Apartment List Vacancy Index Methodology Explainer

Updated August 2023

Note: We most recently updated our methodology in August 2023. If you are working with data dowloaded prior to that date, please use the current series (available here) to access the most recent revisions.

At Apartment List, our research team is committed to providing accurate and timely data so that those interacting with today's rapidly evolving rental market can make well-informed decisions. Researchers, journalists, policymakers, industry specialists, and the general public have all come to rely on Apartment List’s data products to make sense of the latest rental trends. Our core data offerings – the Apartment List Monthly Rent Estimates and the Apartment List Vacancy Index – are both available on our data download page, with trends going back to 2017 for hundreds of individual locations across the U.S. at various geographic levels (national, state, metro, county, and city).

As always, we aim to promote full transparency around our public data products. In that spirit, this post provides a complete explanation of the methodology behind our vacancy index, for those interested in getting deeper into the weeds.

Methodology

To calculate our vacancy index, we leverage the extensive dataset that powers our platform. Apartment List maintains robust data integrations with the properties that list with us, allowing us to track pricing and availability changes as soon as they occur. This not only creates a great experience for our users, but also gives us unique insight into trends in the rental market. For every property on our platform, we know the total number of units in the building, as well as the number that are listed as available to rent on any given day, allowing us to track vacancy rate changes in real time.

Our general approach to calculating our vacancy index is as follows:

- Calculate a daily vacancy rate for each property in our sample (available units / total units)

- Calculate a monthly vacancy rate for each property by taking an average of the daily rates across all days in the month

- For each location – city, county, metro, state, or national – take an average of the monthly property-level vacancy rates for all properties that fall within the bounds of the given location, weighted by the number of units in each property

While the explanation above accurately describes our basic approach, the complete calculation involves additional nuances that are important to note. Specifically, the properties that enter the sample for our vacancy index calculation must satisfy certain filtering criteria. These filters are meant to control for two ways in which the properties that we observe on Apartment List might systematically differ from average stabilized multifamily properties in a given market:

- “Lease-Ups” – Newly developed properties that start off entirely vacant – will, by definition, have extremely high vacancy rates when we first observe them, tending to bias our overall vacancy index upward. At this moment, properties are actively advertising. The vacancy rates for these properties then rapidly decline in the ensuing months as they complete this initial “lease-up” period, biasing the month-to-month changes in our overall vacancy index.

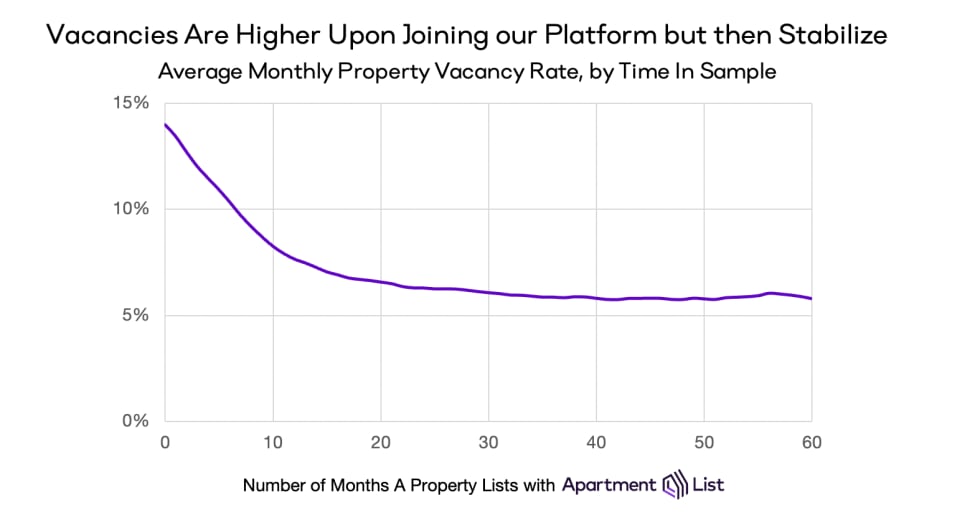

- Self-Selection Onto Platform - Beyond lease-ups, a more muted version of this same dynamic plays out for many properties when they first appear on our platform. This is because a given property’s decision to partner with Apartment List is not independent of its vacancy rate. Rather, those properties which have the greatest need to fill vacancies are most likely to find value in partnering with us. As such, properties tend to have elevated vacancy rates when they first appear on our platform, which then gradually stabilize over time.

The dynamics described above are illustrated clearly in the chart below, which shows a clear trend of declining vacancy rates in the initial months after a property first appears on Apartment List:

In order to control for this selection bias, the sample for our vacancy index does not include every property that we observe on our platform. Rather, we exclude properties from the sample until they satisfy both of the following criteria:

- The property has logged a monthly vacancy rate of 15% or lower at least once (we consider this to be the “stabilization rate” for new lease-up properties, consistent with other industry sources)

- The property has appeared on Apartment List for at least six months (this controls for the initial selection into our product based on the vacancy rates of our partner properties)

Properties enter the sample for our vacancy index in the first month in which they satisfy both of the above criteria. To illustrate this more clearly, consider the following examples:

- Property A has a vacancy rate of 13% in month three after partnering with Apartment List, but does not enter the sample until month seven (the first month after the six-month holdout period is complete).

- Property B has a vacancy rate above 20% for the entirety of its first six months on Apartment List; its vacancy rate falls below 15% for the first time in month ten. This property enters the sample on month ten.

Aditionally, we limit our sample to only include properties that have at least ten units. This controls for the fact that property-level vacancy rates are necessarily a coarse measure for small properties (e.g. in the most extreme example, a single-family home rental property will always be 100% vacant if it appears on our platform). Even before applying this filter, our sample is naturally skewed toward large apartment complexes; a significant majority of the properties that feed into our vacancy index have fifty units or more. One positive benefit of this is that even with a relatively small number of properties, we are able to observe a large number of individual units.

After applying these filters, we then calculate our index for all locations in which we have sufficient data. In order to publish a vacancy index for a given location, we require that our sample for that location consists of at least 25 properties every month for the previous 13 months. We include a longer history for a location only when sample sizes continue to exceed the minimum sample threshold.

Based on the methodology described above, our resulting vacancy index serves as a valuable and timely indicator of trends in the rental market. While we are confident in our methodology and the accuracy of our index, it is nonetheless important to also acknowledge its potential limitations:

- Our sample of properties is not fully representative of all segments of the rental market. We do not capture single-family rentals or multifamily properties with fewer than 10 units. A large majority of the properties in our sample contain 50 units or more. If occupancy trends in large multifamily properties differ from those of smaller rental properties, our index may not be generalizable to the market as a whole.

- The properties that list with us have self-selected into our platform, generally because they have a perceived need for assistance in filling vacancies. While we attempt to control for this with the filters described above, it may be the case that even after the initial stabilization period, the properties on our platform continue to have higher vacancy rates than the market-wide norm.

- Finally, our methodology does not fully control for the composition of our sample; in other words, new properties are gradually added to the sample over time, while others may drop out, meaning that the sample of properties that we observe varies somewhat month-to-month.

As always, we hope that providing open access to this data, as well as transparency around our methodology, will help to democratize a better understanding of the ever-evolving rental market. Feel free to contact our team at research@apartmentlist.com for any questions.

Share this Article