How Will Tax Reform Impact Home Buying Plans?

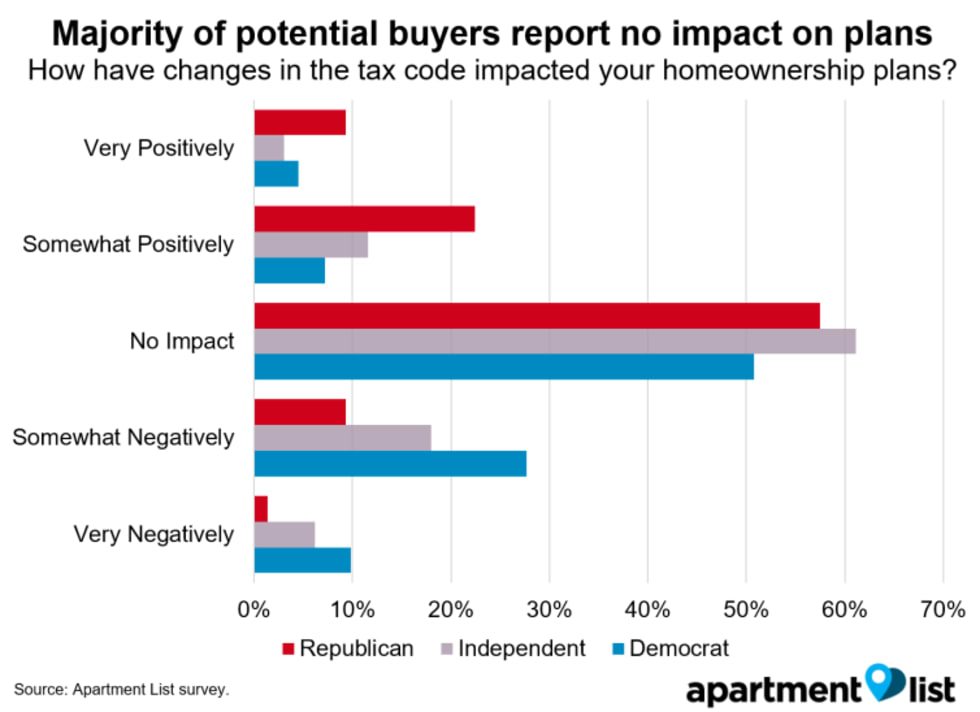

In a new Apartment List survey, 57 percent of future homebuyers say that cuts to homeowner tax benefits under the Tax Cuts and Jobs Act have had no impact on their plans for homeownership.

Of those who do report an impact, sentiment falls starkly along party lines: 38 percent of Democrats say that the changes have negatively affected their homeownership plans, compared to just 10 percent of Republicans.

