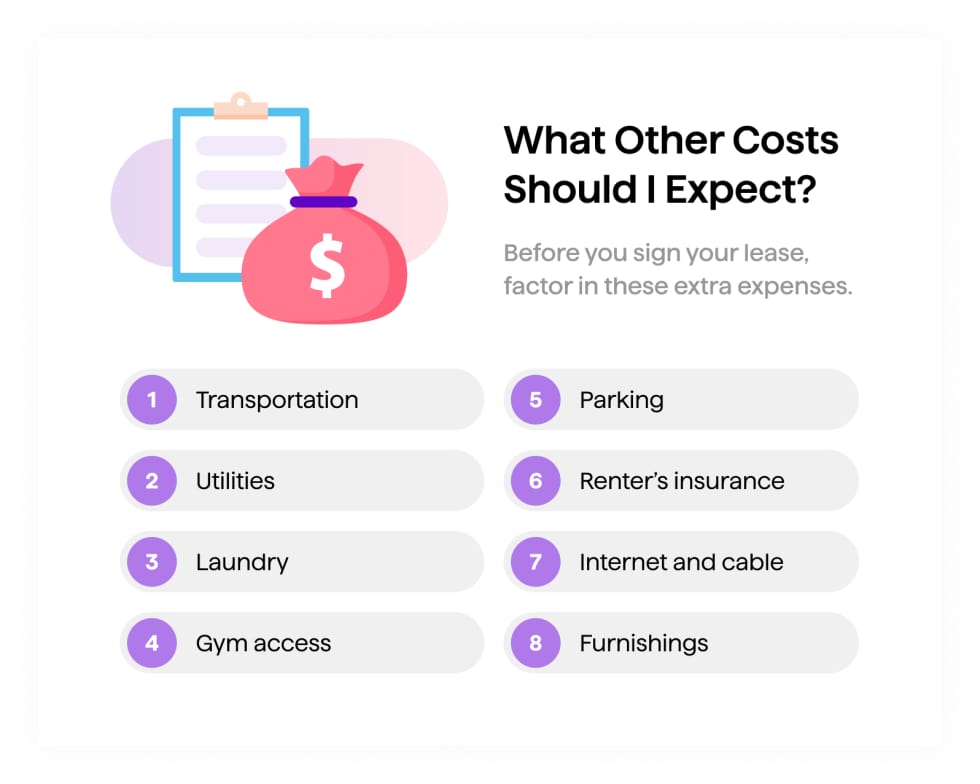

Rent isn’t the whole story. Where you live can impact your daily costs. The “cheaper” apartment isn’t always the better deal once you add up everything else.

For example, living farther from downtown might lower your rent, but you could spend more on gas, rideshares, or transit passes. On the flip side, perks like on-site gyms or included utilities can help you save.

Here are a few common costs to consider when budgeting for your next place:

These extras can make or break your apartment affordability, so keep them in mind when you’re comparing places that seem similar on paper.

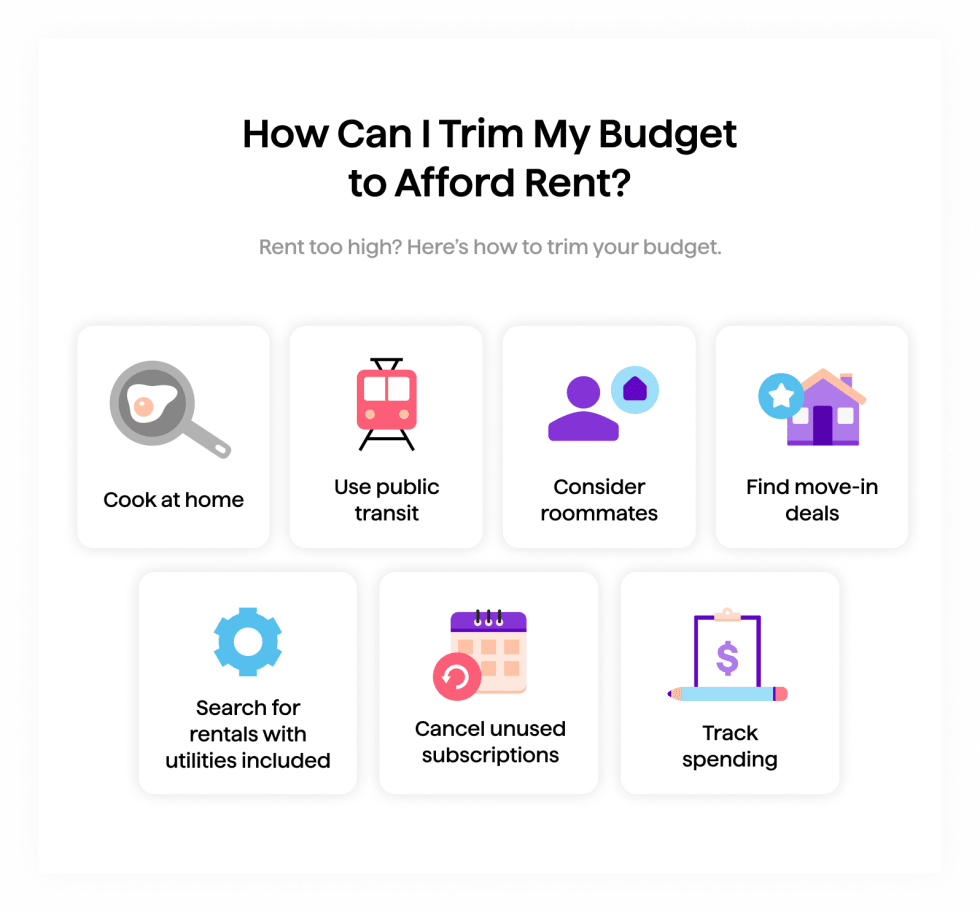

If your rent budget and the local market aren’t exactly matching up, you might be able to make a few small changes to feel more comfortable. The beauty is that you don’t have to sacrifice everything you love to make your budget work.

Cutting back on non-essentials is the obvious move, but there are smart ways to save on everyday needs, too. Here are some ideas to get started:

Rent might be your biggest monthly expense, but it doesn’t have to run the show. A few trade-offs now can create more breathing room later.

Figuring out how much to spend on rent shouldn’t just be about crunching numbers. You also want to make sure your apartment fits your lifestyle.

The 30% rule is a helpful guide, but real life often calls for a more flexible plan. If you’re still asking, “How much should I spent on rent?” or wondering how to find an apartment in your budget, we’ve got plenty more tips and tricks in our Renter Life blog.

When you're ready to start searching, skip the scroll. Take our quiz to get matched with apartments based on your income and your needs, all in one place.

Rent should be no more than 30% of your gross monthly income. For example, if you earn $3,500 a month, aim to spend $1,050 or less on rent.

Not always. Some rentals include basic utilities like water or trash, but electricity, gas, and internet are often separate. Always ask what’s covered before signing.

Yes. Rent is often negotiable, especially if the unit has been vacant for a while or you're moving during the off-season. It never hurts to ask.

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more

In unit laundry, Granite counters, Pet friendly, Stainless steel, Walk in closets, Gym + more