How often does rent growth top 5%?

Earlier this week, President Biden took his latest action in addressing the nation’s ongoing housing affordability crisis, calling on Congress to pass legislation that would force corporate landlords (those that own 50 or more units) to cap annual rent increases at 5 percent. Under the proposal, landlords who fail to adhere to the 5 percent cap would forfeit valuable federal tax breaks.

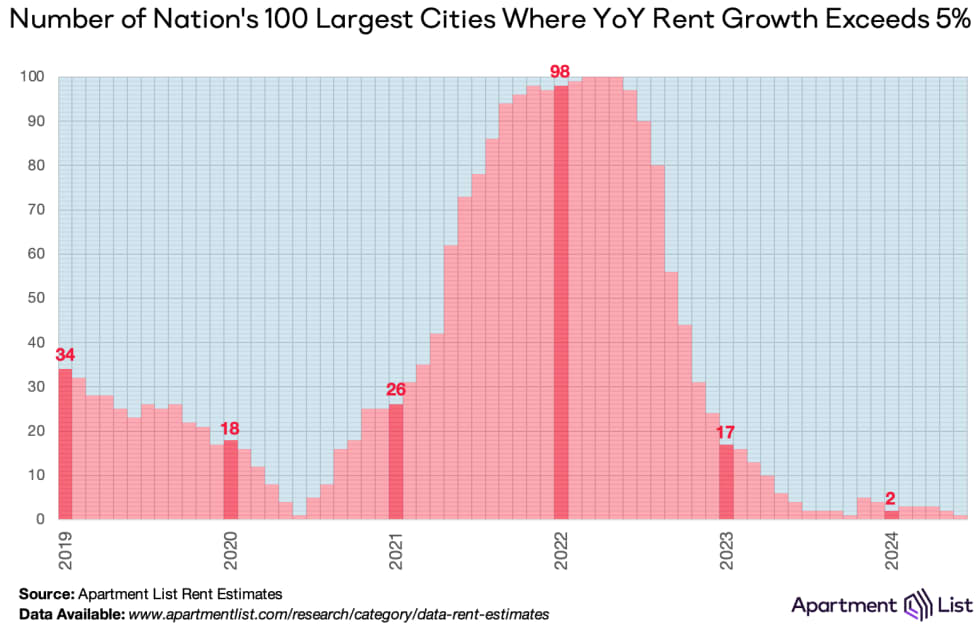

This begs the question – how common is it for landlords to raise rents by more than 5 percent? The chart below provides an answer, showing how many of the nation’s 100 largest cities experienced year-over-year rent growth above 5% in each month going back to the start of 2019.1

This chart makes clear that the impact of a 5 percent cap varies dramatically over time based on the prevailing market conditions. At the outset of 2019, roughly one-third of the nation’s largest cities experienced city-wide rent growth above the 5 percent threshold. Then in late-2021 and early-2022, the impact of the proposed policy would have expanded greatly. A surge in housing demand at that time drove an unprecedented spike in rents, and for a number of months in early-2022, every single one of the nation’s 100 largest cities was logging rent growth greater than 5 percent.

But rent growth has slowed dramatically in the time since, and last month there was only one major city where rents were growing faster than 5 percent (Madison, WI). In fact, a number of markets are actually recording negative rent growth at the moment amid an influx of new apartment construction. If enacted today, President Biden’s proposed rent cap would likely only apply to a fairly limited subset of the rental market. However, as conditions shift, such a policy would have widespread impact during the market’s hotter periods.

- Note that the rent growth figures used in this analysis represent city-wide averages, masking variation across individual properties within cities (i.e. in cities that experienced city-wide rent growth below 5 percent, there may be individual properties that raised rents by more than 5 percent, and vice versa).↩

Share this Article