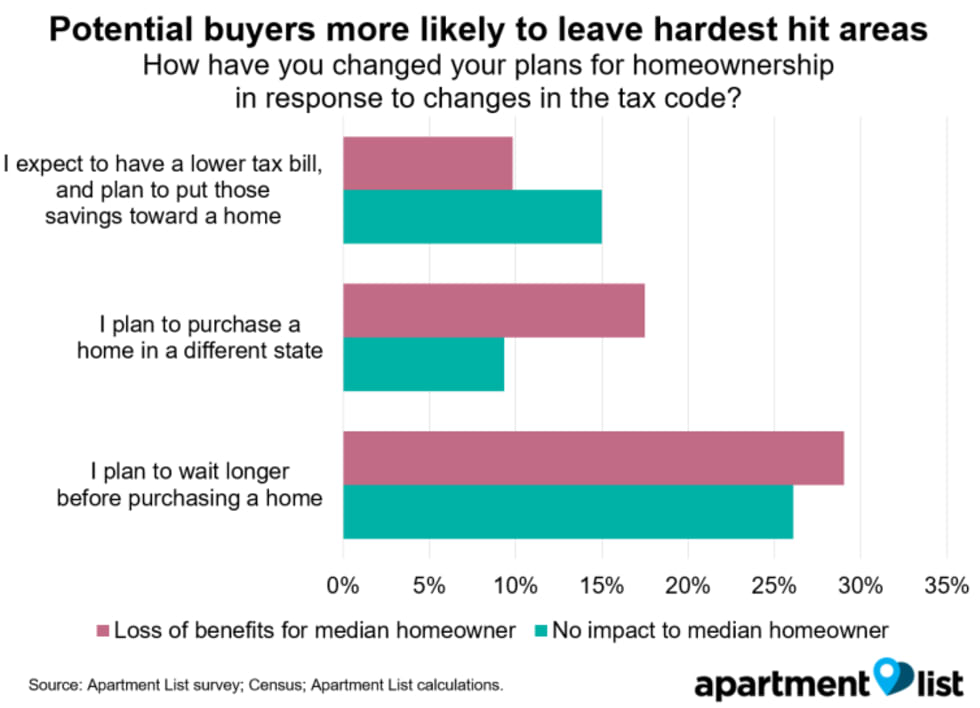

Overall, 26 percent of potential buyers say that they plan to delay purchase in response to the changes. On the other hand, 13 percent say that they expect to have a lower overall tax bill and plan to use those savings to achieve homeownership sooner.

We find that the bill is having a more negative impact on sentiment in areas that Apartment List previously identified as being most impacted by the changes. In counties where the median homeowner stands to lose housing-related tax benefits, 18 percent of potential buyers say that they now plan to purchase a home in a different state, compared to just 9 percent in counties where the median homeowner is unaffected.

Introduction

The Tax Cuts and Jobs Act of 2017, signed into law on December 22, makes significant changes to longstanding tax benefits for homeowners. It reduced the cap on borrowing subject to the mortgage interest deduction (MID) from $1 million to $750,000, and capped deductions for state and local taxes, including property taxes, at $10,000.1 These changes, in combination with a doubling of the standard deduction, mean that many homeowners will experience a loss of tax benefits associated with homeownership, and the changes represent a significant shift in the federal government’s willingness to promote and subsidize homeownership.

Apartment List recently analyzed how these changes will affect homeowners in different parts of the country, finding that the changes hit hardest in coastal blue-state metros with a combination of high real estate values and high local tax rates. That said, the decision to purchase a home involves a complex combination of factors, and it remains to be seen how big of a role the tax code changes will play. In order to assess the impact of tax reform on home buying decisions, Apartment List surveyed potential homebuyers across the country to get their thoughts on the changes and see how they have altered their plans for homeownership in response to the new tax code.

Majority of potential homebuyers say the changes do not impact their plans

Despite the significant attention that these changes have received, our survey shows that the impact with respect to the decision to purchase a home may be somewhat subdued. Overall, 56 percent of survey respondents who plan to purchase a home at some point in the future say that tax reform has had no impact on their plans for homeownership.

Note that there are a number of reasons why potential homebuyers might fail to respond to the changes:

- Many homeowners simply aren’t affected by these changes. Owners of less expensive homes would have taken the standard deduction under the old tax code and will continue to do so under the new one -- households who take the standard deduction do not receive tax benefits related to homeownership.

- Some homeowners may simply be uninformed about the tax code changes and the impact they will have. Potential buyers who view homeownership as a long-term goal and are not actively planning for it may not have thought through the tax implications.

- Finally, the decision to purchase a home involves a multitude of factors, including both financial considerations and lifestyle preferences. For many homeowners, the magnitude of lost tax benefits may not be large enough to swing the needle on this decision.

Of those who do report an impact on their plans, sentiment skews negative, but falls starkly along party lines. Of those surveyed, 38 percent of potential homeowners who identify as Democrats say that the changes have negatively affected their homeownership plans, while just 12 percent report a positive impact. That sentiment is inverted for Republicans -- 32 percent report a positive impact, while just 10 percent say that their homeownership plans have been negatively impacted.

Some of this divide can be explained by the fact that Democrats tend to live in areas with higher home values, where the changes hit harder, although there still seems to be an element of partisanship at play. For example, if we look just at respondents who plan to purchase homes valued over $750,000 -- those who stand to lose the most in housing-related tax benefits -- 37 percent of Democrats report a negative impact on homeownership plans, compared to just 8 percent of Republicans. The reverse is true for households planning to purchase homes for less than $250,000, who will likely see little to no reduction in housing-related benefits, but stand to gain from a doubled standard deduction -- at this price point, 26 percent of Republicans report a positive impact on their plans, compared to just 10 percent of Democrats.

Note that the impact of the changes on respondents’ homeownership plans is highly correlated with their overall sentiment of the new law. Of those who report a negative impact to their homeownership plans, just 5% have a positive view of the tax reform as a whole. Given the way in which sentiment breaks down along party lines, it seems that for some, partisan loyalty may be a more important factor than a rational evaluation of one’s personal circumstances.

Impact is more substantial in areas where the changes hit hardest

In a recent analysis, Apartment List calculated how much homeowners will lose in housing tax deductions for every county in the U.S., and we’ve mapped those findings onto our survey results, to see how sentiment varies based on the expected level of impact.

We find that respondents are more likely to report negative changes to their homeownership plans in the areas we previously identified as being the most impacted:

- In counties where the median homeowner will lose housing-related tax benefits, 29 percent of planned homebuyers say that they will now wait longer to purchase a home, although 26 percent say that they will now wait longer even in counties where the median homeowner loses no benefits.

- Perhaps more strikingly, 18 percent of potential buyers in negatively impacted counties say that they now plan to purchase a home in a different state, which is twice the 9 percent in unaffected counties who plan to move across state lines in response to the new tax code.

- On the flip side, 15 percent of potential buyers in unaffected counties say that they expect to have a lower tax bill, and plan to use those savings to achieve homeownership sooner, compared to 10 percent in negatively impacted counties.

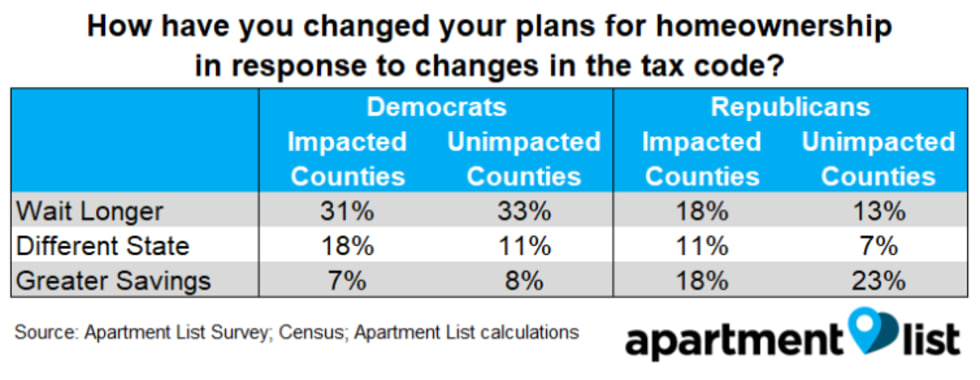

The results above are partially driven by the fact that the negatively impacted areas contain a greater share of Democratic voters, who are more likely to report negative sentiment. That said, the same trends hold true even when accounting for party affiliation:

Conclusion / Implications

Despite a significant reduction to longstanding tax benefits for homeowners, a majority of respondents to our survey report no changes to their home buying plans. Of those who do report an impact, the results are somewhat mixed -- although nearly a third of respondents indicate that they will delay their plans for homeownership, 13 percent of potential buyers say that they expect to have a lower tax bill which will help them save more.

It is important to note that the tax code changes do not have a uniform impact, and some markets will likely be affected more than others. In harder hit areas with high home values and property tax rates, sentiment skews more negative, and twice as many respondents report that they now plan to move out of state. If these self-reported plans are acted on, the tax reform could end up having an impact on migration patterns, with potentially widespread implications. That said, if the loss of homeowner benefits is capitalized in lower property values in these markets, home buyers may be less likely to actually move.

While unlikely to be the decisive factor for most potential homebuyers, the recent changes to the tax code amount to a shifting of incentives that make homeownership less attractive, which could result in softening demand, particularly in the hardest hit markets.

See the table below for localized results for the states and metros where we received sufficient responses to produce estimates:

How have changes in the tax code impacted your plans for homeownership?

| Location | Type | Positively | No Impact | Negatively |

|---|---|---|---|---|

| Arizona | State | 14% | 64% | 23% |

| California | State | 10% | 51% | 38% |

| Colorado | State | 11% | 63% | 26% |

| Florida | State | 19% | 62% | 19% |

| Georgia | State | 17% | 65% | 17% |

| Illinois | State | 13% | 66% | 21% |

| Kentucky | State | 22% | 61% | 17% |

| Maryland | State | 64% | 36% | |

| Massachusetts | State | 19% | 52% | 30% |

| Michigan | State | 11% | 75% | 14% |

Methodology

Survey responses were collected from February 3rd through March 4th, 2018. The results presented above are based on 1,085 responses from respondents who say that they plan to purchase a home at some point in the future. Our sample is nationally representative in terms of age and gender, but we have not controlled for other demographic factors. Local data in the table above is presented for all locations for which we received at least 15 responses. For specific local sample sizes or other questions related to methodology, please contact us at rentonomics@apartmentlist.com.

- Note that the lowering of the MID cap does not apply to homeowners with existing mortgages.↩

Share this Article